<img src="-/media/862CEEC3AD19443287904517AF6CE9F8.ashx?h=35"> HUNGARY: Estimation of Smuggling Activity in the Hungarian National Accounts

Introduction

In Hungary the figures of illegal activities are calculated in the framework of National Accounts for the following three types of activities:

- drugs

- prostitution

- smuggling of tobacco

Including these transactions in the National Accounts have impact on the output, intermediate consumption, gross value added, final consumption and export and import figures.

The results of the calculations for exports and imports are transmitted to the external trade statistics and balance of payments statistics.

The following summary of the methodology of the estimation of smuggling activity is based on the ESA 2010 GNI Inventory of Hungary (2015) the reference year of the calculation is 2011 as reported in the GNI Questionnaire 2015.

Smuggling of Alcohol

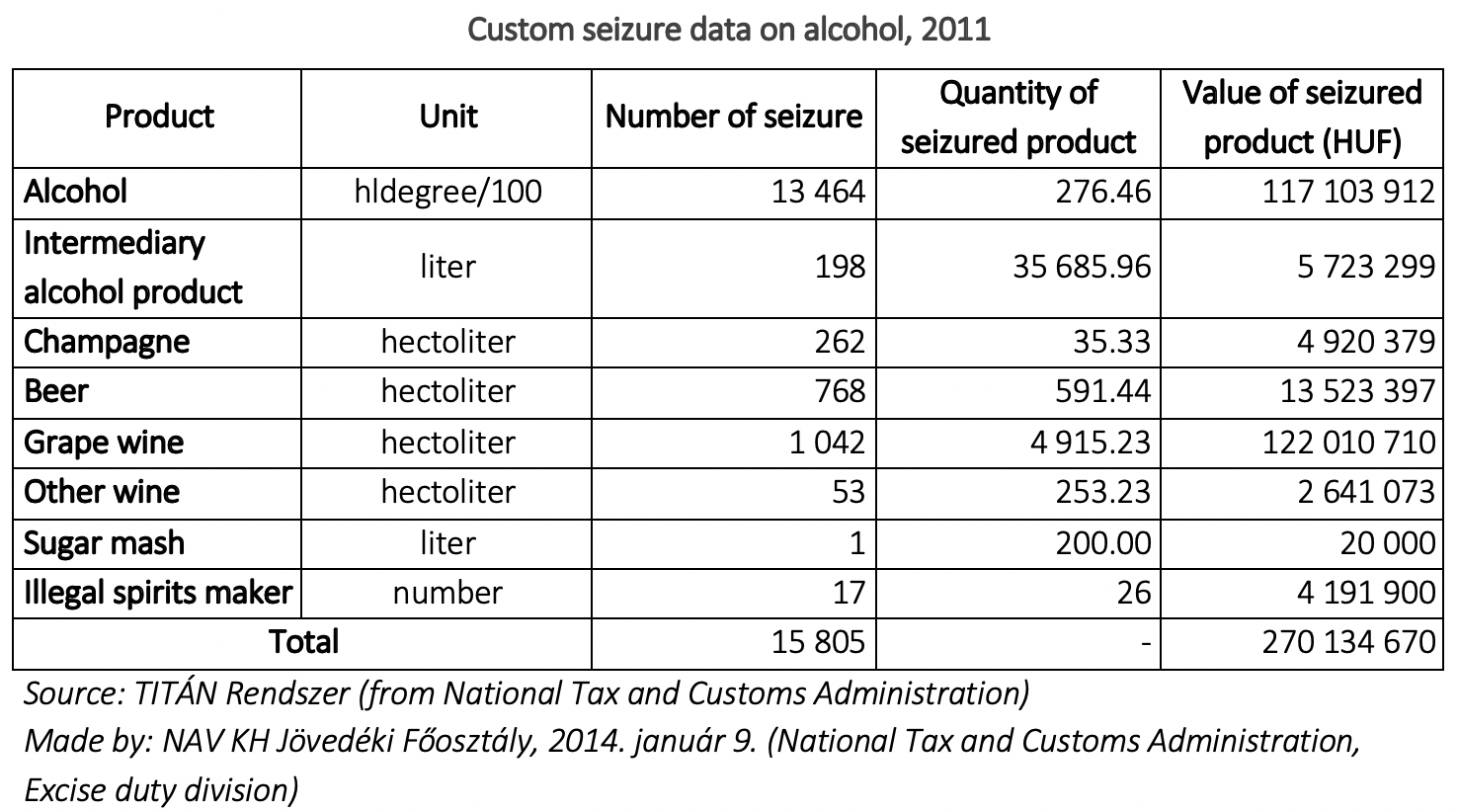

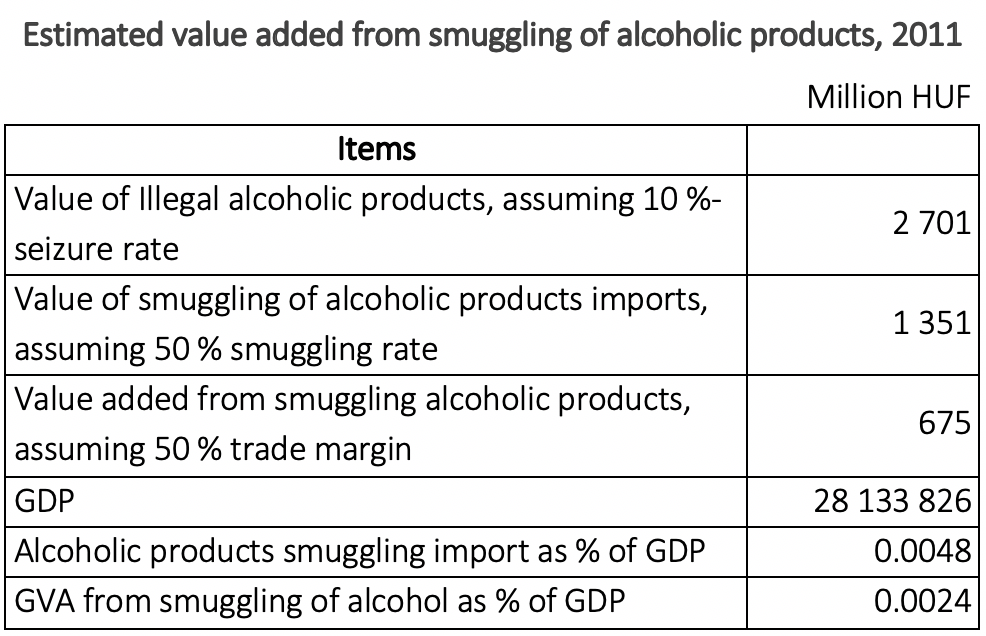

Based on our researches while in the smuggling of tobacco significant amount of value added is generated, the value of alcohol smuggling is negligible. According to the available customs seizure data, the value of the seized alcohol products are around 250-300 million HUF (see Table 1.). Assuming a 10% seizure rate, the whole illegal alcohol market may be around 2.5-3 billion HUF. This contains however not only the smuggled, but the illegally produced alcohol in Hungary as well, thus the contraband alcohol is just a part of this amount. If we assume that half of the illegally available alcohol is contraband, and the trade margin is 50%. As intermediate consumption of smuggling may be insignificant (smuggling is mainly a secondary activity in transport of goods or other cross-border travel), the value added could be 650-730 million HUF, which is 0.0024% of the GDP.

Based on these seizure data and calculation, the smuggling of alcoholic beverages is negligible in Hungary. Moreover, there are no reliable data for dividing the seizures of custom office between domestic and imports origin. That is why Hungary does not incorporate the alcohol smuggling into the national accounts.

Smuggling of Tobacco

At the same time smuggling of tobacco products is a significant issue, since the cigarettes and other tobacco products are usually much cheaper in countries at the eastern border of Hungary, therefore they are illegally imported on a regular basis. The main challenge was to apply the demand side approach based on surveys of tobacco consumption, as the consumption of tobacco typically underreported in the different surveys. The analysis of waste is the only possible option to identify from demand-side the share of cigarettes smuggled from abroad.

Our primary data sources are the regular waste-analysis studies of the market research company GfK1, and the administrative data of the customs authority. Important supplementary information come from the “Project Star 2012” report of KPMG2. This report collects and summarizes the available information sources of the European countries about the smuggled tobacco products (Empty pack surveys, EU flows model, non-domestic legal analysis, etc.) from 2006 to 2012. Information are not only about the share of the domestically consumed cigarettes from abroad, but also about the ratio of smuggled and legally imported part. Since this report combines the data of different countries in an integrated model, there are some information about the origin of the smuggled products too. With the relevant national prices it is possible to estimate the import prices as well.

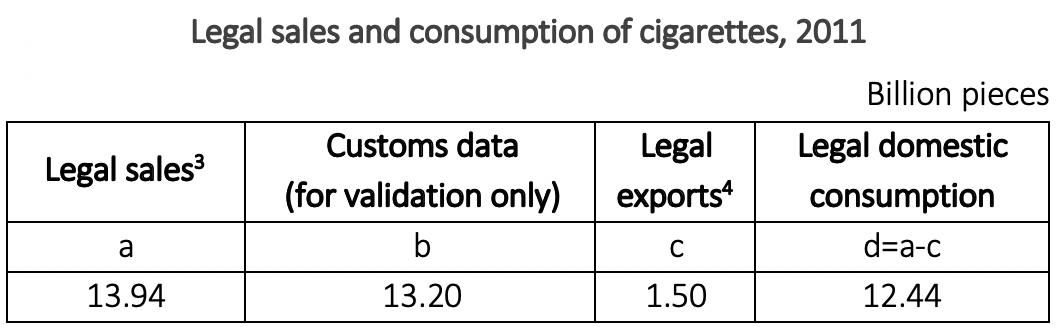

The starting point of the estimations is the legal sales of cigarettes. Data of KPMG are used rather than customs data for estimating the sales, since the customs authority records only the transaction, when the products enter in retail trade, or leave the country as exports.

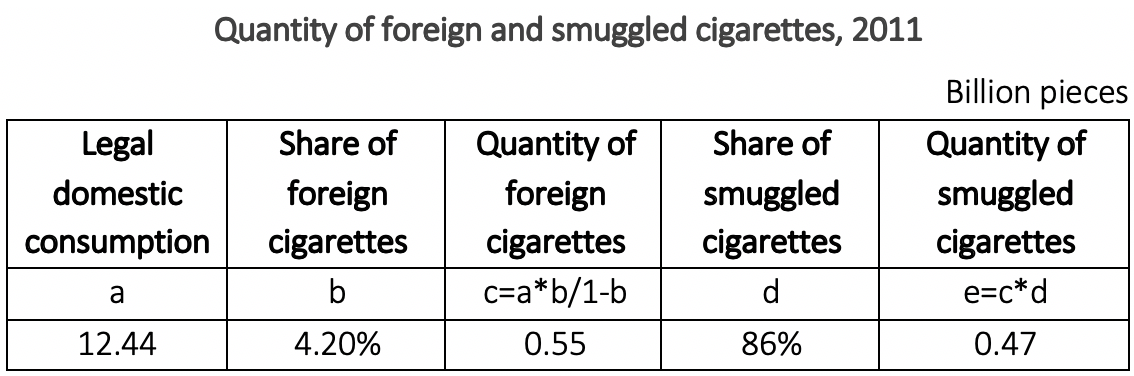

Different waste analysis studies or ‘empty’ pack surveys measure the share of the cigarettes from abroad to the domestic products. The foreign cigarettes could be either smuggled, or legally imported (private import for own use), but in both cases are unregistered. To get the quantity of smuggled cigarettes the legally imported part has to be excluded. These data of the KPMG report and the GfK study are quite similar, but not exactly equal. For the estimation of the amount of cigarettes from abroad the GfK data have been chosen, but for the share of the legal but unregistered import the KPMG data are used. The result is the quantity of the illegally imported cigarettes.

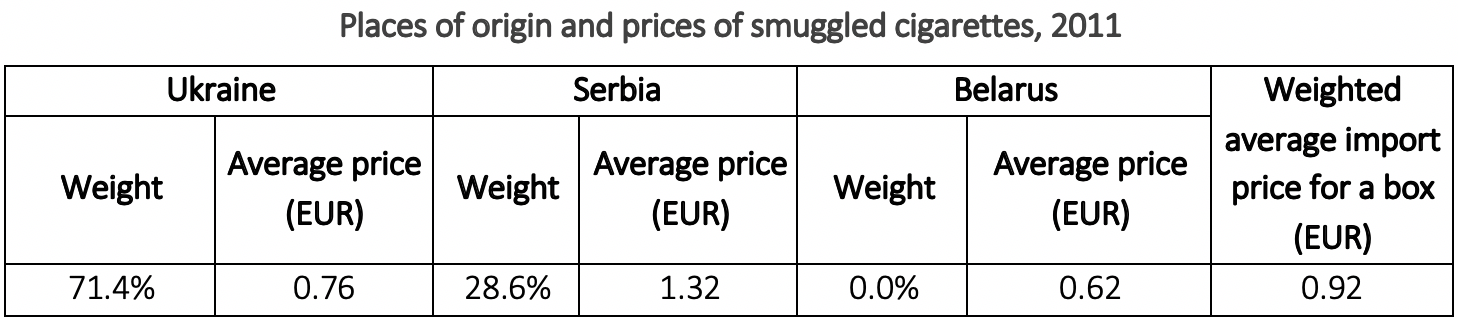

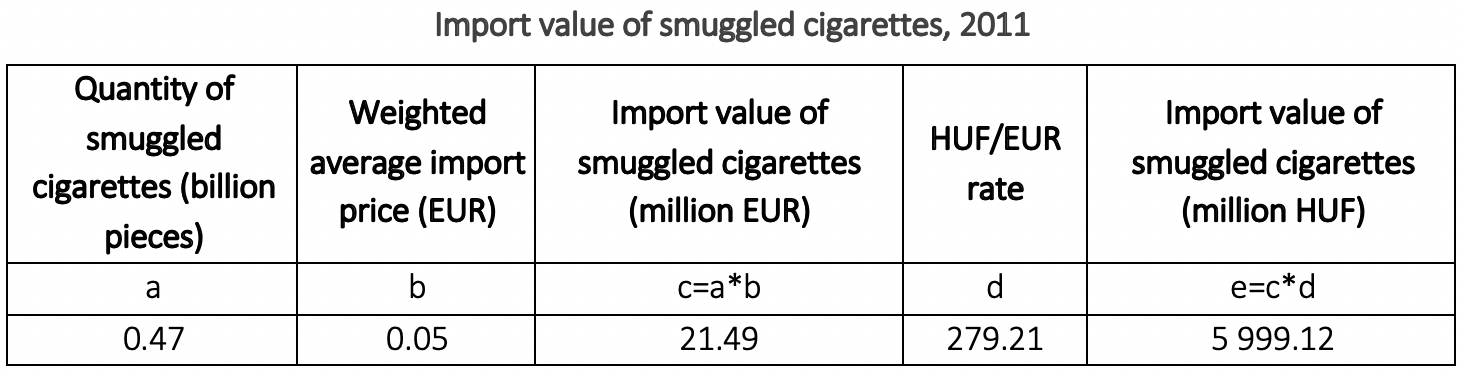

To get the value of imports of the smuggled tobacco, cigarette prices of the origin countries has to be estimated. According to the country flows model of the Project Star report the three main sources of the smuggled cigarettes are Ukraine, Serbia, and Belarus, which countries add up 80% of the illegal Hungarian import. The weighted average price of cigarettes in these countries are used for the estimation of the import prices. The weights were the quantity of the illegal imports originating from each country in the relevant years. Retail prices were available from the Project Star reports for 2012, for the previous years the relevant national year-to-year price indices for tobacco products were used.

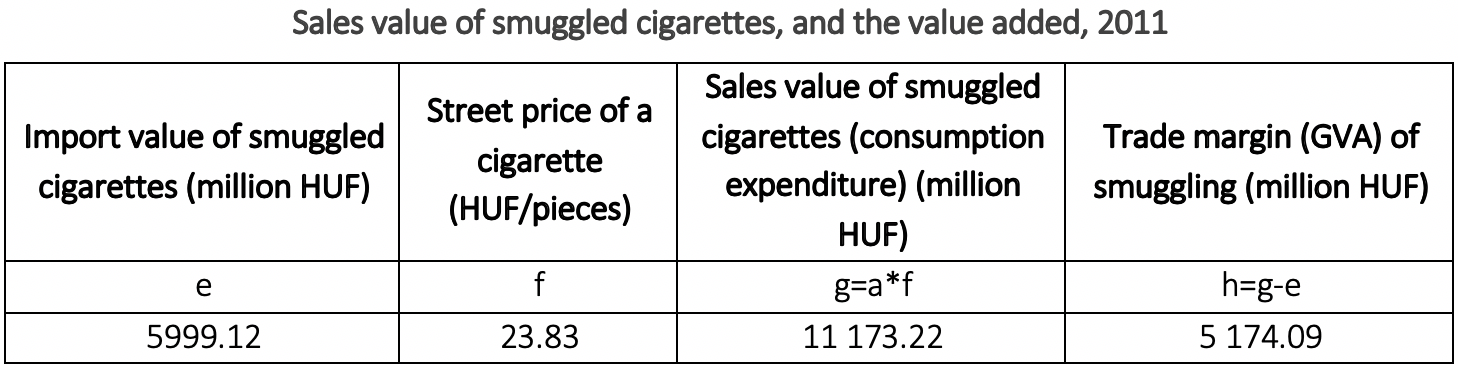

The trade margin of the smuggling activity can be estimated as the difference of the import- and sales prices. Based on expert’s opinions it is assumed, that the street price of smuggled tobacco product is equal to the retail price without the value added tax. For converting the import prices in HUF the annual average HUF/EUR exchange rate of the National Bank of Hungary is used.

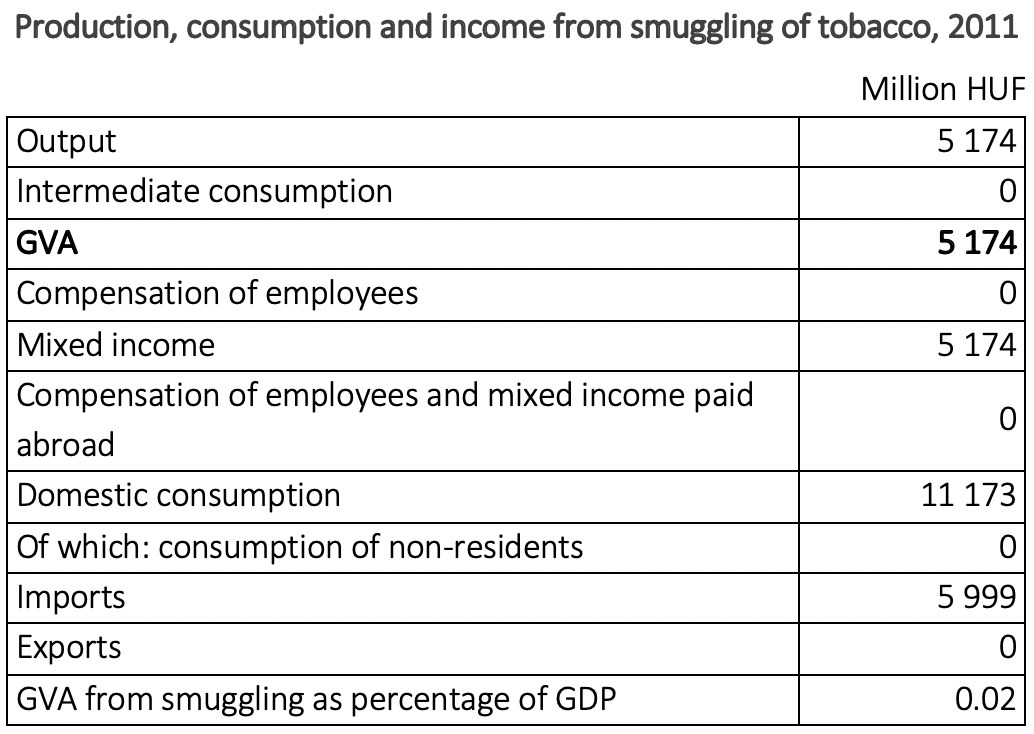

Usually, the intermediate consumption of the smuggling activity consists of transport, storage and distribution. Since the smuggling of cigarettes is typically not a standalone activity, but the contraband goods are transported and stored hidden in a legal cargo, the costs of transport and storage are already recorded in the national accounts, so there is no significant costs for distribution. Thus intermediate consumption for smuggling were not estimated at this point, and the gross value added generated in smuggling is equal to the trade margin.

According to the referred studies the illegal export of cigarettes originating from Hungary is zero or negligible. The results of the estimations and the impact of the smuggling activity is the following for the year 2011:

The sales value of smuggled cigarettes step into the household consumption expenditure calculation, because the consumption figures did not include the smuggling cigarettes so far. The estimation is based on the supply and use tables, and the excise duty data, so it does not contain the contraband cigarettes. As additional cost data (intermediate consumption) are not estimated, the output and the GVA are the same, and the whole GVA is recorded as mixed income, because the institutional units engaged in smuggling are private persons, i.e. households.

1GfK Magyarország (http://www.gfk.com/hu/about-us/Lapok/default.aspx)

2KPMG Magyarország (http://www.kpmg.com/hu/hu/lapok/default.aspx)

3Data are based on the KPMG study. Legal sales are the amount of cigarettes, which are sold in the domestic retail trade market.

4Data are based on the KPMG study. Legal exports are the amount of cigarettes, which are bought in the domestic retail trade market, but are consumed in foreign countries (e.g.: travel, shopping tourism).