Middle East and Central Asia

Regional Economic Outlook: Middle East and Central Asia

October 2019

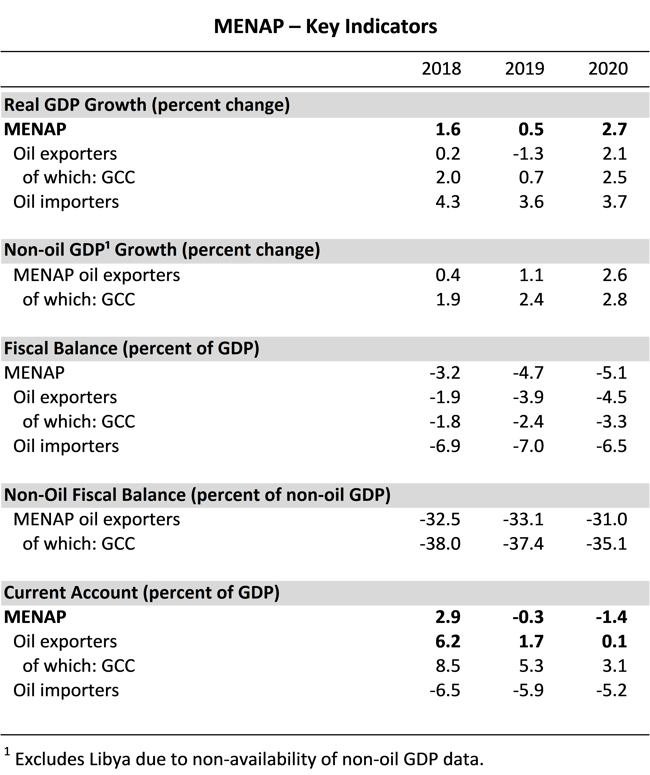

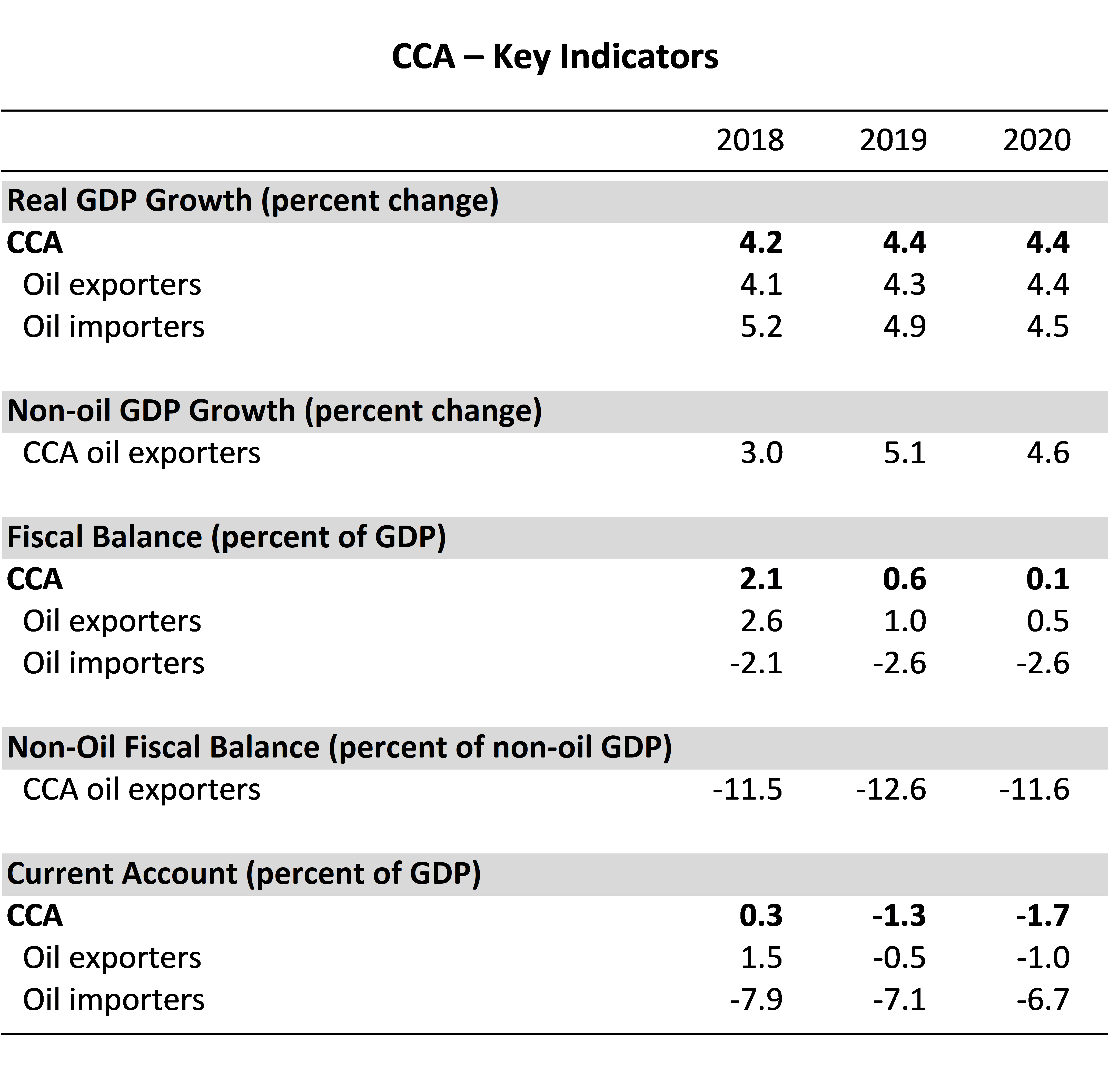

The impact on growth in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region from global headwinds remains muted thus far, while growth in the Caucasus and Central Asia (CCA) region is stable. However, growth is too low to meet the needs of growing populations, while risks to the outlook have increased. They include global trade uncertainties, volatile oil prices, geopolitical tensions, and domestic vulnerabilities in some countries.

MENAP Summary

The impact on growth in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region from global headwinds remains muted thus far. However, growth remains too low to meet the needs of growing populations, while risks to the outlook have increased. They include global trade uncertainties, volatile oil prices, geopolitical tensions, and domestic vulnerabilities in some countries.

CCA Summary

Global trade tensions and slowing growth in key trading partners are affecting the Caucasus and Central Asia (CCA) region. However, despite a decline in export growth, a looser fiscal stance and rising retail credit will maintain broadly stable growth for the region in 2019–20. To foster higher and more inclusive growth and raise living standards, CCA policymakers should strengthen competitiveness, leverage comparative advantages, and foster diverse sources of growth to reap the gains from trade and integration into global value chains.

CCA Outlook

Global Developments: Implications for the Middle East and Central Asia Region

Global developments continue to impact the Middle East and Central Asia (MCD) region. Average growth worldwide has once more been revised down and is anticipated to reach 3 percent in 2019, and 3.4 percent in 2020 versus projections one year ago of 3.7 percent for both of these years (see October 2019 World Economic Outlook). Although the reduction in global demand may be partly offset by the recent loosening of global monetary policy, concentration of the slowdown among key trading partners (especially Europe and China) has amplified the impact on the MCD region. Despite rising geopolitical tensions, including those related to Iran, recent disruptions to Saudi Arabia’s oil production, and ongoing conflicts in the region (Libya, Yemen), global oil prices have remained low and financial conditions relatively loose.

MENAP Oil-Exporting Countries: Transitioning to a Sustainable Fiscal Position and Higher Growth

Growth in the near term remains subdued for oil exporters in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region, amid volatile oil prices, precarious global growth, elevated fiscal vulnerabilities, and heightened geopolitical tensions. In addition, declining productivity is dampening medium-term growth prospects. To reduce dependence on oil prices and pave the way for more sustainable growth, fiscal consolidation needs to resume, underpinned by improved medium-term fiscal frameworks. In parallel, structural reforms and further financial sector development would boost foreign direct investment (FDI) and domestic private investment and foster diversification, thus contributing to improved productivity and potential growth.

MENAP Oil-Importing Countries: Addressing Fiscal Challenges amid Social Pressures

Growth in oil-importing countries in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region is expected to be muted in coming years, and lower than comparators. High public debt levels and associated financing costs are not only holding back growth in the region, but also pose a source of acute fiscal stress. Yet a mix of sustained social tensions, unemployment, and global headwinds leave policymakers facing a difficult trade-off between rebuilding fiscal buffers and addressing growth challenges. For now, supportive global financial conditions and lower oil prices are helping to ease this trade-off. But managing high levels of public indebtedness will require fiscal consolidation and policies to deliver higher, more inclusive growth.

Caucasus and Central Asia: Boosting Competitiveness for Higher and More Inclusive Growth

Global trade tensions and slowing growth in key trading partners are affecting the Caucasus and Central Asia (CCA) region. However, despite a decline in export growth, growth will remain broadly stable in 2019–20, supported by a looser fiscal stance and private sector credit growth. Nevertheless, a slowdown in total factor productivity—especially in the region’s oil and gas exporters—points to lower potential growth and underscores the challenge of creating enough jobs for new workers. To foster higher and more inclusive growth and raise living standards, CCA policymakers should strengthen competitiveness, leverage comparative advantages, and foster diverse sources of growth to reap the gains from trade and integration into global value chains. This will include promoting private-sector-led growth, improving the efficiency of state-owned enterprises, and ensuring a well-functioning labor market. Macroeconomic policies should focus on addressing weak banking sectors, strengthening fiscal institutions, investing in infrastructure and human capital, and upgrading monetary policy frameworks to sustain stable and low inflation and support greater exchange rate flexibility.

Capital Flows to MENAP and the CCA: Opportunities and Risks

Capital flows to the Middle East and Central Asian countries have been resilient even as global financial conditions tightened in 2014–16. Such flows have helped finance current account and fiscal deficits, allowing for more gradual policy adjustments. As the region has become more integrated into global financial markets, portfolio and bank flows have nearly doubled over the last decade; foreign direct investment (FDI) has almost halved, however, reflecting weaker fundamentals. Governments need to seize the benefits of capital inflows while mitigating risks stemming from global financial market volatility, especially global risk sentiment, to which the region is twice as sensitive compared to other emerging market economies. This means revitalizing FDI by easing restrictions and promoting macroeconomic stability in the near term and boosting potential growth over the medium term. Ensuring fiscal sustainability, utilizing macroprudential tools, and, where appropriate, allowing for more flexible exchange rates can help contain the risks from capital flow volatility. Deepening and developing domestic financial markets, especially through strengthening legal frameworks, remains a key priority.

Fiscal Institutions and Fiscal Outcomes

Countries in the Middle East and Central Asia are facing significant fiscal challenges, amid volatile oil prices, subdued growth, and conflicts. Weak fiscal institutions have contributed to spending inefficiencies, rising debt and deficits, and procyclical fiscal policy, especially in countries in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region. Improving fiscal transparency, establishing credible medium-term fiscal frameworks (MTFFs), strengthening public financial management (PFM), enhancing procurement, and moving toward fiscal rules would help mitigate these vulnerabilities over time.