Alfred Kammer Remarks on the "War in Ukraine: Impact and Challenges for the Capital Markets"

February 3, 2023

Part 1. Opening question: Global perspective, latest IMF forecasts, etc., of the war impacts on economic growth, inflation, and trade.

Thank you very much for the opportunity to participate in this discussion.

I’d like to structure these opening remarks around three key messages.

First, Europe’s economic growth will slow sharply in 2023, but our latest forecasts - released just last week - show that the continent’s economy is proving more resilient than we had feared.

Second, while headline inflation is likely to have peaked, core inflation could prove sticky, requiring both a contractionary monetary policy stance for an extended period of time and a restrictive fiscal stance in most countries.

And third, since the onset of the war, natural gas prices have been an important factor underpinning the outlook, with the sharp recent decline in prices to their pre-invasion levels contributing to the resilience of GDP in Europe. While it partly reflects a combination of temporary factors, it is also a testimony to Europe’s impressive response to the energy crisis, which should continue going forward.

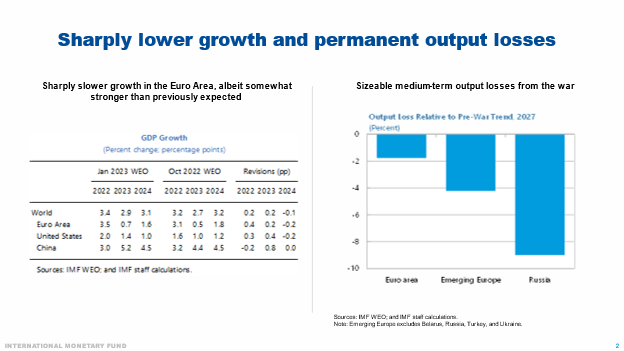

On the global level, annual growth is projected to weaken in 2023 before bouncing back in 2024—with China rebounding already in 2023. A broadly similar picture holds true for Europe, which remains particularly affected by the war in Ukraine through trade, financial and—most importantly—commodity channels.

At the same time, World and European growth are holding up better than we thought a few months ago

For Europe, the slightly better picture for 2023 relative to our October WEO is the outcome of countervailing forces. On the downside, a tighter monetary policy stance and eroding real incomes due to high inflation. On the upside, sizeable declines in energy prices and reduced risks of gas shortages this winter, and more supportive fiscal policies as a result of energy-relief measures. Growth in the Baltics could be slightly above the level seen in the euro area in 2023 and significantly faster than that in 2024.

Of course, the outlook remains highly uncertain at this point, and despite greater than expected resilience so far, we will likely have a challenging period ahead.

The challenges ahead are underpinned by the sizeable output losses we project for Europe over the medium term–around 2 percent in the euro area, and 4 percent in emerging Europe, which were comparatively more exposed to the shock. Medium-term losses in the Baltics are estimated to be broadly comparable to the Emerging Europe average. Russia stands out with a drop of close to 9 percent in 2027 GDP relative to the pre-war trend.

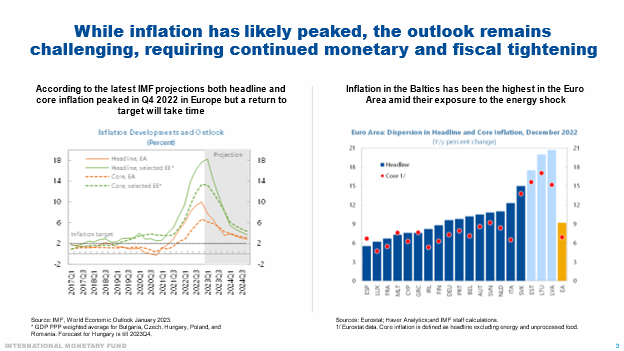

Turning to our inflation projections, I want to highlight the need to continue with monetary tightening to guide inflation back to target amid persistent pressures.

Headline inflation dropped most recently in many European countries, largely driven by lower energy prices. However, core inflation components have continued to increase. While the passthrough from past commodity price increases is one factor, it is noticeable that wage pressures have been gradually building up as workers have sought compensation for high inflation in tight labor markets.

So, even as we project the drop in headline inflation to continue, we have significantly revised up core inflation over the next two years amid signs of greater persistence. In the euro area overall, as well as in the Baltics, both headline and core inflation are projected to remain above target at end-2024.

The large import price shock has led to the highest inflation rates in the Baltics among euro area countries. Our projections imply a convergence to the euro area average over the next two years, although both headline and core inflation will likely prove persistent.

With inflation expected to stay above targets even by the end of 2024, and upside risks remaining, a contractionary monetary policy stance, likely sustained over an extended period, will be needed to keep inflation expectations anchored and bring inflation decisively down to targets over the medium term. Our message to policy makers is thus – stay the course on monetary policy.

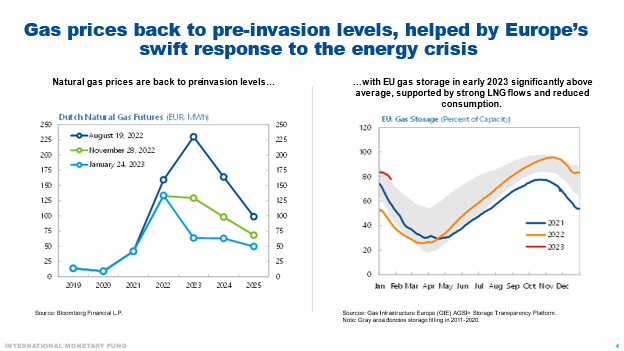

An important assumption underlying both the output and inflation outlook are natural gas prices - this has been true since the onset of the war.

Energy prices are likely to remain persistently above their pre-COVID levels and this is a key reason for the medium-term output losses we project. In the near term, however, an important factor behind Europe’s better-than-expected resilience has been the recent sharp decline in natural gas prices.

Gas prices have dropped significantly relative to our October WEO projections and are now back to around pre-invasion levels. In part, this was driven by temporary factors that could reverse, such as mild weather and lower LNG demand from China.

But this decline also partly reflects Europe’s swift response to the energy crisis. Thanks to meaningful demand compression and large LNG imports, the EU is starting 2023 with above average storage levels and is well prepared for the remaining winter months.

To further bolster energy security, alternative energy sources need to be secured, and intra-European infrastructure bottlenecks need to be addressed. Europe has made an impressive progress on these fronts in recent months, but there is more to do.

The recent decline in energy prices also offers an opportunity to scale down energy relief measures and shift towards more narrowly targeted and non-price-distorting ones. This will also support broader fiscal consolidation goals. Fiscal policy should in general be contractionary at the current juncture to support monetary policy in anchoring inflation. This is certainly true in the Baltics.

Let me conclude with a few words on implications for financial markets and risks.

As discussed, we see the need for continued tight monetary policy as inflation could prove stickier than many market participants currently assume. The likely challenging financing environment for European corporates in the period ahead strengthens the case for further developing European capital markets, including by completing the capital market union (CMU). This would not only enhance macroeconomic risk sharing within the euro area, but also help European firms tap more non-bank private savings as a complement to bank loans. Of course, a tighter financing environment raises many other challenges, and I am looking forward to our discussion on these issues.

Part 2. What is necessary for EU CMU that is missing (reference to earlier IMF proposals)? Have priorities shifted? Overall evaluation of the CMU situation and EU structural reforms.

We all agree that CMU is key for investment and growth in Europe—and it is also essential for the EU’s climate goals. The European Commission estimates that achieving Europe’s emissions-reduction goals will require additional investment of some €3-4 trillion through 2030.

This is a large number and the Commission suggests that at least three-quarters of the total will have to come from the private sector.

In addition, these investment needs are particularly high in the more energy intensive, relatively lower income countries that tend to have less developed capital markets on their own.

Bank lending can help of course. The euro area’s banking system, with assets of about 300 percent of GDP, dwarfs the US system with its 85 percent of GDP.

But complementing this with market financing across EU member countries will be essential—and the potential is vast.

First, there is a lack of scope. If one looks at the balance sheets of nonfinancial firms in the euro area—a space rich in SMEs—one sees that less than one-third of liabilities are tradable stocks and bonds. In the US, this share is over two-thirds.

Second, European capital markets are also segmented nationally. Pervasive home bias creates barriers to integration, holds back innovation, and hurts resilience.

In other words, Europe is a long way from having a single capital market. The ‘U’ in CMU is about helping Lithuanian firms raise equity in Germany, or Latvian firms to issue bonds in France.

What are the key obstacles? We have identified three key issues:

- First, barriers to integration in the form of an unlevel playing field for firms. The average Italian or Greek company in any given industry pays substantially more on its debt than its peers in, say, Germany or France—based on domicile alone.

- Second, restraints on innovation and growth by firms with few tangible assets to post as collateral—think of your typical IT start-up. Such firms face immense difficulty accessing bank loans. Our analysis suggests that start-ups grow much faster in member states with venture capital funds and better-developed capital markets.

- Third, weak cross border risk sharing. In a truly integrated capital market, households will hold equity from different countries as an insurance against domestic shocks. Our estimates suggests this consumption-smoothing effect to be four times stronger in the 50 US states and 10 Canadian provinces than in the EU.

So, what to do about this? The EU’s CMU Action Plan has a long list of “to-dos,” but there are a few key items:

- First, transparency. To improve access to firm-level data, we have suggested a European database modeled on the US SEC’s one-stop-shop for free public access to corporate prospectuses and financial statements—a “European EDGAR”.

- Second, insolvency. Here, we had suggested the European Commission develop a code of good standards in corporate insolvency and systematically report on member states’ progress in observing them—very much like the Basel Core Principles process for banks.

- Finally, oversight. There is a need for more cross country convergence in investor protection, which remains national, and more centralized oversight for systemic investment firms and central clearing houses, with ECB involvement.

But progress has been slow and uneven.

On a positive note, the European Commission is exhibiting a commendable level of ambition on insolvency reform, pushing not just good standards but a harmonization of critical elements through EU legislation.

In contrast, the European Single Access Point for corporate information has been pushed back to 2026-30.

And little or no progress has been made on strengthening oversight, both in terms of supervisory convergence and tighter prudential oversight of systemic central counterparties.

So, we need another policy push. A fully integrated CMU will not only support growth but also make sure that we see the investment at the scale needed to achieve Europe’s climate goals.

Last not least, a true CMU will also allow capital to flow to where it is most critically needed—critically, this includes more energy intensive, faster growing countries such as the Baltics. A lot stands to be gained.

Part 3. Concluding remarks:

I want to conclude by circling back to Europe’s large investment needs.

NGEU, of course, plays a key role—not only with its common bond financing, but with the positive incentives it creates for structural reforms to support economic transformation, growth, and resilience.

But the task also requires tapping into Europe’s vast pool of private savings, including by creating mechanisms to facilitate access from all corners of the union.

And that, in turn, will require not only CMU, but banking union too—there are important synergies between the two. Large cross border banking groups, in particular, are repositories of capital market expertise, ranging from securities underwriting to broker-dealing to asset management. For CMU to take off, their participation will be needed to help lay the groundwork in terms of financial infrastructure and network linkages, and to help serve as gateways to the markets.

Both CMU and the banking union need to advance, as a matter of urgency.