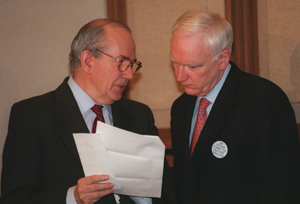

Press Conference of Philippe Maystadt, Chairman of the Interim Committee and IMF Managing Director Michel Camdessus

April 16, 1998

IMF Meeting Hall

IMF Headquarters

Washington, D.C.

MR. MAYSTADT: Good evening, ladies and gentlemen. As you know, the Interim Committee has focused its work on the strengthening that could be brought to the architecture of the international monetary system, and as usual we also had a discussion on the issues raised in the World Economic Outlook, with a special emphasis on the situation of the countries at the center of the crisis. I had invited a representative from Thailand, Korea, and Indonesia to give the Committee their perspective on the current situation in Asia.

|

| IMF Managing Director Michel Camdessus and Interim Committee Chairman Philippe Maystadt |

But what I would like to emphasize is what the Committee considers as the main steps that need to be taken to strengthen the global monetary and financial system. The text of the communiqué provides a detailed account of the richness of the Committee's discussion and of the concrete improvements that the IMF needs to bring to the current framework for crisis prevention and crisis settlement. I could comment on each specific point that is mentioned in the communiqué, but this might require too much of your time. Instead, I would like to underline three main conclusions that in my view can be drawn from the Committee's discussion.

The first conclusion is that globalization has increased the vulnerability of domestic and international financial systems to potential shocks, including to shifts in market sentiment and to contagion effects from policy weaknesses in other countries. The answer to this challenge is manyfold. Let me highlight from the communiqué four areas for action by the Fund.

|

| Mr. Camdessus, Mr. Maystadt and Mr. Anjaria |

Second, the Fund should underscore the importance of orderly and properly sequenced liberalization of capital movements.

Third, the Fund should enhance its surveillance of capital flows and focus on the risks posed by abrupt reversals of capital flows, and in this context a specific request has been made to the Executive Board to examine ways to strengthen the monitoring of capital flows, especially short-term cross-border flows.

Fourth, the Fund should pursue its cooperation with the World Bank to find the most effective way to offer its members the best possible advice on policy measures for strengthening their financial systems, and new forms of collaboration might be needed in order to fully use the accumulated expertise in both institutions.

The second conclusion from the discussion that I would underline relates to the importance of greater availability and transparency of information regarding data and policies. I draw your attention to page 4 of the communiqué. You will see that the Committee underscored members' obligation to provide timely and accurate data to the Fund, and if persistent deficiencies in disclosing relevant data to the Fund impede surveillance, the conclusion of Article IV consultations should be delayed.

|

| Mr. Maystadt and reporters |

Also, the Committee encouraged more members to release press information notices on the conclusions of Article IV consultations.

The third conclusion concerns the involvement of the private sector in crisis resolution. I refer to page 5 and page 6 of the communiqué. You will see that the Committee thinks it is quite important that all creditors, including short-term creditors, bear more fully the consequences of their actions. And the Committee requested the Executive Board to intensify its consideration of possible steps to strengthen private sector involvement. You will find on page 6 of the communiqué a list of different mechanisms for meeting this objective which should be considered by the Executive Board, and the Committee requested that the Executive Board report on all aspects of its work in these areas at the next meeting of the Committee. You will see that there are some quite interesting suggestions, but, of course, it was not possible to make a final judgment today. We have, nonetheless, given to the Executive Board a list of concrete ways to strengthen the involvement of the private sector in crisis resolution.

These are the main points I would like to underline in this rather long

communiqué.

THE MANAGING DIRECTOR: I admire the way that the chairman was able in

so few words to sum up this long and complex communiqué, and I believe

that it is a transparent presentation of our work.

QUESTION: Are you satisfied that the request for the Board to develop a

tiered response in terms of publicizing the advice to countries which

aren't taking the Fund's advice doesn't risk triggering the crisis it's

supposed to prevent?

THE MANAGING DIRECTOR: This suggestion here is useful because it refers

to a situation where a government would persist after being encouraged,

after being assisted in producing data, etcetera, would persist in the

refusal to heed advice. This would be, indeed, a distinct instance of non-

cooperation with the Fund, something very serious, indeed. And I believe

that the fact that the Interim Committee has made clear that we had this

possibility--we have already, as a matter of fact--will be a good

incentive to our members to cooperate even better.

QUESTION: Two questions. First, about the communiqué on page 1, in

reference to the Japanese banking system, you said, and I quote, "any

support to the banking system should be accompanied by appropriate

action on closure or consolidation, and undertaken as part of a coherent

medium-term policy framework." Does this reflect your concern that the

Japanese authorities are not closing banks which should be closed by

infusing public money and by other means?

My second question is to the Managing Director, about the yen. Do you share

the G-7 countries' concern about the excessive depreciation of the yen,

especially its negative impact on the Japanese, Asian, and world

economies? If so, do you support coordinated joint intervention by the G-7

authorities?

THE MANAGING DIRECTOR: First of all, I must tell you that this sentence

about the banking system has been agreed by consensus. It means that it

reflects the views of the entire membership, including the Japanese

authorities. The banking package was agreed only a few weeks ago. This

was an occasion for the Japanese authorities to make clear in which spirit

of transparency and determination they wanted to implement these

measures. They made clear that if banks are truly insolvent, they will be

closed. And that any distribution of financial support will be accompanied

by an explicit program for the consolidation of the banks, a program which

will unfold over the medium term. This is what is captured by this

sentence.

Now, on the yen, yes, I share the views of the G-7. I consider that even if

you take into consideration the cyclical position of the Japanese economy,

the depreciation of the yen is excessive and does not help the proper

rebalancing of the world economy. This being said, the view not only of the

G7, but of the full membership is that such an issue must be addressed by

the quick and full implementation of the program for banking

restructuring and fiscal stimulus, adopted by the government of Prime

Minister Hashimoto. It is the effect of these measures on the Japanese

economy which should help the yen come back to more appropriate levels.

Interventions, coordinated or not, in the absence of a full implementation

of this program wouldn't make sense, and this is why, I think rightly so,

the G-7 in their communiqué have put the finger on the need for taking

macroeconomic, fiscal, budgetary, structural measures, and have not

referred at this stage to the need for coordinated intervention. Even if

they mention the readiness to intervene in the markets, if at all needed,

this applies to all the currencies and not specifically to the yen.

QUESTION: A couple of scattered questions. In the tiered response that

you're talking about, do you foresee a situation where the Fund would go

public on its concerns without the consent of the member nations?

Second, there were several proposals made by G-7 members prior to this

about disclosure and financial regulation, for instance Mr. Rubin's idea of

restricting access to advanced economies for banks whose home countries

have lax regulation, or Mr. Brown's suggestion of joint IMF-World Bank

surveillance of financial regulation; were any of those proposals

discussed?

THE MANAGING DIRECTOR: First, your question on the IMF going public with

its opinion on a given country without the country's consent. This was

mentioned during the meeting of the Committee. But as an ultima ratio. As

a matter of fact, we don't need the Interim Committee to do that. There is

provision in our Articles of Agreement. If my memory serves me well, it

is Article XII, 8, which, with a majority of 70 percent, allows the IMF to

go public with its views on a given country. But, of course, this is truly

the ultima ratio. What the Interim Committee has suggested rather is a

progressive strengthening of our language. This was characterized by the

metaphor of the yellow card in soccer games. The Interim Committee has

encouraged us from time to time to show the yellow card a little more.

One of the aspects of it could be, for instance, when I send a letter to a

prime minister or to a minister of finance, to tell him that he must

respond to my letter, possibly within a short period, and allow me to

share his response with the Executive Board. It's this concept of a

graduated strategy that is favored by the Interim Committee. And I think

it is the strong hope of the Committee that the IMF will never be in the

situation to have to resort to the red card of going public with its

negative opinion on a given country.

MR. MAYSTADT: On the text, we agreed to speak about increasingly strong

warnings. We didn't mention public warnings explicitly, but I think that I

can draw the conclusion from the discussion in the Committee that this

phrase, increasingly strong warnings, does not exclude that as an ultimate

step in exceptional circumstances the Fund might go public, if there is no

other way to convince a member to follow the advice and

recommendations of the Fund. But, it's envisaged really as an ultimate

step and quite exceptional.

THE MANAGING DIRECTOR: I have not answered part of your question,

namely the fear that we could trigger a crisis we are there to avoid. No.

We wouldn't have this fear. This fear wouldn't deter us, because in such a

situation, clearly the origin of the crisis wouldn't be with our statement,

but with the malgovernance of the country.

QUESTION: What about Mr. Rubin's and Mr. Brown's proposals?

THE MANAGING DIRECTOR: Secretary Rubin did not, if I remember well,

mention this idea (of restricting banks' access to advanced economies)

during the discussion. Chancellor Brown has suggested that, if needed, we

consider new forms of cooperation with the World Bank. It is alluded to in

the communiqué. And, I will see during the summer with my colleague how

to build on all of that. If new steps are judged necessary, we will

certainly take them.

QUESTION: I wonder if what you envision after December is that if there

are countries which do not agree to adhere to the code of conduct or if

there are countries which do not make information readily available, or if

there are countries that do not have sufficient banking regulations or

bankruptcy laws, that meet the minimum standards, that you would

identify these countries so that investors would understand the risks of

loaning money or investing money in those countries; is that the

architecture that you have in mind, that you wouldn't force such reforms

on countries, but that everyone should know when countries fall below the

standards that the Fund would set? Am I understanding correctly what you

envision in the future?

MR. MAYSTADT: The Committee asked the Executive Board to reflect on all

this. As regards the special data dissemination standard, it is clear that

after the transition period all the subscribers should be in full compliance

with the obligation. If a member country doesn't comply, we should think

about the best way to convince this member to adopt the right measures

to be sure that we give the right signal to the markets. But, if after some

delay, and if after providing technical assistance to this country if

needed, the country doesn't comply, I think we should envisage

withdrawing the country from the list of subscribers. Otherwise, we

would give a false signal to the markets. The Executive Board will reflect

further on this situation, and we expect more concrete answers on this

question for our next meeting. But obviously members of the Committee

did not exclude that finally, after giving time and after providing

technical assistance, there could be no other solution than to withdraw

this country from the list of the subscribers.

QUESTION: Is there much disagreement among the members on this

question, or is there consensus?

MR. MAYSTADT: I can say that there was a consensus on the fact that if you

subscribe to the special data dissemination standard--and we encourage

more and more members to subscribe--you have to fulfill your obligations.

There is a consensus on that.

By the way, the deadline of December 1998 applies only to this question of

the special data dissemination standard.

QUESTION: This is not your vision for banking regulation standards

MR. MAYSTADT: No. It will take more time.

QUESTION: What is the standard of administration in the developing

countries generally, do they have the ability to fulfill all the requirements

you're asking, for instance the data and also the regulation of all the banks

and all this, and will you be helping them to reach the standards if they

don't have it?

Secondly, if you're going to cooperate more and more with the World Bank,

will it lead eventually to the merger of the two institutions?

THE MANAGING DIRECTOR: I reiterate the statement I have made on other

occasions, namely that we have no intention at all to take over the World

Bank. We cooperate with the Bank, and more and more we are working in

domains which overlap somewhat--particularly so as regards the second

generation of reform--and our teams share more and more the same

concerns and work more and more on the same business. A propos of this, I

must tell you that this afternoon I suggested to members of the Interim

Committee that, in following up on the recent ESAF evaluation, we build

on the very constructive experience we had with the integrated approach

that was followed in designing and implementing the HIPC initiative. I

suggested that we should try to follow that pattern in giving a new boost

to our key instrument for helping the poor countries, which is the ESAF.

Now, on the data issue, it is true that in general the developing countries

are less advanced in the sophistication of their elaboration of data, and

availability and dissemination of them. But we are determined to assist

them, as needed, because it is part of our job, and I think it is one of the

best things we can do to help them manage their economies. We are doing

that, and we will never push a country to subscribe to data dissemination

information if we are not absolutely certain that the country is well

equipped to do it.

QUESTION: On page 6 when you talk about closer contacts with creditors,

have your thought through further how that would be taking place? Would

it be with organizations like the Institute of International Finance, would

it be bilateral, does it include hedge funds, mutual funds, not just

commercial banks? Under the liberalization of capital movements, when

you mention prudential and supervisory systems, does that include

prudential limits on access to borrowing in foreign currencies, or some

way to limit inflows into the developing countries?

THE MANAGING DIRECTOR: On our contacts with the private sector: if I

understand well the philosophy of the Interim Committee, we are invited

to establish contacts in a totally pragmatic way, case by case, according

to the circumstances, according to the problem we are handling, while

trying to be evenhanded in the dissemination of information, to avoid

giving privileged positions to the one or the other, and trying to establish

as much transparency as we can and a climate of mutual confidence and

mutual help. No special organization, no special procedure has been spelled

out. Rather, we are invited to explore the best way of doing all of this, and

we will doubtless learn by doing.

MR. MAYSTADT: On prudential systems, some members of the Committee

did indeed ask that consideration be given to the desirability of prudential

measures to cope with the risk associated with short-term capital flows.

Some members referred, in this context, to the lessons to be drawn from

the Chilean experience. Out of this emerged a request that the Executive

Board give more consideration to, and examine the desirability of, such

measures.

QUESTION: Nothing was decided?

MR. MAYSTADT: Nothing was decided.

QUESTION: One of the traditional characteristics of IMF programs has

always been that the credibility of the country involved should be restored

in the marketplace as soon as possible, but now you are putting forward

suggestions that creditors should, in fact, not be paid. In the past

creditors should be paid to achieve credibility. If creditors shouldn't be

paid or take a hit, or whatever the phraseology that is used, is that not a

contradiction here? How does the country achieve credibility in the

marketplace quickly if its creditors are going to suffer the kind of

difficulties that you propose they should suffer?

THE MANAGING DIRECTOR: I am afraid I don't understand your question

well, unless you are referring to the matter of lending into arrears. This

is not new. As you remember, it became part of the Fund's strategy in

April 1989, when we put in place our strategy for debt reduction and

debt-service reduction. At that time, the point was made that in

situations of protracted or difficult negotiations between private

creditors and our clients, the IMF should take the risk of lending into

arrears to help to speed up the recovery, and possibly also make easier the

development of the negotiation with the other debtors, provided that there

was agreement on a good program, that we were certain that the

negotiators were of good faith, and that we had adequate safeguards. This

was a strategy which was applied at that time, and successfully. The only

innovation here, if any, is that this lending into arrears strategy would

apply now to bondholders, which were not part of the clientele at that

time.

QUESTION: Mr. Camdessus, I have only one key question, how to interpret

this meeting, because we have maybe a very big change in the sense that

now there is a new beginning in terms of including the private sector,

including the banks, and working closely with the Fund on all pertinent

areas. Now, going back a couple of months, I would like to get your

assessment because there was so much maybe very controversial

discussion about the big packages and bringing the banks too late into the

package. What is your assessment looking back? Did you have trouble

getting the banks on board in time, or was it the structure of today's, let's

say, creditor structure like the Bank's and the Fund's? Was it that factor,

because one of the arguments against the big packages was why not having

the banks right away, because now it is transparent, and I would like to

get your assessment on the burden sharing aspect, because the banks and

the other participants argue now that they, in terms of provisioning, have

had a lot of burden sharing like the Institute (of International Finance)

indicated in the letter to Mr. Maystadt. What is your assessment as to the

critical days when we had Korea? Did you have trouble getting the banks

on board in time?

THE MANAGING DIRECTOR: There are many elements in your question, but on

the last point of emphasis, namely how these big packages appeared and

how the banks were brought into the picture, let me tell you several

things. First, one of the difficulties in the case of Thailand, particularly

in the case of Korea, also in the case of Indonesia--at least in the case of

our first round of negotiations with Indonesia--is that the countries

invited us to negotiate a program with them truly at the last minute, and

we had only a few days for negotiating, as you say, a package. As soon as

we had the possibility, we of course suggested that the bank community

be put in the picture, particularly in the case of Korea, to invite them to

maintain and to roll over their short-term credits, even at a lower

interest rate than the market would have normally produced. We did that,

but it took some time to identify who were the bankers involved, and for

what amounts, and to bring them around the table. In the meantime we had

to help the country to avoid defaulting on its obligations. This is why for a

certain period of time we were alone with our financing there. In the case

of Thailand, in the week following the signing of our agreement, we had

the agreement of the bankers, to roll over their credits. In the case of

Korea, the amounts were much more important. The analytical work took

more time, and it took several weeks before the agreement of the banks

was put in place. The amounts of the financial flows in which Korea was

involved explain, of course, the size of the package that was needed, and

that finally has done the job in allowing this country to regain confidence

rapidly.

Now, you have mentioned the big packages and the discussions about the

big packages. Couldn't we do our job without this big package? We have

discussed that somewhat this morning, and we have reaffirmed that the

vocation of the Fund is as much as possible to be a catalytic factor, which

means that we should try to play our role without being the predominant

financing factor there. This continues to be our strategy. There are many

operations in which we are involved in crisis avoidance which are made

with almost no money, or with very small packages, or only through

systems of Fund monitoring programs, precautionary arrangements on

which finally there is no disbursement. For the full picture of what we are

doing, you shouldn't only have the three big packages in focus. You should

consider the entire activities of the Fund, and then our catalytic role

would be clear.

QUESTION: For the first time, I think, the Interim Committee raises the

question of the evaluation of ESAF. Does it mean that the Committee

recognized that ESAF has certain deficiencies? Moreover, it is written in

the communiqué that the evaluation provided important lessons. Can you

tell us briefly what are those lessons?

THE MANAGING DIRECTOR: Perhaps it is the first time the Committee

raised the question of the evaluation of the ESAF because the management

of the Fund had earlier decided to submit ESAF, after ten years of

existence, to two kinds of evaluation, an internal evaluation and an

evaluation by external and totally independent evaluators. Now, we have

the results of these evaluations, which are public. We want to draw the

lessons quickly, and I wanted to bring that to the attention of the Interim

Committee, because I see very important conclusions in the two

documents taken together.

One conclusion of the external evaluators, as you might have expected, is that they see a fundamental importance in the ESAF as an instrument of the Fund for dealing with the poorest countries; and tribute is paid to the remarkable changes which have been permitted by the programs under ESAF. But, at the same time, this evaluation has ratified several of the observations we were making, namely that there is still insufficient ownership of the programs by the countries. The countries still have a tendency to say we do all of that because the IMF asks us--which, of course, is bad for the sustainability of the efforts the country must develop. There is also an insufficient perception of the potential of ESAF for promoting social progress in the countries, not only for sheltering those who suffer during the adjustment process, but also for promoting human development more decisively.

There are also several others deficiencies which are mentioned. For

instance, the fact that some programs have not served to reduce inflation

rapidly enough--which is of particular relevance now that it is understood

that the countries which reduce inflation more rapidly are also those who

grow more rapidly later on. The evaluators also told us that the programs

could gain in quality if their design and follow-up were managed in a more

integrated fashion with the World Bank. And I was very happy to hear the

Interim Committee endorsing this appreciation and the suggestion made to

immediately review the whole architecture of the ESAF to try to respond

to this criticism in a way which would build on the very constructive

experience we have gained in working with the World Bank under our joint

HIPC initiative. I am also happy to report that my colleague, Mr.

Wolfensohn, has agreed that we could try to do that together, that the

World Bank could help us, in particular, with the analysis of the social

situation before the program and during the implementation of the

program, so as to help us focus even better on human development needs.

We will work on that during this summer, and I hope to be able to report

on the progress of this initiative on the occasion of the next meeting of

the Interim Committee.

MR. MAYSTADT: I can confirm that during this afternoon's discussion, the

main concern which was expressed was the fact that beneficiary

countries frequently feel a loss of control over the policy content and the

pace of implementation of the programs. So, we have elevated the question

of strengthening ownership, not only by the government, but by the society

as a whole, and to this end we think that we should encourage more

contacts with representatives of various groups in the society. This was

one of the main concerns expressed this afternoon. We think that is one of

the main lessons to be drawn from the evaluations of the ESAF.

[Edited transcript]

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6278 | Phone: | 202-623-7100 | |