When a Mexican airline buys Brazilian airplanes, it’s likely to finance the purchase with a US dollar loan obtained from a non-US bank. That’s just one example of the dollar’s outsize role in international financial transactions between non-US counterparts.

What happens if non-US banks suddenly find themselves short of dollars? That was the case during the global financial crisis of 2007-2008, when US financial firms were reluctant to lend dollars to their foreign counterparts. To prevent the collapse of the global financial system, the Federal Reserve provided more than $500 billion in emergency funds to overseas central banks, which could then on-lend the money to their dollar-starved home-country banks.

As we explain in Chapter 5 of the latest Global Financial Stability Report, non-US banks continue to play a key role in dollar lending around the world. Indeed, their dollar assets rose to $12.4 trillion by mid-2018 from $9.7 trillion in 2012 and remain comparable to pre-crisis levels relative to their total assets.

Although the reforms introduced after the crisis have strengthened banking systems throughout the world, our analysis shows that non-US banks remain vulnerable to a dollar disruption that could transmit shocks to their home economies and to the countries that borrow from them. The first step to address the problem is to properly measure it; we have developed a set of indicators to help policymakers do that.

An increase in dollar funding costs can reverberate across the global financial system.

How do non-US banks get the dollars they need to finance assets such as loans to Mexican buyers of Brazilian airplanes? In contrast to US banks, they have limited access to a stable base of dollar deposits. So they must rely heavily on short-term and potentially more volatile sources of funding, such as commercial paper and loans from other banks. If those sources are insufficient, non-US banks turn to instruments known as foreign currency swaps, which are more expensive and can be unreliable in times of stress.

We used three measures to analyze non-US banks’ exposure to dollar funding and their vulnerability to a potential disruption. One measure shows that the gap between dollar denominated assets and liabilities has widened to about $1.4 trillion, or 13 percent of assets, from $1 trillion, or 10 percent of assets, in mid-2008. This so-called cross-currency funding gap reflects the amount of financing that must be filled by using instruments like foreign currency swaps, making banks more vulnerable.

Another measure we developed focuses on highly liquid dollar assets, which can be sold quickly in times of stress to make up for a sudden withdrawal of dollar funding. This measure shows that dollar liquidity has improved since the crisis but remains lower than the overall liquidity of the banks’ balance sheets.

A third measure reflects banks’ ability to fund their dollar assets over a long time horizon using stable sources. This gauge, which we call the US dollar stable funding ratio, has improved only moderately since 2008.

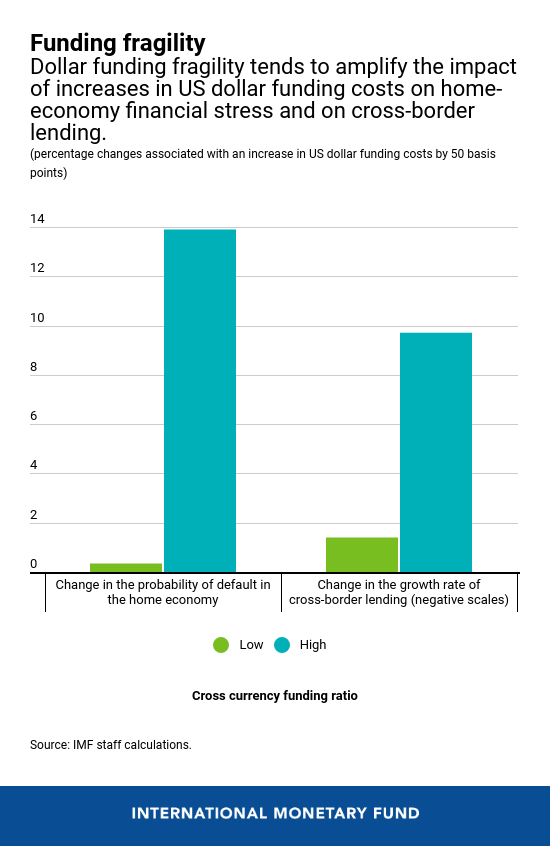

As the crisis showed, an increase in dollar funding costs can reverberate across the global financial system. Our analysis finds that higher costs boost the odds of bank defaults in the home economies of non-US banks that rely on dollar funding. What is more, they increase stress in third countries that receive loans from non-US banks, with emerging-market borrowers being most vulnerable because they cannot easily find alternative sources of funding. We also find that US dollar funding fragility can act as an amplifier, as these negative effects are especially pronounced when any of the measures developed in the chapter points to heightened vulnerability.

On the positive side, our study showed that several factors, some directly related to policy, can act as mitigators, so policy makers have ways to protect their economies in case of a dollar disruption. Ensuring overall health of the banking system, with more profitable, better capitalized banks is one way to provide a cushion. Larger reserve holdings by central banks can also be used to fill the gap if dollar liquidity dries up. Finally, central bank swap arrangements that provide access to US dollars during periods of stress can play in important role, as they did during the crisis.