Sweden--Article IV Consultation Concluding Statement of the Mission

June 7, 2010

Describes the preliminary findings of IMF staff at the conclusion of certain missions (official staff visits, in most cases to member countries). Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, and as part of other staff reviews of economic developments.

June 7, 2010

After a long boom, Sweden was amongst the first to falter in the great recession

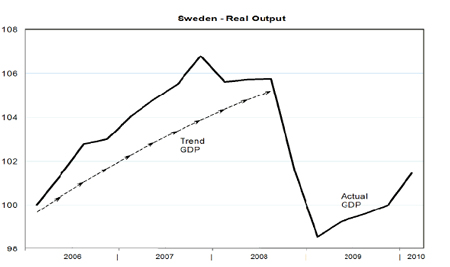

1. Output fell 5 percent in 2009. In this context, unemployment has risen to over 9 percent, corporate financial positions—notably of manufacturing exporters—have deteriorated, and output may be some 4 to 6 percent below capacity.

The downturn was resisted by aggressive stabilization policies

2. These were led by a sharp relaxation of monetary policy—which took nominal policy rates towards their effective floors. A slew of emergency financial sector support measures and steps to raise bank capital were also implemented. Alongside, a fiscal relaxation of 3 percentage points of GDP to a deficit of 0.8 percent of GDP in 2009 supported demand. And on the wages front, local “crisis agreements” and cautious and consensual settlements in the spring 2010 multi-year wage round provided strong support to employment. All these actions were accompanied by a 15 percent real effective depreciation of the krona, from levels that on some measures were already competitive, assisting exporters as well as firms competing against imports.

These policies have yielded fruit

3. As globally, earlier financial strains have eased and several emergency financial sector support measures have been or are in the process of being retired. Credit to households remained buoyant, and concerns with a deflationary spiral have been erased with core inflation and inflation expectations remaining close to the target. Moreover, personal consumption held up firmly, and firms hoarded labor to a far greater extent than in the 1990s—temporary jobs fell fast, but have already risen significantly again, while permanent jobs fell only moderately—albeit at the temporary expense of labor productivity. All this supported the budget. In this context, output began to rise from mid-2009—although it still remains well below capacity (see text chart). And the Riksbank has brought forward the time when it expects to begin raising policy rates.

Strong policy frameworks were essential to this success

4. The decisive policy actions taken were feasible and effective because they occurred against the background of Sweden’s credible inflation targeting and freely floating exchange rate frameworks. These have been supported by sustained fiscal and structural reform efforts over many years, as reflected in the consensus among the general public in favor of budget surpluses in the boom years. This commitment to a strong medium-term fiscal framework and flexible economic structures remains particularly appropriate now, given concerns with sovereign credibility and the growth outlook elsewhere in Europe.

Nevertheless, prospects for growth in 2010-11 remain uncertain

5. While the global growth outlook is better than earlier anticipated, confidence intervals around IMF global projections remain very wide. Within that, global demand for consumer durables, and investment and intermediate goods—in which Sweden specializes—is lagging the global recovery. And the recent growth momentum abroad and in Sweden is qualified somewhat because a significant part of the upturn reflects firms rebuilding stocks.

6. And market stress in Europe has prompted a “search for strong sovereigns” by markets, which is reflected in capital inflows into Sweden. While deserved—public debt is sustainably below 40 percent of GDP—this shift in market sentiment has reversed much of the earlier krona depreciation. If it continues, prospects for net exports and growth will be dented.

7. All this is appropriately reflected in the Riksbank’s assessment that while growth in Sweden is likely to continue in 2010-11, the range of possible outcomes is wide: it notes that growth in 2010 could be as high as 5 percent or as low as -1 percent.

Accordingly, the authorities’ intentions to keep policies supportive are appropriate

Fiscal policy rightly anchors this effort

8. The budget anticipates a further increase in the deficit to over 2 percent of GDP in 2010. This includes tax reductions and increased transfers to municipalities, summing to 2¼ percent of GDP. As this responds to concerns with output prospects, and, as indicated by the Swedish Fiscal Policy Council, is fully consistent with fiscal stability and the framework of fiscal rules, it is appropriate. And the budget balances risks well because the automatic stabilizers will offset the fiscal impulse if economic growth and employment turn out to be stronger than anticipated.

9. The global crisis, the associated implications for growth, and the consensus for strong budgets even during downturns all motivate the continued deepening of fiscal structural reforms to boost flexibility in the economy. The tax reductions in the 2009-10 budgets will help these efforts and could be taken further when the fiscal outlook permits, reinforcing Sweden’s broader labor market structures.

10. Alongside, various suggestions to strengthen the fiscal framework further are under consideration. As the current framework—targeting a surplus of 1 percent of GDP across the cycle, supported by medium-term expenditure ceilings—remains well suited for Sweden, the critical element in any changes will be to reinforce the central role of the Swedish Fiscal Policy Council in assessing compliance with the rules.

Alongside, the monetary stance is set to remain highly accommodative

11. The rekindling of growth optimism and some concerns with house prices has underpinned recent Riksbank announcements that the anticipated tightening cycle would be brought forward to mid-2010.

12. Nonetheless, inflationary pressures remain well contained. Given the large output gap and recent krona strength, the immediate outlook is for core inflation to continue to fall. Moreover, inflation expectations remain low, the Spring 2010 multi-year wage settlements were cautious, and prospects for European and global demand have been dented by recent market strains.

13. Accordingly, the tightening cycle should be gradual and cautious, particularly given continued uncertainty over the implications of market strains in Europe. Whether the anticipated rate rises occur as indicated or a little later, they will leave the stance of monetary policy highly accommodative, without risk to the inflation targets.

14. The decision to retire the +/-1 percent tolerance interval around the inflation target avoids raising unnecessary concern when headline inflation falls outside the range. Accountability under the adjustment is retained by the occasional publication of “Monetary Policy in Sweden” which summarizes the principles guiding policy, including when actual and projected inflation deviate from the 2 percent target.

And financial stability remains under close surveillance

15. The latest Riksbank Financial Stability Report indicates that core Tier 1 capital ratios for all large banks will remain above 8 percent even in a stress scenario. This is stronger than previous assessments, partly reflecting the improved outlook for the Baltics. Detailed assessments of vulnerabilities in the mortgage market indicate that financial firms are resilient even if the housing market turns down sharply. And the Financial Supervisory Authority’s proposal to penalize loan-to-value ratios above 85 percent will provide a welcome assurance against the possible macroeconomic consequences of any unsustainable mortgage borrowing that may be occurring.

16. Nevertheless, stress tests cannot capture all scenarios, with liquidity and institutional-spillover risks particularly difficult to anticipate. Furthermore, significant banking operations abroad—encompassing jurisdictions with varied institutional arrangements—give rise to credit and reputational risks from subsidiaries to parents, and to demand for euro and/or dollar liquidity in the event of market strains. These elements should continue to be reflected in Swedish capital and liquidity requirements in line with forthcoming global agreements on such arrangements. And cross-border resolution frameworks should be developed further, in line with EU proposals.

Ability to manage tail risks should also remain under active review

17. In particular, while direct exposures to Euro Area peripherals are minimal, third countries to which Sweden is exposed directly or indirectly could be affected. Thus, an immediate priority is to update “war games” to verify contingency plans in this context. Thus, we welcome the consideration being given to a special resolution regime for the authorities to manage troubled financial institutions, and we support additional resources for banking supervision. Such war games exercises would also provide a useful opportunity to confirm that international reserves are at appropriate levels in light of European stresses.

18. As elsewhere, the architecture of macroprudential institutions is being reconsidered. Key principles for this should be that effective communication and coordination between all authorities in pre-crisis and crisis periods should be assured, with appropriate accountability, and that the independence of monetary policymaking should remain secure.

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6220 | Phone: | 202-623-7100 | |