Framing the Debate on Fintech: Current Trends and Continuing Policy Concerns

April 1, 2019

Good morning, ladies and gentlemen. It’s a pleasure to welcome you to this second meeting in the IMF Fintech Roundtable Program, as we begin sharing a wide range of insights about the future of financial technologies — and the serious policy issues they will raise.

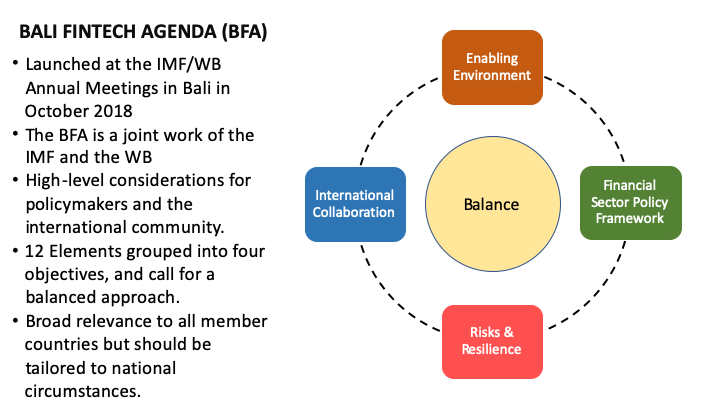

In the first part of my presentation here today, I’ll highlight an important development that has taken place since we met last year — namely, the launch of the “Bali Fintech Agenda.”

In the second part of my remarks, I’ll underscore the key emerging trends that will be the focus of this Fintech Roundtable.

Our meeting today comes at an important juncture, as we see an acceleration of Fintech development and policy actions.

Let me read to you just a few of the news headlines that came out in the month of March —all of which are relevant to our discussion today and tomorrow:

On the legal and regulatory front:

- China’s central bank announced that it will “gradually set up a system of rules for the regulation of Fintech… and create a favorable policy environment for Fintech development."

- The Japanese cabinet approved draft amendments to financial instruments and payment services laws, which would cap leverage in virtual currency margin trading.

- The Mexican central bank, acting under authority from a recently enacted Fintech law, proposed new regulations last week that would limit cryptocurrency exchanges in the country.

- The Swiss Federal Council has initiated a consultation on the adaptation of federal law to Distributed Ledger Technology (DLT) developments.

- Hong Kong has issued its first batch of on-line banking licenses. The virtual banks will be subject to the same supervisory requirements as conventional banks.

On digital central bank digital currencies (CBDCs):

· Two central banks — the Eastern Caribbean Central Bank and the Central Bank of the Bahamas — advanced plans to conduct blockchain-based CBDC pilots, while the Riksbank of Sweden has moved forward with its second interim report into the e-krona. The Bank for International Settlements continues to have some concerns, however, about the potential impact on monetary policy and possible “run risk.”

On cross border payments and transfers:

· Six international banks have announced plans to issue “stablecoins,” or tokens backed by fiat currency, on IBM’s World Wire, to let regulated institutions move remittances or foreign exchange across borders more quickly and cheaply than the legacy correspondent banking system.

· Western Union is partnering with cross-border payments network Thunes to enable clients to transfer funds directly to mobile wallets globally, using blockchain technology.

On Payments and Financial Markets Infrastructures (FMIs)

- The Deutsche Bundesbank and Deutsche Börse successfully completed performance tests of their prototypes for securities settlement based on blockchain technology.

- Swiss stock exchange operator SIX Group picked R3’s Corda Enterprise blockchain platform for the digital asset trading, settlement, and custody service it is building.

These and other developments highlight the importance of deepening the international dialogue among the authorities to exchange information and share experiences to ensure that we all harness the benefits of Fintech while mitigating any potential risks.

This Roundtable is an important opportunity to do exactly that.

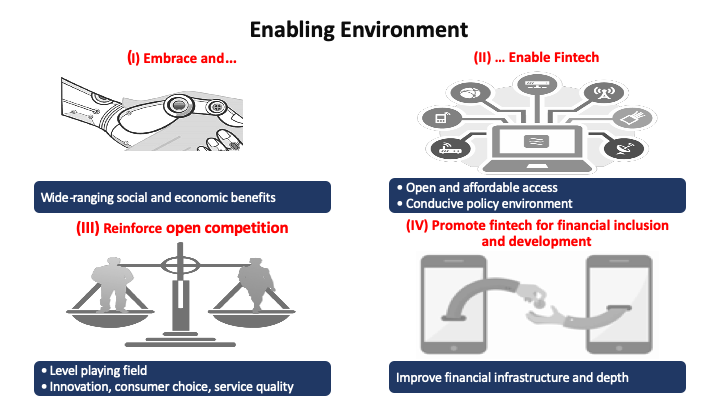

The first four elements of the agenda are intended to highlight and reinforce a key message: that authorities should not be wary of Fintech, but that they should welcome the opportunities that it promises, in terms of widespread economic and social benefits through increased inclusion and efficiency. Then they should prepare for its adoption by building skills and expertise, while also educating consumers and investors.

But welcoming Fintech and recognizing its benefits will not be enough to ensure its successful absorption. In many countries, creating an enabling environment will require supporting the development of foundational infrastructure, such as broadband internet and mobile data services; promoting digitization across the government and the broader service economy; encouraging the use of more efficient payments systems; committing to open, free, and contestable markets that support competition; and promoting financial inclusion and development.

Ensuring the successful adoption of Fintech will require the authorities to remain on top of developments, as well as to provide a continuing assurance that these changes will not lead to disruptions in the financial system.

These two elements underscore the importance of continuous monitoring, including by maintaining an ongoing dialogue with the industry — both innovators and incumbents. Authorities must assess emerging risks and enable the timely formation of policy responses, and of adapting legal and regulatory frameworks to ensure that the financial system remains robust while beneficial innovation flourishes.

Many risks associated with Fintech applications can be addressed by existing legal and regulatory frameworks. However, new issues are being posed by new players in the transaction chain, by non-banks and by information and communication technology providers. New issues are also being raised by the introduction of new products that fall within cross-sectoral regulatory gaps, and that are outside existing legal definitions. Such products require adapting prudential regimes and modernizing the legal frameworks.

Fintech also has implications for risks facing the financial system and for its resilience. While Fintech innovation generally supports legitimate goals, some new business models or products—such as crowdfunding platforms, e-money, pre-paid cards, and crypto assets—may enable users to circumvent or evade current controls. In some cases, they are also being used for criminal purposes, thus posing a threat to financial integrity.

The reshaping of financial markets by Fintech innovations, and by the emergence of new payment tools and settlement systems, poses both a challenge and an opportunity for central banks and supervisory agencies in pursuing their monetary and financial stability mandates. Fintech innovation could transform segments of the financial markets through which monetary policy actions are transmitted. Fintech could also provide new opportunities for central banks to improve their services — including issuing digital currency and expanding access to, and improving the resilience of, payments services.

Finally, developing robust financial and data infrastructure is central to harnessing the Fintech promise, to support operational resilience, and to preserve confidence in the financial system. The critical importance of such infrastructure raises a broad spectrum of issues that are relevant not only to the financial sector, but also to the digital economy at large — including data ownership and privacy, cyber security, the management of operational and concentration risks, business continuity, and consumer protection.

Fintech innovations are increasingly being applied across borders in diverse regulatory environments. This creates opportunities for cross-border arbitrage, the potential for a “race to the bottom” across jurisdiction, and significant risks to Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) standards — all of which could harm national regulation.

Fintech is also blurring financial boundaries, both institutionally and geographically, affecting capital and current-account flows, and potentially amplifying interconnectedness, spillovers, and capital-flow volatility. These developments could lead to the emergence of a more decentralized and interconnected global financial system — increasing uncertainty about the resilience of the system to shocks, and potentially affecting the balance of risks for global financial stability.

As views emerge and as experience is gained at the national levels, it is important that this knowledge be shared among relevant authorities across jurisdictions — as well as with the private sector and the public at large — in order to build a global consensus. The International Monetary Fund and the World Bank could help improve the collective surveillance and could assist member countries through capacity building, in collaboration with other international bodies. Such collaborative efforts would help promote global growth and financial stability.

The IMF is well-positioned to help facilitate the global dialogue and information-sharing. We’re pleased to be working closely with the World Bank on such priorities. In the spirit of the Bali Fintech Agenda, and in line with the IMF’s mandate, the Fintech Roundtable Program was launched last year to facilitate peer-to-peer, in-depth dialogue and information-sharing among the IMF’s member countries regarding the fintech challenges they face and discuss policy responses.

In this second meeting of the Routable, we will focus on a number of issues that have emerged as the most important issues since our first meeting last year. These include:

- The regulatory approach to fintech

- Central Bank Digital Currencies

- Payments and settlement systems

- Legal frameworks, and

- Data governance

Let me briefly highlight the key trends and emerging policy issues in each of these areas.

With respect to the regulatory approach to Fintech: We see many jurisdictions adapting their regulations, particularly regarding crypto-assets — but we also observe that the regulatory response has been uneven and that tensions with traditional mandates sometimes arise. These difficulties are compounded by the lack of relevant international standards.

Various authorities have created “regulatory sandboxes” with the objective of ensuring consumer protection, market integrity, and stability while advancing responsible innovation. There are now about 33 sandboxes in advanced economies and Emerging Market and Developing Economies — as well as a few multi-jurisdictional sandboxes that are used to promote cross-border regulatory harmonization and to foster exchange of information.

However, there is a growing consensus that sandboxes are no panacea, and it remains too early to determine their success. On the other hand, the use of alternatives tools is increasing — including establishing single points of contact, accelerators, and innovation hubs.

These developments raise a number of important questions that will be discussed in the next session, including:

- How do we see the direction of Fintech regulations in the future?

- How successful have sandboxes been so far?

- Where did sandboxes succeed and fail?

- How useful are sandboxes compared to other instruments?

Many central banks have been pondering whether and how to adapt CBDCs. Less than one-quarter of central banks around the world are now actively exploring the possibility of issuing CBDCs, and only four pilots have been reported. We are pleased that the experience of one of these pilots will be shared with us today.

However, there are wide-ranging views and active debate about the benefits and costs of issuing CBDCs. The debate about how these issues are addressed will be of critical economic importance, considering that issuing CBDCs will have a major impact on financial systems, as well as the monetary-policy conduct and transmission channels. In particular:

- Why consider issuing CBDCs, and under what circumstances should they be issued?

- What are the design options and their impact?

- What are the risks to central banks?

We will hear, in our third session, the conclusions of in-depth research from three countries that have invested heavily in exploring these issues.

Recent developments in retail payments systems suggest a move toward real-time settlements, flatter structures, continuous operations, and global reach. Coinciding with these developments, an increasing number of countries are experimenting with, or researching, Distributed Ledger Technologies (DLT) for use in financial market infrastructures, although few countries have carried out pilot projects.

The scope of global research and experimentations covers broad range of FMIs, including, for example, large-value interbank payment projects and experiments (such as Jasper I & II in Canada, Khokha in South Africa, and Stella I in the Euro area and Japan); DLT-based undertakings in securities settlements (such as the Deutsche Bundsbank and Deutsche Börse DLT-prototype Blockbaster in Germany); ASX replacement of CHESS in Australia; international payment networks (such as SWIFT DLT-research) and cross-border payments and settlements (in Canada, the UK and Singapore).

We are looking forward to hearing more details on these experiments in our fourth session, including on such questions as:

- What is the scope of the current or upcoming DLT for broad adoption?

- How do DLT systems compare to newer, real-time centralized payments systems (using a cost-benefits analysis)?

- What are the potential risks?

There is a broad recognition that existing legal frameworks do not adequately address many aspects of Fintech innovations. However, we observe significant diversity in the progress of and the approach to legal reform.

While some progress has been achieved in adapting legal frameworks for financial regulations — with respect, for example, to crypto assets and mobile money — much less has been achieved with respect to financial-sector private law (for example, on such issues as payments and securities transfer law, on solvency, and on other concerns).

We have an excellent panel in our fifth session, which will explore a number of important questions, such as:

- What is the legal status of novel concepts introduced by Fintech (for example, automated processes such as “smart contracts,” and claims on non-bank entities such as telecom companies used for mobile-initiated value-transfer services)?

- What is the legal basis for activities relating to emerging technological change (for example, the treatment of crypto-asset balances in a custody service provider’s bankruptcy)?

- What is the allocation of risk of loss under applicable law (for example, the treatment of operational vulnerabilities in the underlying technology)?

The continued proliferation of data as an input in commercial applications has underscored its value — as well as its implications for efficiency, stability, inclusion, and other fundamental rights.

We see that there is considerable awareness of the need to establish modern data frameworks that support a robust financial system. But we also see significant diversity in approaches to data governance, in areas such as data rights, localization, privacy, and international coordination. This diversity of approaches has emerged as a key policy challenge in defining the future of Fintech development.

Recent data breaches have drawn renewed attention to the cybersecurity risks that are facing the financial sector. While most jurisdictions have frameworks in place to protect the resilience of the financial system, gaps in mapping cyber risks are common.

Our sixth session will help shed some light on difficult issues in this area, including:

- The implications of different data-governance frameworks for market efficiency, access, financial stability, and rights to data — as well as portability, interoperability, and protection, and

- How to strengthen cybersecurity to increase the resilience of financial systems.

Over the next two days, I encourage you to view the IMF Fintech Roundtable Program as an opportunity to have open and frank discussions of Fintech-related issues, and to share your experiences with your counterparts from other institutions.

Thank you very much for joining our Roundtable here this week. I wish you a successful and fruitful conference.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Andreas Adriano

Phone: +1 202 623-7100Email: MEDIA@IMF.org