Fiscal Monitor Press Conference

October 16, 2019

Fiscal policy is at the center of economic policy debates today. In fact, fiscal policy plays a central role in, for example, managing the synchronized slowdown; preparing for downside risks; contributing to financial stability; financing the Sustainable Development Goals and, finally, in addressing climate change—the topic of the Fiscal Monitor.

Major economies should be prepared for coordinated action in case of a severe downturn. Moreover, inflation and inflation expectations are drifting below target and interest rates are negative, in many advanced economies. Hence, the time is now for countries with budgetary room to use it to support aggregate demand.

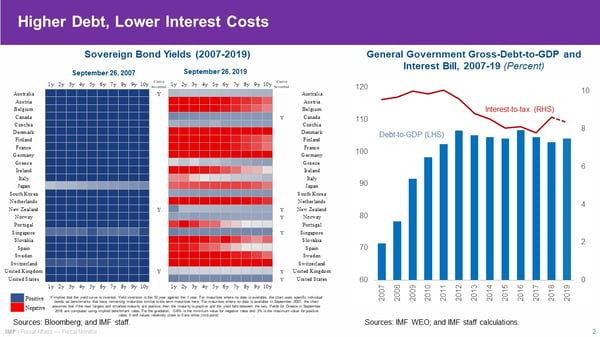

In most other economies, however, monetary policy is not constrained. Public debt and interest‐to‐tax ratios are high and rising. Therefore, we advise policymakers to follow prudent fiscal policies, anchored by a medium‐term framework. Otherwise, as has often happened in the past, complacency fueled by low interest rates may lead to overborrowing, followed by investors’ panic and markets’ disruption.

Sovereign bond yields are negative across the maturity spectrum in most advanced economies. We are now deep into zero or negative territory. Further decreases in policy interest rates are limited. This contrasts with the situation just before the Global Financial Crisis.

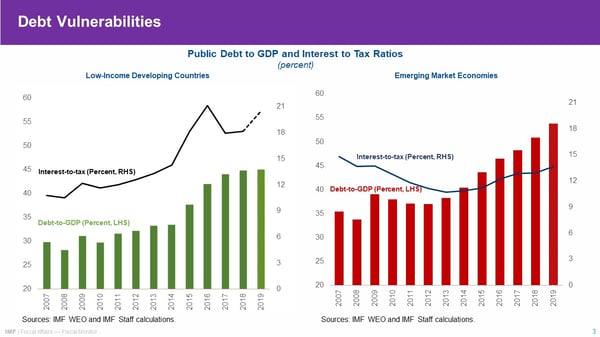

In emerging markets and low‐income developing countries, public debt ratios are high and rising. The cost of servicing debt is also increasing, unlike advanced economies, where low interest rates have compensated for high debt levels. Some countries are vulnerable to exchange and interest rate shocks.

In China, the largest emerging market economy, we expect the economic slowdown and fiscal stimulus to widen the deficit. We recommend that fiscal policy helps to dampen the negative impact on growth from trade disputes, and that it supports long‐term re‐balancing of the economy.

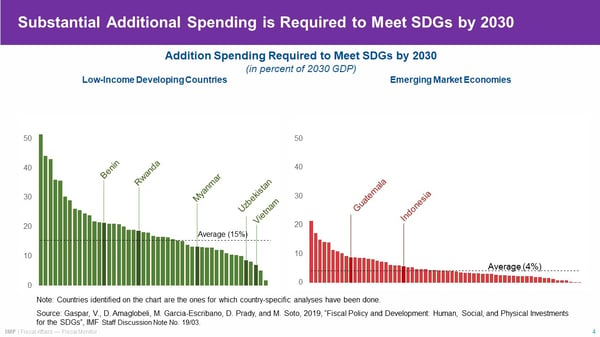

Fiscal policy has an important role to play in the development agendas of many countries, which need to substantially raise spending to meet the SDGs by 2030, particularly low‐income developing economies. The spending must be framed in the context of a comprehensive growth and development strategy. Building tax capacity is necessary to enable a country to generate the extra revenue that underpins inclusive development. And improving the efficiency of a country’s spending is a crucial aspect of good governance. It is also necessary to ensure complementarities between public finance, private investment, and official development assistance.

Let me now turn your attention to the Fiscal Monitor on climate change.

By simply looking at me, you can notice a very important thing: I'm holding a leaflet. Why? Because the Fiscal Monitor is now fully digital, contributing to limiting global warming.

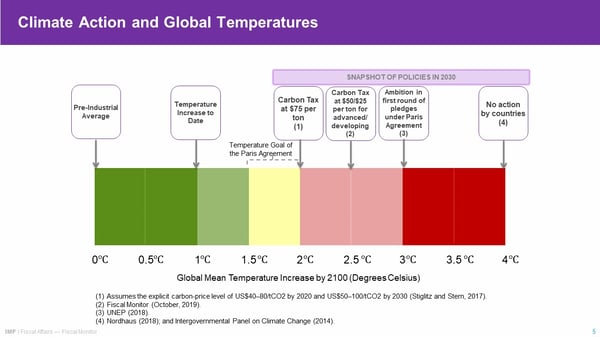

It is important to realize that current pledges under the Paris Agreement are not enough. They will limit global warming to 3°C. This is well above the safe level. To limit global warming to 2°C or less (the level deemed safe by scientists), finance ministers need to take further substantial fiscal policy actions.

How much more? The simplest way to illustrate the point is to focus on a single instrument, such as carbon taxation. Each country would have to take measures that are as ambitious as a carbon tax rising to $75 per ton by 2030. This is not our recommendation. Many alternative combinations of instruments are discussed in the Fiscal Monitor. It is just a way to communicate the scale of the effort required.

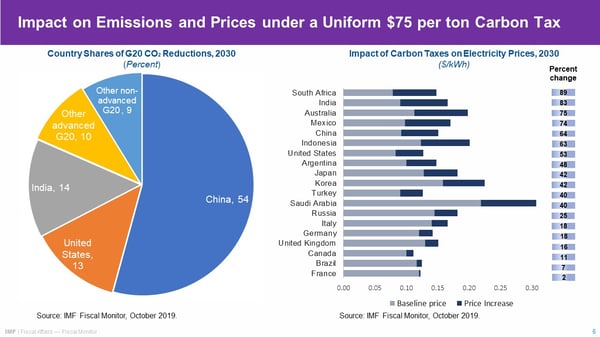

If the carbon tax of $75 per ton were implemented globally, China and India would account for almost 70 percent of CO2 reductions among G20 economies (compared with a no action scenario). This reflects the dominant role of coal in the energy sectors of China and India.

The carbon tax would lead to higher prices for consumers. For retail electricity, for example, price increases would vary between 2 percent in France and 89 percent in South Africa. These different increases largely reflect differences in the share of coal in power generation in each country.

The goal is to reshape the tax system and fiscal policy more generally to discourage emissions. It is crucial that the additional revenues from carbon taxation are used appropriately to reduce burdens and make the reform more politically acceptable. The Fiscal Monitor presents several options involving, for example, labor tax cuts, payments to households and public investment. For discussion, please consult the Fiscal Monitor.

Fiscal policy is at the center of the economic policy debate today. In fact, fiscal policy plays a central role in managing the synchronized slowdown; preparing for downside risks; contributing to financial stability; financing the Sustainable Development Goals and, finally, in addressing Climate Change.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org