The Asia-Pacific region prospered by becoming the source of more than half of global factory output, but another transformation to higher-productivity services has the potential to further support growth.

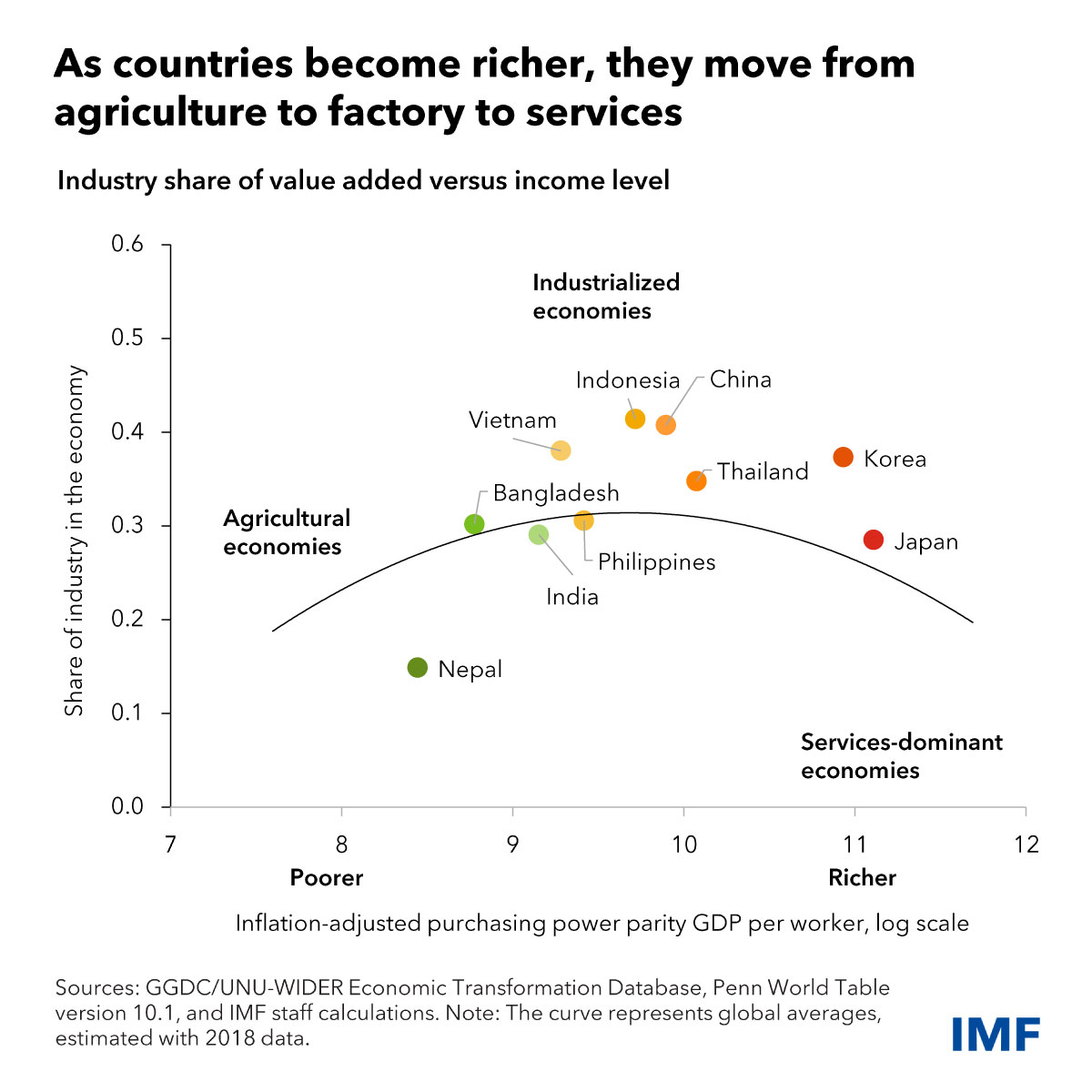

Employment and production typically move from agriculture to manufacturing to services, as part of natural progression that comes with rising income. Today, many Asian countries—including China, Indonesia, Korea, and Thailand—are highly industrialized. If history is a guide, industry’s share of production will shrink as more activity passes to services.

Indeed, the growth of services has already drawn about half of the region’s workers into that sector, up from just 22 percent in 1990, as hundreds of millions moved from farms and factories. This shift is likely to accelerate with further expansion of international trade in modern services such as finance, information, and communication technology, as well as business outsourcing (for example, as already done in India and the Philippines). By contrast, traditional services—for example, tourism or distribution services—have lower productivity and contribute less to economic growth.

Policymakers should embrace this shift to modern services because they have higher productivity, as we show in an analytical note accompanying our October 2024 Asia-Pacific Regional Economic Outlook. Transitioning to a more services-led economy comes with greater economic growth opportunities, provided the right policies are in place.

Productivity is an important variable when considering which sectors can best deliver growth in coming years. Manufacturing productivity in Asia is already close to the level of global leaders, so further improvement offers only limited scope to boost productivity and growth. By contrast, services in Asia don’t enjoy the same efficiency advantage, so the region’s economies have more to gain by catching up with countries that have the most efficient services sectors.

In addition, in several services sectors like finance and business services, productivity is higher than in manufacturing, which means greater contributions to growth. For example, Asia’s labor productivity in financial services is four times higher than in manufacturing, and it’s twice as high in business services, our new analysis shows.

Even so, countries need to have the right conditions in place to benefit from services. Manufacturing benefited from low trade costs and greater global integration, but services sectors are relatively protected in Asia, which can hamper progress. Just like Asia’s higher tariffs on agriculture, which average 12 percent versus 7.5 percent globally, foreign companies that hope to enter the services sector face various restrictions. These include outright bans, approval requirements, local presence, and higher tax rates.

Policymakers should also recognize that workers leaving agriculture and manufacturing need the skills to find good jobs in services. With waves of new digital technologies replacing some jobs like clerical support, policies should ensure widespread internet and technology access, and introduce education and training to develop a digitally skilled workforce capable of leveraging artificial intelligence.

With growth projected to slow in many Asian countries due to rapid aging, boosting productivity by nurturing productive services is a key to Asia’s future success.

—This blog is based on an analytical note, “Asia-Pacific’s Structural Transformation: The Past and Prospects,” included in the October 2024 Asia-Pacific Regional Economic Outlook.