Construction of apartments in Petah Tikva city, Israel, in the Tel Aviv metropolitan area; the country has a housing shortage (photo: A. Koldertsov)

Israel: Housing's Too Tight to Mention

April 26, 2017

Israel has a housing problem. Construction has not kept up with the rising number of households, so the young and the less well-off find it increasingly difficult to afford their own homes, while rising rents take up a growing portion of the income of poorer households. In a recent report, the IMF suggests ways to improve housing affordability, which would also help Israel avoid risks to growth from this sector.

Related Links

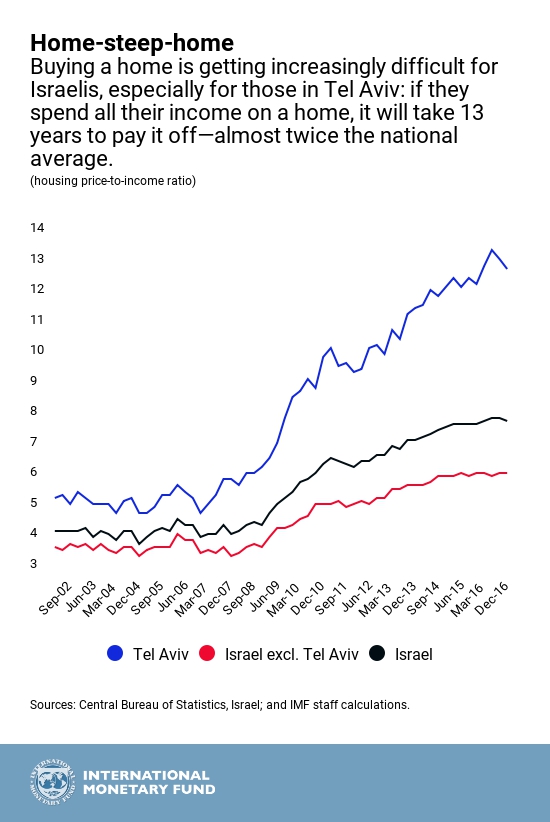

It is getting more and more expensive to buy a home in Israel. In the past 10 years or so, average housing prices rose by about 125 percent and rents by 62 percent. The situation is especially difficult in Tel Aviv, Israel’s financial and business hub, where it would take the average household 13 years to buy a home—almost twice the national average―if all their income were dedicated to solely this purpose.

The reasons for this housing shortage are manifold. Municipalities have strong incentives to approve construction of commercial properties rather than residential projects that pay less tax to municipalities and need additional infrastructure and public services. The state owns most of the land that is not yet developed, and the planning, approval, and construction process faces cumbersome administrative hurdles that can stretch for up to 13 years, although recent reforms are estimated to have expedited the planning and approvals process by 2-6 years.

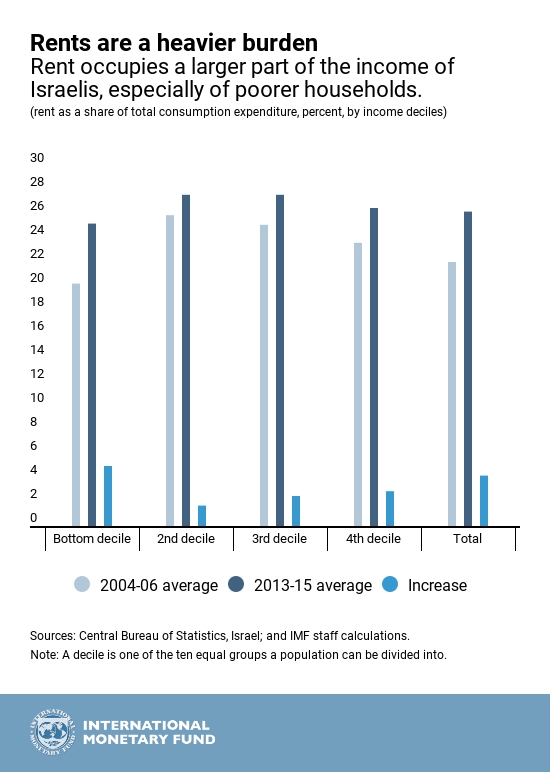

Heaviest hit are the young and low-income families. As it takes more time to save up the down payment for a new flat, they must rent apartments for longer. In turn, their rising demand drives up rental costs.

But it is the poorest who feel the impact the most: the share they spend on rent has jumped 5 percentage points in the decade to 2013-15.

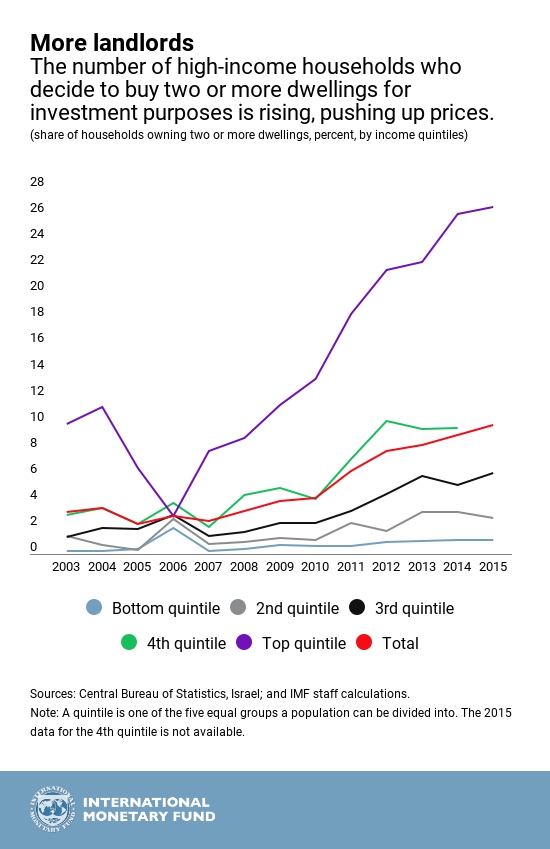

Meanwhile, on the other end of the income spectrum, wealthier households have responded to low interest rates in recent years by increasingly investing in flats for rent. This reinforces the upward pressure on prices that makes it more difficult for young, less well-off households to achieve home ownership. Israel’s rental apartments are mainly offered by small-scale landlords, in part because rental income is taxable for companies but largely not taxable for individuals.

In response to the mass protests in 2011 opposing the continued rise in the cost of living, especially the cost of apartments for young families, the Israeli authorities have already taken significant steps, including shortening planning procedures, using “blanket agreements” with municipalities to promote residential development, and discouraging investor demand through tax measures.

The IMF recommends more measures to expand supply and improve affordability:

- correcting municipal incentives for residential property development would make the supply of housing more responsive to demand in a lasting manner;

- privatizing more land for residential projects, dramatically expanding the scale of urban renewal, and improving public transportation to help relieve demand in major centers;

- allowing broader entry of foreign construction companies and streamlining building regulations would reduce construction time and costs; and

- further developing and improving the rental market.