Chile’s Central Bank Governor Rosanna Costa: The government’s multi-year fiscal package has helped to safeguard health, protect incomes and jobs, support credit, and buttress the recovery. (Photo: Central Bank of Chile)

Chile’s New Short-term Liquidity Line to Support Resilience and Recovery

May 20, 2022

Related Links

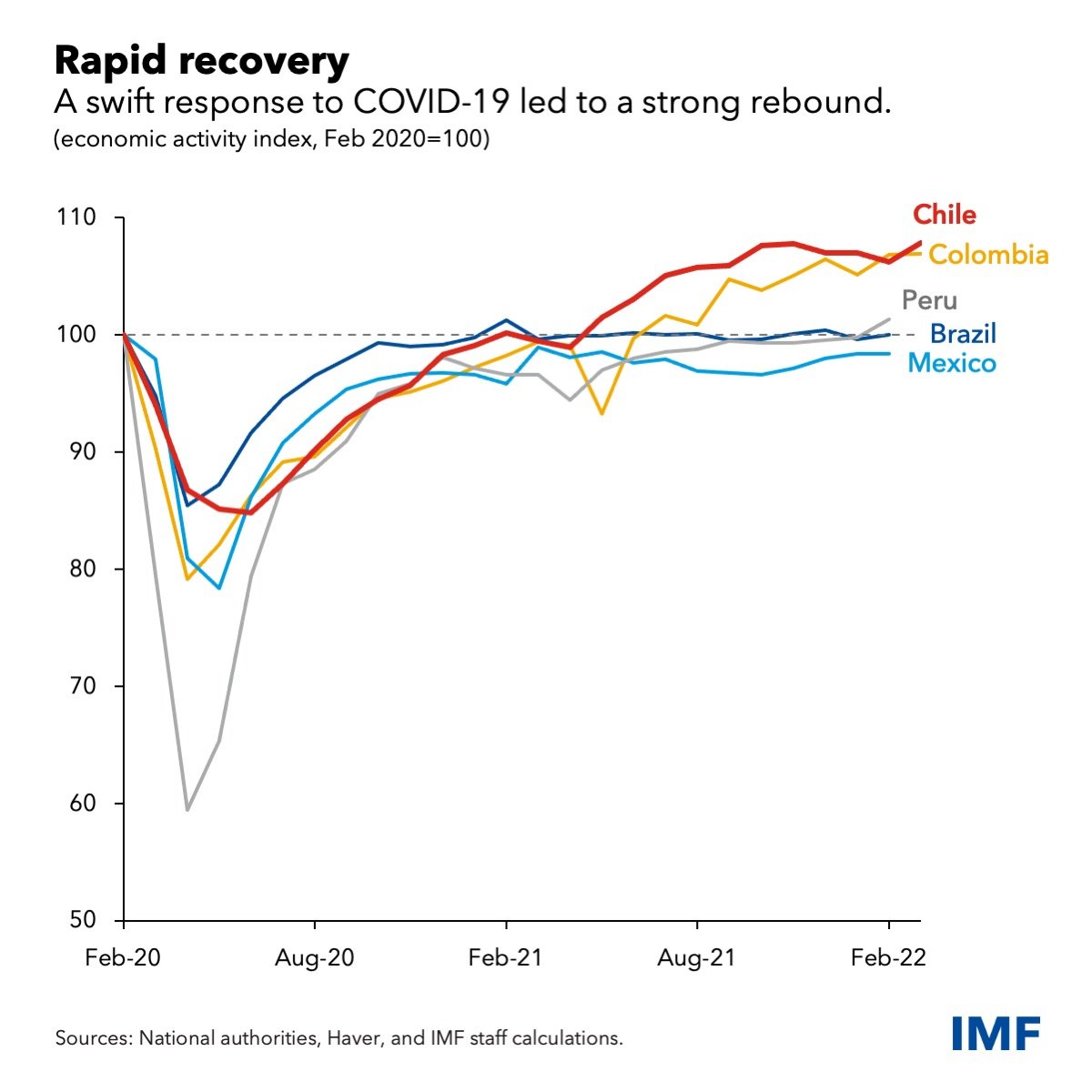

Chile has rapidly recovered from the COVID-19 crisis after a policy response that included an effective vaccination campaign and wide-ranging stimulus measures. As part of its strategy to support resilience, Chile is now accessing the IMF’s Short-term Liquidity Line (SLL)—the first country to benefit from this liquidity backstop—and exiting the Flexible Credit Line (FCL). In an interview with Country Focus, Rosanna Costa, Governor of the Central Bank of Chile, and Ana Corbacho, IMF Mission Chief, talk about the country’s comeback from the pandemic and how the new liquidity line is expected to help Chile achieve its economic agenda and manage risks.

Chile’s economy recovered very fast from the pandemic. What policies helped achieve this outcome?

Governor Costa: Chile entered the pandemic with a healthy economy, a solid fiscal position, and a sound financial system. The very fast recovery was due to the extensive vaccination campaign and an effective economic policy response to the pandemic that was swift and comprehensive, and anchored in very strong policy and institutional frameworks. Chile also had significant buffers bolstered by its access to the FCL. The government’s multi-year fiscal package has helped to safeguard health, protect incomes and jobs, support credit, and buttress the recovery.

To support liquidity, the Central Bank of Chile undertook monetary stimulus and unconventional measures, and adjusted financial sector policies to facilitate the flow of credit, especially to households and small and medium-sized enterprises.

Chile is now successfully exiting the FCL. What is the role of the new SLL in the country’s economic strategy?

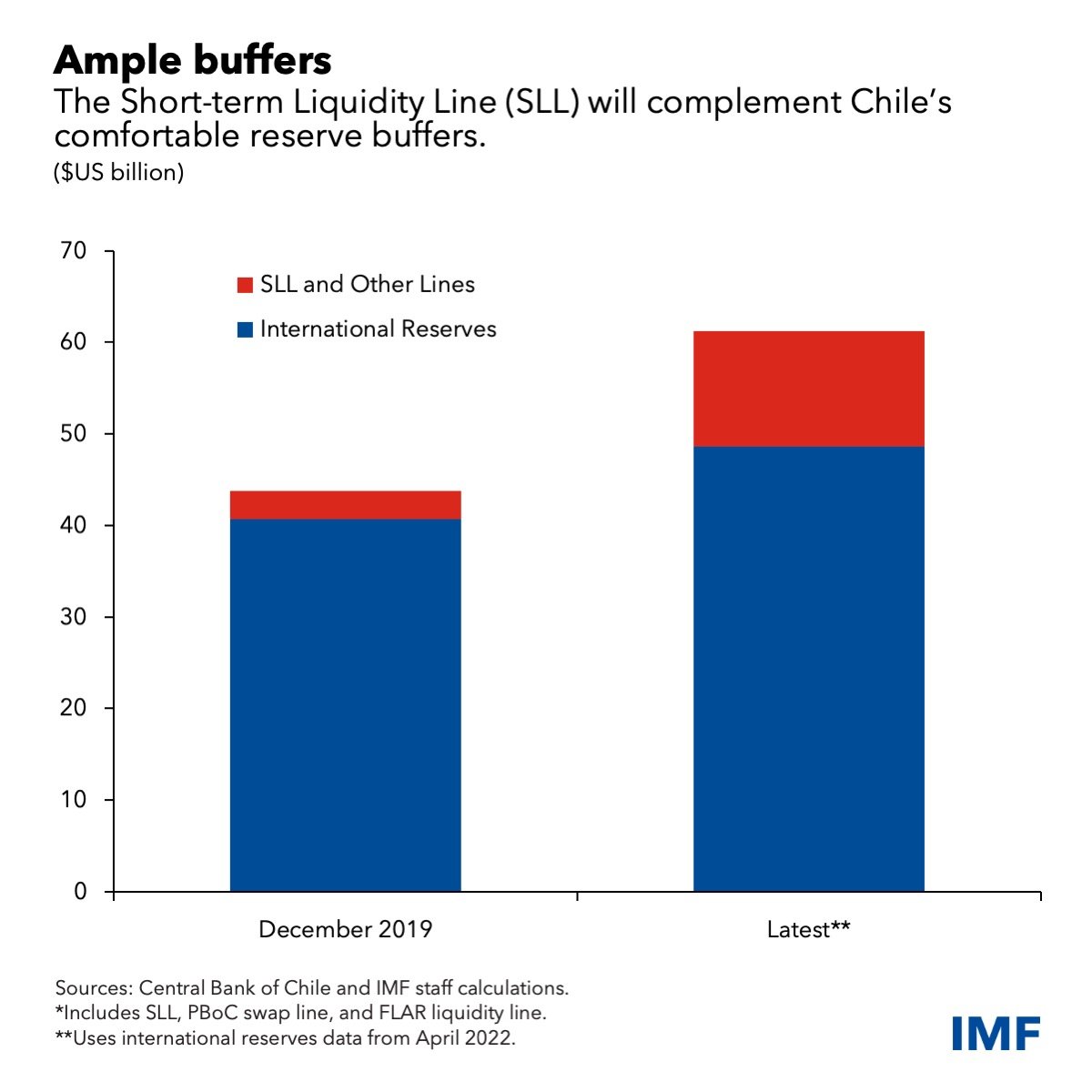

Governor Costa: Chile started preparing the exit strategy from the FCL ever since it gained access in May 2020. As part of this strategy, the Central Bank of Chile purchased international reserves for a total of US$7.4 bn. Chile’s external position was further strengthened by the IMF’s general allocation of Special Drawing Rights, the central bank joining the Fondo Latinoamericano de Reservas (FLAR), and the country’s access to the US Federal Reserve’s REPO FIMA.

Considering these tools, the normalization of the exceptional measures implemented during the pandemic, and the lower risks perceived in relation to the public health emergency, the central bank decided to access the SLL to complement its sources of external liquidity.

IMF Mission Chief for Chile Ana Corbacho. (Photo credit: IMF)

Chile is the first IMF member country receiving an SLL since the facility was created in April 2020. What made Chile a good candidate for the liquidity line and how will it support Chile’s resilience?

Ana Corbacho: The SLL is designed to be a liquidity backstop for members with very strong policy frameworks and fundamentals that face potential, moderate, short-term balance of payments needs. It is an innovative instrument that provides predictable, revolving, and renewable liquidity support in foreign exchange.

Chile is an excellent candidate for the SLL. It has very strong economic fundamentals and institutional policy frameworks, has shown a sustained track record of implementing very strong policies, and the authorities are committed to maintaining very strong policies in the future. Policy frameworks are anchored in a well-established structural fiscal balance rule, credible inflation targeting with a free-floating exchange rate, and a sound financial system supported by effective regulation and supervision. These features have sustained Chile’s resilience even in the face of very large shocks.

The SLL will complement existing buffers, make available predictable and revolving liquidity support, and is a signal of confidence in Chile’s very strong fundamentals and policies. By supporting Chile’s resilience and capacity to respond to shocks, the SLL will also help maintain macroeconomic stability and lay the foundations for sustained and green growth to the benefit of the Chilean people.