Like many economists, I tend to fear the worst. I have witnessed phenomenal changes for the better in sub-Saharan Africa over the past 20 odd years. Part of me still worries that this trajectory will not endure. But, the more I see of the region’s economic performance and outlook, the more I’m changing my tune.

Old anxieties set aside

Until my latest source for anxiety took hold a few months ago (more on this in a moment), I’d worried about the impact of the global financial crisis on sub-Saharan Africa. The crisis hit just as many countries in the region were starting to enjoy a hard-earned period of economic growth, their best since at least the 1970s. I did not want this to be derailed by the crisis.

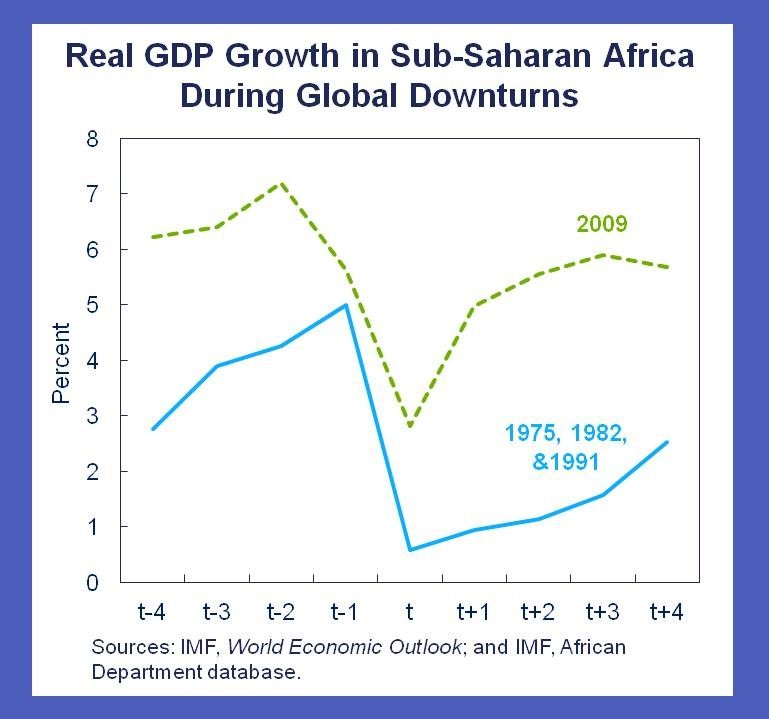

Previous global economic slowdowns were unkind to the region. While other regions tended to recover quickly, recoveries in sub-Saharan Africa tended to be more protracted, looking more U- or even L-shaped. So, in the face of the worst period for the global economy in two-generations, what chance did the still fragile economies have?

However, it soon became clear that this time would be different. And in fact, my initial fears were unfounded. This time the region’s recovery has been more V-shaped.

Credit for that goes, in large part, to policymakers in the region. Good macroeconomic policies in many more countries the years before the crisis put them in good stead to weather the crisis relatively well. This allowed them to adopt strong counter-cyclical monetary and fiscal policies.

And, looking ahead, the recovery to pre-crisis growth rates is well underway in most countries. As we report in our latest Regional Economic Outlook, output in sub-Saharan Africa looks set to expand by around 5½ this year and 6 percent in 2012.

To be sure, the crisis has caused considerable dislocation. The 1 million or so jobs lost in South Africa are a case in point. Elsewhere, progress towards the poverty reduction Millennium Development Goal has also been delayed.

But it could also have been much worse. In the face of the largest shock to the global economy, many sub-Saharan African countries have shown surprising resilience.

Tackling worries

My latest worry is the recent sharp increase in food and fuel prices on world markets.

When food prices spiked in 2008, there was a prompt and pronounced increase in local prices in most African countries.

So far, this time, we have seen a more diverse picture. In a number of countries, strong harvests have helped in limiting increases in local food price. But, in many other countries, prices have started to increase sharply. This will be particularly harmful for the urban poor and landless rural households.

The surge in fuel prices will also test the resilience that the region has exhibited in recent years. For the region’s 37 oil importing countries, it will imply higher oil import costs, and higher fiscal deficits where the pass-through of international price to domestic price is delayed. And, across the region, it will imply higher inflation.

To help minimize the dislocation that this shock may entail, countries should consider a two-pronged policy response.

- Wherever food price increases are pronounced, governments should consider targeted interventions—providing the poorest families with transfers from the budget or, less directly, by subsidizing food items they consume.

- In the case of fuel prices, however, we recommend that local prices should adjust in line with international prices. Fuel price subsidies tend to be highly regressive—the bulk of the benefits go to the richest households—and very costly.

So, once again, I might fear the worst. But, witnessing how countries handled the global financial crisis gives me hope—hope that the appropriate policies will be adopted and will be as effective this time too. And that gives this dismal scientist cause for optimism.