Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Weakening Growth in Sub-Saharan Africa Calls for Policy Reset

May 3, 2016

- Growth lowest in 15 years, with significant variation across region

- Severe shocks: weak commodity prices, tight external financing, drought

- Urgent need to reset policies to secure growth

After a prolonged period of strong economic growth, sub-Saharan Africa is set to experience a second difficult year as the region is hit by multiple shocks, the IMF said in its latest Regional Economic Outlook for Sub-Saharan Africa

Road building project in Marsabit, Kenya. While commodity price slump takes a toll, many countries continue to benefit from infrastructure investment (photo: Zhou Xiaoxiong/Xinhua Press/Corbis)

REGIONAL ECONOMIC OUTLOOK

The steep decline in commodity prices and tighter financing conditions have put many large economies under severe strain, and the new report calls for a stronger policy response to counter the effect of these shocks and secure the region’s growth potential.

The report shows growth fell to 3½ percent in 2015, the lowest level in 15 years. Growth this year is expected to slow further to 3 percent, well below the 6 percent average over the last decade, and barely above population growth.

Hit by several shocks

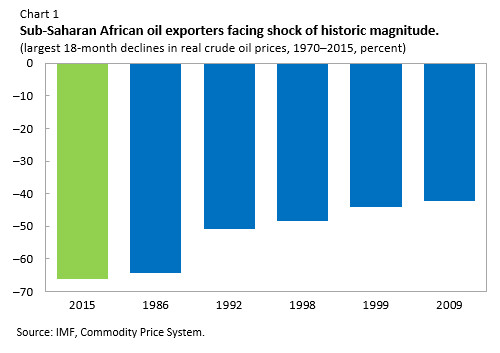

The commodity price slump has hit many of the largest sub-Saharan African economies hard. While oil prices have recovered somewhat compared to the beginning of the year, they are still more than 60 percent below 2013 peak levels—a shock of unprecedented magnitude (see Chart 1).

As a result, oil exporters such as Nigeria, Angola, and five of the six countries within the Central African Economic and Monetary Community continue to face particularly difficult economic conditions. The decline in commodity prices has also hurt non-energy commodity exporters, such as Ghana, South Africa, and Zambia.

Compounding this shock, external financing conditions for most of the region’s frontier markets have tightened substantially compared to the period until mid-2014 when they enjoyed wide access to global capital markets.

In addition, a severe drought in several southern and eastern African countries, including Ethiopia, Malawi, and Zimbabwe, is putting millions of people at risk of food insecurity.

Medium-term prospects still favorable

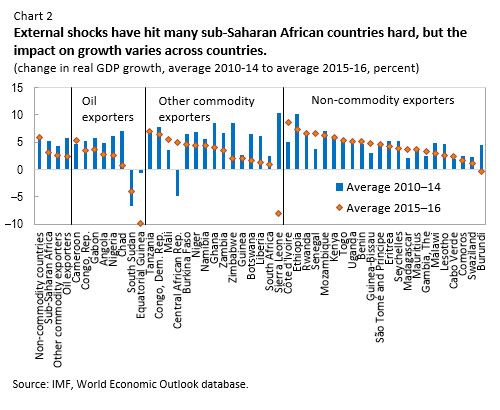

However, the impact of these shocks varies significantly across the region and many countries continue to register robust growth, including in per capita terms (see Chart 2).

In particular, most oil importers are faring much better with growth of 5 percent or higher in countries such as Côte d’Ivoire, Kenya, Senegal, and many low-income countries. These countries continue to benefit from infrastructure investment efforts and strong private consumption.

While the immediate outlook for many sub-Saharan African countries remains difficult, the region’s medium-term growth prospects are still favorable. The underlying domestic drivers of growth at play over the last decade generally continue to be in place. In particular, the region’s much improved business environment and favorable demographics should help bolster growth in the medium term.

Policy reset urgently needed to secure growth potential

To reap this strong potential, however, a substantial policy reset is critical in many cases, as the policy response to date has generally been insufficient.

In commodity exporting countries, where fiscal and foreign reserves are depleting rapidly and financing is constrained, the response to the shock needs to be prompt and robust to prevent a disorderly adjustment. Countries outside monetary unions should use exchange rate flexibility, as part of a wider macroeconomic policy package, to absorb the shock. As revenue from the extractive sector is likely durably reduced, many affected countries also critically need to contain fiscal deficits and build a sustainable tax base from the rest of the economy.

Given the substantially tighter external financing environment, market access countries with elevated fiscal and current account deficits will also need to recalibrate their fiscal policies to rebuild scarce buffers and mitigate vulnerabilities if external conditions worsen further.

The required measures may come at the cost of lower growth in the short-term. However, they will prevent what could otherwise be a significantly more costly disorderly adjustment. These policies would lay the ground work needed for the region to reap the substantial economic potential which still lies ahead.

In two background studies, the Regional Economic Outlook also examines the current commodity terms-of-trade shock and policy responses against past downswings, and the economic impact of progress made in financial development. The region has made strides in broadening access to financial services through the use of mobile technology, and the expansion of home-grown pan-African banks.