Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Designing Flexible Fiscal Regimes to Protect Revenues

November 24, 2015

- Lower resource revenues are a concern in Andean countries

- Sound fiscal regimes can help reduce the impact of revenue losses

- Improved regional coordination and collaboration needed

Protecting the tax base of extractive industries, moving toward more responsive and flexible fiscal regimes, and improving international cooperation have become priorities in the Andean region, as commodity prices and revenues from extractive industries continue to decline, participants at a recent IMF conference heard.

Oil worker in Barrancabermeja, Colombia: Moving toward more flexible fiscal regimes will help protect the tax base in the Andean region (photo: Bloomberg GDA Photo Service/Newscom)

Natural Resource Taxation

The three-day conference, Determining the Tax Base for Extractive Industries in the Andean Region called for flexible tax regimes that are robust in the face of changing circumstances, while protecting revenues from aggressive tax planning. In that context, participants recognized the importance and relevance of IMF technical assistance in fiscal regime design and evaluation for extractive industries and, in particular, its role in promoting a regional dialogue on these issues.

The conference, which took place September 29–October 1 in Bogotá, Colombia, was hosted by the IMF’s Fiscal Affairs Department and the Ministry of Finance of Colombia, and sponsored by the IMF’s Managing Natural Resource Wealth Topical Trust Fund. The event brought together more than 60 senior government officials from resource-rich countries in the region, international experts, private sector representatives, and IMF staff.

Changing global environment

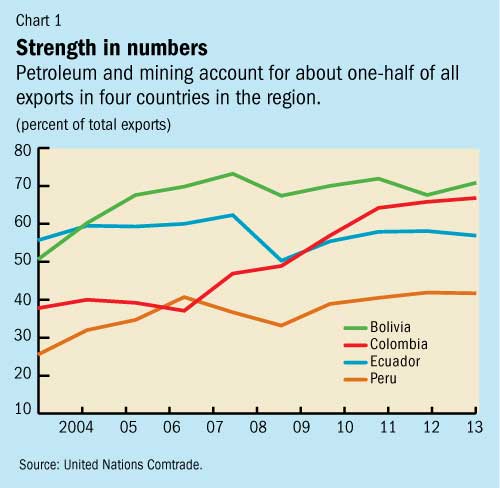

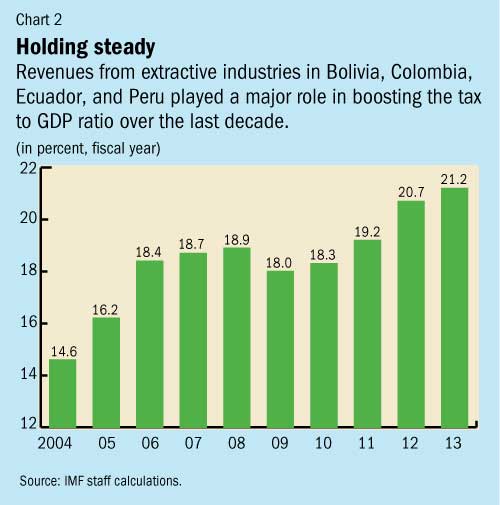

The discussion took place at a time when the global economic outlook was affected by major economic transitions, including the prospect of rising U.S. interest rates, the slowdown in China, and the rapid drop in commodity prices. Extractive industries have played a strategic role in the region in recent years. On average, the sector represented about 50 percent of total exports in Bolivia, Colombia, Ecuador, and Peru between 2004 and 2013 (see Chart 1). Moreover, revenues have contributed to the increase in the average tax to GDP ratio in these countries from 14.6 percent to 21.2 percent in the same period (see Chart 2).

The persistent decline of commodity prices, which started in 2011 for metals and more recently in the second half of 2014 for oil, has further deteriorated the region’s terms of trade, as reflected in widening current account deficits, exchange rate depreciation, and weakening investment. Weaker commodity prices for the foreseeable future will continue to hurt Andean net commodity exporters—lowering national incomes, reducing investment, and worsening fiscal balances.

Flexible and responsive fiscal regimes

While experts indicated that Andean countries have provided a relevant response during the downturn, participants highlighted the difficulties in doing so with inflexible fiscal regimes. Both Ministers from Colombia—Mauricio Cardenas (Finance) and Tomas Gonzalez (Mines and Energy)—agreed on the importance of having a fiscal regime that strikes a balance between promoting a healthy business environment and protecting government revenues.

Government officials acknowledged the benefits of more responsive and flexible fiscal regimes for extractive industries, but they also recognized the need for greater simplicity and transparency—a long held demand from investors, tax administrators, and civil society.

In the current commodity price environment, investments in exploration and development— which require large upfront capital outlays—are the first to suffer, compromising future activity and tax revenues. It is important therefore that the tax regime does not worsen the investment climate, but at the same time allows countries to increase revenues when prices recover and projects become more profitable. In sum, an efficient and flexible fiscal regime—including clear rules, well-defined responsibilities, adequate institutional capacity, and transparency of the resource revenue management process—is vital for the sector.

International taxation issues

Panelists devoted much attention to international taxation issues, including transfer pricing challenges, indirect transfer of interests, alternative financing arrangements, and specific issues in estimating net-back prices (the actual prices used for tax purposes), among other problems that define the extractive industries tax base.

They agreed that, while ongoing multilateral efforts to prevent base erosion and profit shifting by multinational enterprises is encouraging, it is important to look at problems faced by developing countries more closely. Government representatives described a number of examples of aggressive tax planning in the extractive industries, which have no clear antidote in current or proposed international guidelines. Countries have found their own ways to deal with these issues and the exchange of experiences was quite enriching for all participants.

Participants discussed the tax implications of alternative international financing schemes, such as streaming and overriding royalties, which appear immune to rules that limit the tax deductibility of interest when the debt-to-equity ratio exceeds a certain threshold. They also underlined the difficulty in dealing with derivatives and back-to-back operations, as indicated by case studies presented by officials from Mexico and Chile. Trinidad and Tobago illustrated the difficulties in identifying the first arm’s length sale for natural gas, while Colombia highlighted the challenges posed by mineral transactions channeled through tax havens. Ecuador, Peru, and Bolivia added their own perspective to the discussion, explaining how they reformed their regulatory and administrative environment in order to grapple with these challenges. The common denominator, however, was that there is a lot to be done still.

Regional collaboration

The conference was also an opportunity for participants to share experiences and discuss common challenges. Participants called for continued dialogue on how to better design flexible and progressive regimes, a national and regional approach to international tax challenges for extractive industries, and further collaboration among countries and international organizations in the design of tax regimes.

More than 60 senior government officials, international experts, private sector representatives, and IMF staff took part in the Bogotá conference.