Aircraft factory in São José dos Campos, Brazil: the Brazilian economy is expected to grow 0.7 percent in 2017 and 1.5 percent next year (photo: Andre Vieira/KRT/Newscom)

Latin America's Recovery on Track but Long-Term Growth Weak

October 13, 2017

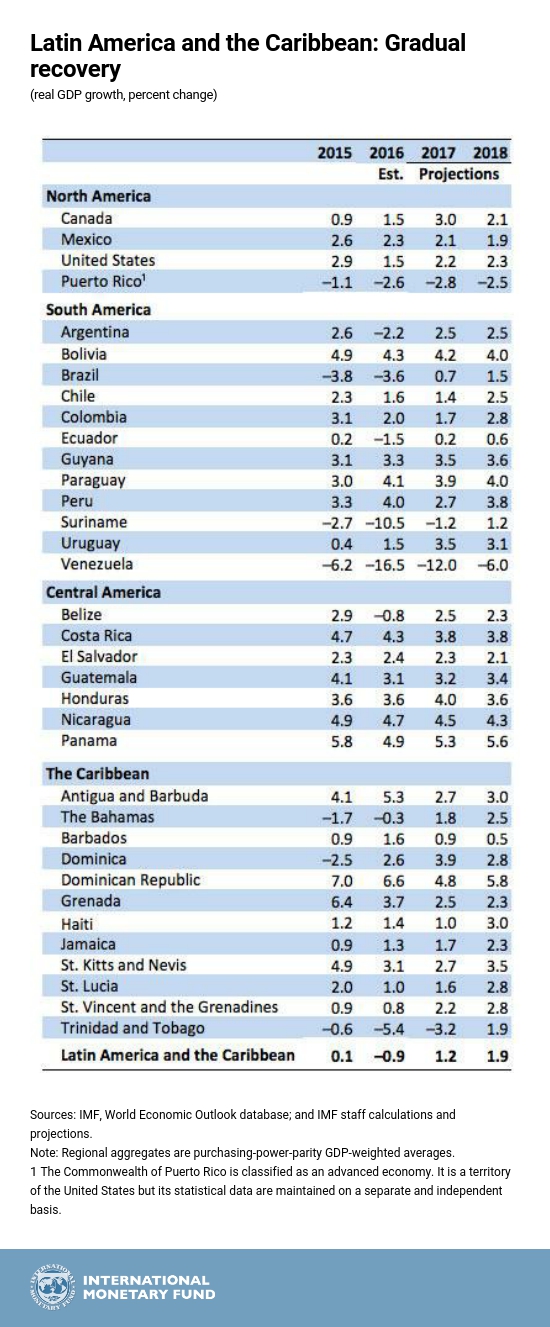

Economic activity in Latin America remains on track to recover gradually in 2017–18, but long-term growth remains stuck in low gear, slowing progress in catching up to income levels in advanced countries, according to the IMF’s latest regional update.

Related Links

At the same time, inflation is moderating in many countries as the effects of earlier exchange rate depreciations on domestic prices subside, some currencies appreciate, and economic slack (the quantity of labor and capital that remains idle) continues. Inflation at the regional level is expected to decline to 4.2 percent in 2017 (from its peak of 6.2 percent in 2015) and to remain at about 3½ percent thereafter.

Despite this ongoing recovery, prospects for strong long-term growth in Latin America and the Caribbean look dimmer. In the next 3-5 years, Latin America is projected to grow 1.7 percent in per capita terms. This growth rate is almost identical to the region’s performance over the past quarter century and only marginally better than those in advanced economies, raising concerns that the region is not catching up to income levels in advanced countries.

Regional mix

After bottoming out in 2016, growth in South America is gradually picking up, the report said. Argentina is recovering from last year’s recession and is expected to grow by about 2½ percent in 2017 as investment firms up. After entering positive territory in the first half of 2017, growth in Brazil is expected to reach 0.7 percent for the whole year and 1.5 percent in 2018. In Chile, growth in the first half of 2017 remained weak, despite resilient household spending. In Colombia, the economic slowdown continues, given the permanent shock to commodity income and the tax reform. The Venezuelan economy continues contracting for the fourth consecutive year and inflation is on the path to hyperinflation.

In Mexico, economic activity remained solid in the first half of the year despite uncertainty about future trade relations with the United States. In Central America, economic activity, in aggregate, remains close to potential.

Economic prospects for the Caribbean are generally improving, but the baseline projections reflect data available before the impact of Hurricanes Harvey, Irma, and Maria, and do not include the devastating impact of these hurricanes on a number of countries in the region and the risk they pose to their growth outlook.

Risks

Domestic and external risks include:

- political, related to the uncertainty of policy stance following the elections that will take place in several countries;

- humanitarian , if the ongoing crisis in Venezuela deteriorates;

- financial , if global financial conditions tighten; and

- economic, if there is an abrupt adjustment in demand from China.

Retreat from cross-border economic integration and natural disasters and climate change also pose risks to the region’s long-term outlook.

Policy priorities

Limited room in the budget. The region’s public debt increased above the average level for emerging markets. This suggests that many countries would need to continue to lower their deficits to put their public finances on a sustainable path.

More supportive monetary policy. As inflation and inflation expectations decline and are at or below target ranges in many countries—central banks have been reducing their policy rates. Monetary policy can continue to play a more supportive role, particularly given the limited fiscal space and continued economic slack.

Lifting incomes. Countries need to push forward much-needed structural reforms to ensure sustainable and inclusive growth. Priorities include: closing infrastructure gaps, enhancing female labor force participation where it is still low, reducing labor market informality, investing in human capital to ensure broad-based access to high-quality education, improving governance and curbing corruption, and furthering regional trade and financial integration.