Related Links

2015 IMF External Sector Assessments

Last Updated: November 21, 2025

2015 External Sector Report

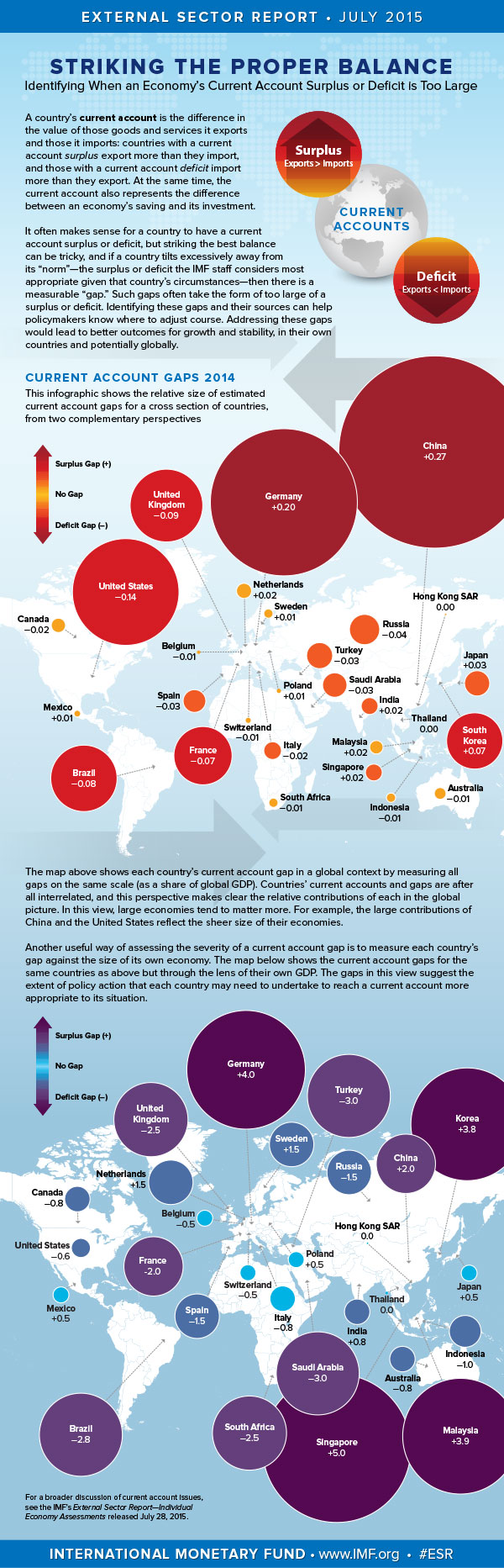

The 2015 External Sector Report overview paper, and accompanying Individual Economy Assessments paper, analyze and assess the external positions of 29 of the world’s largest economies, plus the euro area. The analysis systematically assesses current accounts, exchange rates, external balance sheet positions, capital flows, and international reserves. In doing so the reports combine multilateral and bilateral perspectives.

The papers provide a snapshot of multilaterally consistent analysis, and staff assessments, of the external positions of the largest economies simultaneously, also point to potential policy responses. The staff assessments draw on estimates from the External Balance Assessment approach, together with other evidence and judgment, while acknowledging the uncertainties inherent in such assessments.

The report ensures that assessments are candid and evenhanded. The same methodologies and metrics are applied to all countries and assessments for individual countries are together multilaterally consistent. At the same time, the models take account of countries’ individual characteristics and country teams provide in-depth knowledge of country-specific factors to identify those not captured by models.

External Balance Assessment Approach

The External Balance Assessment (EBA) approach is used as an input to the staff assessments of current accounts and real exchange rates. The objective of the EBA approach is to inform a normative evaluation, taking account of the effects of policies and potential policy distortions. In contrast to analyses that seek to predict future values of current accounts and exchange rates, EBA seeks to identify levels that would be consistent with country fundamental characteristics and desirable settings of relevant policies. EBA strips out the influence of cyclical factors and allows one to estimate the impact on a country's current account and real exchange rate of potential policy distortions in the areas of fiscal policy, social protection (public health expenditure in particular), capital controls, reserve accumulation, financial policies, and monetary policy. The approach estimates the impact of both domestic and foreign influences on an economy’s current account and exchange rate.

A comprehensive explanation of the EBA methodology is available. Data and estimates from the 2014 EBA exercise are available online.