Chinese electric cars will help some European economies and harm others, but tariffs would leave everyone worse off

BYD Qin, Nio ES, and Xpeng P—these are popular series of Chinese electric vehicles (EVs). Well-built and affordable, they are not currently household names in Europe, but millions of them are already on the road in China and other emerging markets, such as Brazil. And with China now the largest automobile exporter in the world overall—accounting for 60 percent of global EV sales in 2023—these cars could soon come to a road near you.

The rise of China as a major EV producer has posed a dilemma for policymakers looking to promote the transition to a low-carbon economy. The European Union (EU) has set itself ambitious EV adoption goals: 100 percent of new car purchases by 2035, up from 15 percent today—a goal that could be achieved more easily by importing low-cost Chinese cars, which retail for about 20 percent less than similar French, German, or Italian models in the EU. However, several central and eastern European economies rely heavily on car and parts manufacturing for the leading European brands. Losing market share to Chinese car makers could put high-value jobs at risk and undermine political support for the green transition.

In new IMF research, we ask how the EU would be affected if it were to pursue its proposed EV adoption goals while permitting Chinese manufacturers to capture a significant share of its car market. We use state-of-the-art macroeconomic and trade models to quantify the impact of such an “EV shock” scenario on EU economies, relative to a hypothetical world in which EV adoption and China’s market share remain fixed at their pre-2023 values.

A crucial ingredient in the analysis is how much EU market share Chinese imports could capture. This depends on how strong a comparative advantage China is able to establish in a global car sector that is shifting toward EV production. Given the relative novelty of EVs, and the highly dynamic nature of technological innovation in this industry, projecting the evolution of comparative advantage is naturally difficult. For this reason, we turn to a historical episode and use it as a yardstick for our scenarios.

High fuel prices in the 1970s raised US consumer demand for low-cost, fuel-efficient vehicles. This helped promote Japan’s emergence as a global auto exporter. Between 1970 and 1985, the share of imported Japanese cars in the US rose from almost 1.7 to nearly 15 percent, before shrinking as trade tensions grew. Japan’s entry transformed US and global car markets.

Our scenarios assume that China’s rise could prove similarly transformative, leading to a 15 percentage point increase in its share of the EU market absent trade impediments, albeit over a shorter period. This serves as an illustration, not a forecast, as China’s penetration of the EU market is unlikely to mirror Japan’s entry into the US market exactly. The EU has already imposed new tariffs on Chinese EVs, up to 45 percent in some cases, so the import surge from China could prove weaker than in this earlier episode. It could also prove stronger, if China emerges as a more dominant producer in the car sector than Japan did.

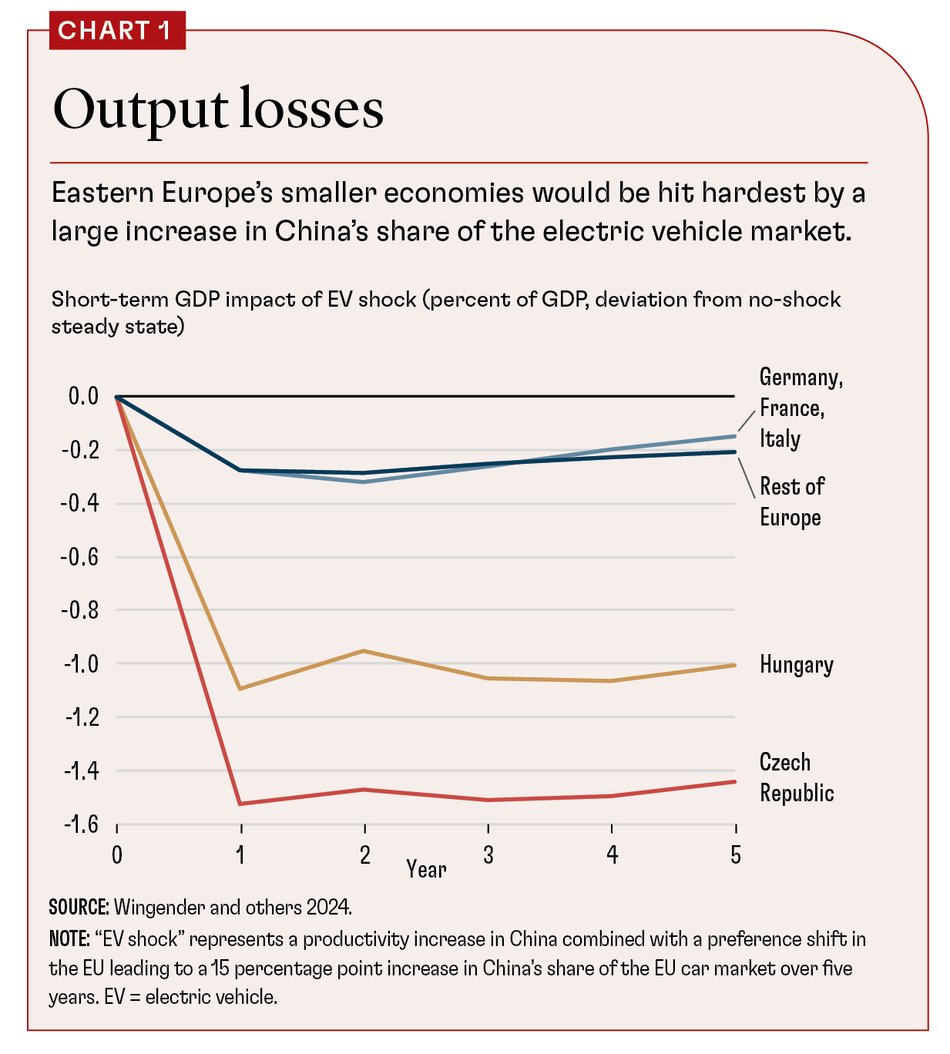

We find that the GDP impact from an EV shock is very small for the EU as a whole, but varies widely across its members (see Chart 1). Two countervailing forces are at work here. The increased supply of cheap Chinese vehicles benefits consumers throughout the EU. But it reduces demand for European car manufacturing, an economically important sector because of its high profitability and labor productivity. The resulting income loss is modest for Germany, France, and Italy. Despite being home to Europe’s major car brands, their economies are large and very diversified. Instead, the hardest blow is on smaller eastern European countries, where manufacturing in the supply chain for European cars makes up a large share of economic activity. Our model results show that Hungary and the Czech Republic are the worst-affected economies, with a decline in real GDP of 1 percent and 1.5 percent over five years, respectively.

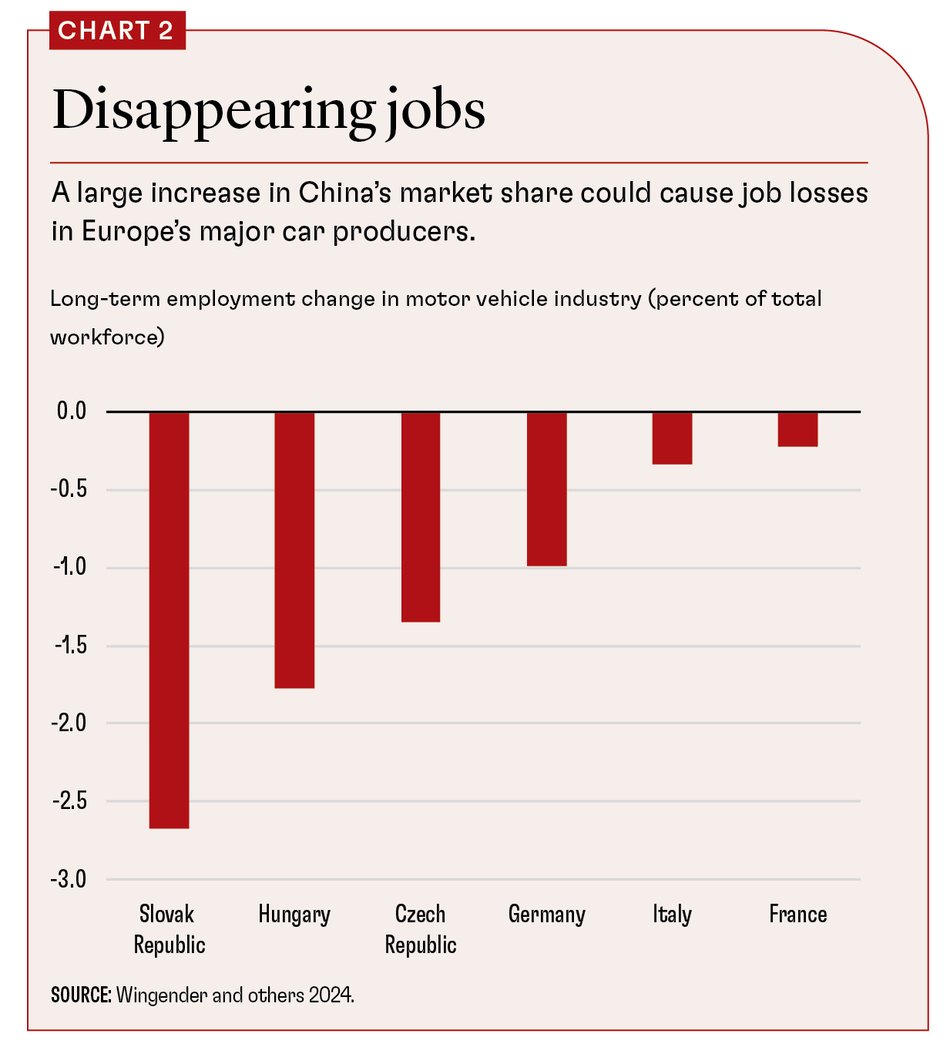

Beyond the headline GDP impacts, the shock would imply a significant labor reallocation away from the automobile sector. Our models show that the dislocated workers amount to as much as 2.6 percent of the workforce in the Slovak Republic and 1.7 percent in Hungary (Chart 2). Although these workers would ultimately be reemployed in other sectors—primarily services—labor reallocation on such a scale may have significant social, economic, political, and psychological costs, which are outside the scope of our models.

What should governments do to cushion the economic impacts? Some restrictions on Chinese EV imports may appear tempting, and the EU has gone down this route to some extent with the new tariffs on EV imports from China finalized in October.

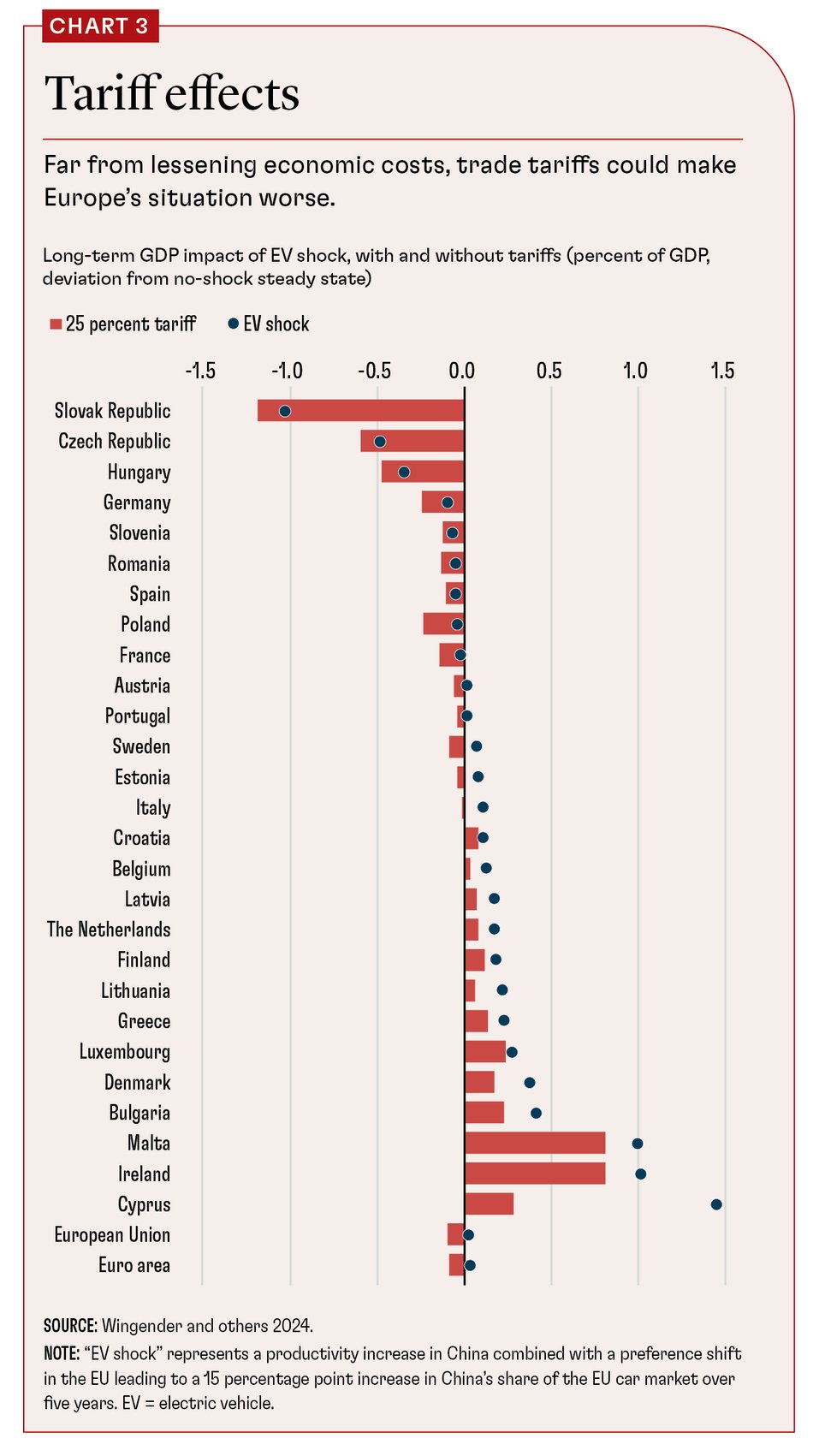

But trade barriers are not the right answer. Our model simulates the effects of a 25 percent and a 100 percent average tariff on Chinese automotive imports into the EU in the face of the EV shock. Far from lessening the economic costs, we find that tariffs make the situation worse, both in the short and long run (Chart 3). While the tariffs protect domestic auto production and yield limited revenue gains, they raise consumer prices as well as production costs in sectors that could use Chinese vehicles as inputs. These costs outweigh the benefits, leaving all EU countries poorer, with an especially adverse effect on economies that do not have a sizable domestic auto sector. The tariff protection will also not make European carmakers more competitive in the global market.

Beyond their economic impact, it has been argued that tariffs on Chinese EVs could slow the EU’s climate transition, resulting in additional CO2 emissions. On this point, our modeling results offer a more nuanced picture. The price effect of tariffs does cause consumers to buy some more traditional vehicles over the next decade, which adds to emissions. However, as long as the EU sticks to a path of policies that achieve its adoption target of 100 percent EV purchases by 2035, the overall fallout for emissions is minimal. In this case, the main effect of the tariffs is to raise the price tag of the transition. However, in practice a higher price tag may very well create pressure to delay EV adoption targets—and such a delay would cause a much more severe impact on emissions.

If not tariffs, what else might dampen the job and output losses of the EV shock? The key lies in investment and productivity. Our modeling shows that if higher EV demand in Europe is met by Chinese firms producing directly in Europe, via increased foreign direct investment, adverse impacts could be lessened. This is how Japanese automakers began to serve the US market beginning in the 1980s. We also find that realistic productivity gains in the European car sector could go a long way toward softening the macroeconomic impact on the worst-affected EU economies. A removal of remaining intra-EU barriers to trade and capital flows could allow car manufacturers to better exploit economies of scale, thereby incentivizing investment in research and development.

This points toward a middle-ground solution to the EU’s dilemma of whether to preserve high-value manufacturing jobs or stand firm on climate goals. It would involve active policies to encourage investment and productivity gains in the auto sector and to assist with any job transitions—while making room for BYDs, Nios, and Xpengs on European roads.

This article draws on IMF Working Paper 2024/218, “Europe’s Shift to EVs amid Intensifying Global Competition,” by Philippe Wingender, Jiaxiong Yao, Robert Zymek, Benjamin Carton, Diego A. Cerdeiro, and Anke Weber.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.