Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Strong Recovery in Jamaica but Bold Reforms Still Needed

June 21, 2016

- Jamaica’s reforms beginning to bear fruit but growth still too low

- Fiscal discipline crucial to restore economic stability

- Focus on growth-enhancing structural reforms

After several decades of low growth and rising public debt, Jamaica has made significant progress in restoring economic stability thanks to strong policies and program ownership.

Open-air market in Kingston, Jamaica: despite impressive progress on the reform front, growth remains weak (photo: Hans Deryk/Reuters/Newscom)

The government’s reform program—supported by a four-year IMF loan approved in 2013—has been a turning point for the Jamaican economy and a case study in ownership and collaboration. The government took on the program to break the cycle of high debt and low growth that has afflicted Jamaica for decades.

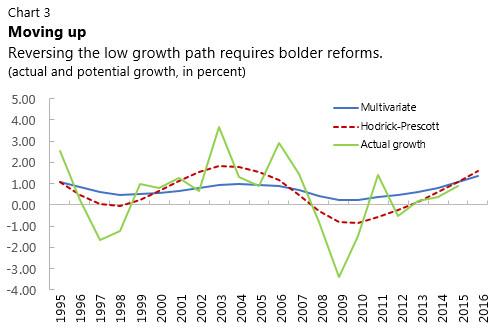

Although the economic recovery continues, growth remains weak. In its latest assessment of the Jamaican economy, the IMF projects growth at 1.7 percent in fiscal year 2016/2017. The government will therefore need to implement bold structural reforms to unleash Jamaica’s potential.

An unhappy cycle of high debt and low growth

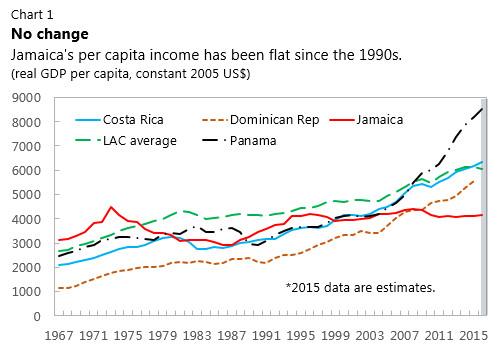

Years of high fiscal deficits, public enterprise borrowing, and financial sector bailouts led to rapid debt accumulation, crowded out private credit, and stifled growth. Low growth, in turn, further weakened the fiscal situation and raised social pressures as standards of living stagnated (see Chart 1).

Jamaica’s historical vulnerability to natural disasters reared its head when, in October 2012, Hurricane Sandy brought the economy to a screeching halt. The current account deficit soared, reserves plummeted, and public debt reached 147 percent of GDP—one of the highest levels in the world. The government’s economic reform program—bolstered by an IMF program in May 2013—focused on boosting growth and employment, improving external competitiveness, achieving fiscal and debt sustainability, strengthening the financial system, and protecting the poor by requiring a minimum level of spending on social programs.

Proving the skeptics wrong

Skeptics regarded the IMF program’s challenging targets—including a primary balance of 7.5 percent of GDP at the time, and relaxed in December 2015 to 7 percent of GDP for fiscal year 2016/17—as unattainable. Jamaica’s patchy track record of reform did not help.

But implementation has been extraordinary—over 95 percent of program conditions were met. The creation of the Economic Program Oversight Committee (EPOC)—a civil society group made up of representatives from the private sector, public sector, and civil society and a first in an IMF program—has ensured strong program ownership. The goal was to build recognition of the challenges, keep an open channel of communication with both the IMF and the government, and hold all sides accountable for achieving the program’s commitments.

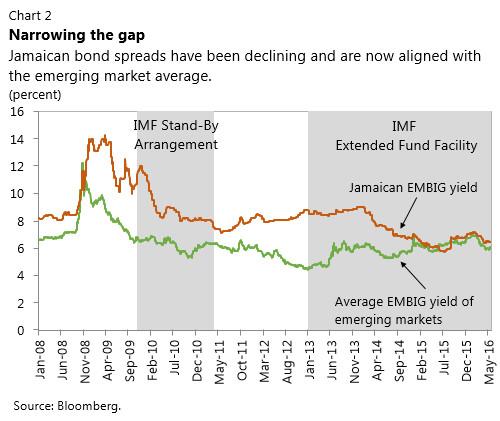

Three years into the program, the macroeconomic landscape has improved dramatically. Inflation is at a historical low and business confidence is at an all-time high. The current account has drastically improved and Jamaica has regained access to both domestic and international financial markets. Public debt dropped by over 18 percentage points of GDP, helped by strong fiscal consolidation and the PetroCaribe debt buyback. Furthermore, Jamaica’s credit ratings have moved up while its bond spreads have fallen and are now aligned with the emerging market average (see Chart 2).

In February 2016, a new government took office. With broad public support for the IMF program already ensured, there was never any question of the commitment to continuing the economic reforms. There has been close collaboration with the new government to take forward the reform effort, including on a bold and necessary package that shifts the tax burden from direct to indirect taxation.

The road to more jobs and higher living standards

Jamaica is not out of the woods yet. Despite the impressive progress on the reform front, growth remains unacceptably low and unemployment is far too high (see Chart 3).

The obstacles to Jamaica’s growth and job creation are numerous and severe. Key among them are: crime, the cost and availability of credit, tax compliance costs, unreliable and expensive electricity, and a large informal economy. The large size of the public sector has also stifled private sector dynamism and places too much emphasis on government as the engine of growth and employment.

The new government is now working closely with the IMF and other international partners to tackle key roadblocks to development and help expand the private sector. Five key reform areas top the list:

• Increasing access to finance by increasing banking sector competition and reforming financial sector taxation.

• Downsizing the public sector through improving efficiency and reallocating public functions back to the private sector.

• Cutting red tape and unnecessary “gatekeeping” at all levels of government to aid the business climate and strengthen productivity and competitiveness.

• Implementing labor market reforms that strengthen the link between pay and performance and increase labor market dynamism.

• Reducing crime and tackling both its economic and broader social ramifications.

These measures will take time to bear fruit. But they can only take place in an environment of fiscal discipline and economic stability. Despite the difficult road ahead, Jamaica can rise to the challenge and seize the moment.