Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Conference Probes Links Between Nordic-Baltic Banks

December 19, 2013

- Euro area banking union to have impact on Nordic-Baltic banks

- Nordic-Baltic banking sector is large and highly integrated

- Financial stability supported by joint supervisory vigilance and well-capitalized banks

The central banks of Estonia and Sweden and the IMF hosted a conference on “Nordic-Baltic Financial Linkages and Challenges” in Tallinn, Estonia, where policymakers and bank executives examined financial integration and cross-border collaboration in light of the euro area’s nascent banking union.

IMF Deputy Managing Director Nemat Shafik acknowledged the consistent collaboration on cross-border banking issues in Nordic-Baltic region (photo: Annika Haas)

Financial Linkages & Spillovers

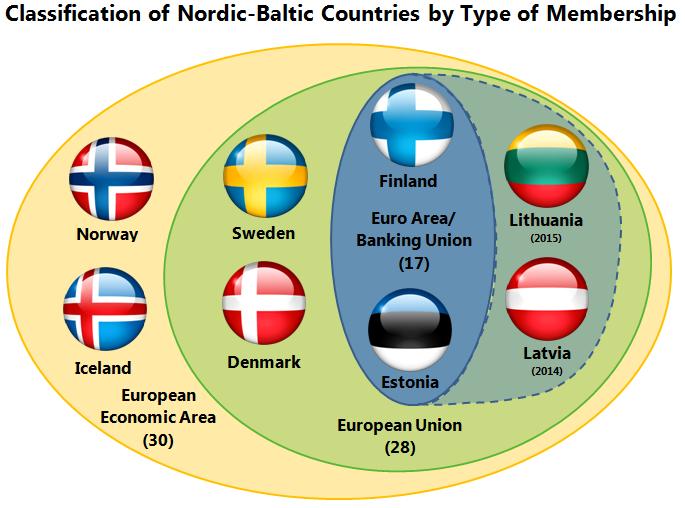

The eight Nordic-Baltic countries—Denmark, Estonia, Finland, Iceland, Latvia, Lithuania, Norway, and Sweden—share a regionally integrated financial market, and often similar philosophies on economic, monetary, and financial policies. The region’s banks are well capitalized and highly rated, and, for the most part, have weathered the recent crisis better than most.

“The long-standing Nordic-Baltic collaboration on cross-border banking supervision has been very important not only for the region’s financial stability, but also for cementing market confidence,” said IMF Deputy Managing Director Nemat Shafik, who spoke at the conference.

Nordic-Baltic Financial Sector

The financial sectors of the eight Nordic-Baltic countries are concentrated around a small group of large banks.

• The recent Nordic Regional Report highlighted how the assets of the six largest banks (Danske Bank, DnB, Handelsbanken, Nordea, SEB, and Swedbank) comprise roughly 90 percent of the total assets of all of the region’s publicly-listed banks with most of their business concentrated within the Nordic-Baltic region. Mergers following the 1990s banking crisis, and a subsequent period of dynamic growth, have made these banks bigger and more systemically important. For example, banking assets in Denmark and Sweden amount to approximately 400 percent of GDP in each country.

• Banking systems in the Baltic countries have a significant foreign presence, mainly by large Nordic banks—in Estonia and Lithuania, for example, the banking systems are more than 90 percent foreign owned. Baltic banks are also heavily dependent on funding from their Nordic parent banks, albeit to a much lesser extent than before the crisis. These strong ties make the Nordic-Baltic countries subject to spillovers from within the region, as well as to global shocks due to their high degree of trade and financial openness.

Although collaboration and cooperation across the region have been essential for financial stability, especially in the context of the financial crisis, the crisis also showed that the region needs a stronger institutional framework as national supervisory mandates are not equipped to handle cross-border challenges. Looking forward, the challenges of collaboration may increase with the advent of the euro area banking union, and a new approach to cooperation is likely to be needed.

New approach to cooperation

IMF Deputy Managing Director Shafik said that “the banking union is critical to ensure recovery from the crisis, to break the bank-sovereign nexus, and to restart credit in the economy.” However, she also highlighted the importance of enticing countries outside the euro area to join.

At present, Finland and Estonia will be joined in the euro area by Latvia in January 2014 and thus automatically qualify for full membership in the banking union; Lithuania is seeking euro adoption in 2015. So, the countries with largely foreign-owned banking sectors will automatically join while the parent banks (located mainly in Denmark, Norway, and Sweden) will remain outside. This raises the question of how the existing Nordic-Baltic supervisory arrangements will be either augmented or replaced once the composition of regional supervisors’ changes.

The advent of the banking union could be an opportunity for the region. The European Central Bank intends to promote smooth interaction between jurisdictions within the single supervisory mechanism and those outside, as well as between euro area countries and those opting in to the single supervisory mechanism. At the same time, the challenge will be to create a structure that ensures coherence and integration between the banking union and the supervisory structure that are already in place in the region.

In-depth look at Nordic-Baltic linkages

In 2014, a Baltic Cluster Report will accompany the IMF’s Article IV consultations with the individual Baltic countries. The report will build partly on the Nordic Regional Report which analyzed the Nordic countries’ strengths and weaknesses and recommended strong national financial policies and regional cooperation in order to mitigate common challenges and shared risks. Keeping in mind the entire region’s interconnectedness, the Baltic Cluster Report is intended to provide greater insight into the nature of Baltic linkages as well as understand how these three countries remained resilient in the face of the recent European downturn.