Managing Capital Flows in Emerging Markets

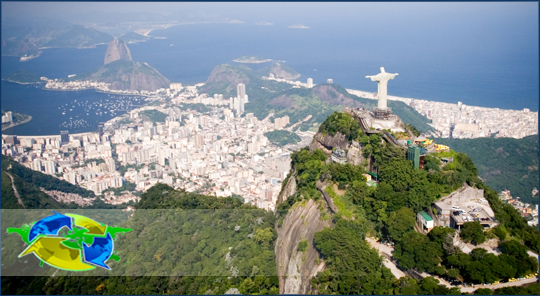

JOINT HIGH-LEVEL CONFERENCE BY THE BRAZILIAN AUTHORITIES AND THE IMF, RIO DE JANEIRO, BRAZIL, MAY 26-27, 2011

Capital flows to emerging market economies (EMEs) have resumed from the sharp decline in the aftermath of the global financial crisis and are projected to remain high, although volatile, in the coming years. These flows, and capital mobility more generally, allow countries with limited savings to attract financing for productive investment projects, foster the diversification of investment risk, and contribute to the development of financial markets. But, especially since the financial crisis, which has highlighted the potential for procyclical behavior of the financial sector, many EMEs are also concerned about the fragility that large inflows—and herd behavior that contributes to boom-bust cycles—can engender:

- Many of the flows may reflect interest rate differentials, which may be at least partially reversed when policy interest rates in advanced economies (AEs) return to more normal levels. A rapid reversal could also occur if the global recovery falters and there is a renewed increase in global risk aversion. While larger inflows could be the result of improved fundamentals in EMEs over the last decade, and the relative strength of their economies vis-à-vis AEs, a history of "sudden stop" episodes suggests caution before interpreting these flows as a "structural break."

- Large inflows can complicate macroeconomic policy management, leading to exchange rate appreciation pressures or overshooting, and some loss of monetary policy independence. Particularly if the inflows turn out to be temporary, they may entail a costly reallocation of productive resources back to the tradable sector as inflows subside and the exchange rate returns to its more normal level.

- Regardless of whether the inflows are temporary or more persistent, a sudden surge can overwhelm the domestic prudential framework, and wind up fueling asset price bubbles rather than financing worthwhile investments.

A policy response to a surge in capital inflows thus may need to include both macroeconomic and prudential elements. This conference, jointly organized by the Brazilian authorities and the IMF, will provide an opportunity for senior officials and academics to debate the issues, focusing on the root causes of the pickup in capital flows to EMEs, their impact on these economies and the appropriate policy responses.

Kindly note that attendance is by invitation only.

Thursday, May 26, 2011

Caesar Park Hotel, Rio de Janeiro

| 11:30–12:00 | Registration |

| 12:00-13:30 | Lunch: Speaker: Guido Mantega, Minister of Finance of Brazil |

| 13:30–14:15 | Introductory Remarks: Alexandre Tombini, Governor, Banco Central do Brasil Min Zhu, Special Advisor to the MD, IMF |

| 14:15–15:45 | SESSION I — The Causes of the Recent Wave of Capital Inflows to Emerging Market Economies To set the stage, this first session will look at the behavior of capital flows and the main causes of the recent pickup in EME capital inflows. What determines surges and volatility of capital inflows? What role have macroeconomic policies in the U.S. and other advanced countries played? Are there differences between types of flows? Does the recent surge in inflows represent a structural phenomenon that defines a “new normal” or baseline for EMEs? Or are they more a reflection of a failure to rebalance the global economy? Chair: Cristiano Romero, Valor Economico Speakers: Joyce Chang, JP Morgan Chase José Antonio Ocampo, Columbia University Eduardo Loyo, BTG Pactual Hyun Song Shin, Princeton University |

| 15:45–16:15 | Coffee break |

| 16:15–17:45 | SESSION II — Capital Inflows: Blessing or Curse? What is the impact on EMEs of the resurgence of capital inflows? What are the channels of transmission and links between capital inflows and real and financial sectors in EMEs? The theoretical benefits of capital flows are well-known, but how should these be weighed against the macroeconomic challenges and risks—diminished competitiveness, inflation and overheating, and asset price bubbles/financial fragilities—that rapid inflows may entail? How does experience differ according to country characteristics (exchange rate regime, fiscal institutions, quality of domestic supervision/regulation)? Chair: Stephanie Flanders, BBC Speakers: Paulo Nogueira Batista, Executive Director, IMF Nicolás Eyzaguirre, IMF Roberto Frenkel, University of Buenos Aires John Williamson, Peterson Institute for International Economics |

| 19:00–21:00 | Dinner Speaker: Jagdish Bhagwati, Colombia University |

Friday, May 27, 2011

Caesar Park Hotel, Rio de Janeiro

| 8:45–10:15 | SESSION III — How Should EMEs Manage Rapid Inflows? This session will turn to policy options for effective management of capital inflows and their impacts: macro-economic policies; macro prudential policy; and capital controls. What can be said about the policy hierarchy among these various tools? To what extent do broader systemic consequences of the various policy instruments need to be factored into individual country choices? Chair: Zanny Minton-Beddoes, The Economist Speakers: Kristin Forbes, Massachusetts Institute of Technology Jonathan D. Ostry, IMF Subir Vithal Gokarn, Deputy Governor, Reserve Bank of India Olivier Jeanne, Johns Hopkins University |

| 10:15-10:30 | Coffee break |

| 10:30-12:00 | Policy Forum: Regional Perspectives on Managing Capital Inflows Moderator: Adriana Arai, Bloomberg Speakers: José De Gregorio, Governor, Central Bank of Chile Turalay Kenç, Vice Governor, Central Bank of Turkey José Uribe, Governor, Banco de la Republica de Colombia Atchana Waiquamdee, Deputy Governor, Bank of Thailand |

| 12:15-12:45 | Tentative Conclusions: Nelson Barbosa Filho, Exec. Sec., Min. of Finance, Brazil, and Olivier Blanchard, IMF |

| 12:30 | Adjourn |

| 13:30 | Press Briefing |