Modern industrial policy should shape markets, not just fix their failures

The climate crisis is intensifying, with temperatures set to rise at least 1.5 degrees Celsius above preindustrial levels this century. Global warming is inflicting terrible destruction—much of it irreversible—on planet, people, and economies. And we are nowhere near reaching the climate finance flows of at least $5.4 trillion a year by 2030 needed to stave off the worst effects of a hotter planet.

It’s worth stating the obvious: the crisis is not an accident but the direct result of how we have designed our economies—particularly public and private institutions and their relationships. This means that we have agency—the power to redesign them to put planet and people first. But to do so we must move beyond fixing markets and the related notion of “financing gaps” toward shaping markets and paying attention to finance’s quality not just quantity. We must design policies that tilt economies toward achieving ambitious goals with strong direction while leaving open the question of how to reach those goals. Simply “leveling the playing field” and transferring money won’t do.

This requires new economic thinking and a modern approach to industrial policy (Mazzucato, Doyle, and Kuehn von Burgsdorff 2024). Governments must recognize that economic growth is worth striving for only if it’s sustainable and inclusive. Growth has a rate but also a direction. To tackle climate change, we must attend to both. Without growth, there are no jobs; without direction, jobs may contribute to global warming and exploit workers. It’s the role of governments, as stewards of the public interest, to direct growth and shape markets for a fairer net-zero future.

What does this mean? It means redesigned policies and contracts; it means new partnerships between public and private sectors; it means building instruments and institutions that are fit for purpose; and it means investment in public services.

Loading component...

Mission-led approach

In the past, governments that pursued industrial policies attempted to build national champions by picking winners from among sectors or technologies, often with mixed results. Modern industrial strategy should be different. Instead of picking winners, it should “pick the willing” by setting clear missions—such as solving the climate crisis or strengthening pandemic preparedness—and then shaping economies and markets to accomplish them (Mazzucato 2021).

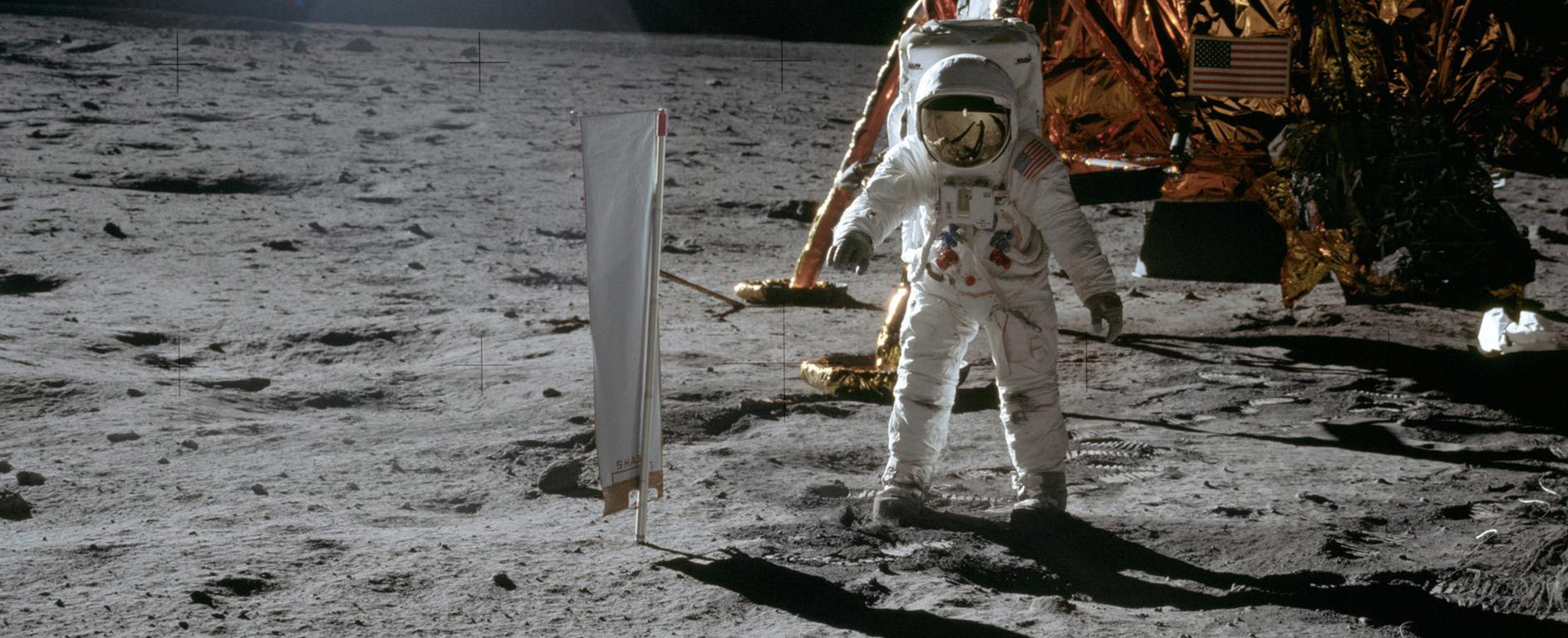

All sectors, not just a chosen few, must transform and innovate. Just as NASA’s 1960s mission to the moon involved not only the aerospace industry but also investment in, for instance, nutrition and materials, so today’s climate missions require all sectors to innovate. It means changing how we eat, how we move, how we build. A mission-oriented industrial strategy can catalyze this transformation.

Some leaders who have adopted a mission-oriented approach to industrial policy make the mistake of identifying growth itself as the mission. But stronger macroeconomic performance, as measured by GDP, productivity, or job creation, should be understood rather as the result of all well-designed missions.

Because governments can both spur growth and steer it by adopting a mission-oriented approach. An initial public investment can have an amplified impact on GDP through spillover benefits and multiplier effects. It can catalyze innovation and “crowd in” private investment across multiple sectors—particularly important in countries where companies invest little in research and development (Mazzucato 2018). This can spark new solutions to our most pressing problems, such as reaching net zero. But these growth-promoting spillovers will be realized only if public-private collaboration is designed sensibly, to prioritize the common good.

Currently, governments and companies alike are failing to make the necessary pivots to combat global warming. The world spent $7 trillion subsidizing fossil fuels in 2022. The 20 biggest fossil-fuel firms are expected to invest $932 billion developing new oil and gas fields by the end of 2030.

Unless governments change their approach, it’s clear that many companies will continue to put windfall profits ahead of investing in productive economic activities or transforming their practices to align with climate goals. And they will continue to contribute to a widening gap between the richest and poorest. S&P 500 companies transferred $795.2 billion to shareholders last year through stock buybacks—about half of that figure coming from the 20 biggest firms. Five of the world’s largest listed energy companies transferred $104 billion through buybacks and dividends in 2023. Meanwhile, the share of total income going to workers has declined by 6 percentage points since 1980.

Contract conditions

The terms and conditions governments write into contracts structuring public-private collaboration are a powerful instrument for change. Governments should make access to public funds and other benefits (grants, loans, equity investments, tax benefits, procurement deals, regulatory provisions, intellectual property rights, for instance) conditional on companies aligning their behavior with mission goals. The resurgence of industrial policy—with billions of dollars in public funds flowing to the private sector—is an opportunity to forge a new social contract between the public and private sectors, and between capital and labor.

These conditions must be thoughtfully designed and calibrated to maximize public value but not so specific that they snuff out innovation (Mazzucato and Rodrik 2023). Developers could, for example, be told to follow ambitious net-zero building requirements. But how they do this—through passive house design, tall-timber construction, modular housing, sourcing low-carbon concrete, or other approaches—should be left open.

Conditionalities can take many forms. They can direct firms toward socially desirable goals, such as net-zero emissions, affordable access to the resulting products and services, profit sharing, or reinvestment of profits in productive activities such as R&D rather than unproductive ones like shareholder buybacks.

Conditionalities are underused, but they are not new. The French government’s COVID-19 bailout of Air France was conditional on the carrier’s curbing emissions per passenger and reducing domestic flights. Germany’s national development bank, KfW, provides low-interest loans through its energy-efficient refurbishment program only to companies that agree to decarbonize. It establishes accountability and incentives by providing debt relief of up to 25 percent for buildings that meet the requisite energy standards—the higher the energy efficiency, the greater the relief.

In the US, companies can access funding under the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, a key prong of the Biden administration’s industrial strategy, only if they commit to climate and workforce development plans. They must also provide accessible childcare, pay certain workers prevailing wages, invest in communities in consultation with local stakeholders, and share a portion of profits above an agreed threshold for funding of $150 million or more. Stock buybacks are excluded from CHIPS funding, and the legislation discourages them for five years.

These are important provisions that—contrary to criticism by skeptics who liken this approach to an “everything bagel”—have not stopped businesses from applying. This critique might have legs if there were too many hard-to-meet provisions. But intelligent design is a feature of any good product—and if more flavors on a bagel taste good and don’t cost more, then this is the way to go.

A more justified criticism is that the conditionalities in CHIPS may not go far enough—they allow for significant flexibility with precise commitments negotiated case by case behind closed doors. Labor unions have pushed for funding to be conditional on higher labor standards.

Strategic public finance

Strategic public procurement is another powerful tool. Global public procurement budgets total about $13 trillion a year, accounting for 20–40 percent of national public spending in Organisation for Economic Co-operation and Development countries. Procurement can create new market opportunities and incentivize innovation and investment in line with government priorities. However, public procurement has traditionally focused on efficiency, fairness, cost reduction, risk management, and preventing corruption. It explains why procurement functions are often placed within legal and finance teams rather than policy strategy teams.

New procurement models emphasize outcomes, innovation, social value, or local production. Brazil, for instance, is redesigning procurement to support industrial strategy goals. The US Buy Clean Initiative promotes low-carbon, American-made construction materials in federal projects.

In addition to demand-side policies like procurement, mission-oriented industrial strategies require patient long-term financing directed toward specific ends (Mazzucato 2023). Raising and structuring this type of financing rely on the state’s willingness to take on risk. Public financial institutions, such as development banks, should be lenders of first not last resort. They have vast assets: national development banks (NDBs) have $20.2 trillion under management and multilateral development banks (MDBs) a further $2.2 trillion. Together this amounts to about 10–12 percent of global financing. They must be ready to provide countercyclical financing, fund capital development projects, and act as venture capitalists, catalyzing investments aimed at solving specific challenges.

A mission-oriented approach can strengthen connections between NDBs and MDBs, influencing their loan conditions to require that private companies transform production. Loans from Germany’s KfW to the national steel sector were conditional on companies lowering the material content of production. This is why Germany has green steel today. If all public banks united to promote sustainability, we could achieve a true Sustainable Development Goal multiplier, as advocated by the United Nations.

More broadly, mission-oriented industrial strategy will struggle for success unless there is a stable and connected national innovation ecosystem. Public institutions should fund innovation and shape it at each stage, from research, to commercialization, to scaling up. Dynamic systems of innovation—centered around outcome-oriented financing, tools, and institutions—can spread knowledge and innovation throughout the economy. Public policy tools and institutions should align with missions (the vertical component of new industrial strategy, in place of sectors in the old) and invest in the broader ecosystem (the horizontal component).

Public sector dynamism

The shift to new industrial strategy requires parallel investment in government capabilities (Kattel and Mazzucato 2018). Closed-minded perceptions of the state’s role, cuts to public sector employment, and overreliance on big consulting firms have left many governments ill equipped to implement mission-oriented industrial policy (Mazzucato and Collington 2023). Investment in the teams responsible for rolling out industrial policy, at all levels of government—and attention to the design of the institutions where they are embedded and the tools they have access to—is key to better delivery of this approach’s transformative promise.

Industrial policy requires a competent, confident, entrepreneurial, and dynamic public sector—one equipped to take risks, experiment, and collaborate with the private sector on ambitious goals yet open to how those goals are achieved. It must work across ministerial domains (climate is not only for the energy department, just as well-being is not only for the health department). This calls for a fundamentally different approach.

It also requires changes to government institutions to enable new ways of working. “Govlabs” such as Chile’s Laboratorio de Gobierno are examples of some countries’ safe spaces for civil servants to take risks, collaborate, and learn—allowing them to experiment with different approaches to policy instruments, such as mission-oriented procurement, and then scale them up.

Governments can also develop capabilities to measure the multiplicative effects of industrial policy. Static measures, such as cost-benefit analyses and macroeconomic indicators like GDP, fail to capture the broader impact of mission-oriented industrial strategies. A dashboard of economic, social, and environmental indicators is more effective.

Social and environmental indicators should reflect mission goals and core values. Economic indicators should include spillover and multiplier benefits, alongside standard metrics such as job creation and patent filing. These indicators should be tools for learning and accountability, not missions themselves. Some government ministries, such as the UK Treasury, are updating public spending guidance to establish clear cross-departmental objectives.

Carrying on as usual is not an option. The challenges we face—the climate crisis ranking high among them—are too great. But countries must also resist the temptation to slide into green protectionism by prioritizing their own carbon-neutral development over global cooperation that prioritizes equity and progress toward global climate goals. The US Inflation Reduction Act has driven Europe to prioritize decarbonization of its own industries but is draining financing from emerging economies that climate change harms the most. This is worrisome. It makes it more important to design national industrial strategies carefully and consider the implications for international development, trade, and supply chains so that we tackle our gravest global challenges in a coordinated way.

Modern industrial policy has great potential to put countries on a different path, but only if it orients investment, innovation, growth, and productivity around bold climate and inclusion goals. It must drive a global green race to the top, not to the bottom.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Kattel, R., and M. Mazzucato. 2018. “Mission-Oriented Innovation Policy and Dynamic Capabilities in the Public Sector.” Industrial and Corporate Change 27 (5): 787–801.

Mazzucato, M. 2018. “Mission-Oriented Research and Innovation in the European Union.”

Mazzucato, M. 2021. Mission Economy: A Moonshot Guide to Changing Capitalism. London: Allen Lane.

Mazzucato, M. 2023. “Financing the Sustainable Development Goals through Mission-Oriented Development Banks.” UN DESA Policy Brief Special Issue, UN Department of Economic and Social Affairs, New York, NY.

Mazzucato, M., and R. Collington. 2023. The Big Con: How the Consulting Industry Weakens Our Businesses, Infantilizes Our Governments, and Warps Our Economies. New York, NY: Penguin Press.

Mazzucato, M., and D. Rodrik. 2023. “Industrial Policy with Conditionalities: A Taxonomy and Sample Cases.” UCL Institute for Innovation and Public Purpose Working Paper IIPP WP 2023-07, London.

Mazzucato, M., S. Doyle, and L. Kuehn von Burgsdorff. 2024. “Mission-Oriented Industrial Strategy: Global Insights.” IIPP Policy Report 2024/09, UCL Institute for Innovation and Public Purpose, London.