STANDARDIZED GUARANTEES ASSESSMENT TOOL (SGAT)

STANDARDIZED GUARANTEES ASSESSMENT TOOL (SGAT)

helps countries to assess the fiscal costs and fiscal risks associated with government standardized guarantee schemes using a cash-flow based portfolio approach. The analysis can help inform ex-ante decision making, risk mitigation measures, and fiscal risk monitoring and reporting.

What does the tool do?

- Quantifies the fiscal costs and risks from standardized guarantees or loan schemes using baseline and stress scenarios.

- Uses cash-flow based portfolio analysis modelling aggregate borrowers' behavior, rather than relying on a more burdensome underlying risk assessment of individual borrowers, institutional or funding structures.

- Focuses on loans to businesses (the current tool is not tailored to assess risks from mortgages, student loans, or insurance schemes).

- Accommodates multiple schemes or sub-schemes, which allows for comparison of alternative design options or individual sub-portfolios.

- Is flexible to accommodate various scheme features (e.g., risk coverage, loss sharing, pricing, collateralization, guarantee trigger.

Why analyze these risks?

Governments in many countries have implemented or supported standardized credit guarantee schemes to correct market failures and facilitate the access to finance of SMEs. In response to the COVID-19 pandemic, governments across the world, particularly in advanced and emerging market economies have created new, or scaled up existing, guarantee schemes to ensure the flow of credit and support economic activity.

Standardized guarantee schemes create fiscal risks. To safeguard fiscal sustainability, governments should assess and manage these risks. When first implemented, standardized guarantee schemes are often only recorded below-the-line and do not immediately affect government deficit or debt levels. However, defaults of borrowers lead to fiscal costs over time. Assessing these fiscal costs and risks before implementation helps government's make better-informed decisions by allowing them to compare the costs and benefits of alternative policy options, to design more effective schemes, and to provision for losses in fiscal plans. Also, international accounting and statistical standards require the expected cost of such schemes to be recognized as government debt.

How can the tool support fiscal policymaking?

- Support ex-ante decision-making by estimating the fiscal impact of guarantee schemes and comparing the fiscal costs with different scheme structures or alternative policy options.

- Inform the amount that should be provided in the budget to cover expected calls under the scheme, as well as potential contingencies for unexpected calls.

- Facilitate risk management and monitoring by producing metrics for quantifying risks, stress-testing, risk mitigation and provisioning.

- Support fiscal risk disclosure through quantification of fiscal risk and output, tables and charts that can be incorporated into various reports (e.g., fiscal risk statements).

- Provides basis for accounting and reporting of expected costs, which should be provisioned as a debt liability in the government balance sheets.

- Supports macro-fiscal analysis as the fiscal costs and risks can be included in baseline and shock scenarios for debt sustainability analysis, cash and debt management, and other macro-fiscal tools.

Linkages to other IMF fiscal risk and macro-fiscal analytical tools

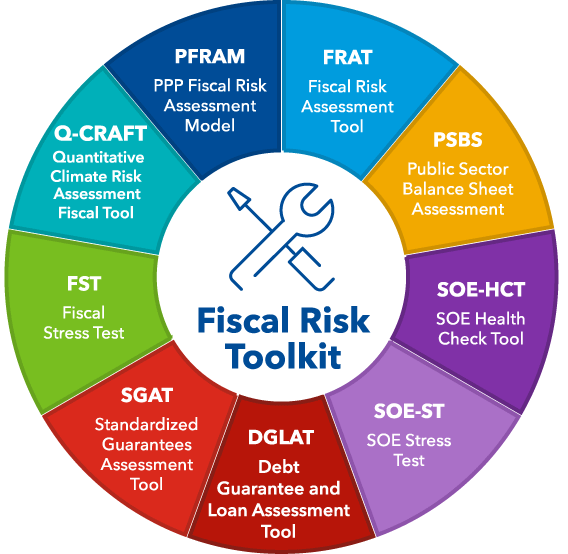

The SGAT is complementary to the Discrete Guarantee and Loan Assessment Tool (DGAT): both estimate the fiscal costs and risks from guarantees and loans with the SGAT focused on guarantee and loan schemes and the DGAT focused on discrete guarantees and loans.

Outputs from the SGAT can be used to account for the contribution of guarantee schemes to:

- Debt liabilities in the Public Sector Balance Sheet in accordance with the Government Finance Statistics Manual 2014; and,

- Baseline or shock scenarios in the Fiscal Stress Test, Debt Sustainability Analysis for Low-Income as well as Market-Access Countries, the Medium-Term Debt Management Strategy Analytical Tool, as well as the tool to calibrate fiscal rules.

Outputs from the SGAT can also support the assessment of fiscal risks from guarantees in the Fiscal Risk Assessment Tool and the assessment of fiscal transparency related to guarantees according to Pillar III of the Fiscal Transparency Code.