<img src="-/media/01C9971E62074CF18E8686195FA7A008.ashx?h=35"> UNITED STATES: Personal Transfers in the U.S. International Accounts

Introduction

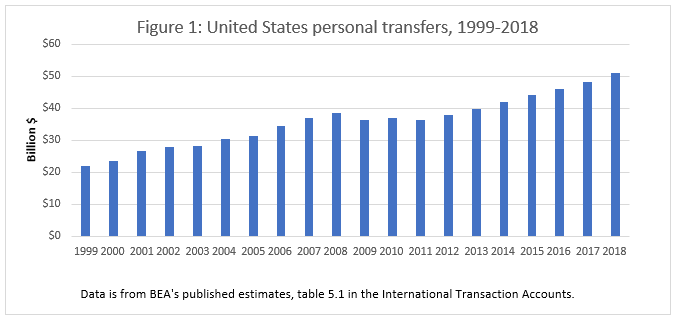

U.S. personal transfer payments—current transfers in cash or in kind sent by the foreign-born population resident in the United States to households abroad—have grown significantly over the last two decades, more than doubling from $21.9 billion in 1999 to $50.9 billion in 2018 (figure 1). [1] The U.S. Bureau of Economic Analysis (BEA) records personal transfers in the U.S. international transactions accounts. BEA’s estimates of personal transfer payments reflect transfers from the foreign-born population resident in the United States, which in some instances are sent through informal channels. A portion of this activity falls within the scope of informal activities as defined by the IMF Task Force on Informal Economy (TFIE). Because the work of the task force is focused more on practical issues related to informal transactions rather than methodological issues, TFIE uses a definition of informal economy that covers all cross-border transactions and positions that arise from informal, underground, and/or illegal activities. [2] This report seeks to identify the scope, data sources, and methodology used by BEA to compile estimates of personal transfers and to highlight estimation challenges.

Scope, Methodology, Compilation Practices, and Data Sources

The scope, methodology, compilation practices, and data sources used to estimate personal transfers are described below.

Scope

Current transfers in cash or in kind sent by the foreign-born population resident in the United States, regardless of the resident’s legal status, to households abroad through both formal and informal channels. The foreign-born population resident in the United States is that part of the total foreign-born population that has resided, or intends to reside, in the United States for one year or more. Formal channels for transfers typically are subject to more regulatory oversight and supervision than informal channels (GAO, 2016). Formal channels for transfers include banks, credit unions, and money transfer organizations (MTO) such as wire services, and postal services. Informal channels for sending transfers include hand-carried cash and courier services.

Compilation, Methodology, and Data Sources

Transfers are estimated using a model that incorporates demographic and economic characteristics of the foreign-born population, including size of the foreign-born population, the income of the foreign-born population, and the percentage of income remitted by the foreign-born population. The percentage of income remitted varies based on the demographic characteristics—including country of birth—of the foreign-born population.

The size of the foreign-born population, their demographic characteristics, and their income are based on annual source data from the U.S. Census Bureau’s American Community Survey (ACS). The percentage of income remitted for each combination of demographic characteristics is a BEA estimate based on the Census Bureau’s 2008 migration supplement to the Current Population Survey (CPS), research conducted by BEA, and academic studies. The demographic characteristics in the model include duration of stay in the United States, family type (that is, presence or absence of the spouse and the presence or absence of roommates), and country of origin—all of which have been shown to impact remitting behavior.

Current Challenges

While BEA has confidence in the reliability of its estimates, we face several challenges in estimating personal transfers given the limitations of our source data. Respondents to demographic surveys may underestimate personal transfer values due to the difficulty of recalling every transfer that they sent abroad during the previous year and a lack of trust that the survey responses will be kept confidential (Greico et. al, 2010). BEA’s methodology attempts to address this likelihood of underreporting.

There are also censoring issues within the reported survey data. The published CPS microdata censors reported personal transfers and income values to avoid disclosure of confidential responses. It also reports income within categories rather than providing exact amounts and values above an upper income limit. BEA has been exploring econometric methods to attenuate possible bias resulting from this censoring.

The use of a model to estimate remittance behavior, and the fact that model parameters are based on the 2008 migration supplement to the CPS, create additional challenges. These include small sample sizes in the regressions for smaller remittance receiving countries and the potential of not fully capturing changes in remittance behavior over time.

Relying instead on estimates compiled by banks or formal money transfer organizations (MTOs), as some other countries do, would also present challenges. Data from banks and MTOs do not capture transfers conducted through informal channels. Separate data for transfers through these channels often either does not exist or could be obtained under data sharing frameworks that currently do not exist (GMDAC, 2019). Additionally, it may not be possible to distinguish personal transfers from other transactions such as business investments, real estate transactions, and other financial transactions by private investors and diaspora members captured in bank and MTO data (GMDAC, 2019). Finally, it is often difficult to distinguish between intermediate flows between countries and flows to recipients in the country of the final recipient if the transfer passes through one or more intermediate countries (IMF, 2009; GMDAC, 2019 ).

Conclusions

Obtaining accurate and timely source data for measuring personal transfers is challenging. This is further compounded by the fact that a portion of this activity falls within informal economic activities, which is even more difficult to measure. Challenges stemming from the use of survey data include correcting for underreporting on surveys, censoring within the source data, and the use of model parameters estimated based on regressions. Alternative source data, such as estimates provided by banks and MTOs, also suffer from limitations. [3] Despite these challenges, BEA continues to explore potential new source data and methods to improve these estimates.

References

Grieco, Elizabeth, Patricia de la Cruz, Rachel Cortez, and Luke Larson. Who in the United States Sends and Receives Remittances? An Initial Analysis of the Monetary Transfer Data from the August 2008 CPS Migration Supplement. U.S. Census Bureau, Working Paper No 87. November 2010. https://www.census.gov/content/dam/Census/library/working-papers/2010/demo/POP-twps0087.pdf

International Monetary Fund (IMF). Preliminary Report of the Task Force on Informal Economy. Thirty-First Meeting of the IMF Committee on Balance of Payment Statistics, Washington D.C., October 24-26, 2018. https://www.imf.org/external/pubs/ft/bop/2018/pdf/18-10.pdf

International Monetary Fund (IMF). International Transactions and Remittances: Guide for Compilers and Users. 2009. https://www.imf.org/external/np/sta/bop/2008/rcg/pdf/guide.pdf

IOM’s Global Migration Data Analysis Center (GMDAC). Migration Data Portal: The Bigger Picture: Remittances. https://migrationdataportal.org/themes/remittances . Accessed April 16, 2019.

United States Government Accountability Office (GAO), International Remittances: Money Laundering Risks and Views on Enhanced Customer Verification and Recordkeeping Requirements . GAO-16-65. January 2016.

Figure

[1] Data on U.S. personal transfers is from the Bureau of Economic Analysis International Transactions data, Table 5.1, line 9. Personal transfers comprise a significant part of remittances by U.S. residents to foreigners. Remittances are defined in a variety of ways, some narrowly and some more broadly. The World Bank uses a broad definition of personal remittances—which includes gross compensation of employees and personal transfers—in its data on global remittances. World Bank data on global remittances can be found at https://data.worldbank.org/indicator/BM.TRF.PWKR.CD.DT .

[2] TFIE’s definition of the informal economy is broader and different in scope than most statistical definitions of the informal sector (IMF, 2018).

[3] These alternative source data may or may not exist for the United States.