IMF Spring Meetings Update | April 14, 2023

In the final daily recap for Friday, April 14, we discuss the outcome of the IMFC meeting, the economic outlooks for Europe and sub-Saharan Africa, central banks' strategies to reduce inflation, and more as we mark the end of the IMF-World Bank Spring Meetings.

International Cooperation Essential For Stronger Global Growth and Stability

The worst macroeconomic outcomes contemplated six months ago have not come to pass, but international cooperation and strengthened multilateralism are essential to boost global growth and protect stability, Nadia Calviño, the chair of the International Monetary and Financial Committee, said in a statement at the conclusion of the body’s first twice-yearly meeting. The past week has seen progress on the issues that matter to the world’s most vulnerable countries through the Global Sovereign Debt Roundtable as well as contributions to the Poverty Reduction Growth Trust and the Resilience and Sustainability Trust that reinforce the global financial safety net, Calviño told a press briefing. “These meetings conclude with an enhanced commitment by members to coordinate our economic policies, to reinforce our global financial safety net, and to work together in a constructive manner to deliver on our shared roadmap as we start the road to the Annual Meetings i Marrakesh.

How Should Central Banks Battle High Inflation?

While headline inflation is falling, core inflation remains stubbornly high. But central banks must stay the course in bringing this metric down while keeping the financial system stable, the IMF’s Gita Gopinath told a seminar. Many countries have responded by raising interest rates, but some reacted late, panelists said. If the United States had started earlier, “we would not be in the midst of this trilemma of trying to simultaneously lower inflation, minimize damage to growth, and maintain financial stability,” Cambridge University’s Mohamed El-Erian said. Policymakers must now contend with a financial system conditioned to “low for long” rates adjusting to a world of “higher for longer.” Should central banks aim for inflation higher than 2 percent, the target of many central banks? Olivier Blanchard, of the Peterson Institute for International Economics, said he has long favored a higher target, which would give monetary policy more scope to adjust. Supply shocks aren’t going away in a hurry, panelists said, which means monetary policy will face more serious tradeoffs than before. But the lesson is to let these shocks happen and not fight them too hard, Blanchard said. “If the central banks have built credibility, they won’t suffer second round effects.”

Quote of the Day

Let us learn the lessons of the past and not forget that peace and multilateralism, as opposed to war and fragmentation, have brought progress and prosperity to millions of people all around the world.

NADIA CALVIÑO, CHAIR, INTERNATIONAL MONETARY AND FINANCIAL COMMITTEE

The Regional Economic Outlooks

Sub-Saharan Africa

People in sub-Saharan Africa are feeling the effects of a funding crisis, as access to cheaper financing is curtailed and borrowing and living costs increase, said IMF African Department Director Abebe Aemro Selassie at a press briefing on the region’s economic outlook. “Coupled with a long-term decline in aid and a more recent fall in investment…this means that there is less money to be spent on vital services like health, education and infrastructure.” Growth in sub-Saharan Africa will decline to 3.6 percent this year, although there is significant variation across the region, Selassie said.

WATCH THE EVENT

Europe

Europe has so far avoided a full-blown recession but faces a triple challenge of maintaining economic recovery, defeating inflation and safeguarding financial stability, according to Alfred Kammer, director of the IMF’s European Department. At a press briefing, Kammer said that Europe’s advanced economies would grow by just 0.7 percent this year. For emerging economies (excluding Russia, Ukraine, Belarus and Türkiye), growth will decline to 1.1 percent. Kammer said central banks should maintain tight monetary policy until core inflation is on a clear path back to targets and governments should pursue more ambitious fiscal consolidation to fight inflation and replenish depleted fiscal reserves.

WATCH THE EVENTNumber of the Day

0.2-7%

The longer-term cost of trade fragmentation alone could range from 0.2 percent of global output in a limited fragmentation scenario to almost 7 percent in a severe scenario—roughly equivalent to the combined annual output of Germany and Japan.

Learn more

Digital first

It cost just a dollar per person to provide a unique digital identity to all Indians, Nandan Nilekani, the founding chairman of the Unique Identification Authority of India, told a panel on digital infrastructure. “Digital public infrastructure does not require deep pockets, it requires deep conviction,” he said. India’s experience creating digital public infrastructure proves that low-cost and scalable digitalization can help build resilience against shocks such as pandemics, spur economic growth and ensure inclusivity. Verification through digital identity has saved at least $27 billion in government welfare schemes and brought down customer acquisition costs to four cents from $6-9 previously, according to Nirmala Sitharaman, India’s finance minister. Digitalization, layered on top of public-funded infrastructure, as in the case of India, have sped up financial inclusion. “It brings in so many people who are on the margins of society to now participate in economic opportunity,” said Melinda French Gates, co-chair of the Bill and Melinda Gates Foundation.

CHART of the Day

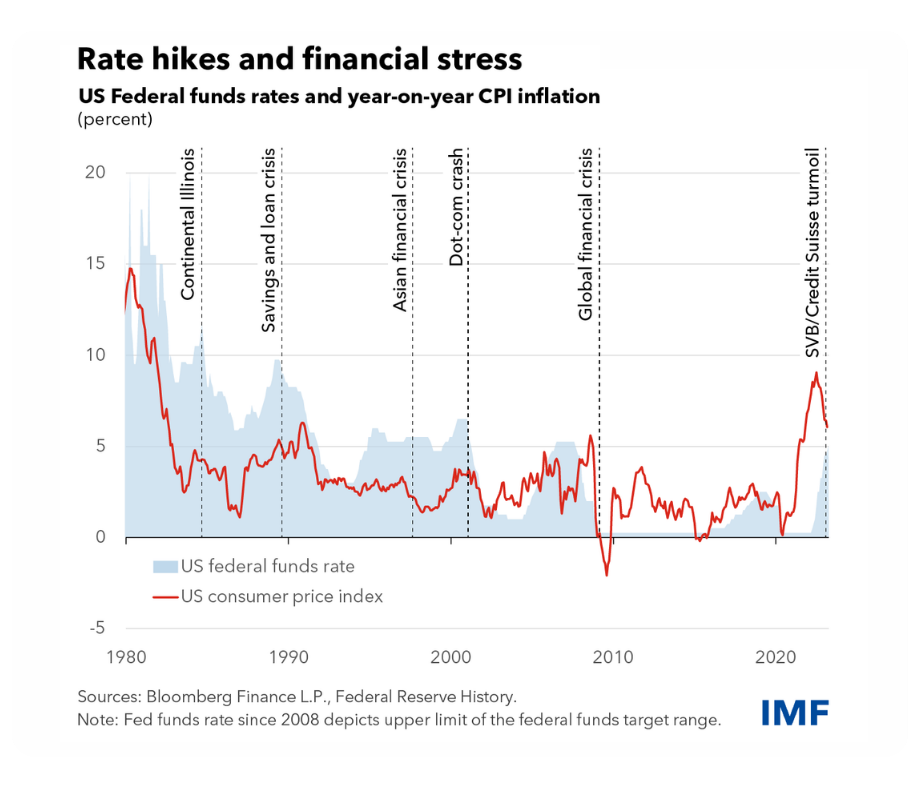

Our latest Global Financial Stability Report shows that risks to bank and nonbank financial intermediaries have increased as interest rates have been rapidly raised to contain inflation. As the Chart of the Day shows, such forceful rate increases by central banks are often followed by stresses that expose fault lines in the financial system.

Learn more

The Flagship Reports in Rewind

World Economic Outlook (WEO)

Pierre-Olivier Gourinchas, the IMF's Chief Economist, announced during the release of the latest World Economic Outlook that global output growth is anticipated to decrease from 3.4% in the previous year to 2.8% in 2023, before increasing to 3% in 2024. The baseline forecast for global output growth is 0.1 percentage point lower than predicted in the January 2023 update. Global inflation will fall, though more slowly than initially anticipated, from 8.7 percent last year to 7 percent this year and 4.9 percent in 2024, he added.

Learn more

Global Financial Stability Report (GFSR)

During a press conference on the latest Global Financial Stability report, Tobias Adrian, the IMF's Director of the Monetary and Capital Markets Department, stated that the rapid tightening of monetary policy after years of low interest rates is revealing weaknesses. These interest rate hikes could exacerbate vulnerabilities in the banking sector, but policymakers have the means to mitigate them. Central banks possess tools for combatting inflation as well as for ensuring the stability of the financial sector.

Learn more

Fiscal Monitor (FM)

Launching the Fiscal Monitor on Wednesday, the IMF’s Vitor Gaspar said that fiscal policy has moved a long way toward normalization since the pandemic. Governments have withdrawn exceptional fiscal support, and public debt and deficits are falling from record levels. That is happening amid high inflation, rising borrowing costs, a weaker growth outlook, and elevated financial risks. Gaspar called for consistent policies to bring inflation back to target, address public finance risks while protecting the most vulnerable, and safeguard financial stability.

Learn morePhotos

An attendee takes a selfie at the Photo Booth during a reception.

Custom-designed treats are on display at the publication booth inside the IMF building.

A participant enjoys a cup of tea at the Moroccan Tea Ceremony in preparation for the 2023 Annual Meetings in Marrakech.