Slower productivity growth in the world’s largest economy threatens to reverberate around the globe

The US economy has a multitrillion-dollar problem. It’s the dramatic slowdown in productivity growth over the past couple of decades. Between 1947 and 2005, labor productivity in the US grew at an average annual rate of 2.3 percent. But after 2005, the rate fell to 1.3 percent. Such seemingly small differences have astonishingly large consequences: if economic output for each hour worked had kept expanding at 2.3 percent between 2005 and 2018, the American economy would have produced $11 trillion more in goods and services than it did, according to the US Bureau of Labor Statistics.

This is part of a broad-based trend across advanced economies. Productivity growth in Europe has been even slower than in the US. As a consequence, Europe has fallen significantly behind the US in terms of GDP per capita. Productivity is a key driver of economic expansion. Its anemic performance in the world’s largest economy threatens to send ripples around the globe and into developing economies, where growth is key to lifting millions of people out of poverty.

What’s behind the stubborn stall in productivity growth in the US and other advanced economies? Research points to two developments. One is that the rapid deployment of advanced information technologies helped big established businesses at the expense of smaller start-up companies. Another is falling population growth and changing demographics, which reduced the speed of new business creation. Together, those factors led to a decline in creative destruction, an important element of innovation as identified by the early 20th century economist Joseph Schumpeter. This sapped dynamism from the US economy.

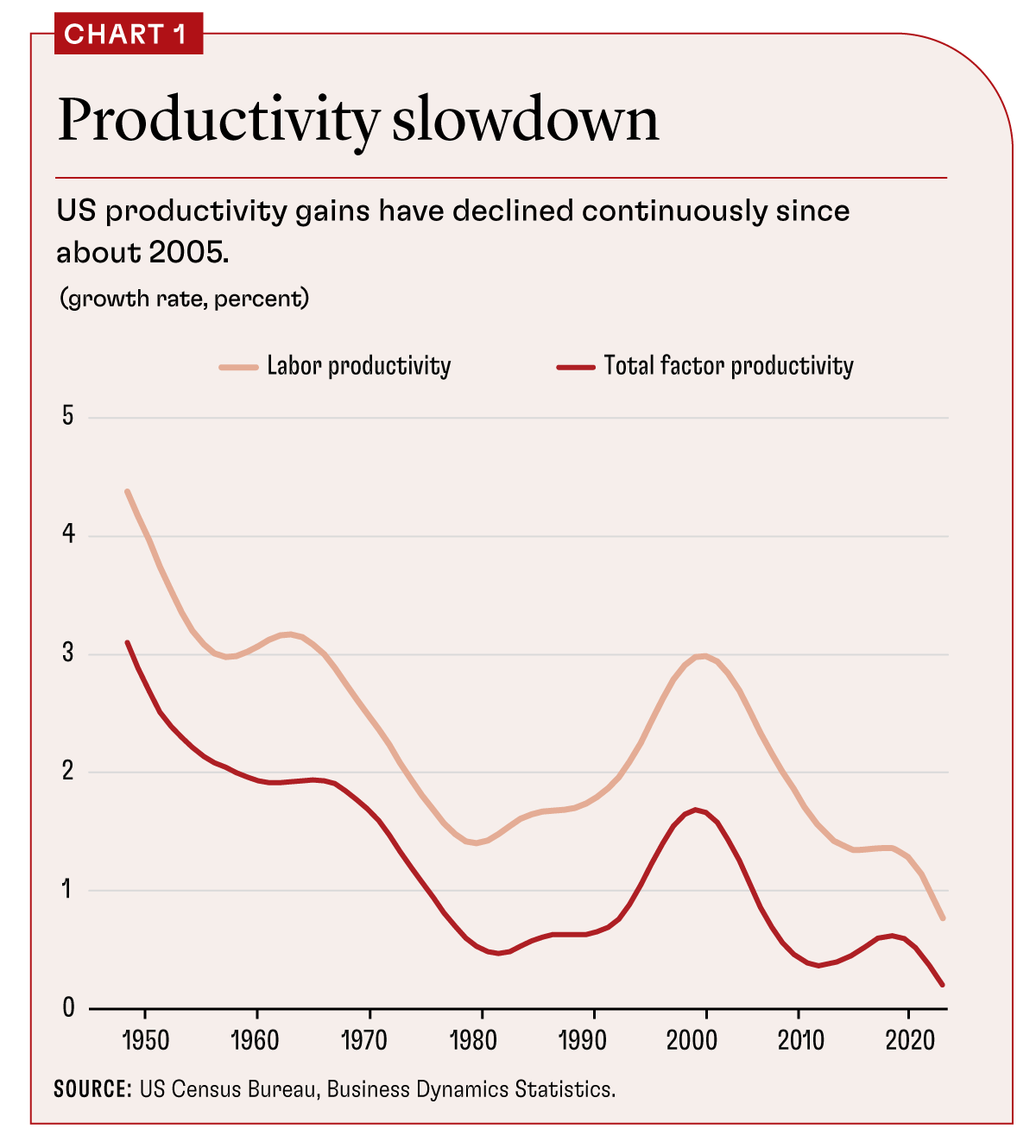

There are two key measures of productivity growth, which are closely related. The first is labor productivity, or the simple computation of real output per hour of work. The second is total factor productivity (TFP), which also takes into account changes in capital intensity and capacity utilization.

Labor productivity and TFP have evolved in tandem since the 1940s (see Chart 1). Labor productivity gains slowed from the range of 3–3.5 percent a year in the 1960s and 1970s to about 2 percent in the 1980s. In the late 1990s and early 2000s, the US economy experienced a sizable but temporary productivity boom as productivity growth rebounded to 3 percent. Since about 2003, productivity gains have been lackluster, with labor productivity slowing to an average growth rate of less than 1.5 percent in the decade after the Great Recession. Recent economic shocks such as COVID-19 and surging energy prices since the war in Ukraine had a notable impact on employment and inflation dynamics. However, productivity growth has been relatively unaffected and has remained low. Changes in TFP closely mirror the fluctuations in labor productivity growth. While labor productivity growth always exceeds that of TFP because of increases in capital intensity, falling TFP growth drives the decline in labor productivity gains.

Understanding the causes of the slowdown is crucial because of the high economic stakes. It’s also vital for determining whether governments and central banks have effective policy tools to address the issue or whether they must prepare for a prolonged period of lower growth.

Creative destruction

Recent research suggests that changes in the process of creative destruction and reallocation across businesses might hold the key to understanding the productivity slowdown. Aggregate TFP reflects the economy’s state of technology and the efficiency of resource allocation. Intuitively, aggregate productivity can be low either because the technologies enterprises use are inefficient or because some businesses may have access to productive techniques, but market imperfections prevent them from displacing less efficient competitors. Productivity growth can stem from the arrival of new and better technologies or from reallocation of resources from unproductive to productive companies.

There is growing evidence that the US economy is not as dynamic as it used to be. A key aspect of business dynamism is new business formation. It is often measured by the entry rate, or the share of enterprises that started operating in a given year. The entry rate fell from 13 percent in 1980 to 8 percent in 2018, according to the US Census Bureau. In addition, US enterprises became substantially larger, with the average number of employees rising from 20 in 1980 to 24 by 2018. Older and bigger companies thus account for a much larger share of economic activity than they used to. These trends indicate significantly declining dynamism in the US economy over almost four decades.

This raises two critical questions. First, why does a decline in business dynamism correlate with a slowdown in productivity growth? Second, what are the fundamental factors driving these trends?

Proximate causes

The link between productive churn, business-to-business reallocation, and aggregate growth lies at the heart of Schumpeter’s famous concept of creative destruction, in which new enterprises develop innovative technologies aiming to displace incumbent producers and take their market share. Aggregate productivity growth and markers of business dynamism such as churning and turnover at the company level are therefore two sides of the same coin.

From that perspective, the slowing formation of new businesses and the expanding role of older, bigger companies are exactly what one would expect in times of low productivity growth. The falling entry rate is an indication that the arrival of new technologies might be slowing. And given that entrants are of course younger and, on average, smaller than incumbent businesses, a decline in the entry rate naturally leads to an increase in business size and a rise in concentration.

A large and growing body of research provides additional evidence. First, the rise in corporate concentration has been shown to go hand in hand with expanding market power. The average markup by publicly traded US companies surged from about 20 percent in 1980 to 60 percent today. Large incumbent businesses thus seem to be shielded more and more from competition, allowing them to jack up prices and widen profit margins.

Loading component...

A second line of research shows the flip side of rising corporate market power: the weakening of workers’ bargaining position. Since 1980, labor’s share of the US economy has fallen by about 5 percentage points. The plunge was faster in industries that experienced more concentration, where large superstar firms such as Google, Apple, Amazon, and Walmart grew the most—as documented by the Massachusetts Institute of Technology’s David Autor and his research partners.

Third, there has been a secular decline in business-to-business reallocation since the late 1980s, as shown in a series of papers by John Haltiwanger and other researchers. This suggests that the process of workers moving from declining to expanding businesses is not as fluid and dynamic as it once was.

These patterns are consistent with the view that creative destruction has been decreasing and that business dynamism and aggregate productivity growth fell as a consequence. If incumbent businesses face less competition from entrants, they have an easier time building a dominant market position. This allows them to expand markups, profit margins, and (eventually) corporate valuations. Because higher profits cut into the share of output paid to workers, a shrinkage in labor’s share of the economy will ensue, especially in the most concentrated industries.

Fundamental causes

Even if one were convinced that the productivity slowdown and the decline in business dynamism were driven by a fall in creative destruction, the main question is, Why? Answering this question is particularly important for policymakers seeking clues as to what they can do to reverse these trends.

Researchers have considered four broad explanations:

- The advent of information technology and resulting economies of scale

- Changes in the process of knowledge diffusion

- Demographics and falling population growth

- Changes in policies, such as regulatory entry costs or tax incentives for research and development

While these explanations are not mutually exclusive—and presumably are all relevant in the real world—it is useful to discuss them separately.

IT and economies of scale: In discussing the productivity dynamics of the 1980s and 1990s, the advent of IT is the elephant in the room. Could the availability of such technologies have caused the decline in dynamism and the peculiar boom-bust shape of productivity growth? Two recent papers argue that the answer is yes and that economies of scale play an important role. French economist Philippe Aghion and his research collaborators (2023) posit that advanced IT makes it easier for businesses to scale their operations across multiple product markets. The London School of Economics’ Maarten De Ridder (2024) argues that IT allows enterprises to reduce their marginal costs of production at the expense of higher fixed costs.

What these explanations have in common is that the adoption of such technologies is particularly valuable for productive companies. This implies that such businesses took advantage of IT developments in the late 1980s and early 1990s, and the economy experienced an initial productivity boom. More surprisingly, the researchers argue that the existence of these megabusinesses can have dynamic costs in the long run. If new businesses (such as a new IT start-up) expect that they will have a hard time competing with existing enterprises that produce at scale (such as Amazon, Microsoft, or Google), their incentives to enter the market shrink. As a result, overall growth and creative destruction can decline, and incumbent companies benefit by charging higher markups.

Changes in knowledge diffusion: A separate strand of research suggests that the process of knowledge diffusion among businesses has changed in fundamental ways. In particular, the argument goes, in recent decades technologically lagging companies had a harder time adopting technologies of competitors at the productivity frontier. This change could be technological in nature: companies such as Google or Apple may be so technologically advanced that adoption simply becomes impossible for smaller rivals. At the same time, it could also have legal origins, as large businesses increasingly engage in defensive patenting to protect their technological lead by creating a dense, overlapping thicket of patents. Consistent with this hypothesis, Ufuk Akcigit and Sina Ates (2023) document a substantial rise in the concentration of patenting among superstar firms and estimate that changes in technological adoption can explain why dynamism has declined, why incumbent enterprises enjoy noncompetitive rents, and why productivity growth has fallen.

Slowing population growth: While those explanations link changes in creative destruction and slower productivity growth firmly to changes in the technological environment, some recent papers advance an entirely different explanation. These researchers argue that both the slowdown in productivity gains and the decline in dynamism reflect falling US population growth.

Expansion of the US population has plunged since the 1960s and has reached a historic low in recent years. That falling population growth should lead to falling productivity growth is the hallmark of most theories of economic expansion. My colleague Conor Walsh and I showed in 2021 that slowing population growth also reduces creative destruction and business dynamism by causing a decline in the entry of new businesses. Other researchers have compiled direct empirical evidence on the relationship between population growth, the rate of new business formation, and the resulting process of business dynamics.

Policy changes: Finally, one could think of many changes in policies that could have triggered a decline in business creation and consequently a decline in growth, creative destruction, and dynamism. Examples are changes in regulation, such as licensing requirements; R&D subsidies that benefit incumbents rather than potential entrants; and changes in corporate taxes.

While such policies might be important for specific industries, it seems unlikely that they would offer a significant explanation at the aggregate level. Recent research shows that the observed changes in such policies cannot quantitatively account for the productivity slowdown and the decline in dynamism. More important, the productivity slowdown and the decline in dynamism are not exclusively US phenomena. They also occurred to varying degrees in most developed economies.

Occam’s razor

The 14th century principle of Occam’s razor—that the simplest explanation is the most likely—suggests focusing on changes that occurred globally rather than policy changes specific to the US. The development of advanced information technology and declines in population growth fit that bill and are most likely to have played an important role in the drop in business dynamism and the slowdown in productivity growth.

Those developments also highlight the potential for specific policies to counter these trends. With respect to changes in demographics, policymakers around the world are already acutely aware of the rising costs of aging populations. While this debate centers mostly on concerns about fiscal sustainability, the economic consequences could be much more pronounced if falling population growth indeed leads to falling productivity growth. Given the limited success of policies to reverse declining fertility, the main policy lever available in the short to medium term is likely to be immigration policy.

By contrast, the policy options related to the ramifications of the IT boom are more specific and arguably directly related to antitrust enforcement. If information technologies indeed caused the increase in concentration, with adverse consequences for productivity growth, the rise in market power harms consumers not only through higher prices but also through slower innovation and growth. This, of course, raises the stakes of competition policy because how to counter the growth slowdown is, quite literally, a trillion-dollar question for policymakers.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Aghion, Philippe, Antonin Bergeaud, Timo Boppart, Peter J. Klenow, and Huiyu Li. 2023. “A Theory of Falling Growth and Rising Rents.” Review of Economic Studies 90 (6): 2675–702.

Akcigit, Ufuk, and Sina Ates. 2023. “What Happened to U.S. Business Dynamism?” Journal of Political Economy 131 (8): 2059–124.

De Ridder, Maarten. 2024. “Market Power and Innovation in the Intangible Economy.” American Economic Review 114 (1): 199–251.

Hopenhayn, Hugo, Julian Neira, and Rish Singhania. 2022. “From Population Growth to Firm Demographics: Implications for Concentration, Entrepreneurship and the Labor Share.” Econometrica 90 (4): 1879–914.

Karahan, Fatih, Ben Pugsley, and Ayşegül Şahin. Forthcoming. “Demographic Origins of the Startup Deficit.” American Economic Review.

Peters, Michael, and Conor Walsh. 2021. “Population Growth and Firm-Product Dynamics.” NBER Working Paper 29424, National Bureau of Economic Research, Cambridge, MA.