How To Do Better

October 25, 2024

As prepared for delivery

Thank you, Governor Munawar, and a very good morning to all!

It is my privilege to address you on behalf of the talented and dedicated staff of the IMF—and to do so alongside Ajay Banga, who has been a great partner since he started in his job. Ajay, I cannot stress enough how much I admire your leadership of the World Bank and value our partnership—the two of us, as well as between our institutions!

Let me start with some good news: inflation is in retreat [FIGURE 1]. From 5.7 percent in the fourth quarter of last year, our World Economic Outlook sees global inflation falling to 5.3 percent in the current quarter and further to 3.5 percent in Q4 2025—with a faster decline in advanced economies. Tight monetary policies have worked without breaking the back of the global economy. Big sense of relief.

But not yet time for celebration—including because, even if inflation is coming down, the new and higher price level is here to stay. Families are hurting.

And, looking ahead, the world now faces a low growth – high debt trajectory:

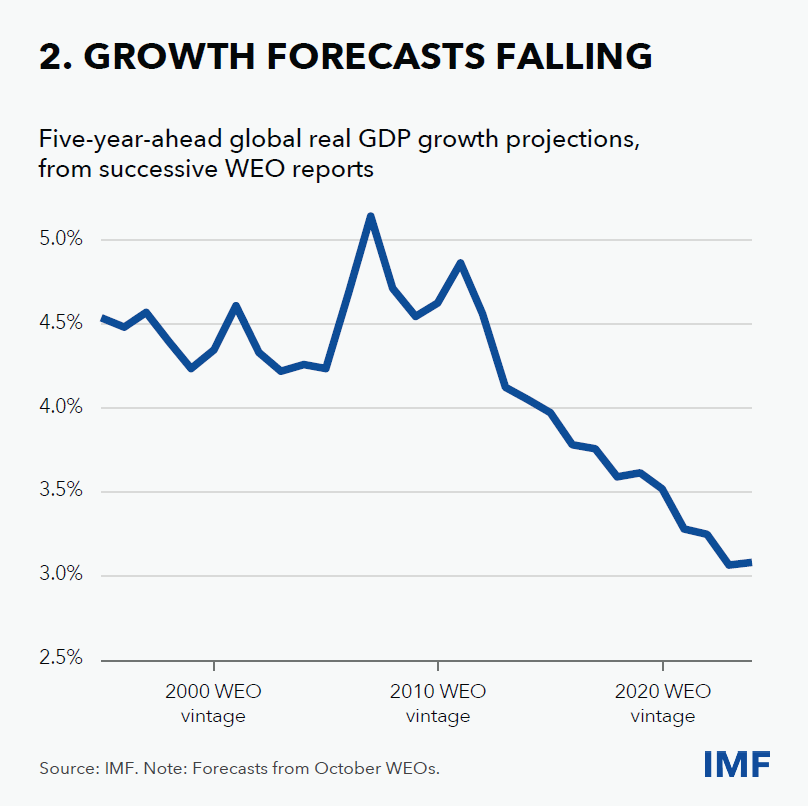

- We project world GDP to grow at an anemic average rate of 3.2 percent per year over the next five years—just look at how our forecasts have been revised lower and lower over the years [FIGURE 2].

- At the same time, we forecast global public debt to keep rising—with a risk that it could exceed our baseline projection by as much as 20 percent of world GDP in a severe but plausible negative scenario [FIGURE 3]. A hundred trillion dollars in government debt worldwide. Higher interest payments eating up a growing slice of fiscal revenues, especially in low-income and emerging market countries. All of this as spending pressures pile up.

Spending priorities include outlays related to climate and demography and, in emerging market and low-income countries, investment to close development gaps. By 2030, IMF research sees these spending pressures adding some 7 percent of GDP to annual expenditure in advanced economies, 9 percent of GDP in emerging markets, and 14 percent in low-income developing countries.

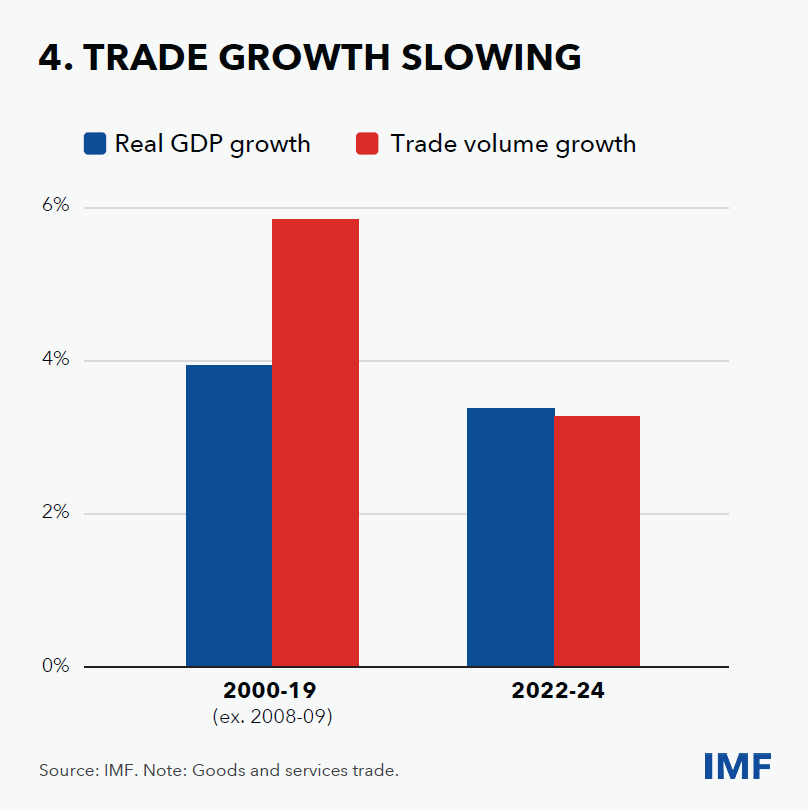

To make matters worse, the world is fracturing, and trade is no longer the powerful engine of growth that it used to be [FIGURE 4]. The retreat from global economic integration—driven by both national security concerns and the anger of those who lost out from it—is visible in a mushrooming of industrial policy measures, trade barriers, and protectionism.

There is much work to do.

My message to our members is this: first, shift toward rebuilding fiscal buffers; second, invest in growth-enhancing reforms; and third, work together to tackle global challenges.

With monetary policy easing, fiscal consolidation should start now. Credibility requires persuasive communication with the public. Multi-year fiscal plans should lay out consolidation paths tailored to country-specific situations.

This is not easy. Governments face a dilemma—more accurately, a “trilemma”—of large spending needs, political redlines on taxation, and the need to rebuild buffers.

Domestic revenue mobilization will be critical for many countries to square this circle. Growth-enhancing investments, notably in climate and technology, must be protected. And consolidation should be designed so it does not come at the expense of social protection and jobs.

The IMF can help. Take for instance the case of Jamaica, where the government secured public support for a carefully designed package of revenue and expenditure reforms that protected public investment and social spending yet still succeeded in almost halving debt between 2012 and 2022. More than 20 countries have been able to boost their tax revenues by over 5 percent of GDP in the past three decades. There are many good examples.

In parallel with fiscal consolidation, countries must launch ambitious reforms to lift their growth potential. Higher growth not only helps creates well-paid jobs but also eases the fiscal trilemma by generating higher tax revenues.

These reforms span labor-market measures such as skills enhancement and job matching, product-market measures to cut red tape and mobilize savings, and specific measures to foster innovation and raise productivity. In the advanced economies, venture capital and capital market integration are key priorities; elsewhere, the focus needs to include steps to improve governance and institutions.

Real progress is possible. A new IMF study shows that reforms are best developed through two-way dialogue with the public, with measures to mitigate the impact on those who risk losing out.

But domestic policies will not be enough. To tackle today’s global challenges, we need—more than ever—cooperation andmultilateral action. The IMF and World Bank have a critical role to play here.

Take the issue of debt. In countries on the edge of fiscal distress, proactive steps are needed to restore debt sustainability. The Fund has prioritized addressing debt vulnerabilities and enhancing debt resolution, with efforts that are now paying off. Already, the Common Framework has delivered milestone achievements for Ghana and Ethiopia—even if further efforts are needed to increase predictability and accelerate timelines in debt treatments.

Progress has been underpinned by enhanced cooperation among stakeholders at the Global Sovereign Debt Roundtable, which has helped build consensus on technical issues.

In today’s high-temperature geopolitical environment, we can’t take cooperation for granted. This is why everything we do at the Fund is about delivering value to our members, tailored to their needs.

Our bilateral surveillance provides timely diagnostics and advice to help countries implement strong policies. During the pandemic, it was pivotal in helping countries assemble coordinated policy responses swiftly, despite high uncertainty.

The focus of our regular consultations with member countries ranges from supporting institutional development in fragile and conflict-affected states, to capital flow management in emerging market economies, to advising on the details of interest rate policy in advanced economies. And we have deepened our analysis of the macroeconomic policy challenges posed by the green and digital transformations.

Our multilateral surveillance then pulls it all together to extract cross-cutting lessons for all. Again, the goal is to ensure that problems are identified and addressed early. This is precisely what we do in our flagship reports: the World Economic Outlook, the Global Financial Stability Report, and the Fiscal Monitor.

All of this is complemented by our capacity development work. We have fielded thousands of technical assistance missions in the last five years alone, transferring knowledge and creating a deep well of goodwill in the process.

In short, we are the world’s essential transmission line for the sharing of country experiences across our membership.

And then there is the Fund’s unique role as a lender at the center of the global financial safety net.

We are the first responder in times of trouble. Countries know we are here to catch them if they fall—especially the poorest and most vulnerable.

We have stepped up our lending to support reforms and help vulnerable countries address balance of payment needs and build resilience in the face of multiple shocks.

Barbados and Benin, Cabo Verde and Costa Rica, Moldova and Morocco, Suriname and Sri Lanka, to name but a few—the list of recent IMF program successes is long.

In the years since the onset of the pandemic, we have set records for both our total lending volume and the number of countries assisted, with the stock of concessional credit outstanding from our Poverty Reduction and Growth Trust tripling to $28 billion. And, in the less than three years since its launch, 20 countries have received long-term loans from our Resilience and Sustainability Trust, supporting policies to boost resilience to climate change.

At the Fund we are currently exhibiting an artwork that captures our lending volumes over the decades in a beautifully visual way—the results are truly remarkable, please come and see for yourself!

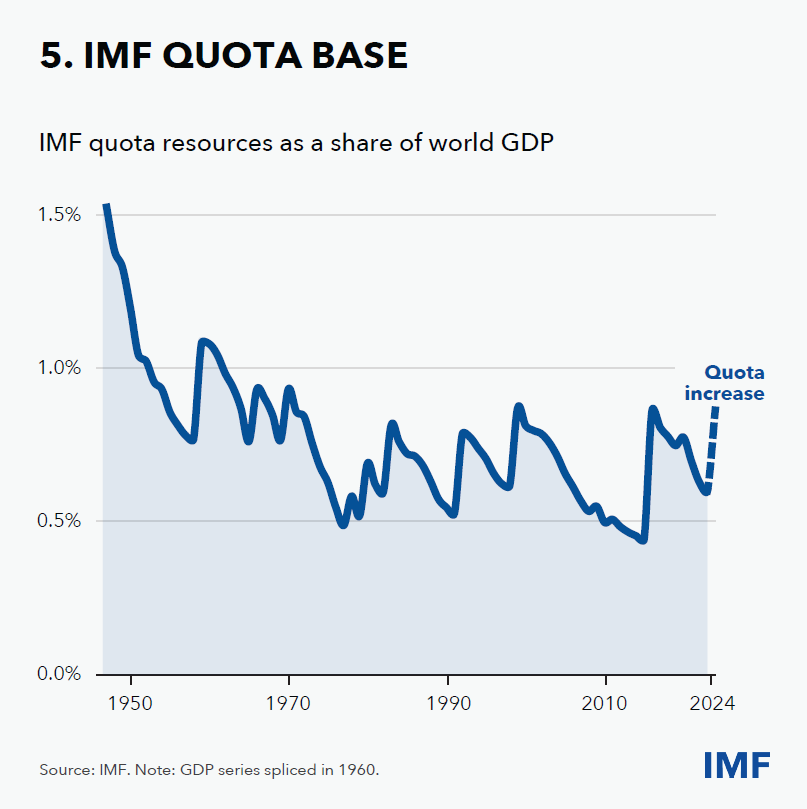

The 50 percent quota increase we agreed last year in Marrakesh, solidifies our lending capacity [FIGURE 5]. We will build on these foundations by continuing to refine our toolkit. Strengthening the Fund’s lending role and precautionary credit facilities strengthens the global financial safety net. All countries stand to benefit—because less instability means the whole world does better, and because aggregating resources together is efficient.

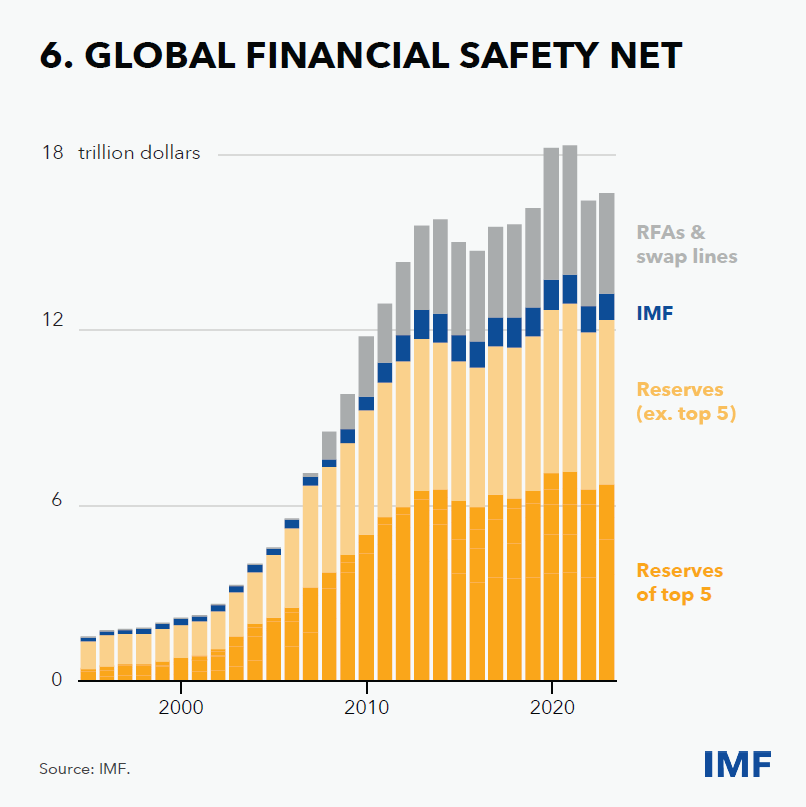

Fund support is essential for countries with a limited capacity to build international reserves—and doubly so given that five countries own more than half of the world’s total reserves, while many countries remain relatively unprotected [FIGURE 6].

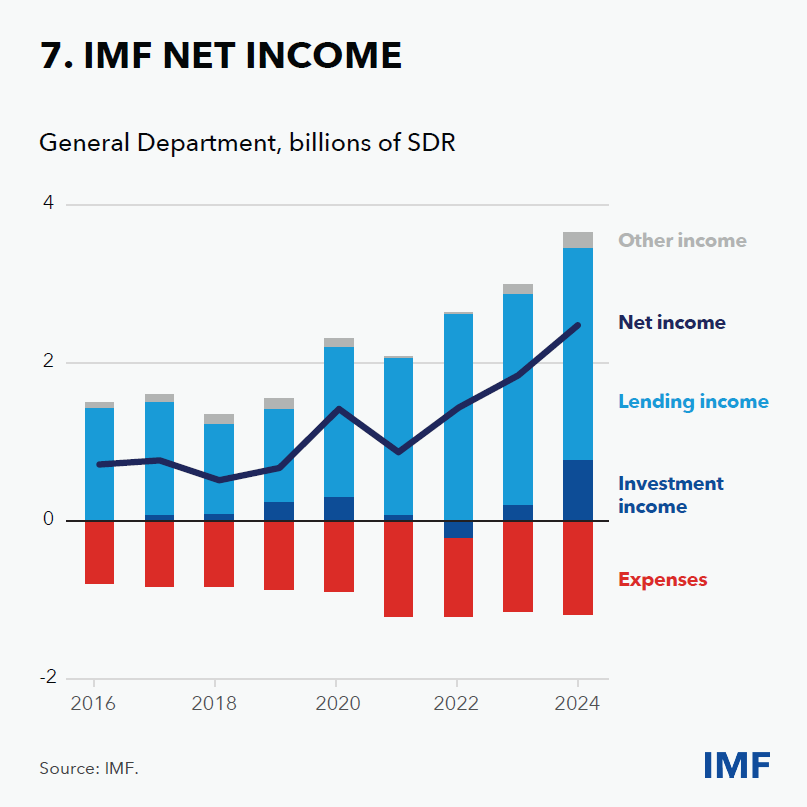

At the IMF, we have just had a great example of cooperation occurring on the very eve of these Annual Meetings. Reflecting years of strong net income, our Executive Board agreed a set of measures that will, first, safeguard the financial strength that underpins our support for our members; second, reduce charges and surcharges on our regular lending by an average of 36 percent; and, third, deliver a comprehensive reform and financing package that more than doubles our concessional lending capacity and places our support to low-income countries on a firm footing for years to come [FIGURE 7].

Beyond the substance of these important reforms, let me highlight that we succeeded in securing unanimous support. Not a single member country objected.

This did not “just happen”—we had to work very hard for it, and we iterated many times with our members to deliver a result that in the end worked for all.

This is a lesson for the coming years. No matter how difficult the geopolitics may be, we can work to preserve the spirit of concrete, actionable cooperation. Countries rally not in idealism or charity but out of enlightened self-interest.

To do our job well we must strive for inclusivity. In this spirit I ask you all to please join me in warmly welcoming Prime Minister Daniel Risch and his team—they are here to represent our newest, 191st member: the Principality of Liechtenstein.

We must also never stop striving for fair representation of the world we live in. Work is ongoing with our Board and the membership to develop, by June, possible approaches as a guide to better reflect members’ weight in the world economy, including through a new quota formula.

Similarly, voice matters. I am delighted that on November 1 our Board will welcome a third Director for Sub-Saharan Africa, ensuring more voice for this region.

Last but not least, cooperation does not happen in a vacuum. At the Fund, we rely on institutional strength and our excellent staff to do the work of supporting our member countries. Please join me in a round of applause for them!

Let me close with an anecdote.

This year being the 80th anniversary of the historic Bretton Woods conference, Ajay and I decided to go to our birthplace. We took a group of leading thinkers with us for two days of reflection. We went to draw inspiration from our founders: men who, even in the darkest days of total war, were able to shape a new world. And we understood: if Keynes and White could shine a light in a tunnel that dark, then clearly, our mission is to carry their torch.

The skies over Bretton Woods were mostly dark and gloomy during those two days last month. But then—suddenly—the sun broke through, and Mother Nature gifted us a gorgeous double rainbow. Set against the turning foliage of Mount Washington in the Fall, it was just spectacular. There is no other way to put it.

To us, that was a great omen—and a reminder that the sun is always there, it is only the clouds that come and go. Our founders have left us a legacy to see through darker times. And so we will—because we know it can be done.

Thank you!

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org