Economists monitor income disparities because they can harden into more structural wealth inequalities that concern policymakers. Wider wealth gaps may also impact monetary policy transmission and financial stability.

Accordingly, the European System of Central Banks developed new experimental Distributional Wealth Accounts for the euro area and most European Union countries. Combining wealth information drawn from household surveys with broader economic indicators, the new data offer an integrated picture of wealth across groups that match national accounts figures.

This year’s release also marked a significant advance in addressing the Group of Twenty’s recommendation on household wealth results, as part of the third phase of the Data Gaps Initiative, a G20-led partnership involving the IMF, the Inter-Agency Group on Economic and Financial statistics, the Financial Stability Board, and statistical authorities, working to enhance economic and financial data quality worldwide.

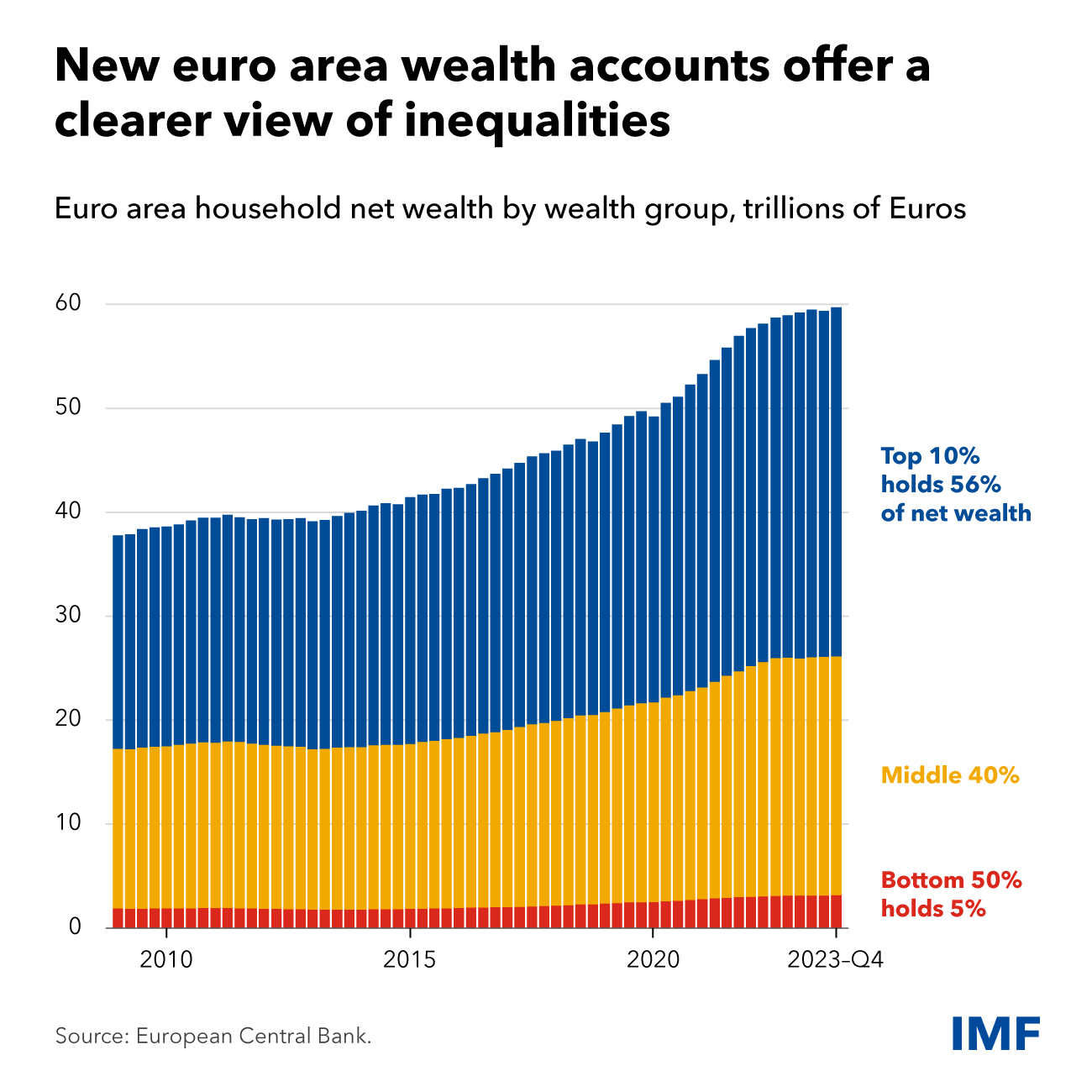

As the Chart of the Week shows, net wealth in the euro area rose 27 percent over the past five years—accompanied by a slight decrease in inequality, partly because homeowners benefited from increasing housing prices. The share of wealth held by the top 10 percent stood at 56 percent in the fourth quarter of 2023, while the bottom half held just 5 percent. By comparison, the top 10 percent on a global basis holds about three-quarters of total wealth, according to the World Inequality Lab.

These Distributional Wealth Accounts far surpass the scope of standard distribution data. They are crucial because they detail not only who owns what—from real estate to savings—but they also align these figures with the broader economic metrics of an entire country. This integration provides more timely estimates and allows for a deeper understanding of how wealth distribution interacts with overall economic health.

Moreover, maintaining consistency across different countries enables more meaningful comparisons and informed policymaking. Essentially, these accounts provide policymakers with a clearer, richer picture of economic trends, helping to tailor policies that address inequality and promote economic fairness.

The G20’s recommendation will broaden this kind of analysis beyond Europe. Thirty-three countries, including 13 in the G20, have joined a new expert group convened by the Organisation for Economic Co-operation and Development to collaborate and develop internationally harmonized wealth distribution estimates. These would complement existing data on income, consumption, and saving, providing a unique and consistent picture of economic inequality across countries.

Harnessing household distributional data helps policymakers foster economic growth that benefits all, and better understand how their policies affect people. And that in turn lays the groundwork for crafting more equitable policies in the future.

—This blog is by Francien Berry and Darja Milic, economists in the IMF Statistics Department, Henning Ahnert, the European Central Bank’s head of financial accounts and fiscal statistics, and Jorrit Zwijnenburg, the acting head of national accounts at the OECD.