IMF ANNUAL Meetings Update | OCTOBER 12, 2023

In the fourth daily recap on the Annual Meetings in Marrakech, today, October 12, 2023, we spotlight the Managing Director’s global policy agenda and the Marrakech principles for global cooperation, how high debts and interest rates are complicating countries’ quest for growth, market reforms that can fuel the green transition, and much more.

Managing Director Sets Out Policy Priorities For Shock-Prone Worlds

Severe shocks are becoming the new normal for a world that is weakened by slow growth and economic fragmentation, Kristalina Georgieva said at the launch the Global Policy Agenda. As she set out her four policy priorities, the IMF managing director said far too many countries and communities are affected by natural disasters and, worse, by wars in Ukraine and now in the Middle East that cause tragic loss of civilian lives and tremendous suffering. “We have to stand firm against the forces that divide us,” Georgieva said. “In a more shock‑prone world, we need each other even more.” The release by the IMF, World Bank, and Moroccan authorities of the Marrakech Principles for Global Cooperation this week lays out a broad framework for harnessing multilateralism for the benefit of all, she said.

High Debts and Interest Rates Complicate Countries’ Quest For Growth

A combination of record-high debts, elevated interest rates and weak economic growth is making it harder for countries to meet their spending needs, the IMF’s First Deputy Managing Director Gita Gopinath told a seminar. By 2030, emerging markets and developing economies will need around $3 trillion in additional spending—about 5.5% of gross domestic product—to finance their development goals and the climate transition.“Prioritizing spending so it goes to areas that raise productivity is critical”, Gopinath said. For Canada, that means investing in early learning and childcare, the country’s deputy prime minister, Chrystia Freeland, said. Germany’s government is pushing reforms to labor and energy markets, according to the country’s finance minister, Christian Lindner. He told the seminar some developing economies could increase the tax burden by 8-9 percent of GDP and still be efficient, in contrast to many advanced economies where the tax take is high already. Tackling informality, increasing tax efficiency through digitalization, and ensuring tax compliance are all important. But Egypt’s finance minister Mohamed Maait said that traditional solutions might not always work or be possible politically.

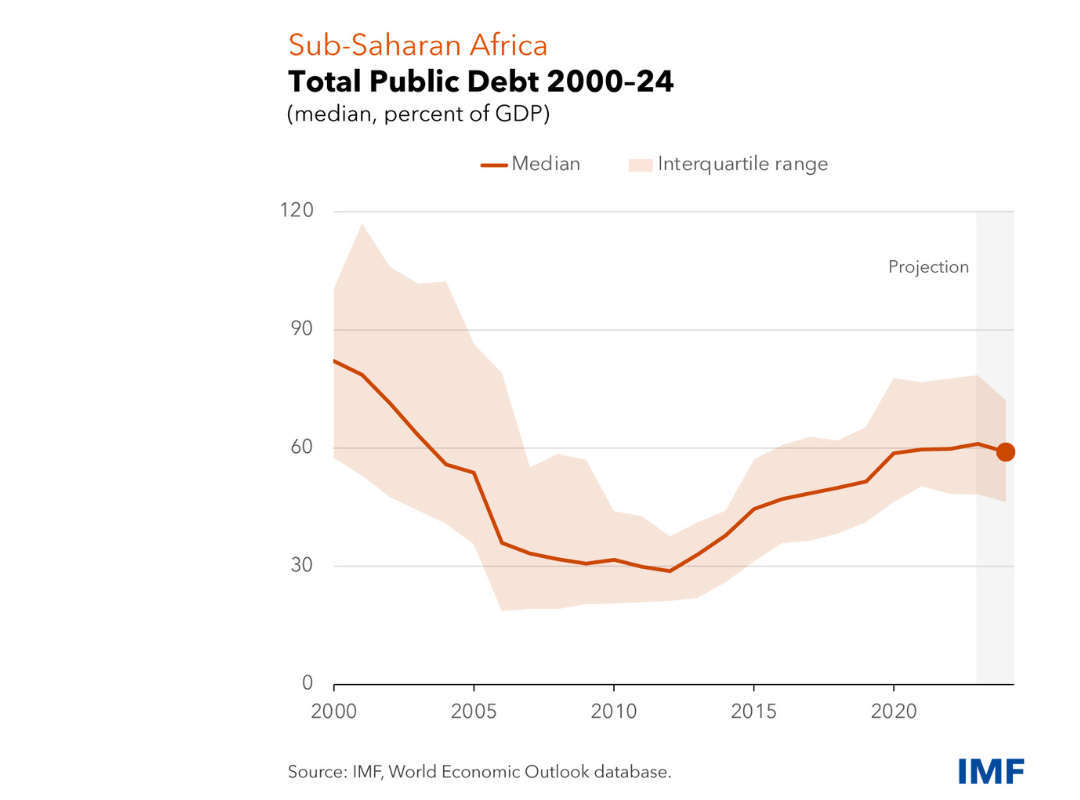

CHART of the Day

After rising for almost a decade, sub-Saharan Africa’s public debt has largely stabilized at around 60 percent of gross domestic product and is projected to decline slightly from 2024, according to our latest Regional Economic Outlook.

Learn more

Middle East Can Boost Economies With Market Reforms

Growth in the Middle East and North Africa will slow to 2 percent this year, but will accelerate to 3.4 percent in 2024, Jihad Azour, the director of the IMF’s Middle East and Central Asia Department, told a press briefing. Growth in Central Asia and the Caucasus is projected to remain relatively robust at 4.6 percent this year, down from 4.8 percent in 2022, according to the department’s Regional Economic Outlook. Azour stressed the importance of structural reforms, which can help support growth prospects. IMF research shows that implementing governance, external sector and regulatory reforms could increase output by almost 10% over 5 years. Promoting inclusive growth will require substantial reforms to close the gap between the developed model of the past and what is needed going forward, Azour said.

Debt Resolution Boosted by Common Framework and Sovereign Roundtable

It’s right to remain concerned about debt, but we are not facing a debt crisis, IMF Managing Director Kristalina Georgieva told a seminar on sovereign debt. Low-income countries are especially affected by unsustainable debt due to a lack of fiscal buffers, increased costs of debt servicing owing to high interest rates, and stagnating international support. But there are positive signs, including the expectation that Zambia will soon sign a memorandum of understanding on debt restructuring, Georgieva said. “I am more optimistic about international cooperation on debt resolution than I was before the common framework and sovereign debt roundtable.” Politicians in credit countries should advocate debt resolution for debtor countries as a means of making the global economy more sustainable, said Saudi Arabia’s finance minister, Mohammad Al-Jadaan. Zambia’s finance minister, Situmbeko Musokotwane, outlined domestic reforms his country has passed to stabilize debt. These include stronger powers for parliament to push back on new borrowing, using money from phased-out fuel subsidies to invest in education, and attracting private investment to create opportunities for jobs and growth.

Quote of the Day

The trifecta of record-high debt, high interest rates, and weak growth in many parts of the world is a toxic combination.

IMF First Deputy Managing Director Gita Gopinath, speaking at an IMF seminar on boosting growth with domestic resources.

Reforms Can Ignite Growth and Fuel the Green Transition in Poorer Economies

Emerging market and developing economies can benefit considerably from basic structural reforms to improve governance, enhance the regulatory environment, and reduce trade restrictions, IMF Deputy Managing Director Antoinette Sayeh told a seminar. “If prioritized, sequenced and bundled properly, these first-generation reforms can make for a growth increase of 4% over two years and 8% over four years in countries with large structural gaps,” Sayeh said, citing a new IMF paper. Combined with green reforms, these structural reforms can ignite growth. The private sector must play a major role, noted Blackrock’s Amer Bisat, who put the green transition’s cost to emerging markets at $1.9 trillion annually between now and 2050. How can investors be persuaded to invest? They need stability—but also the first-generation reforms that permit returns to be sufficiently high.

Number of the Day

$3trillion

By 2030 emerging markets and developing economies will need around $3 trillion in additional spending to finance their development goals and the climate transition.

Learn more

Photos

Managing Director Kristalina Georgieva and First Deputy Managing Director Gita Gopinath attend a meeting of the Finance ministers & Central Bank Governors from G7 countries.

Delegates arrive at the campus of the 2023 Annual Meetings.

AI Researcher Pierrette Master, Tholang Mathopa, and Kofi Dadzie participate in the New Economy Forum on Artificial Intelligence - Leapfrogging Potential in Africa.

Upcoming Events

IMF Press Briefing: Asia and Pacific Department

Join Krishna Srinivasan, Director of the IMF's Asia and Pacific Department, for a press conference on the IMF's latest economic forecast for the region.

Event Details

IMF Press Briefing: African Department

Oct 13 at 11:15 AM GMT+1 (6:15 AM ET)

Join Abebe Aemro Selassie, Director of the African Department, for a press conference on the IMF's latest economic forecast for the region.

Event Details

IMF Press Briefing: European Department

Oct 13 at 12:30 PM GMT+1 (7:30 AM ET)

Join Alfred Kammer, Director of the European Department, for a press conference on the IMF's latest economic forecast for the region.

Event Details