Public Lecture on Global and Regional Economic Prospects by Naoyuki Shinohara, IMF's Deputy Managing Director

February 7, 2011

Phnom Penh, Cambodia, February 7, 2011

As prepared for delivery

Good afternoon. It is an honor and a privilege for me to meet with students and distinguished academics and policy makers during my visit to Cambodia. I am grateful for your kind hospitality and to learn first-hand about Cambodia’s impressive economic progress and the challenges that lie ahead to sustain its recovery from the global recession.

My presentation will cover three broad points. I will start with the economic outlook and risks for the world and then consider Asia. In doing so, I will focus in particular on two challenges for macroeconomic management in the region: The first is how to sustain the recovery and move to a more balanced pattern of growth, and the second is managing the risks associated with rising and volatile capital inflows. Finally, I will offer some brief remarks on particular challenges facing Cambodia in this context.

In a nutshell, the good news is that we expect the global recovery to proceed, led by Asia, but the not so good news is that that it will remain a multi-speed recovery with considerable downside risks. For Asia, this means that rebalancing growth and strengthening its domestic sources will need to remain high on the agenda, as will managing strong capital inflows which in part reflect global growth differentials. For Cambodia, rebalancing growth in Asia offers significant opportunities for more inclusive and diversified growth, but reaping those will require a continued focus on macroeconomic stability and competitiveness.

Global and Asia Outlook

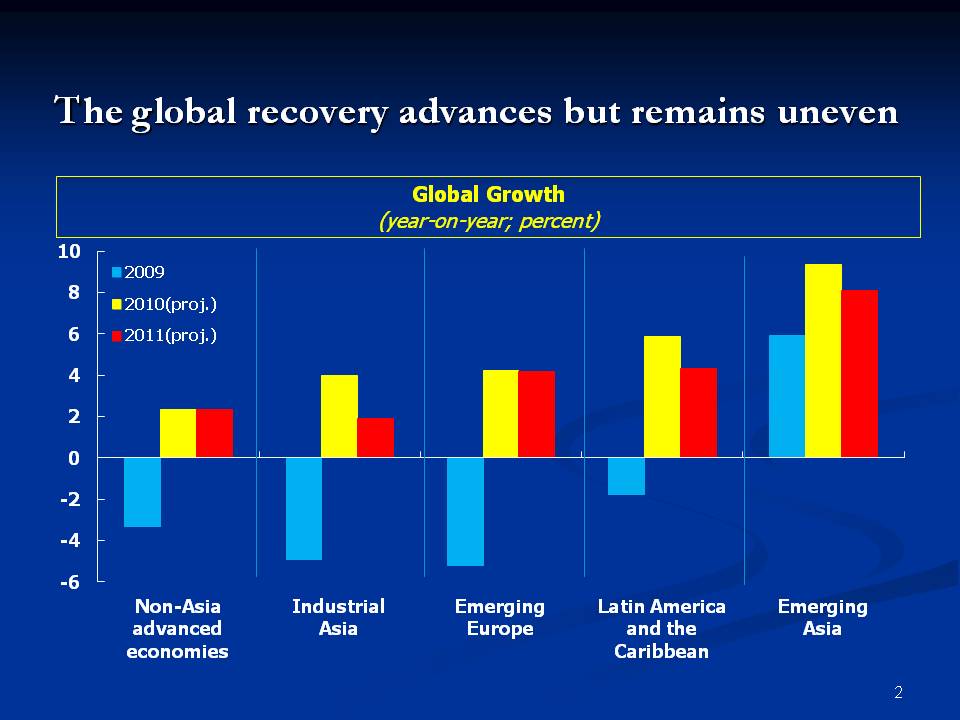

The multi-speed recovery is set to continue. Although activity in advanced economies moderated less in the second half of 2010 than we expected, growth remains subdued, unemployment is still high, and renewed stresses in the euro area periphery are contributing to downside risks. By contrast, in many emerging economies, activity remains buoyant, but inflation pressures are emerging and there are now signs of overheating, in part driven by strong capital inflows.

Against this backdrop, we project activity in advanced economies to expand by 2½ percent during 2011–12, which is still sluggish considering the depth of the 2009 recession and insufficient to make a significant dent in high unemployment rates. Nevertheless, this projection reflects an upward revision to our October 2010 forecast, mostly due to a new fiscal package passed late last year in the United States that is expected to boost growth by ½ percent this year. In Japan, a package with a similar growth impact will sustain a moderate recovery in 2011. And, although growth in the periphery of the euro area is marked down for this year, this is offset by an upward revision to growth in Germany, due to stronger domestic demand. In emerging and developing economies, growth is expected to remain buoyant at 6½ percent. Developing Asia continues to grow most rapidly, but other emerging regions are also expected to continue their strong rebound.

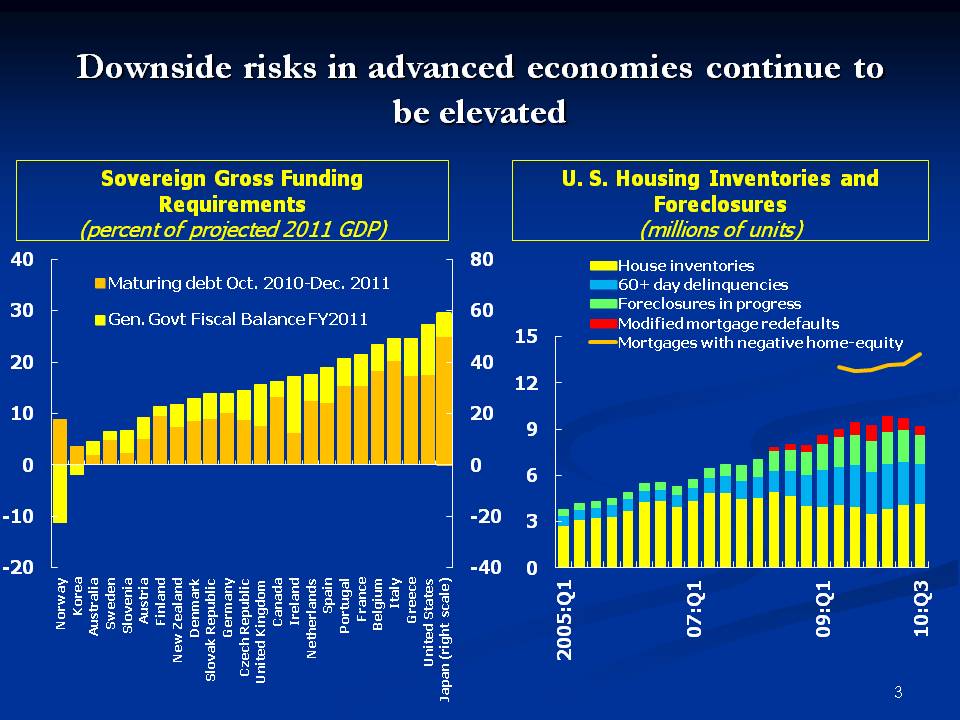

Downside risks in advanced economies continue to be elevated. In the main, these risks are not new. As private and financial sector balance sheets remain weak across a number of advanced economies, coupled with questions about fiscal sustainability and the recovery in real estate markets, a key risk is turbulence in advanced sovereign debt markets that could be triggered by unsuccessful debt rollovers or underperformance relative to fiscal consolidation plans in the Euro periphery. Such an event could create renewed financial market dislocations that interrupt the transition toward stronger private-led demand. A more marked slowdown in advanced economies together with heightened global risk aversion would quickly spread to developing and emerging economies through adverse feedback loops between real and financial sectors. Another risk to the outlook stems from the possibility of renewed weakness in key property markets, including the United States.

Our baseline projections assume that current policy actions manage to keep the financial turmoil and its real effects contained in the periphery of the euro area, resulting in only a modest drag on the global recovery. This view reflects the limited financial spillovers observed so far across financial markets and regions, as well as the fact that policy responses following the Greek crisis helped limit its impact on the global recovery in the second half of 2010. For example, reaction in global debt and equity markets to the Irish crisis was more contained.

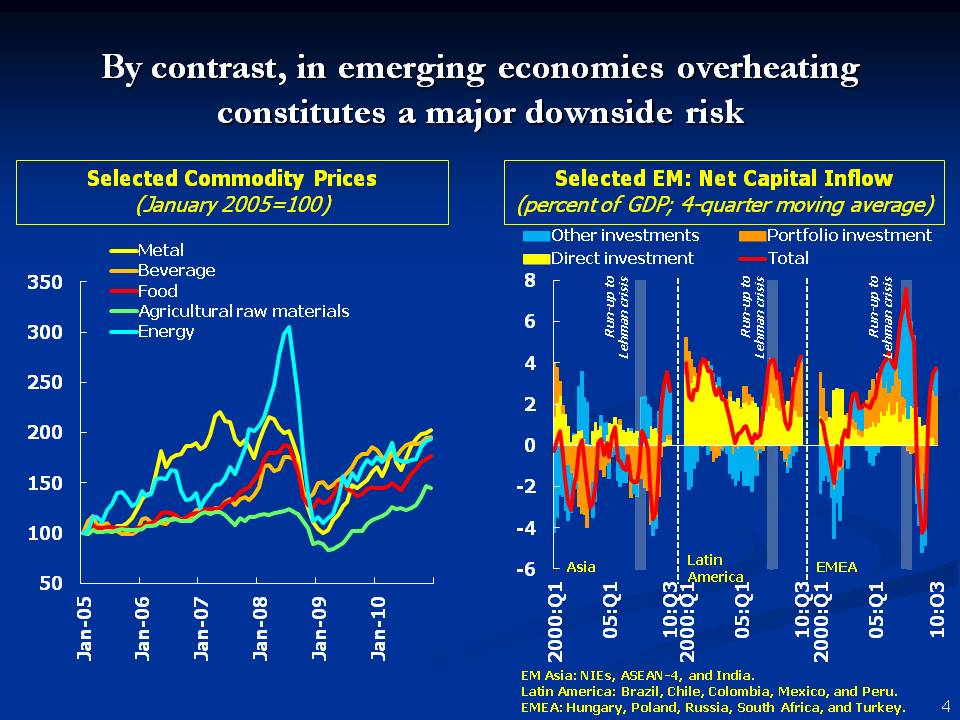

The risks for emerging economies are very different. Mainly they are related to overheating, a rapid rise of inflation pressures, and the possibility of a hard landing. Prices for both oil and non-oil commodities rose considerably in 2010, partly in response to strong global demand, but also due to supply shocks for selected commodities, such as weather-related crop damage. Upward pressure on prices is expected to persist in 2011 and the IMF’s baseline petroleum price projection for 2011 is now $90 per barrel, up from $79 per barrel in our October 2010 forecast. The uptick in consumer price inflation in emerging economies in 2010 was attributable partly to rising food prices. But the recent bout of high food price inflation has been quite persistent and is beginning to feed into overall price inflation in a number of emerging economies.

In addition, resurgent capital inflows into emerging markets are adding to overheating pressures via rapid credit growth and rising asset prices. If policy makers fall behind the curve in responding to nascent overheating pressures and asset price bubbles, macroeconomic policies in key emerging economies could be setting the stage for boom-bust dynamics in real estate and credit markets and, eventually, a hard landing in these economies. With emerging markets now accounting for almost 40 percent of global consumption and more than two-thirds of global growth, a slowdown in these economies would deal a serious blow to the global recovery.

What are the implications for Asia? Asian economies grew vigorously in 2010—leading the global recovery with growth at about 8 percent—but the expansion will moderate and assume a more normal pace of 6¾ percent in 2011. This moderation mainly reflects the challenging outlook for exports. After staging a remarkable turnaround in 2010, propelled by inventory dynamics and the restoration of trade links disrupted by the global recession, exports will face stronger headwinds in 2011 as growth of final demand in advanced economies remains subdued. While China is likely to become a more important engine for external demand growth for Asian economies, it is still a small market in comparison with large advanced economies, especially for consumer goods. Having said that, with Chinese domestic demand heavily biased toward the more commodities-intensive investment sectors, including infrastructure, exporters of capital goods, as well as commodities, such as Korea, Japan, Malaysia and Indonesia are set to benefit more from domestic demand growth in China.

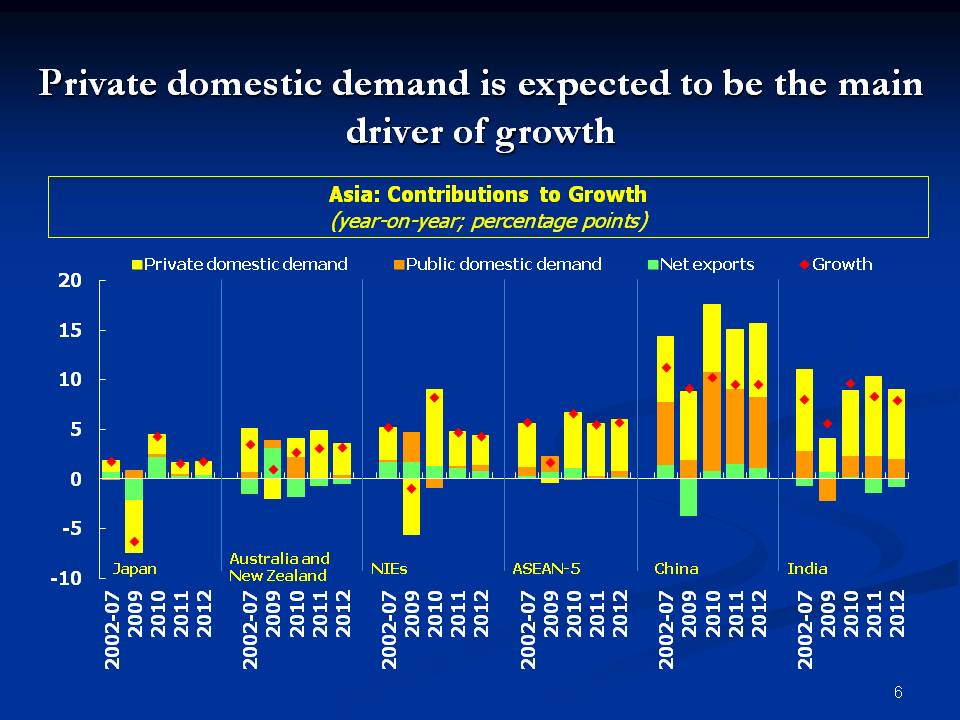

Domestic demand in Asian economies should maintain a robust pace of expansion. Strong labor market conditions and consumer confidence point to healthy private consumption growth across the region, even in the absence of further policy stimulus. In some cases, private consumption will be further boosted by resilient remittance flows, and, in a number of countries with an important agricultural sector by a steady rise in rural incomes. Moreover, with manufacturing capacity utilization increasing sharply and, in some cases already close to full capacity, private investment should also maintain healthy growth. As bank credit growth has turned the corner and lending spreads are easing, domestic financial conditions should also remain favorable for further investment. Having said that, the moderation of export growth and uncertainty surrounding the global recovery might induce some moderation of investment. However, there are structural or medium-term impediments to private investment growth which I will address later.

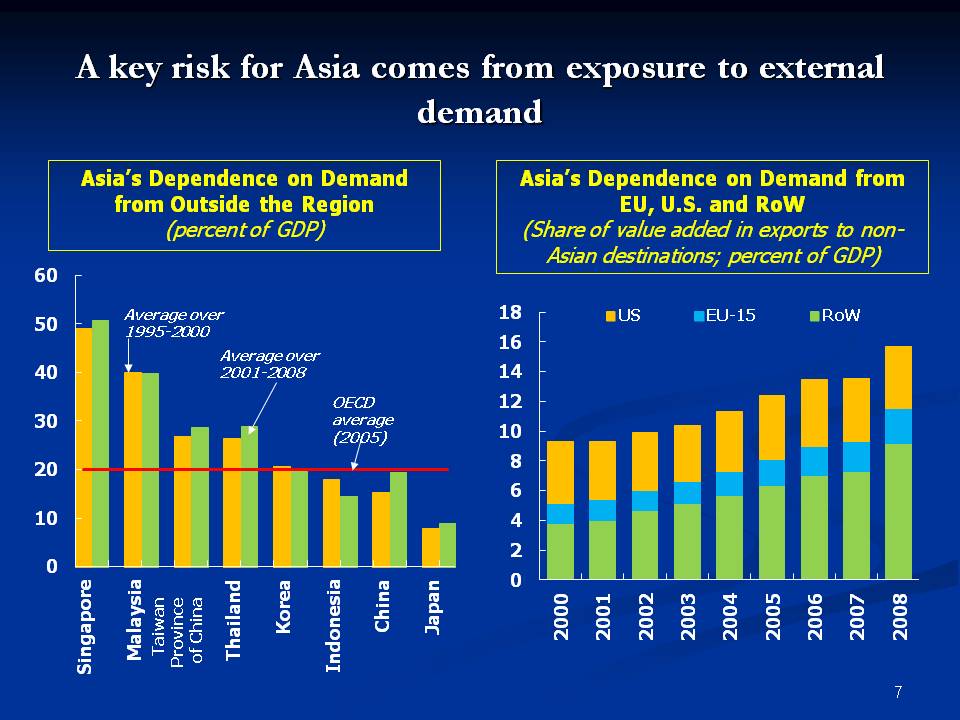

The main risks to this outlook pertain to the global recovery. While economic fundamentals in the region are generally strong, important trade and financial linkages with the rest of the world would make Asian economies exposed to the downside risk of an advanced economy slowdown I described before. For example, final demand from the United States and the euro area accounts for an estimated 15 to 25 percent of value added produced in the smaller and more open ASEAN economies. Therefore, a one percentage point decline in U.S. and euro area domestic demand could subtract about 1/3 percentage points on average from GDP growth across the region.

On the other hand, financial spillover risks appear generally more manageable for Asian economies. First, overseas exposures by banks, including to the most vulnerable advanced economies in the euro area are small; second, there are strong shock absorbers, such as gross official reserves that provide significant insurance in the event of foreign funding freezes; and third, levels of government debt compared with other regions are low. Indeed, Asian sovereign CDS spreads have remained broadly stable during the last two episodes of euro area debt jitters. Having said that, an escalation of debt sustainability concerns in advanced economies and a jump in global risk premia would also raise financing costs across Asian economies, in particular, in those economies with relatively high public and/or external debt.

Within Asia, there will be a need to monitor developments in China given the sizable spillover effects that economic developments there can have on the region. Risks of a sharper-than-expected slowdown in China would increase if the deterioration in local public finances and banking sector asset quality from credit misallocation during the domestic stimulus program in 2009 turned out to be greater than envisaged.

Key Economic Policy Challenges

Rebalancing Growth

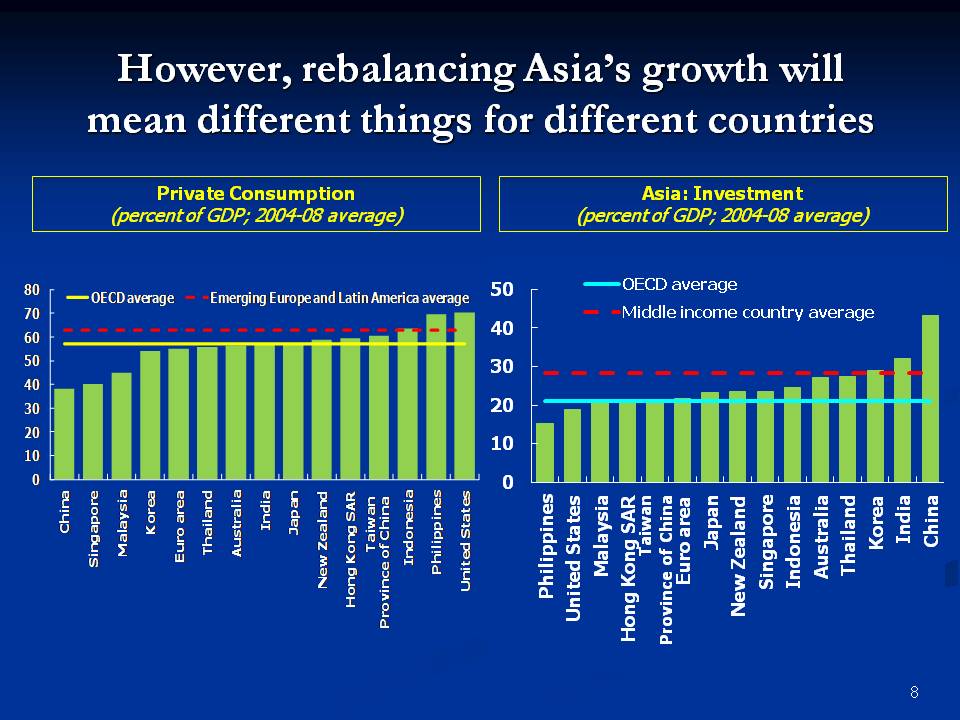

With this, let me now turn to some key policy challenges facing the region. As I have already mentioned, a key risk for Asia comes from its high exposure to external demand. A major challenge for sustaining the recovery and strengthening resilience to economic shocks is thus to rebalance Asia’s growth. However, it is important to know that such a rebalancing, or the strengthening of domestic sources of growth, will mean different things for different countries in the region. The first point to make is that consumption is not generally weak in Asia, contrary to perceptions of an Asian savings glut.

However, China is a notable exception with a low or declining share of consumption in GDP and research in the IMF and elsewhere suggests a number of important reasons for this. First, the share of household income in GDP is falling. This reflects the fact that as China industrializes, the share of household income in total income tends to decline. Second, the household saving rate has risen reflecting a need for precautionary savings to offset a lack of social safety nets.

Asia’s high current account surplus may also be the result of an investment slump. However, investment-to-GDP ratios across the region are not generally low, suggesting again some caution against generalization. In our analysis, two important factors are holding back investment in a number of Asian economies: the first relates to financing constraints, and the second relates to shortfalls in infrastructure, suppressing the return on private investment. Let me explain in somewhat greater detail.

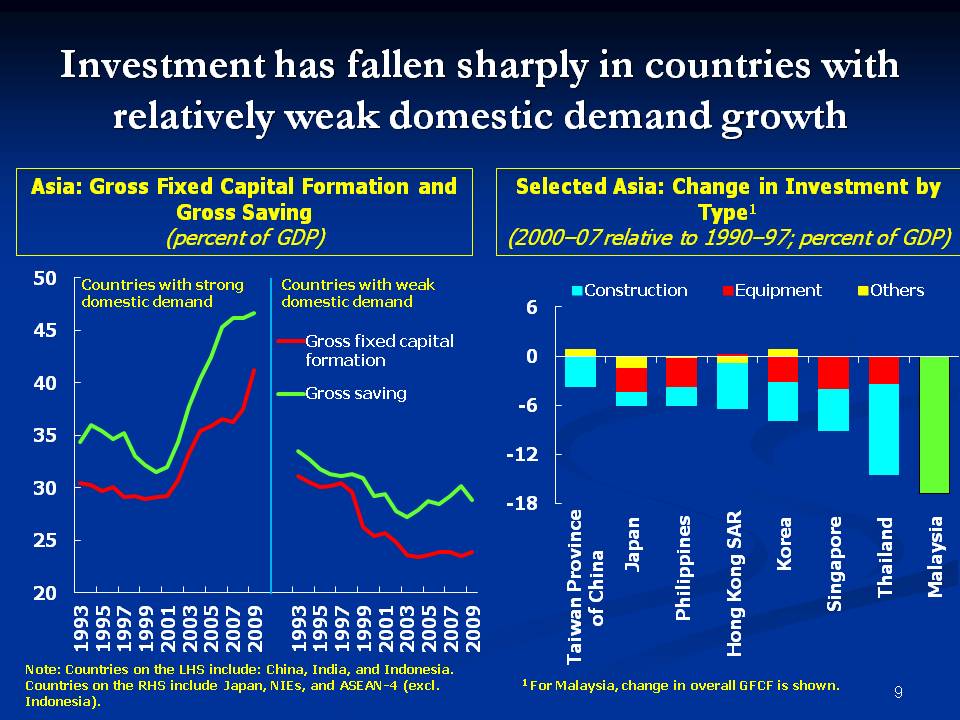

First, at the aggregate level, investment spending has diverged across two groups of Asian economies. In economies that have large bases of domestic demand, such as India and China, the investment share of GDP dipped slightly after the Asian crisis, but has risen nearly continuously since 2000. In a second group that has a weaker domestic demand base, such as Korea, Taiwan Province of China, Hong Kong and Singapore, and leading ASEAN economies, the investment share of GDP fell steadily after the Asian crisis. Along with relatively stable savings in this group of economies, the decline in the investment share has contributed to Asia’s widening current account surpluses in the recent decade. Looking more closely at this group of economies, the decline in investment has been mainly due to the fall in the private investment share. One view of this decline in private investment is that it reflects a fall in construction investment following the Asian crisis. Some have argued that this is appropriate and warranted, given the excesses in construction prior to the Asian crisis. But the chart on the right shows that the decline was broad-based, going beyond construction.

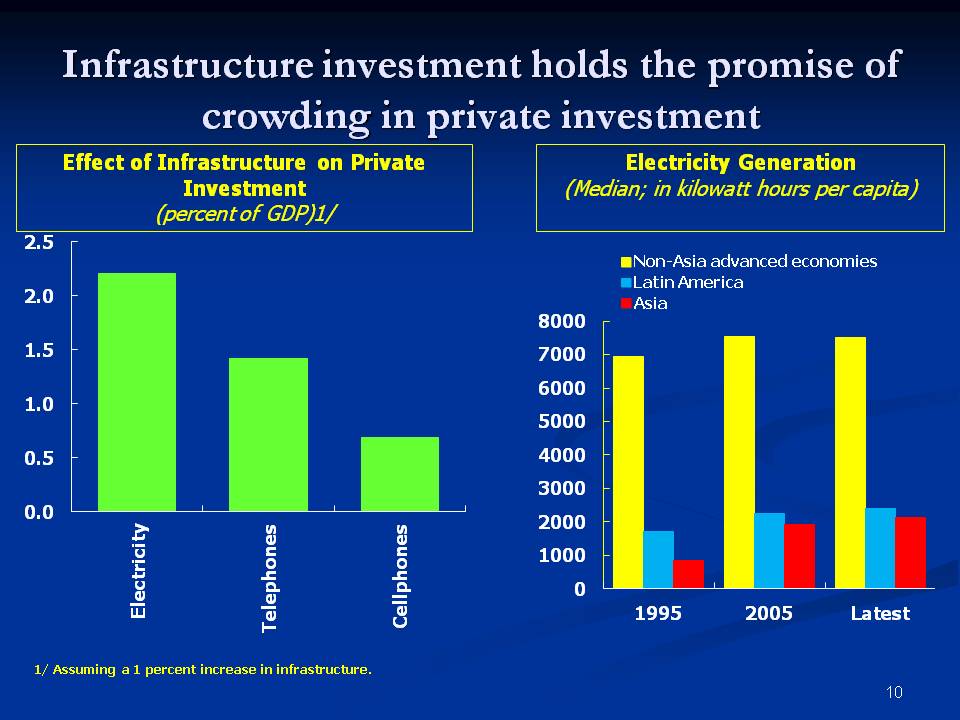

What explains this decline in private investment? We find that low and declining returns to investment have played an important role in holding down investment. In some parts of Asia, the effect of greater infrastructure investment on the returns of private investment can be large. This is because of strong complementarities between infrastructure and private investment spending. For example, infrastructure can boost connectivity, thus lowering transportation and energy costs, allow for better ease of matching of resources to firms and result altogether in productivity gains. At the same time, compared with other world regions, the provision of basic infrastructure in particular in emerging Asia still lags. To give just one example, electricity generating capacity in per capita terms is still below levels attained in Latin America.

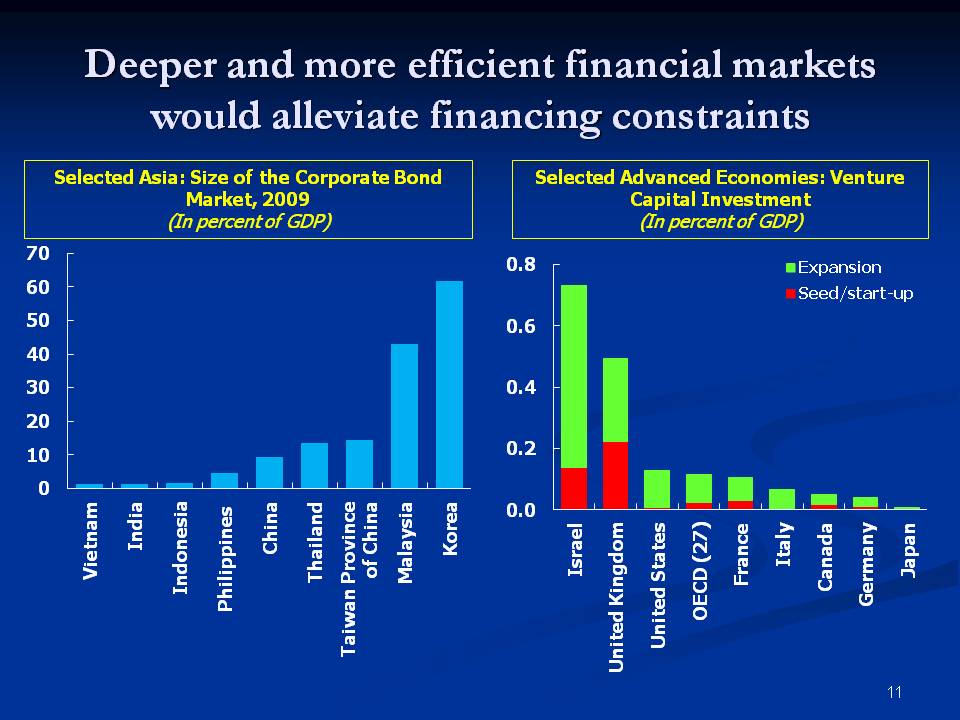

Apart from infrastructure bottlenecks, we find that financing constraints also affect investment, in particular by smaller firms, or those operating in the domestic oriented services sector. Despite financial reforms in the aftermath of the Asian crisis, there is ample room for deepening financial markets in the region. In some parts, as the chart on the left shows, the corporate bond market is small, denying Asia a useful “spare tire” of corporate finance when banks become reluctant to lend. Encouraging corporate bond market development would help open up additional channels of funding. Even in the advanced parts of the region there is still room for financial market development. For example, venture capital, which can play a catalytic role for start-up firms in new growth areas, still only plays a minor role compared to other advanced economies.

Capital inflows

I would now like to turn to the second major policy challenge, which is the one arising from large capital inflows. After a sharp, but short-lived contraction in late 2008 to early 2009, capital flows to emerging Asia have surged and in some cases, including Indonesia among the ASEAN economies, even surpassed the high levels before the crisis. Euro area debt jitters appear to have brought only a temporary halt to such flows, although volatility, in particular of portfolio flows, remained elevated. At the same time, the composition of flows appears to be shifting in favor of debt flows, especially where local bond markets are relatively sizable, such as in Indonesia and Malaysia. Foreign investors’ interest in regional debt, including both corporate and sovereign bonds, has remained robust against a backdrop of positive interest rate differentials, expectations of exchange rate appreciation, and the relatively sound fiscal positions of Asian governments compared with several other regions.

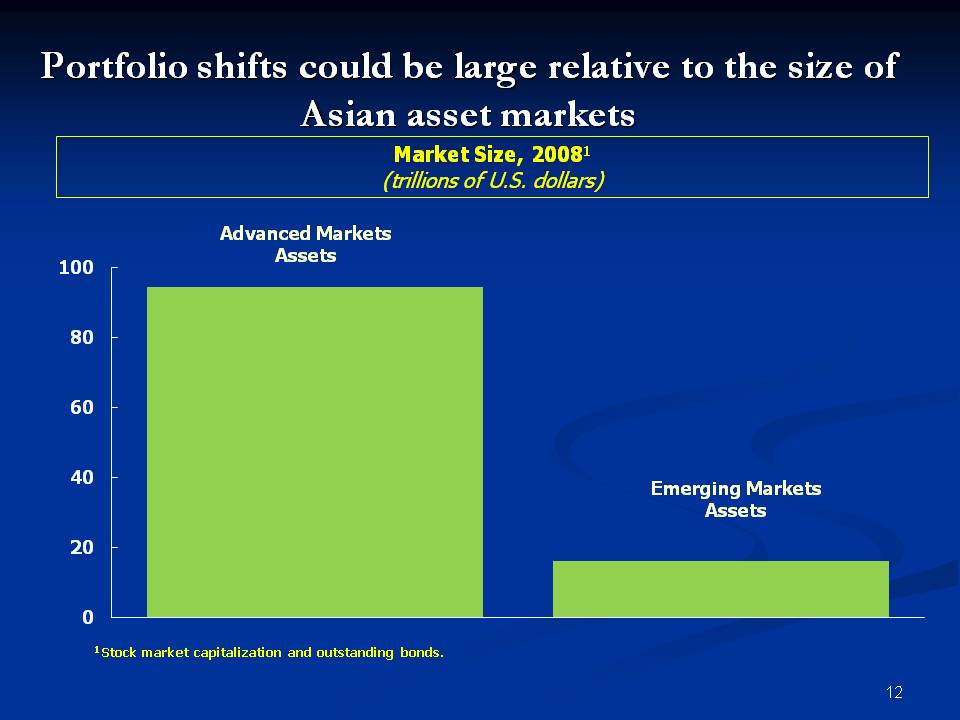

A more favorable outlook for growth relative to advanced economies will likely lead to a prolonged period of capital flows to the region. In addition to cyclical interest rate differentials, structural factors, including the higher longer-term growth factors and stronger policy fundamentals and ongoing capital market deepening, will lead fund managers to increase their Asian emerging market allocations. As this portfolio shift could take years to play out, given investment mandates only change gradually, and the size of emerging asset markets is still small in relation to advanced markets, the effects on markets and economies in the region could be both persistent and significant.

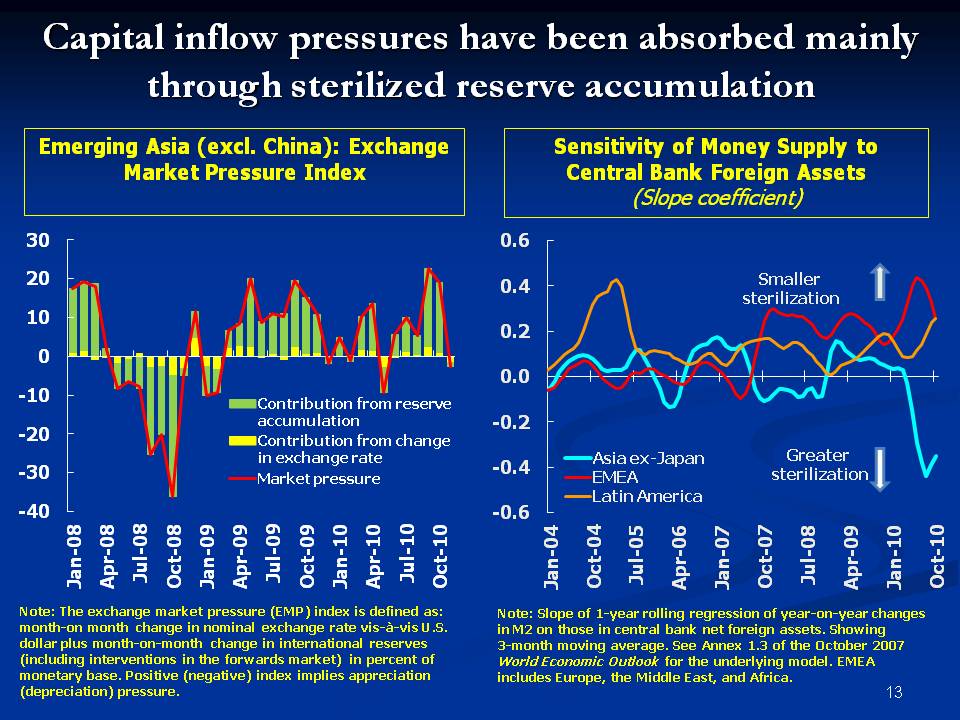

So far, most countries have relied on a combination of currency appreciation and reserve accumulation to accommodate resurgent capital inflows. Evidence suggests that reserve accumulation has absorbed a large fraction of the pressures from a return of capital flows, but this masks significant variation of the response between countries. On the one hand, India has abstained from intervention since end-2009, allowing the exchange rate to take the brunt of the adjustment; on the other hand, intervention was rapid in countries such as Indonesia and Thailand, where reserves are 30 and 40 percent above their pre-crisis levels, respectively. However, compared with other regions, Asian policymakers have been particularly effective at controlling money growth in response to reserve accumulation, as evidenced by the relatively low sensitivity of money supply growth to the build-up in central bank foreign assets.

Going forward, greater exchange rate flexibility can offer an important buffer against the risk that large capital inflows undermine efforts to tighten the monetary stance. With global interest rates likely to remain low, countries with tightly managed exchange rates in effect import easy global monetary conditions, unless they tighten capital controls. Experience shows that domestic demand overheating in response to surges in capital inflows is less likely in economies that have more flexible exchange rates. Moreover, greater exchange rate flexibility could reduce expectations of large abrupt appreciations and thus dampen pressure on inflows.

Greater exchange rate flexibility would also lessen the need for intervention and the resulting risk of excess liquidity and credit booms. While sterilization policies in the region appear to have worked so far, as I mentioned, the question going forward is whether the structure of central banks’ balance sheets and the limited size and depth of domestic fixed income markets can support a significant further expansion in sterilization operations. This may require introducing new instruments, such as allowing central banks to issue their own paper where this is currently not possible.

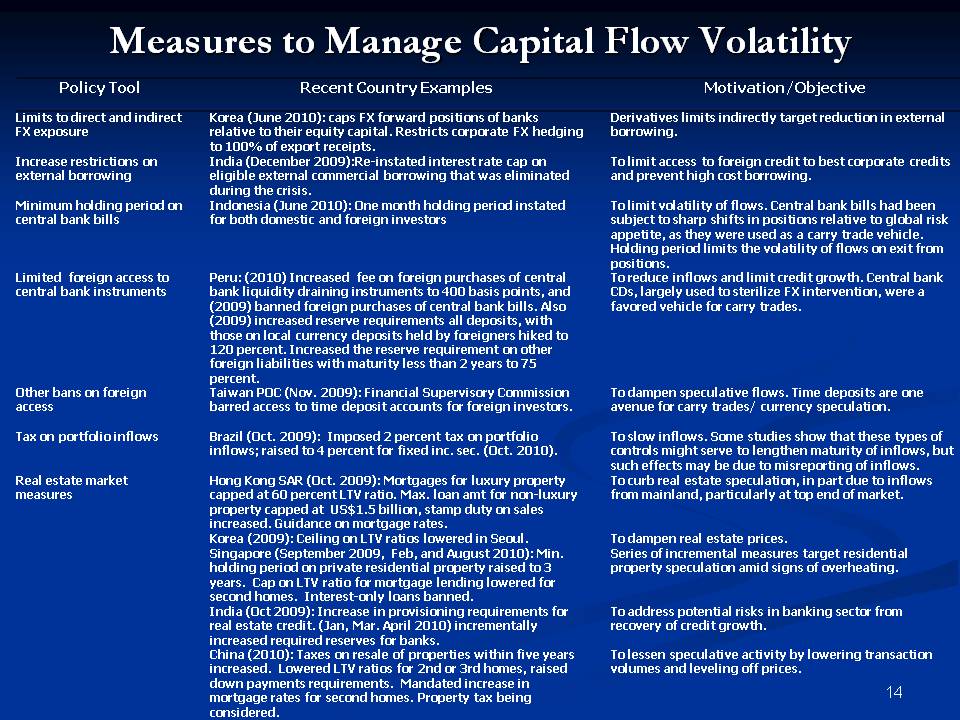

Extending the toolkit to macro-prudential measures can also help mitigate the consequences of sizable and potentially volatile capital flows. Indeed, several Asian economies have already implemented measures to safeguard financial and macroeconomic stability. These measures have mainly related to banking sector leverage, short-term foreign capital inflows, property price inflation, and foreign currency exposures. Sometimes, measures have been more successful in altering the nature of inflows rather than their size.

Market perceptions on macro-prudential measures taken so far may offer valuable lessons. The recent measures by Indonesia and Korea have had a relatively mild market response in part because they were narrowly targeted or phased in gradually. In addition, the more elaborate communication, clearly spelling out the objectives and motivation of the measures helped limit fears of wider limits on capital flows. However, there are lingering concerns about wider macro-prudential measures that may follow if the current initiatives fall short of their goals. Policy makers will need to continue to communicate clearly with markets and carefully explain the rationale for targeted macro-prudential initiatives.

From a longer-term perspective, the key policy question of how to improve local market absorption to deal with persistent capital inflows still remains to be addressed. In this context, we should consider that large capital inflows into Asia are not only a challenge, but also present opportunities to facilitate medium-term rebalancing. The question is how capital inflows can be appropriately channeled toward financing broader-based growth. Better allocation of capital (both domestic and foreign) and harnessing more long-term, stable capital inflows, will essentially require two things. It means making long-term investment into Asia more attractive, for example, by lowering restrictions on foreign investment in the services sector as recently done in Malaysia, or by promoting private-public partnerships for much needed infrastructure investment. It will also require promoting financial market development and access to finance, including for smaller and more service-oriented firms which remain credit-constrained.

Cambodia Perspective

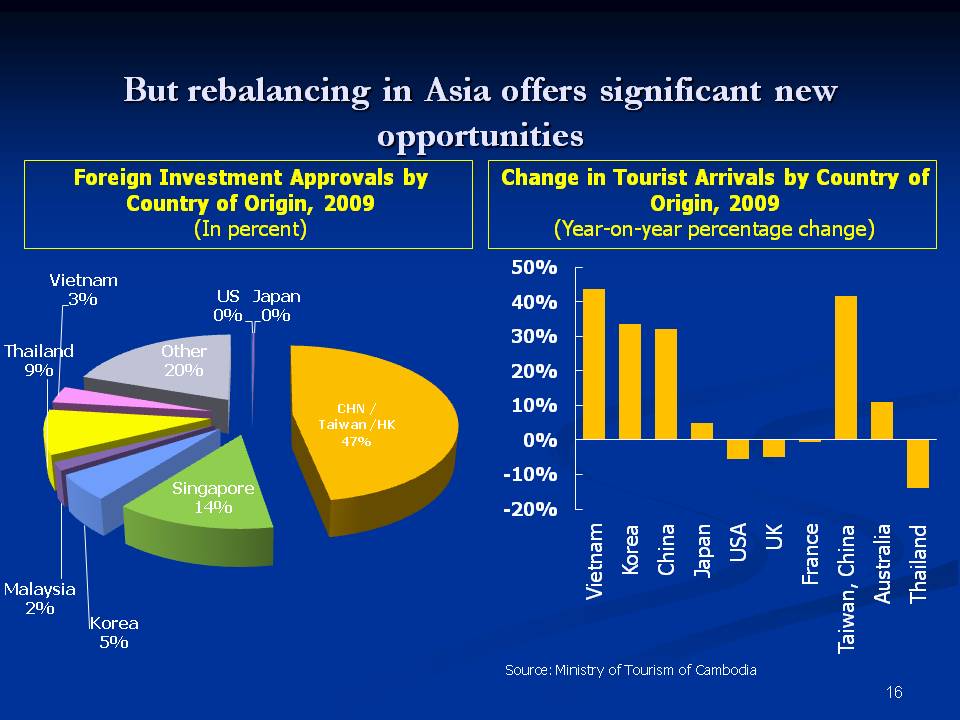

Finally, I would like to share a few thoughts on the opportunities and challenges arising for Cambodia from these global and regional economic developments. The global recovery has helped re-start two of the three main engines for Cambodia’s growth in recent years. Garment exports and tourism arrivals, notably by air, are bouncing back, with both growing at about 10 and 20 percent, respectively in 2010. However, the third engine, construction activity, appears to remain sluggish as evidenced by subdued imports of construction related materials, and a sustained drop in real estate prices, suggesting a lingering overhang from the pre-crisis construction boom. Against this background, creating additional engines of growth going forward, for example, in agriculture and food processing, and making growth more inclusive, in particular to benefit the rural poor, are important policy priority for Cambodia.

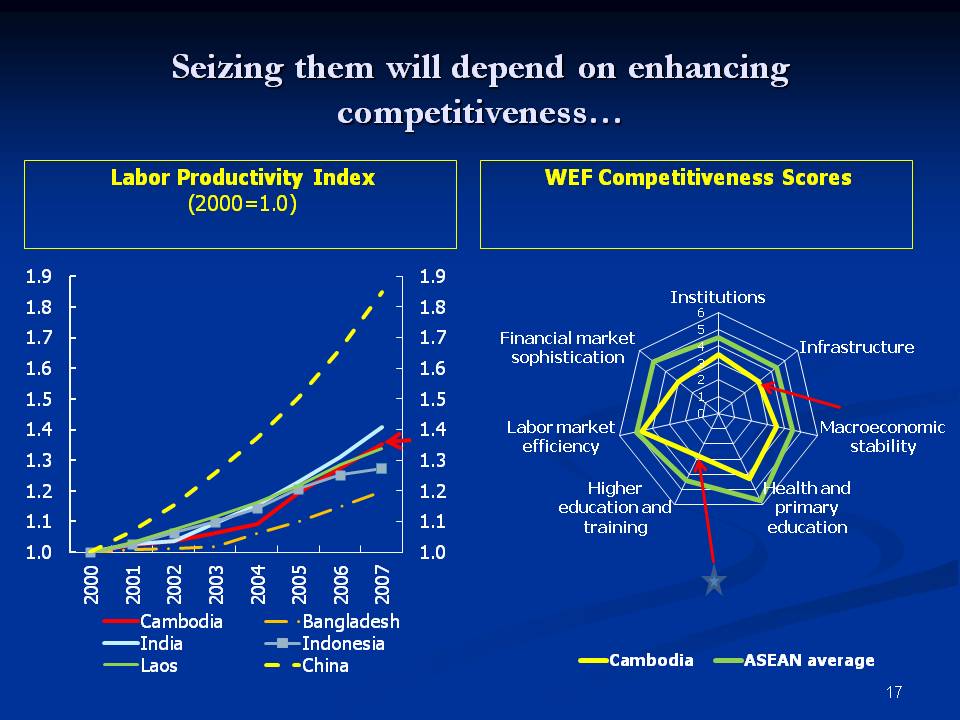

Global rebalancing and greater reliance in Asia on domestic sources of growth offer significant opportunities for economic diversification that Cambodia should seize. With a rapidly growing middle class in emerging Asia, Cambodia is close to the world’s fastest growing markets. Continued healthy growth rates of tourist arrivals from the region during the global recession underscore Cambodia’s growth potential from exports to new markets. Moreover, emerging Asia’s demand for agricultural products and raw materials is set to grow rapidly. With the investor base in Cambodia’s textile industry already mostly from neighboring countries, Cambodia could also become a primary beneficiary of Chinese outsourcing in the face of growing wages in the region.

Against this background, the government’s recent initiatives to improve the business environment and address infrastructure bottlenecks are timely. For example, the anti-corruption law could significantly enhance the prospects for more effective tax collection, thereby expanding the fiscal envelope for critical public investment to meet Cambodia’s development needs in infrastructure, education, and health, which would also enhance international competitiveness. Renewed emphasis on agricultural development and rural infrastructure investment, including by the recently adopted Rice Policy, will broaden Cambodia’s sources of growth and make future development more inclusive and thus sustainable by directly addressing the still large divide between rural and urban areas. I visited an irrigation project in Kampong Cham province that has been financed from resources released by the IMF’s Multilateral Debt Relief Initiative (MDRI) which has clearly had a major impact in improving the lives of villagers.

The IMF actively supports Cambodia’s efforts to strengthen macroeconomic and financial sector policies in support of broad-based and inclusive growth. In particular, Cambodia is one of the major recipients in Asia of technical assistance from the IMF. Through our experts and resident advisors, we support efforts at strengthening financial system surveillance and supervision, moving ahead with Cambodia’s ambitious public financial management reform, as well as enhancing the efficiency of tax policies and administration. We also seek to maintain an ongoing dialogue on current macroeconomic policies and challenges through our resident representative office in Phnom Penh and regular visits by our economics team based in Washington.

Conclusion

Summing up, let me say that Asian economies are set to continue their robust growth and lead the global economy. But as the multi-speed recovery proceeds, the policy challenges that have emerged since the crisis are becoming more pressing. Rebalancing Asia’s growth will mean different things for different economies. For some, including China, the focus of policies will need to be on boosting domestic consumption, for others it will mean finding ways to promote private investment. In this regard, mitigating infrastructure bottlenecks and improving access to finance can play an important role. At the same time, capital inflows will need to be managed carefully, both in the short term, but also over the medium term with a view to facilitate economic rebalancing. For Cambodia, the changing global economic landscape offers significant opportunities for broader-based and more inclusive growth. As a committed development partner, the IMF looks forward to discussing ways to reap these opportunities.

Thank you!

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6220 | Phone: | 202-623-7100 | |