Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Preparing for Jump in Age-Related Spending

December 27, 2007

- Rising longevity, retiring baby boomers will boost G-7 fiscal spending

- Higher spending on elderly will require improved fiscal balances

- Advanced countries should adjust fiscal balances sooner rather than later

Governments in advanced economies will have to step up their spending on the elderly in coming decades and should prepare by strengthening their fiscal positions in the near term.

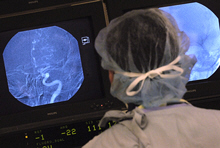

Neuroradiology in Ontario, Canada, where bulk of age-related spending increase is expected to be extra health care costs (photo: Zuma Press)

FISCAL POLICY

The combination of increased longevity, falling fertility rates, and the retirement of the baby boom generation will mean that, by 2050, populations in most Group of Seven (G-7) countries will be smaller and considerably older, with ratios of elderly people to the working-age population (the old-age dependency ratio) projected to double. These trends will put great added pressure on national fiscal balances.

Key points

The issue: How much of a toll will increasing longevity, falling fertility, and the retirement of baby boomers have on G-7 countries' fiscal accounts in coming years and how much fiscal discipline will be needed to prepare?

The evidence: These countries are expected to see age-related spending rising by an average of 4 percentage points of GDP over the next 45 years. To prepare for these spending needs, G-7 governments will have to improve their primary fiscal balances by 4-4½ percentage points of GDP relative to their 2005 positions to ensure long-run fiscal sustainability.

Policy considerations: To prepare for the projected large rise in age-related spending, the G-7 countries will need to strengthen their fiscal positions, mainly through fiscal consolidation. Early adjustment will be less costly for long-run growth than delayed adjustment.

General government, age-related spending in these countries is expected to climb by an average of 4 percentage points of GDP over the next 45 years, although with substantial variation across countries.

Life expectancy

United Nations projections show that the old-age population in the G-7 countries will increase by an average of 80 percent between 2005 and 2050. According to Eurostat projections, life expectancy in the European Union countries will rise by about six years over the next five decades. Given the age structure of European populations, the old-age dependency ratio is expected to double to about 50 percent from 25 percent, owing to a small decline in the working-age population and a sharp rise in the elderly population.

Such developments imply a steep increase in age-related government spending in G-7 countries—by an average of 4 percentage points of GDP over the next 45 years. Estimates vary substantially across countries, with Canada at the high end (with growth estimated at 9 percentage points of GDP), and Italy and Japan at the low end (with growth rising by about 2 percentage points). The bulk of the spending increase is expected to cover additional health care costs, with long-term care and pension spending accounting for the rest.

Assessing the impact of these demographic changes on the sustainability of public finances is complicated by uncertainties about long-term technological, demographic, labor supply, and productivity growth forecasts—especially the strength of the link between aging and health care costs. Also, a comparison of age-related spending across countries is complicated by differences in methodology across age-related spending projections.

Nonetheless, the relationship between projected old-age population growth rates and age-related spending is fairly close. Still, the uncertainty surrounding long-term spending projections suggests that fiscal policy should recognize the upside risks to the projections and give more attention to "worse case" scenarios.

Fiscal adjustment

We used two measures to assess the evolution of fiscal sustainability for each of the G-7 countries and evaluated the impact of policy. (For detail on the methodology and robustness testing, see the Working Paper).

Under either measure, the estimated fiscal adjustment needed to ensure long-run fiscal sustainability (i.e. stabilizing fiscal debt at a permanently sustainable level) is large for all G-7 countries—requiring an average improvement of 4-4½ percentage points of GDP in the primary fiscal balance (i.e., revenues less non-interest spending) relative to 2005 positions.

Nearly two thirds of the fiscal adjustment reflects the expected rise in age-related spending, while the remaining one third owes to the interest on public debt. The largest primary gaps are shown for Japan, which had the largest primary deficit and a high debt level in 2005, and the United States, owing to a combination of a high primary deficit and large projected increases in age-related spending. The smallest primary gap was shown for Canada, whose primary surplus of 5.5 percent of GDP helps offset the projected impact of the very large expected gain in age-related spending.

Recent improvement

The trends during the years leading up to 2005 had been disturbing. Indeed, fiscal positions of all G-7 countries but Japan worsened during 2001-05—by some 2.7 percentage points of GDP. Even in Japan, whose fiscal sustainability improved over the five-year period, the end-2005 fiscal position was unsustainable.

The main cause of the deterioration in fiscal sustainability in the G-7 countries was a worsening primary fiscal balance--which deteriorated by 2.8 percentage points of GDP. The countries showing the sharpest deterioration were the United Kingdom and the United States, whose fiscal balances worsened by 5½ percentage points of GDP.

The public debt component also contributed to widening the primary gaps during 2001-05, but by far less than the fiscal balance. Since 2005, however, fiscal positions have improved substantially, although uncertainties surrounding structural fiscal balances imply that it remains to be seen to what extent this improvement can be sustained.

Most G-7 countries have recently adopted substantial reforms to contain the growth of age-related public spending, making more progress on pensions than on health care. Over the past five years, for example, France, Germany, Italy, and Japan have passed pension reforms that should bring about sizable savings. But additional structural reforms or fiscal consolidation in other areas will be needed. New reforms are also planned, notably health care reforms in Germany and Japan.

Delaying fiscal adjustment is costly

The sooner G-7 countries begin to adjust their fiscal positions the better, both for their own fiscal sustainability and for long-run growth. We consider two scenarios:

Immediate adjustment. If the G-7 countries adjust their fiscal policy within the next five years, the cost to economic activity will be substantially less and the country will experience gains in long-run output--with the economy growing faster by an average of 0.3 percentage points a year over the next 10 years.

Delayed adjustment. If these countries delay adjustment for 10 years, their public debt levels will increase substantially. The exception is Canada, whose large initial primary surplus permits a steady reduction in debt even if it delays fiscal consolidation. Moreover, delaying adjustment and allowing public debt to increase also implies the need to run permanently larger primary surpluses to service the higher interest costs on the debt. On average, the primary balance required to stabilize public debt on a sustainable basis is 1.1 percentage points of GDP higher in the long run than in the immediate adjustment scenario. Finally, delayed adjustment entails lower economic growth over the next 10 years, owing to increasing crowding out effects and a large rise in payroll taxes.

Over the long run, the faster growth in the early adjustment scenario implies a GDP level about 2 percent higher than in the delayed adjustment scenario. The long-run output gain is attributable to higher labor supply owing to lower payroll taxes and to higher investment as a result of lower debt and smaller crowding out effects.

In sum, early fiscal adjustment can be expected to deliver a permanent economic output gain averaging about 2 percent of GDP. Postponing adjustment increases the size of the fiscal adjustment ultimately required to restore sustainability. Given the upside risk to fiscal spending pressures, early fiscal adjustment would also allow greater fiscal scope to absorb any higher-than-expected age-related spending needs.