Financial stability risks remain contained in the near term, although rising economic and geopolitical uncertainty increases the likelihood of adverse shocks, exposing fragilities.

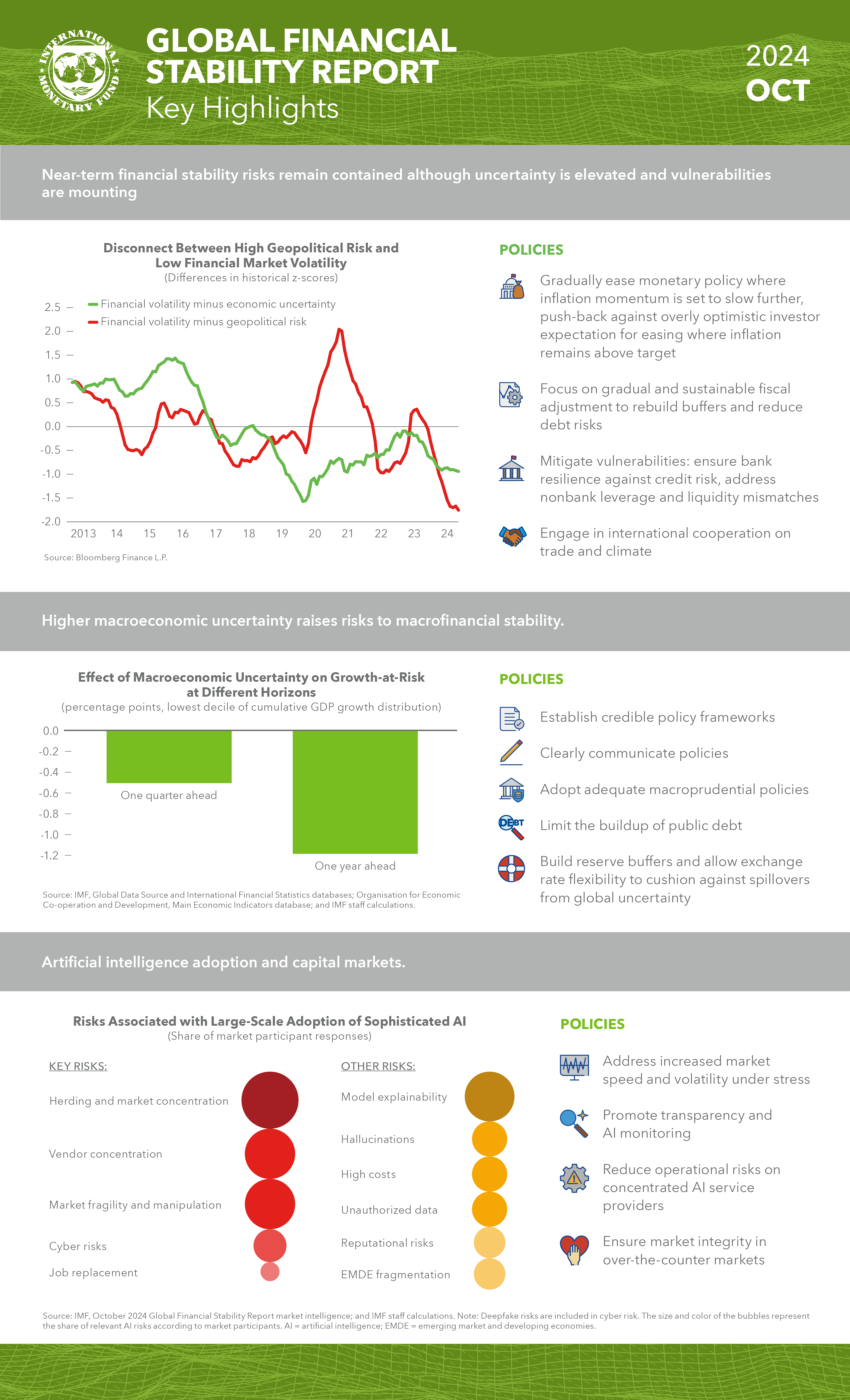

Chapter 1 of the October 2024 Global Financial Stability Report shows that although near-term financial stability risks have remained contained, mounting vulnerabilities could worsen future downside risks by amplifying shocks, which have become more probable because of the widening disconnect between elevated economic uncertainty and low financial volatility.

Chapter 2 presents evidence that high macroeconomic uncertainty can threaten macrofinancial stability by exacerbating downside tail risks to markets, credit supply, and GDP growth. These relationships are stronger when debt vulnerabilities are elevated, or financial market volatility is low (during episodes of a macro-market disconnect).

Chapter 3 assesses recent developments in AI and Generative AI and their implications for capital markets. It presents new analytical work and results from a global outreach to market participants and regulators, delineates potential benefits and risks that may arise from the widespread adoption of these new technologies, and makes suggestions for policy responses.

Chapter 2: Macrofinancial Stability Amid High Global Economic Uncertainty

Uncertainty regarding global economic outcomes and policies has been higher since the COVID-19 pandemic amid inflation shocks, rising geopolitical tensions, emerging technologies, and climate-related disasters. This chapter examines the implications of high macroeconomic uncertainty for macrofinancial stability by studying its association with downside tail risks to future output growth, asset prices, and bank lending growth. The findings show that high macroeconomic uncertainty can significantly raise downside risks for economic and financial stability, and the relationship may be stronger when macrofinancial vulnerabilities are elevated, or financial market volatility is low (during episodes of a macro-market disconnect). Moreover, macroeconomic uncertainty can trigger cross-border spillover effects through trade and financial linkages. More credible policy frameworks and building resilience through adequate macroprudential policies and reserve buffers, and by reducing fiscal vulnerabilities could help mitigate the adverse consequences of high macroeconomic uncertainty.

Chapter 3: Advances in Artificial Intelligence: Implications for Capital Market Activities

Chapter 3 assesses recent developments in AI and Generative AI and their implications for capital markets, using new analytical work and results from a global outreach to market participants and regulators. Evidence from labor markets and patent filings suggests that adoption of AI in capital markets is likely to increase significantly in the near future, and AI could cause large changes in market structure through the greater and more powerful use of algorithmic trading and novel trading and investment strategies. AI may reduce some financial stability risks by enabling superior risk management, deepening market liquidity, and improving market monitoring by both participants and regulators. At the same time, new risks may arise, including increased market speed and volatility under stress, more opacity and monitoring challenges of non-bank financial institutions, increased operational risks as a result of reliance on a few key third-party AI-service providers, and increased cyber and market manipulation risks. Many of these risks are addressed by existing regulatory frameworks, but important new and unforeseen developments may arise. To ensure relevant authorities are prepared for these potentially transformative changes, they should consider additional policy responses.

Publications

-

March 2025

Finance & Development

- The Talent Equation

-

September 2024

Annual Report

- Resilience in the Face of Change

-

Regional Economic Outlooks

- Latest Issues

Transcript

Transcript