Creating Fiscal Space

Enhancing domestic tax capacity is essential for strengthening social protection and developing human capital

A key challenge for developing economies wishing to strengthen their social protection systems and expand access to education and health is how to raise the necessary revenue in the context of a large informal sector.

The informal sector is typically characterized by high levels of self-employment, low skill levels, and often multiple and volatile sources of income. This limits the potential to raise revenue by taxing income—especially from lower-income groups—which requires the ability to verify total individual income. In the context of social insurance, it also means greater reliance on financing through general government revenue sources than on the contributory models emphasized in advanced economies (see "Shifting Tides" and "Reimagining Social Protection," in this issue of F&D).

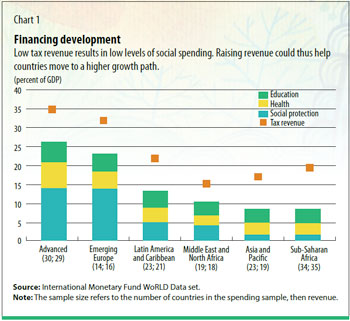

Recent research also finds that countries move to a higher growth path once tax revenue reaches about 15 percent of GDP (Gaspar, Jaramillo, and Wingender 2016), in part reflecting higher social spending. However, about half of low-income countries—and a third of emerging market economies—have tax ratios below this 15 percent threshold. Low tax ratios in turn result in low levels of social spending (see Chart 1).

This large variation in tax ratios within emerging market and low-income countries suggests that many have ample room for higher taxation. Some have succeeded in increasing their tax ratios in recent years, sustainably increasing tax revenues to bring them close to or above 15 percent of GDP. Georgia is a leader in this group, having increased tax revenue by 12.9 percent of GDP during 2004–08. Maldives raised revenue by 11 percent of GDP during 2011–15. Others that have made significant gains over similar periods include Dominica (7.5 percent, 2002–06), Ghana (7.3 percent, 2000–04), Mauritania (6.1 percent, 2010–14), Mozambique (6.1 percent, 2007–11), Guinea (5.8 percent, 2008–12), Malawi (5.7 percent, 2003–07), and Cambodia (5.0 percent, 2012–16).

These countries show what’s possible. But how can governments increase their tax capacity both equitably and efficiently?

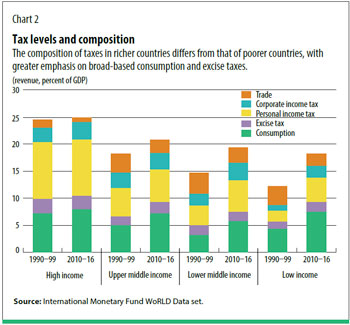

As countries modernize their tax systems, they typically expand broad-based consumption taxes and selective excise taxes and prioritize the development of progressive income tax systems (see Chart 2).

Broad-based consumption taxes: Increased revenue from consumption taxes, especially value-added tax (VAT), has been the main driver for most countries that have managed to significantly increase their tax ratios over recent decades.

Greater reliance on excise taxes: "Corrective" taxes on such goods as energy, alcohol, tobacco, and (somewhat more contentiously) sugar-sweetened beverages—levied on top of the normal VAT—can be an efficient source of revenue and help reduce the negative health impacts associated with their consumption. Along with consumption taxes, excise taxes provide an administratively feasible way of increasing revenues over the short term.

Progressive personal income taxes: The development of a such a system has been an important source of revenue for advanced economies and a key component of efficient systems for redistribution of income. However, high levels of tax exemption or tax evasion in emerging market and developing economies limit the short-term potential for such revenue. Even so, experience shows that countries can still raise sizable additional revenue through stronger personal income tax systems.

Additional tax measures: Other measures can be employed to protect and further expand tax sources. These include reforms to address corporate income tax avoidance and reduce mutually destructive international tax competition, but these may also need stronger international cooperation to be effective. Average effective corporate tax rates have declined significantly over recent decades across the globe and are typically lower than statutory rates due to exemptions, deductions, and tax planning. Recent estimates put the long-term costs from profit shifting to lower-tax countries at about 1 to 1.5 percent of GDP for developing economies (Crivelli, de Mooij, and Keen 2016).

Removing tax incentives, such as tax-free zones, exemptions, tax holidays, can lead to sizable revenue gains. There is also room in most emerging market and developing economies to expand revenue from property taxes, an efficient and equitable source of revenue, but with relatively modest potential. Finally, in many countries, natural resource revenue is an equitable and efficient revenue source that is often inadequately tapped.

Policy and institutional reforms must go hand in hand. For example, as administrative capacity is strengthened, VAT and income tax thresholds can be lowered. Risk-based tax audit systems can help enhance compliance and tax fairness. In the context of the VAT, the potential for such revenue gains can be explored though the concept of C-efficiency—defined as the ratio of actual revenue to potential revenue when all consumption is taxed at the standard rate in a country. C-efficiency measures how close a government comes to collecting tax on all consumption in the economy. The revenue potential from increasing this ratio is substantial. In practice, the rise in VAT revenue in recent decades has been driven primarily by improvements in C-efficiency rather than by increasing tax rates (Keen 2013).

Improved spending efficiency: There is large variation in social outcomes across countries with similar spending levels, suggesting substantial room to improve spending efficiency. This is essential to ensure that additional revenue is not wasted. All spending items need to be scrutinized to ensure that they are achieving their economic and social objectives. Estimates of spending inefficiencies in the health care sector suggest that as much as 40 percent of spending may be wasted across all country income groups. Many countries spend significant amounts on inefficient and inequitable energy subsidies aimed at protecting domestic consumers from volatile international oil prices. A key barrier to reforming these subsidies is the absence of a strong safety net to adequately protect the poor from rising energy prices.

While broad-based consumption and selective excise taxes are efficient sources of revenue, it is important to ensure that countries have access to strong safety nets that adequately protect the poor and vulnerable from associated price increases. Absent such protection, harm to the poor can be mitigated through a higher VAT registration threshold, which determines when a firm is large enough, based on sales, to be required to charge VAT. Another possibility is reducing the VAT rate for goods consumed disproportionately by the poor. Excise tax increases can also focus first on goods consumed disproportionately by higher-income households, such as gasoline and high-end alcohol, and possibly tobacco. A gradual reform process that phases in and sequences tax increases across products allows for some of the revenue gains to be allocated to strengthening safety nets over the short term, thus allowing poor and vulnerable households to be adequately protected from more comprehensive reforms over the medium term.

Strategies for strengthening tax capacity should be framed within a broader process that involves all of government (line ministries and the Ministry of Finance), citizen participation, and good governance. It is essential to embed tax reform plans within national development plans that identify priority spending needs, which are often anchored in national strategies for attaining the United Nations Sustainable Development Goals. Effective consultation on, and communication of, comprehensive spending and tax plans to strengthen the social contract with civil society is necessary as well. This could lead to adoption of a consensus-based medium-term revenue strategy, as described in the Platform for Collaboration on Tax (IMF and others 2016). (Nobody votes for a tax hike in isolation!)

Equally important is the need for transparent and effective public financial management systems that ensure and demonstrate that tax revenues are spent efficiently and not wasted or fraudulently used.

ART: ISTOCK / BEASTFROMEAST; ALFEXE

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Coady, D., M. Francese, and B. Shang. 2014. "The Efficiency Imperative." Finance & Development 51 (4): 3–32.

Crivelli, E., R. de Mooij, and M. Keen. 2016. "Base Erosion, Profit Shifting and Developing Countries." FinanzArchiv 3 (72): 268–301.

Gaspar, V., L. Jaramillo, and P. Wingender. 2016. "Tax Capacity and Growth: Is There a Tipping Point?" IMF Working Paper 16/234, International Monetary Fund, Washington, DC.

International Monetary Fund (IMF), Organisation for Economic Co-operation and Development (OECD), United Nations, and World Bank. 2016. "Enhancing the Effectiveness of External Support in Building Tax Capacity in Developing Countries." Policy paper prepared for submission to G20 finance ministers.

Keen, M. 2013. "The Anatomy of the VAT." National Tax Journal 66 (2): 423–46.