IMF ANNUAL Meetings Update | OCTOBER 13, 2023

In our final daily recap of the Annual Meetings in Marrakech, today, October 13, 2023, we spotlight the Managing Director’s call for world leaders to unlock economic opportunities for the next generation, the complex challenges facing the global economy from geopolitics to technology, how voluntary channeling of the IMF’s unique international reserve asset is benefitting countries, and regional economic outlooks for Asia, Europe, Africa and the Americas.

Economic Reform And Cooperation Can Unlock Opportunities For Next Generation

It’s 50 years since the IMF held its Annual Meetings in Marrakech in 1973. After looking back at the past half-century of extraordinary progress and periodic upheaval, Kristalina Georgieva asked the governors of the Fund to imagine what the world would look like in 2073. Drawing on visions from artificial intelligence, and mindful of the challenges facing the global economy, the Managing Director proposed two priorities for policymakers. First, investment in strong economic foundations—notably bringing down inflation, financial stability, and transformational reforms. “The right package of reforms could boost output levels by up to 8% in four years,” she said. Second, policymakers should invest in international cooperation—particularly in areas such as debt, climate, and the global financial safety net, with a strengthened IMF at its center. While the Fund has responded to recent shocks in an agile and unprecedented way, the IMF needs to be urgently strengthened, she noted, pointing to the need to boost permanent quota resources, and replenish the subsidies that enable the Poverty Reduction and Growth Trust to provide zero-interest loans.

Global Economic Faces Complex Challenges, From Geopolitics To Technology

Global leaders face a bumpy road ahead, characterized by weak medium-term growth prospects, persistent inflation, geopolitical tensions, mounting debt, and higher interest rates, IMF First Deputy Managing Director Gita Gopinath told a seminar on the global economy. With countries borrowing at much higher interest rates, they will need to find alternative ways to finance their development goals and manage the green transition. Adding that countries must turn to domestic resource mobilization and seek to bolster their tax revenues. With interest rates higher for longer, the focus has return to fiscal and debt sustainability, noted chair of global research at JP Morgan Joyce Chang. “The bond vigilantes are back, and the Great Moderation is over.” In this complex global environment, countries should avoid protectionism and fragmentation, said WTO director general Ngozi Okonjo-Iweala. Their research shows that trade fragmentation could result in long-term losses of up to 5% of global GDP, with significant higher losses for emerging markets. She argued the issue does not lie with trade itself, but rather with the overconcentration of some supply chains.

Quote of the Day

"Higher for longer [interest rates] is also harder for longer for emerging markets.

JOYCE CHANG, Managing Director JP Morgan

The Regional Economic Outlooks

Asia and Pacific

Strong consumer spending has supported economic growth in Asia this year, but there are already signs that the region’s recovery may be losing some steam. The IMF lowered the growth estimate to 4.2%, from the 4.4% projected in April, according to the latest Regional Economic Outlook for Asia and the Pacific. The region is likely to expand 4.6% this year, unchanged from the projection from last April. While Asia is still poised to contribute about two-thirds of all global economic growth this year, Asia-Pacific Department Director Krishna Srinivasan noted in a blog that growth is significantly lower than what was projected before the pandemic and output has been hurt by a series of global shocks. “The region is facing challenges from persistent medium-term output losses and China’s structural slowdown, geoeconomic fragmentation, and inflation,” Srinivasan told reporters at a press briefing.

WATCH THE EVENT | READ THE BLOG

Sub-Saharan Africa

Growth in sub-Saharan Africa will slow to 3.3 % this year but is expected to rebound to 4% in 2024, Abebe Aemro Selassie, the director of the IMF’s African Department told a press briefing at the launch of the department’s latest Regional Economic Outlook. Growth is expected to be broad-based, he said, indicating that outcomes are encouraging given strong external headwinds. Significant challenges remain, including double-digit inflation in a third of the region’s countries. Selassie stressed four policy priorities going forward: addressing inflation, reducing debt vulnerabilities, allowing exchange rates to depreciate where needed, and continued investment in priority areas like health, education and infrastructure. Governments in many countries have been working hard to address macroeconomic imbalances, he said, highlighting enormous potential in the region.

WATCH THE EVENT | DOWNLOAD THE REPORT

Europe

Europe’s policymakers must remain focused on defeating inflation, restoring fiscal stability, and raising productivity to set the stage for stronger growth over the longer term. IMF European Department Director Alfred Kammer told reporters at a press briefing that central banks should maintain a restrictive monetary policy stance for as long as necessary to secure price stability. “Experience from past inflation episodes cautions against easing too early,” Kammer said. The IMF forecasts growth of 0.7% for 2023 in advanced Europe, down from 3.6% in the post-pandemic rebound of 2022. Thereafter, the outlook should improve gradually, with growth in 2024 rising to 1.2% in advanced and 2.9% in emerging market economies, according to IMF projections.

READ THE BLOG | WATCH THE EVENT

Western Hemisphere

Growth in Latin America and the Caribbean will slow from 4.1% in 2022 to 2.3% this year and remain around this rate in 2024, Rodrigo Valdes, director of the IMF’s Western Hemisphere Department, said at the launch of the department’s latest Regional Economic Outlook. The slowdown reflects tighter policies to contain inflation and a weakening global environment, tighter external financing conditions, and lower commodity prices. Inflation is likely to converge gradually toward central bank targets, but Valdes told a press briefing that the balance of risks remains tilted to the downside. Risks include slower growth in the region’s main trading partners, commodity price volatility, further inflationary shocks, renewed turbulence in global financial markets, and an intensification of geopolitical tensions.

WATCH THE EVENT | DOWNLOAD THE REPORT

CHART of the Day

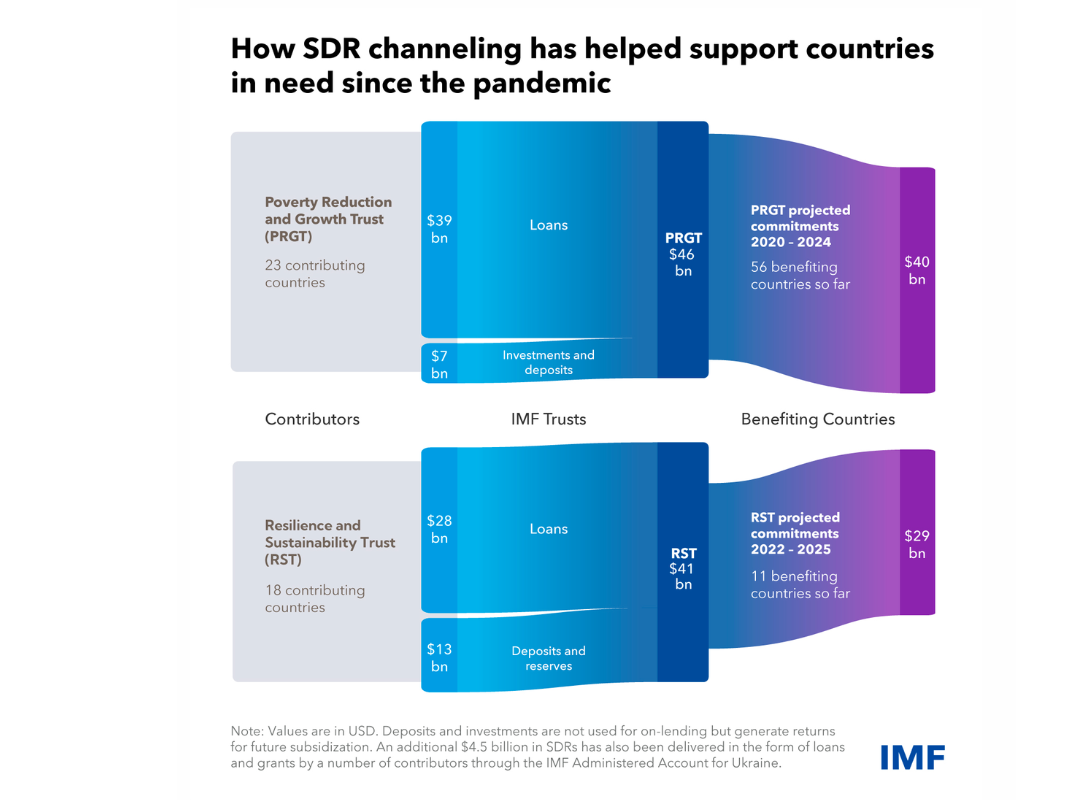

The Chart of the Day shows how voluntary channeling of special drawing rights, the IMF’s unique international reserve asset, benefits countries through two key lending instruments: the Poverty Reduction and Growth Trust and the Resilience and Sustainability Trust.

These trusts allow us to support our vulnerable and low-income members confronting multiple and varied challenges.

Support for Low-income countries

Special Drawing Rights

Number of the Day

5-9%OF GROSS DOMESTIC PRODUCT

Domestic resource mobilization holds huge potential. Tax reforms alone can raise revenue by up to 5% of gross demostic product in emerging markets and up to 9% in low-income countries, according to IMF research.

Learn more

Photos

Live music event during the Annual Meetings in Marrakesh.

Participants gather after the Governor's Talk event.

Finance Minister of India Nirmala Sitharaman speaks with President of the European Central Bank Christine Lagarde.

Upcoming Events

Press Briefing: International Monetary and Financial Committee (IMFC)

October 14, 12:15 PM GMT+1

IMFC Chair Nadia Calvino and IMF Managing Director Kristalina Georgieva summarize the outcome of the IMFC.

Event Details

IMF Seminar: Financial Inclusion as a Pathway to Resilient and Shared Growth

Join us in shaping national financial inclusion strategies, particularly in Africa and the Arab world, while paving the way for efficient solutions that benefit all stakeholders.

Event Details

Per Jacobsson Lecture: Building Economic Resilience in Uncertain Times: Challenges for Emerging Markets and the Region

This seminar will discuss how countries can work towards economic resilience in an era of greater uncertainty and shocks.