Republic of Latvia: Staff Concluding Statement of the 2019 Article IV Mission

June 28, 2019

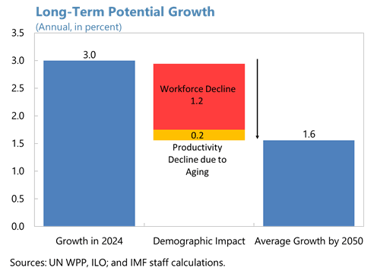

Latvia’s economic fundamentals remain broadly sound, with a low and declining debt burden and prudent fiscal and current account deficits. Growth is projected to decelerate to just above 3 percent in 2019, amid a less supportive external environment. A tight labor market and adverse demographic trends create capacity constraints and will limit long-term growth without reforms.

Efforts should continue to focus on measures that ease labor market constraints, increase productivity, and support investment growth. The long-term policy mix should also aim to ensure space to accommodate demographic and social spending costs.

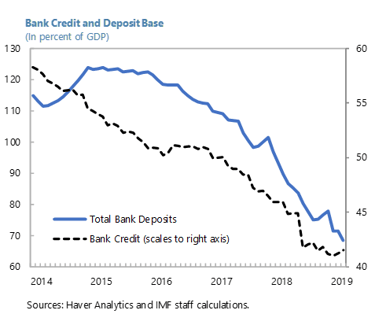

Improving the effectiveness of the anti-money laundering regime, upgrading supervisory powers in bank liquidation, and de-risking the banking sector while ensuring efficient and inclusive financial intermediation will be critical to preserving financial sector stability and supporting growth.

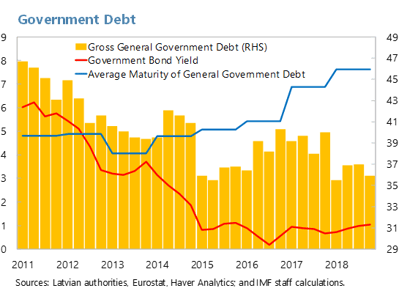

The Latvian economy has become considerably more resilient since the global financial crisis. Growth has averaged above 3½ percent in the last 10 years; there are no significant economic imbalances; external and government debt are on declining paths; and private sector balance sheets continue to improve. Inflation has been moderate, and competitiveness has held up. The new government has signaled a firm commitment to set the economy on a path of rising prosperity.

Economic prospects remain favorable. Real GDP grew 4.8 percent in 2018, led by a pick-up of private investment along with a boom in EU-funded construction and strong growth in IT and communications. Growth is projected to slow in 2019 to just above 3 percent, as a less supportive external environment weakens export growth and reduced pace of EU funds absorption and wage growth moderates domestic demand. Over the medium term, growth is projected to converge to a still robust rate of 3 percent.

However, important challenges and risks may test the economy’s resilience.

- Latvia faces significant demographic challenges. The population continues to decline on average by 1 percent per year. To a great extent this is still due to ongoing emigration, especially of young and skilled Latvians. This affects the size and productivity of the working age population, puts pressure on the labor market, and makes it harder to sustain high growth in living standards over the long term.

- External risks have become more pressing . Latvia is small and relatively well integrated in the global economy and is thus vulnerable to external demand shocks. Weaker than expected global growth, especially in the euro area, and rising protectionism could weigh on GDP growth due to lower demand for Latvian exports. A sharp decline in confidence and tightening of global financial conditions could increase borrowing costs for the Latvian government and the private sector.

- The financial system still confronts reputational risks . The 2018 assessment by MONEYVAL raised concerns about Latvia’s anti-money laundering and combating of terrorism (AML/CFT) regime. Failure to strengthen the effectiveness of the AML/CFT regime and refocus banks servicing foreign clients towards a viable business model could significantly undermine the stability of the financial system and its capacity to support investment and GDP growth.

The authorities’ policy mix should aim at raising productivity and competitiveness while strengthening confidence in the financial system. Reform efforts should focus on easing labor market constraints to preserve Latvia’s competitiveness and external resilience. The planned fiscal stance provides space to face downside risks, if needed, but over the longer-term rising aging and health care costs will force the budget to confront difficult trade-offs about the best use of limited public money. Higher productivity and investment growth are needed to offset the impact of Latvia’s exceptionally unfavorable demographic trends. Persistent efforts would also be critical to repair the reputation of the financial system by strengthening the effectiveness of the AML/CFT framework, upgrading supervisory powers, and de-risking of the banking sector.

Raising Productivity to Support Long-Term Growth

The long-term growth outlook is challenging amid intensifying demographic headwinds. A shrinking and aging labor force is likely to reduce productivity growth and have a negative impact on long-term growth and living standards. In the absence of reforms, long-term growth could fall by half. Ongoing efforts to ease labor market constraints should be redoubled, including by promoting better skill matching and reducing long-term unemployment, increasing labor participation of targeted groups, encouraging Latvian emigrants to return and allowing skilled immigrants to enter the domestic labor market. Raising productivity growth will also allow more rapid wage growth to take place sustainably and help slow emigration. Addressing structural and institutional obstacles that inhibit greater use of new technologies and better resource allocation could yield important productivity gains. This could be achieved through reforms that upgrade the insolvency framework, improve access to finance for small and productive firms, and encourage investment in research and development and foreign direct investment.

Fiscal Policy Mix: Balancing Social and Fiscal Sustainability

The medium-term fiscal stance provides some space to respond to potential downside risks. The authorities’ planned fiscal stance reverses past procyclicality—when the budget position was allowed to weaken despite strong growth—and is appropriate given the expected deceleration of the economy. In the short term, given pressures on overall wages in the economy, the authorities should avoid further public sector wage increases that are not aligned with productivity growth to protect competitiveness. Given Latvia’s relatively low and declining government debt and favorable financing terms, some fiscal space is available to react to shocks. The authorities should carefully assess the potential fiscal costs of new spending initiatives and identify stable revenue sources to preserve this fiscal space. If negative shocks affect the economy, the authorities should accommodate the decline in revenues and rise in spending to protect vulnerable population. In the event of a severe economic downturn, temporary high-quality measures could be considered to support the economy.

Fiscal space could be more limited over the long term due to demographic challenges. Government spending pressures may increase to address the needs of Latvia’s rapidly aging population and deal with relatively high poverty and inequality levels. Thus, long-term policies should focus on securing new revenue sources to accommodate the impact of demographic and social spending costs and to support reforms that boost productivity and growth: public spending is already relatively low in Latvia, meaning that expenditure savings alone are unlikely to be adequate to cover growing age-related demands on the budget. Given Latvia’s vast investment needs and scarce resources, the authorities should focus capital spending on projects that have the potential to catalyze private investment and have high social impact. Poverty and inequality concerns could be addressed by improving the adequacy and targeting of existing social programs. Furthermore, reforms to improve the efficiency of public services and strengthen the transparency and governance of local authorities and state-owned enterprises can help improve the use of public resources and prevent misuse.

Restoring Confidence in the Financial System and Reviving Credit Growth

Money laundering concerns continue to weigh on Latvia’s financial sector, and steadfast actions are necessary to restore its reputation. The authorities have demonstrated strong political commitment at the highest level for such actions. Their efforts to reduce exposure to risky banking operations, address MONEYVAL’s recommendations through legislative and institutional changes, and oversee new business plans of banks servicing foreign clients are welcome. The task ahead remains challenging due to the need to demonstrate effectiveness of the AML/CFT regime, including through long-term reforms. Such reforms should aim at enhancing risk-based supervision, the quality and use of financial intelligence, the application of preventive measures, investigation and prosecution, and coordination among relevant national and regional authorities. Upgrading the supervisory powers for bank liquidation to include mandatory out-of-court administrative liquidation would reduce legal uncertainty and limit potential contingent liabilities for the government, consistent with EU harmonization efforts.

Banks are stable, profitable and liquid, but credit growth remains elusive. Despite record low borrowing costs, lending standards have tightened amid structural changes in the sector and growing uncertainty. Mortgage lending is slowly recovering, supported significantly by the state guarantee program for families with children and young professionals, but other lending programs remain underused. Efforts to revive credit growth should focus on completing the ongoing insolvency reforms to accelerate the rehabilitation of debtors and to lower lending costs through improved expected recovery rates. Steps are also needed to strengthen the revenue administration to more effectively combat the shadow economy and improve borrowers’ transparency. Careful oversight of banks’ de-risking and business model re-orientation towards the real economy should encourage consolidation and ease lending constraints. Improving access to and knowledge about the system of state loan guarantee programs could spur SME lending. New preemptive macroprudential measures, applied to both banks and non-banks, should support sound lending standards through the cycle. This, alongside a review of the side effects of state guaranteed mortgage programs, would mitigate medium-term financial sector vulnerabilities amid persistently rising property prices.

The IMF team is grateful for the generous hospitality of the Latvian authorities, and would like to thank, once again, all interlocutors in government, the Bank of Latvia, and the private sector for constructive and fruitful discussions.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Gediminas Vilkas

Phone: +1 202 623-7100Email: MEDIA@IMF.org