St. Lucia: Staff Concluding Statement of the 2024 Article IV Mission

November 25, 2024

Washington, DC:

Recent Developments and Outlook

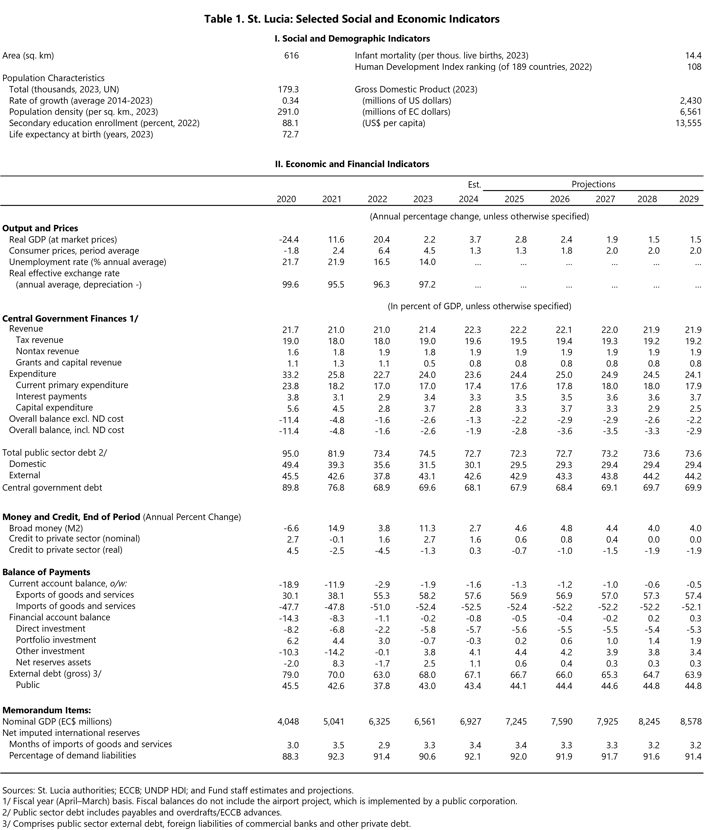

Growth is expected to pick up to 3.7 percent in 2024 on tourism expansion and revived construction activity and then moderate to 1.5 percent over the medium term. Both overall unemployment and youth unemployment have dropped to decade lows. A brief boost to growth will taper off, with growth moderating to a modest 1.5 percent toward the end of the medium term. Inflation, after peaking in 2022, is expected to fall to an estimated 1.3 percent in 2024, driven by lower utilities costs and deceleration in food prices. Inflation is expected to gradually rise to around 2 percent over the medium term. Staff assesses the external position in 2023 as broadly in line with the level implied by fundamentals and desirable policies. The current account deficit is projected to narrow further going forward, driven by tourism and lower fuel prices.

The FY2024 fiscal deficit ex. cost of natural disasters (ND) is expected to be 1.3 percent of GDP and then rise to 3.2 percent of GDP, on average, in coming years. The FY2024 deficit is projected to remain well below the 2.9 percent of GDP in the budget on lower project execution. Tax revenue improved across the board on the back of the economic expansion and the Health and Citizen Security Levy. Public debt stood at 74.5 percent of GDP in FY2023. The fiscal outlook remains challenging over the medium term. Capital expenditure is forecasted to fall to 2.5 percent of GDP by 2029, constrained by limited access to financing. Public debt is projected to stabilize at around 74 percent of GDP.

Bank credit growth remains sluggish. Profits have largely recovered, and NPLs have declined but remain elevated (11.6 percent as of 2024Q2). Despite ample liquidity and adequate capital, bank lending fell by 2 percent year-on-year in 2024 (as of August), driven by a sharp contraction in business loans. Bank credit is expected to remain anemic. On the supply side, high NPLs, a lack of foreclosure legislation, competition from less regulated credit unions (CUs), and concern over the fiscal outlook constrain credit provision. On the demand side, borrowers face stringent loan qualification requirements and burdensome application processes. In contrast, credit growth in the CU sector has been rapid (12 percent year-on-year in June 2024). Although the delinquency ratio has fallen modestly, only three out of sixteen CUs have capital ratios above the new regulatory minimum.

Risks to the outlook are tilted to the downside. Further investment delays relative to the baseline could lower growth. While St. Lucia is currently able to refinance its debt and has been successful in lowering the cost of debt and lengthening its maturity, in a risk scenario, it could face challenges in raising public debt, which could result in an abrupt fiscal adjustment. St. Lucia remains vulnerable to a global slowdown and supply disruptions. A larger recognition of NPLs could further depress credit growth and hinder economic recovery. The country is also heavily exposed to NDs and climate change risks. On the upside, stronger-than-expected tourism and construction growth would boost the economy.

Economic Policies

Fiscal Policies

The policy priority is decisive fiscal consolidation, while safeguarding space to support capital projects and climate resilience. Fiscal consolidation is critical to mitigate St. Lucia’s vulnerabilities to NDs and address high rollover [financing] needs, as well as to achieve the regional debt target of 60 percent of GDP by 2035. It will also promote the investment needed for sustainable and equitable long-term growth by increasing domestic revenue to secure space for capital expenditure. These objectives can be met through comprehensive tax policy reforms, improved control and targeting of current expenditures, and the adoption of a sound fiscal rule within a fiscal responsibility framework.

To achieve the regional debt target by 2035, the fiscal stance needs to be tightened by 1.3 p.p. of GDP cumulatively relative to the baseline over five years. Then, a primary surplus of 2.1 percent of GDP should be maintained over the subsequent five years. This plan would rely on gradually increasing tax revenue by 2.5 p.p. of GDP over five years through comprehensive tax reform and enhanced tax collection, alongside controlling the wage-to-GDP ratio. This would allow capital expenditure to reach its pre-pandemic average of 3.7 percent of GDP, with an additional 0.6 percent of GDP allocated to ND resilience. Combined with structural reforms in labor, social, and financial sectors, this strategy would be consistent with an improvement in potential growth and equity over the medium term. Staff assesses that the net impact of the recommended tax reform and fiscal consolidation on growth is expected to be positive over the longer run.

Reforming the tax system, as recommended in TA reports, will boost tax revenue, enhance equity, and reduce distortions. St. Lucia has excessive tax expenditures, resulting in low and regressive tax collection. With the post-pandemic recovery on track and above-potential growth expected in the near-term, the time is ripe to redesign a more equitable and growth-friendly tax system with manageable short-term costs. Staff analysis suggests that the recommended increase in tax revenue by at least 2.5 p.p. of GDP is achievable. Priorities should include: the elimination of corporate tax exemptions, especially for the profitable tourism sector; broadening the VAT base, as well as raising and equalizing VAT rates; widening the personal income tax (PIT) base and increasing progressivity; re-orienting property taxation to re-introduce and raise recurrent taxes and lower the high transaction taxes; and modernizing fuel taxation.

Improving tax administration is essential for mobilizing domestic revenue in an efficient and fair way. Strengthening auditing and inspection capabilities to align with regional standards, improving taxpayer access and service digitalization, reducing the perception of impunity for tax avoidance and evasion, and fostering a strong culture of compliance are critical steps. The ongoing tax amnesty program should not be extended further. Lastly, customs operations need to be improved to promote international trade.

Better control and targeting of current spending can help secure fiscal space. Expenditures on public wages, goods and services, transfers, pensions, and interest payments should be tightly managed and where possible curtailed through measures such as headcount reduction to keep fiscal consolidation on track. Improved targeting of transfers to vulnerable households is essential. Creating fiscal space will allow for an expansion in capital expenditure and climate resilience, addressing growth bottlenecks and climate challenges.

A stronger fiscal framework, including well-designed fiscal rules, can instill fiscal prudence. A legal primary balance floor, a ceiling on current expenditures, and alignment with the regional debt target--complemented by narrowly defined escape clauses for NDs--would be well suited to St. Lucia. The fiscal rules would be a key component of a broader fiscal responsibility framework.

Ensuring the sustainability of the National Insurance Corporation (NIC) is critical. The NIC proposed reforms to gradually raise contribution rates and the early retirement age--extending the fund’s projected depletion from 2051 to 2080--deserve support but should be part of a more comprehensive strategy. Additional measures could include pension caps and voluntary investment options for high earners as discussed in the 2024 ECCU Staff Report.

The authorities have enhanced the Citizenship-by-Investment (CIP) program, in line with recommendations from previous consultations.

Financial Sector Policies

Progress in reducing bank NPLs and closing the remaining legislative gap on foreclosures is essential to improve credit growth. Persistently high NPLs restrict credit growth, especially for SMEs and micro firms. A multi-pronged approach to reduce NPLs could help stimulate economic activity.

- All banks should comply with the ECCB’s 60 percent requirement on loan loss buffers, preferably through provisions, and meet the 100 percent coverage requirement for legacy NPLs. Strengthening supervisory enforcement will be key to achieving this.

- Enhancing debt enforcement frameworks and addressing information gaps are necessary steps. The recent passage of the Insolvency Act, which is expected to facilitate out-of-court debt workouts for both borrowers and lenders, is an important milestone. However, addressing the remaining legislative gap in foreclosures is imperative, as this obstacle increases the risk and cost of mortgage lending, restricting access to credit and limiting inclusive home ownership. Additionally, the effectiveness of the regional credit reporting bureau will depend on the full participation of all banks and is expected to improve credit conditions, and at least the large credit unions.

- Improvement in the infrastructure for distressed debt and repossessed properties is needed. Strengthened regional cooperation with the Eastern Caribbean Asset Management Company could enhance efforts to manage NPLs. The government, banks, and realtors could also collaborate to develop a comprehensive property cadaster.

Given their ample liquidity and large foreign investment portfolios, banks should exercise prudence. This includes investing in international Treasury and high-grade corporate bonds, while avoiding riskier instruments, such as international equities. Continued progress in addressing gaps in the AML/CFT framework is needed to mitigate risks related to cross-border financial flows and help maintain correspondent banking relationships.

The passage of the Co-operative Societies Act was an important step in strengthening the regulatory framework for the rapidly growing CU sector. The new Act introduces higher capital requirements for CUs and empowers the Financial Services Regulatory Authority (FSRA). The FSRA is encouraged to streamline and tighten the provisioning requirements to align more closely with the ECCB. For deposit insurance, the recommended approach is first to complete the ECCB’s work on deposit insurance for banks, which can then be extended to CUs. The pilot asset quality review has been successfully completed and should now be extended to other large CUs.

In the insurance sector, rising reinsurance rates for property insurance are a key challenge. This is leading to reduced coverage both in terms of the number of insured households and the adequacy of coverage relative to home values. This trend could significantly increase household and public costs for reconstruction and recovery costs in the event of a ND.

Structural Policies

Continued efforts to address supply-side bottlenecks will help support long-run growth. Major obstacles reported by businesses include credit access and high financing costs, inadequate workforce education, and tax and customs compliance challenges. The government’s commitment to investment in physical, social, and digital domains is welcome. Future initiatives should focus on enhancing tourism offerings, diversifying economic activities, and moderating public sector employment growth.

A well-functioning labor market is essential for sustainable and inclusive growth. Authorities introduced a minimum wage and increased minimum pensions in 2024, and they are considering an unemployment insurance scheme. While a wage floor can reduce income disparities and encourage labor supply, it risks reducing business competitiveness—particularly for smaller firms—limiting job opportunities for the less-skilled workers and encouraging informality if miscalibrated. To mitigate these risks, authorities could consider cyclical multiparty reviews, sector-specific differentiation, active labor market policies, and targeted investment to address skill mismatches as well as youth and gender gaps in salaries and labor force participation.

Investments in climate adaptation and energy transition are critical for long-lasting growth. St. Lucia is highly vulnerable to both NDs and climate change, which have significant fiscal and financial implications. Allocating at least 0.6 percent of GDP annually to resilience measures would yield growth and fiscal benefits over the long term. Additional fiscal resources should support a comprehensive three-layered insurance framework. Developing geothermal energy on the island would help reduce electricity costs, decrease exposure to oil price volatility, and enhance long-term growth prospects.

The mission would like to thank the St. Lucian authorities and all other counterparts for the constructive and candid policy dialogue and productive collaboration.

|

St. Lucia: Selected Social and Economic Indicators, 2020–29 |

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Brian Walker

Phone: +1 202 623-7100Email: MEDIA@IMF.org