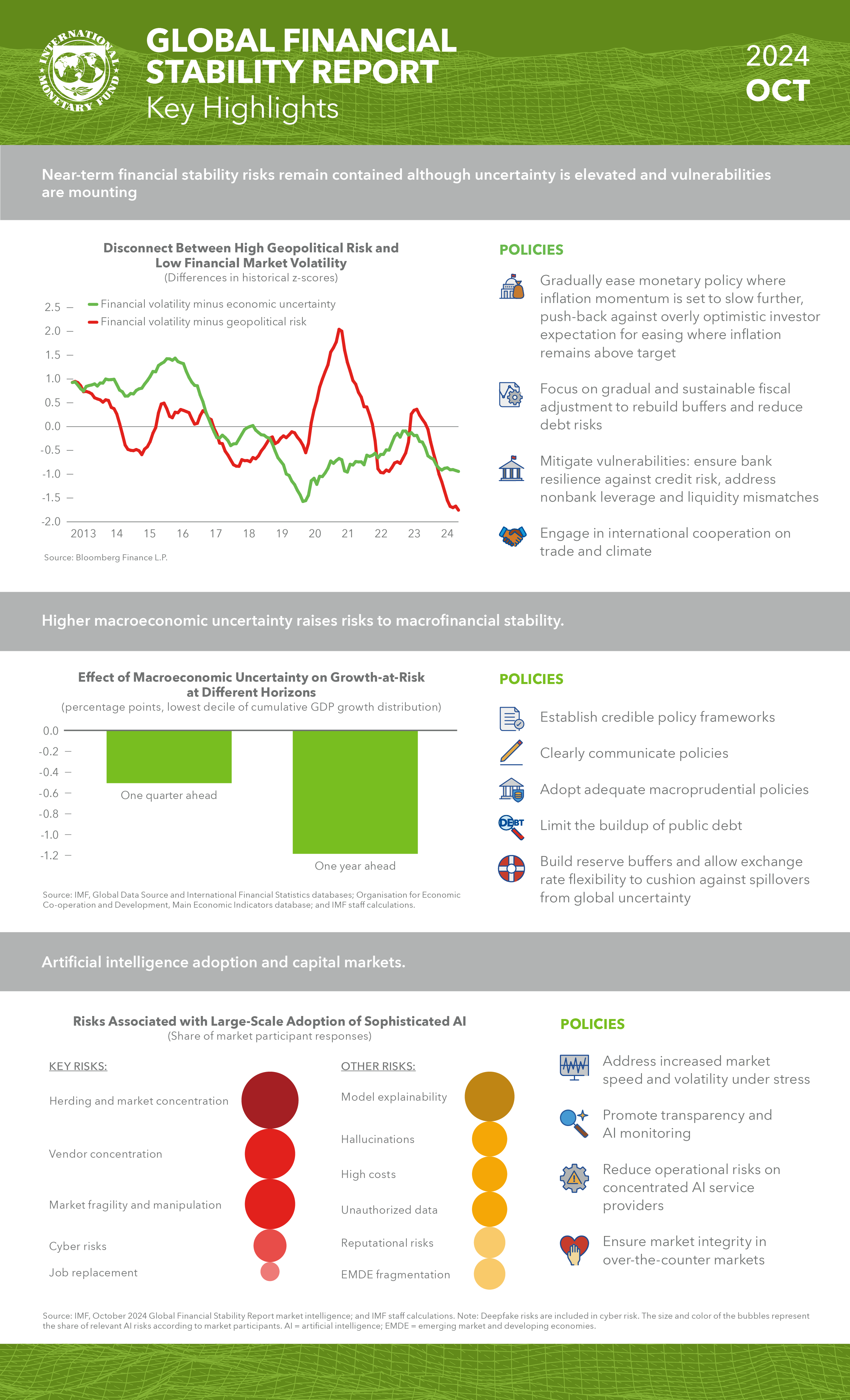

Financial stability risks remain contained in the near term, although rising economic and geopolitical uncertainty increases the likelihood of adverse shocks, exposing fragilities.

Chapter 1 of the October 2024 Global Financial Stability Report shows that although near-term financial stability risks have remained contained, mounting vulnerabilities could worsen future downside risks by amplifying shocks, which have become more probable because of the widening disconnect between elevated economic uncertainty and low financial volatility.

Chapter 2 presents evidence that high macroeconomic uncertainty can threaten macrofinancial stability by exacerbating downside tail risks to markets, credit supply, and GDP growth. These relationships are stronger when debt vulnerabilities are elevated, or financial market volatility is low (during episodes of a macro-market disconnect).

Chapter 3 assesses recent developments in AI and Generative AI and their implications for capital markets. It presents new analytical work and results from a global outreach to market participants and regulators, delineates potential benefits and risks that may arise from the widespread adoption of these new technologies, and makes suggestions for policy responses.

Chapter 2: Macrofinancial Stability Amid High Global Economic Uncertainty

Chapter 3: Advances in Artificial Intelligence: Implications for Capital Market Activities

Publications

December 2025

Finance & Development

- More Data, Now What?

Annual Report 2025

- Getting to Growth in an Age of Uncertainty

Regional Economic Outlooks

- Latest Issues

Transcript

Transcript