IMF Executive Board Concludes the Sixth Reviews Under the Extended Credit Facility and Extended Fund Facility, and Second Review Under the Resilience and Sustainability Facility for the Republic of Moldova

December 17, 2024

- The IMF Executive Board completed on December 17, 2024, the sixth review under the Extended Credit Facility/Extended Fund Facility (ECF/EFF), and the second review under Resilience and Sustainability Facility (RSF) with Moldova, allowing for a disbursement totaling SDR 122.2 million (about $162.6 million).

- The recovery from adverse spillovers from Russia’s war in Ukraine and energy price shocks is taking hold. Growth picked up in 2024 and is expected to strengthen further in 2025, driven by robust domestic demand. Downside risks remain high, mainly related to Russia’s war in Ukraine and renewed energy shocks.

- While quantitative performance of the program has been strong, implementation of structural reforms has been uneven. Further reforms to enhance fiscal performance and the allocation of public resources, strengthen energy security, strengthen governance and the rule of law, and advance climate adaptation and mitigation are key to protect Moldova against shocks and improve its growth prospects.

Washington, DC: The Executive Board of the IMF concluded the sixth reviews under the Extended Credit Facility (ECF) and Extended Fund Facility (EFF)[1] and the second review under the Resilience and Sustainability Facility (RSF)[2], for the Republic of Moldova. This allows for a total disbursement of SDR 122.2 million (about $162.6 million) under both programs, usable for budget support. This brings Moldova’s total disbursements under the ongoing program arrangements to about $810.2 million.

“The economic recovery is taking hold with growth projected at 2.6 percent this year and 3 percent next year. The fiscal deficit is projected to decline from 5.2 percent of GDP in 2023 to 4.4 percent in 2024 and 4.0 percent in 2025 reflecting stronger-than-expected revenues, driven by buoyant wage and import growth and contained spending. Inflation has remained broadly within the National Bank of Moldova’s (NBM) 5 ± 1.5 percent target corridor since October 2023. The outlook remains subject to significant uncertainty, with large downside risks, mainly related to the war in Ukraine and renewed energy shocks. By contrast, faster progress on structural reforms, including under the EU Growth Plan for Moldova, and steady progress on the EU accession path represent upside risks.

“While quantitative performance of the program has been strong, implementation of structural reforms has been uneven. The authorities completed conditionality related to financial inclusion, the insurance sector, and state-owned enterprises, and submitted legal amendments to Parliament to strengthen NBM’s autonomy and governance. Agreed actions to establish the Anti-Corruption Court (ACC) and ensure appropriate staffing of the Anti-Corruption Prosecutor’s Office (APO) are pending. The switch from providing in-bill energy subsidies to targeted cash transfers took place in time for the current heating season and the government approved a disaster risk management program. Two other RSF reform measures are in progress but will require more time to complete.

Following the Executive Board discussion, Mr. Kenji Okamura, Deputy Managing Director and Acting Chair, made the following statement:

“While economic recovery picked up in 2024 and is expected to continue in 2025, risks remain tilted to the downside. The authorities should pursue prudent policies and maintain buffers and robust contingency plans, including in the energy sector, while fostering growth-friendly investment and reforms, which will be also supported by the EU accession process.

Fiscal policy should remain on a gradual consolidation path to create space for addressing shocks and for growth-enhancing investment, while continuing to protect the most vulnerable. Policies should also focus on improving budget planning and capital investment execution and raising revenues.

While inflationary pressures have receded, energy and other shocks call for cautious, data-driven approach to monetary policy and for maintaining sufficient foreign exchange buffers. The base rate is now at an appropriate level, and normalization of still-high reserve requirements should be implemented gradually, carefully monitoring developments in the real estate and foreign exchange markets. The current prudential requirements on share ownership in the banking sector should be maintained to safeguard macro-financial stability. The upcoming FSAP will take stock of financial sector developments and inform the reform agenda going forward.

Continued progress on anti-corruption reforms is needed to further increase trust in Moldova’s institutions and foster socio-economic development. To this end, adoption of the law establishing a new ACC and ensuring appropriate staffing of the APO are key priorities. Efforts to strengthen the governance, autonomy, and transparency of the National Bank of Moldova should continue.

The authorities should step up implementation of the RSF arrangement to complete the two delayed reform measures for this review and advance on the remaining climate policy agenda. Progress in this area is important to build resilience to climate change, catalyze financing for green investments, and support sustainable long-term development.”

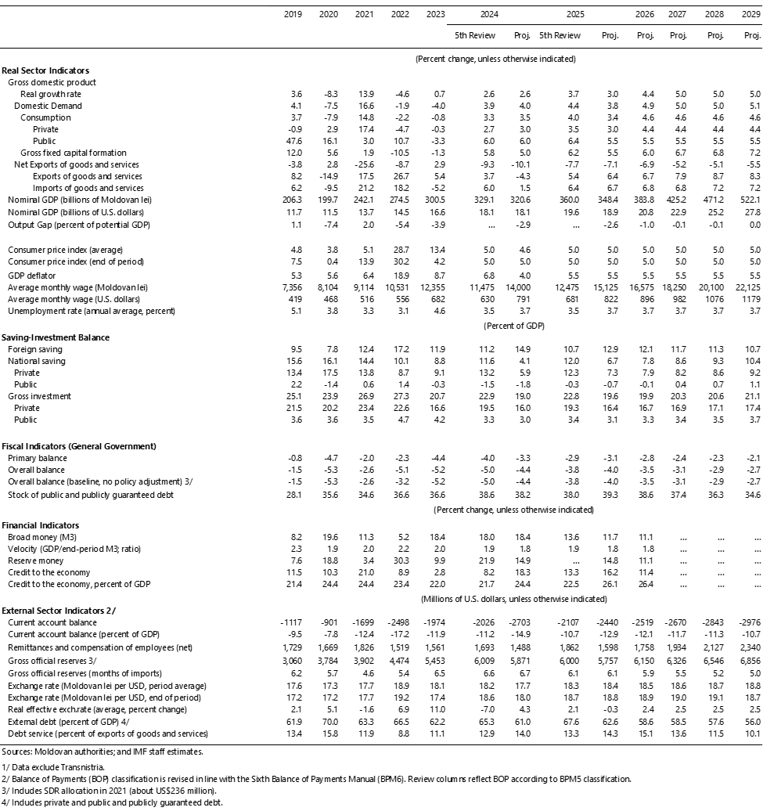

| Moldova: Selected Economic Indicators, 2019–2029 1/ |

|

[1] The ECF provides financial assistance that is flexible and tailored to the diverse needs of low-income countries (LICs), including in times of crisis (e.g., protracted balance of payments problems). The EFF provides assistance to all countries that experience serious payment imbalances because of structural impediments or slow growth and an inherently weak balance-of-payments position. The 40-month ECF/EFF arrangements with Moldova were approved in December 2021 (Press Release) and augmented in May 2022 to increase total access under the arrangements to SDR 594.26 million (Press Release).

[2] The RSF provides longer-term financing to strengthen economic resilience and sustainability by (i) supporting policy reforms that reduce macro-critical risks associated with climate change or pandemic preparedness, and (ii) augmenting policy space and financial buffers to mitigate the risks arising from such longer-term structural challenges. Moldova’s RSF was approved in December 2023 (Press Release).

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Camila Perez

Phone: +1 202 623-7100Email: MEDIA@IMF.org