NEWS from Asia and the Pacific

Getting Debt Management Right is Vital, says IMF at Tokyo Forum

June 21, 2019, Tokyo – Amid new challenges presented by unprecedented levels of government indebtedness and innovations in sovereign debt capital markets, the International Monetary Fund (IMF) yesterday opened a two-day international forum to discuss new challenges in debt management in Tokyo.

The forum, co-organized with the Japanese Ministry of Finance, brought together senior officials of 33 countries - both advanced and emerging economies – and private sector representatives. State Minister Keisuke Suzuki of the Finance Ministry opened the forum to wish the participants constructive discussions to gain new insights and ideas on debt-management policy and government bond markets.

The forum, co-organized with the Japanese Ministry of Finance, brought together senior officials of 33 countries - both advanced and emerging economies – and private sector representatives. State Minister Keisuke Suzuki of the Finance Ministry opened the forum to wish the participants constructive discussions to gain new insights and ideas on debt-management policy and government bond markets.

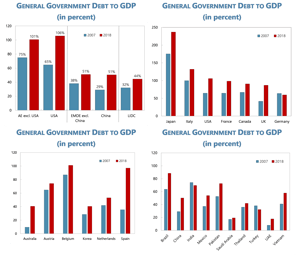

Mr. Tobias Adrian, IMF Financial Counsellor and Director of the Monetary and Capital Markets Department, made a keynote address to set the tone of the discussions. “Sound debt management and the efficient functioning of sovereign debt capital markets is as important as ever,” he told the audience of more than 100 participants from around the globe, pointing out that debt outstanding is very large in many advanced economies and in some emerging markets, and that the ratio of general government debt to GDP has gone up markedly.

He further said that a wide range of developments and trends in debt capital markets, including the digitalization of markets and the change in players and instruments, present opportunities and challenges for all market participants. Reminding participants that markets can swing from loose to tight conditions over short periods of time, he said that debt management policies are macro-critical and that policy makers must anticipate the effect of those policies on the economy. He also stressed the importance of transparency and open communication in sovereign debt and debt management.

He further said that a wide range of developments and trends in debt capital markets, including the digitalization of markets and the change in players and instruments, present opportunities and challenges for all market participants. Reminding participants that markets can swing from loose to tight conditions over short periods of time, he said that debt management policies are macro-critical and that policy makers must anticipate the effect of those policies on the economy. He also stressed the importance of transparency and open communication in sovereign debt and debt management.

This year’s forum is the 17th held by the IMF and the ministry to provide a platform for the international community to exchange views on the latest challenges and opportunities in the evolving debt capital markets.

Over the two days, the participants discussed the global debt outlook, market access challenges, new trends in lending, and the evolution of debt markets. The forum also reflected on possible strains in debt markets, looked at more structural changes in regulations and technology, and explored the way to foster beneficial innovation.

The next forum is slated for 2021.