The Impact of the Financial Crisis on Low-Income Countries, Remarks By Dominique Strauss-Kahn, Managing Director, International Monetary Fund, Delivered at the Brookings Institution

March 4, 2009

At the Brookings Institution

Washington, D.C., March 3, 2009

As prepared for delivery

It is my pleasure to take part in this important discussion of the impact of the financial crisis on low-income countries. I am grateful to Brookings for hosting this discussion and to Strobe Talbott for his kind introduction. My remarks will focus on the key messages of a new IMF study on this topic, which has been published today.

I start with a very sobering message: after hitting first the industrial countries and then emerging markets, a third wave of the global financial crisis is now hitting the world's poorest and most vulnerable countries, and hitting them hard.

As you know, the global economy is in the midst of a deep downturn. Recent data suggest that even the gloomy forecasts in our January update of the World Economic Outlook were probably too optimistic. We now expect the global recovery to be delayed into 2010—and even this remains dependent on the right policies being adopted. The IMF has been calling for an increased fiscal stimulus for a long time already, and here action has already been taken. But for bank restructuring, there have been unfortunate delays.

While the global crisis has taken a little longer to reach the low-income countries, the outlook for these economies has deteriorated sharply. The problem is not their exposure to the toxic assets at the heart of this crisis, of which they hold very little. Rather, it is their increased integration into the global economy. And while this integration brought many benefits when other countries were growing rapidly, it now means that low-income countries are exposed to the global slowdown.

Our most recent growth forecast for 71 countries eligible for concessional IMF lending is just over 4 percent in 2009—more than 2 percentage points lower than what we expected a year ago. But even this forecast is likely to be too optimistic, given the serious downside risks to global growth. And in any case, in per capita terms many low-income countries may at best see incomes stagnate next year—and possibly even contract.

As you all know, the main impact on low-income countries will be through trade. Exports are projected to decline sharply, with commodity exporters facing a hard hit.

I also foresee mounting financing problems for developing countries. The outlook for foreign direct investment in developing countries is bleak—we forecast a 20 percent decline this year. This reflects investor uncertainty, as well as the significant downturn in commodities (where much of the FDI goes). The cost of borrowing has risen significantly—and in some cases may not be available at any price. Remittances are also likely to drop, reflecting much weaker growth in the advanced and emerging economies where workers from low-income countries have found employment. Finally, and very worryingly, aid flows are under threat, reflecting budgetary pressures in donor countries.

These two shocks—on trade and on financing—will have a major negative impact on the external finances of the poorest countries. While the recent decline in food and fuel prices should provide an offset in some countries, many others will see their balance of payments deteriorate.

The external crisis is rapidly spilling over into a budgetary crisis. Tax revenue will shrink as growth slows and corporate profits fall. These countries may also face higher debt service from currency depreciation and rising interest rates. For commodity exporters, the impact we forecast on overall fiscal balances could be very large, at about 5 percentage points of GDP on average. For other countries, the impact will probably be closer to 1 percentage point of GDP.

I am deeply concerned about the potential humanitarian costs of this crisis. If you look at the data just released by the World Bank, they are worried about an extra 53 million people trapped at income of less than $2 a day unless the most vulnerable countries' financing needs are met. Even more chilling is the World Bank's outlook for infant mortality, with up to 1.4 million to 2.8 million additional children dying between now and 2015 if the crisis persists. We see social costs, and of course social costs on this scale should raise serious concerns about political stability in the most affected countries. So it's not just an economic and income question, it's also a social question—and a political question.

For this reason, low-income countries need to safeguard vital spending on health, education, and infrastructure, while boosting safety nets to protect the most vulnerable. Transfer programs that do a good job of reaching the poor, such as targeted food distribution or school meal programs—tailored to the most vulnerable—can help mitigate the impact of the crisis. The IMF is trying to encourage low-income countries to improve the targeting of their spending on social safety nets.

What can be done to avert this potential economic and humanitarian calamity?

There is some good news, but—as always—not so much good news. The good news is that low-income countries are in a stronger position than before to confront such a crisis. Macroeconomic conditions have improved across the board in the last decade: growth is up, inflation is down, fiscal and current account deficits have declined, reserves are higher and debt is lower. This success reflects prudent policies, higher aid, and debt relief—including significant debt relief from the IMF.

As a result, some countries do have scope to accommodate the shock, or even increase spending to cushion the impact of the crisis. These are countries that have achieved macroeconomic stability, have sustainable public debt, and do not face financing constraints. Also, other countries like commodity exporters have built up fiscal cushions during the recent boom years. That's the good news.

But the bad news is that many of the most vulnerable countries do not have much fiscal space to deal with the crisis. They can adjust by making spending more efficient, and strengthening revenue mobilization. But an appropriate response to the crisis needs significant additional concessional financing.

In some low-income countries, monetary and exchange rate policies allow some room for responding to the external shock. Countries in which inflation is well controlled should look for opportunities to ease monetary policy. And those with flexible exchange rates may allow them to move, to function as shock absorbers. But in many low-income countries inflation is still a problem, and reducing interest rates could backfire. And those countries with fixed exchange-rate regimes—almost two-thirds of low-income countries—may have even less room for maneuver.

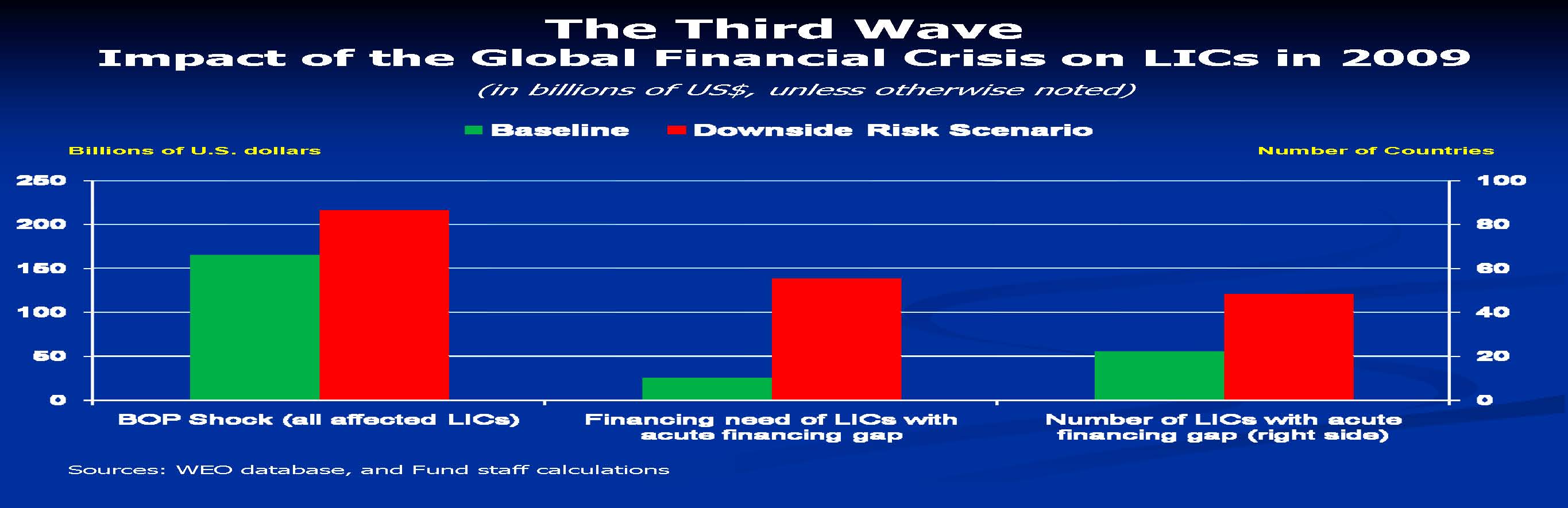

Chart 1: Balance of payments shock and financing needs in 2009

Our analysis identifies 22 developing countries that face the most acute financing constraints. To keep their external reserves safe (at 3-4 months of imports), these countries need at least $25 billion in additional concessional financing in 2009. $25 billion is almost 80 percent of annual aid flows received by these countries in recent years.

Moreover, the need for concessional financing could be much higher. If global growth and financing conditions deteriorate further (which now seems likely), the number of vulnerable countries could more than double, to almost 50, while the additional concessional financing would climb sharply.

So the financing needs are substantial, and they are very urgent. I therefore want to use this opportunity to call on the international community to provide the financing the most vulnerable countries need to preserve their hard-won gains and prevent a humanitarian crisis.

Of course, the primary responsibility lies with bilateral donors, to ensure that aid flows are scaled up, not down. In advanced economies, billions of dollars are spent on fiscal stimulus and financial sector restructuring. But within these huge numbers, we must find room to help low-income countries.

What do we need to do?

Let me just remind you of the commitments that donors have already made. At the Gleneagles G-8 Summit just a few years ago, major donors committed to double their annual aid to Africa to $50 billion by 2010. There is a risk that we will end up being far away from this pledge—so one of our tasks is to push countries to translate this pledge into financing.

Advanced countries also have an obligation to avoid protectionism. Given developing countries' growing dependence on trade, protectionism in their trading partners would impose significant costs on their growth. I therefore urge the world to work towards a successful conclusion of the Doha round. But I'm not too worried about traditional protectionism. I'm actually very worried about "back door" protectionism in the financial sector. In many low-income countries, a large share of the banking sector is foreign-owned—and many parent banks have already started repatriating funds to their home countries.

Of course, it's not only a question of bilateral donors—international organizations must also play their part. I welcome the efforts being discussed by the World Bank and other institutions.

Speaking for the IMF, I can assure you that the Fund is mounting an extraordinary response to this extraordinary crisis.

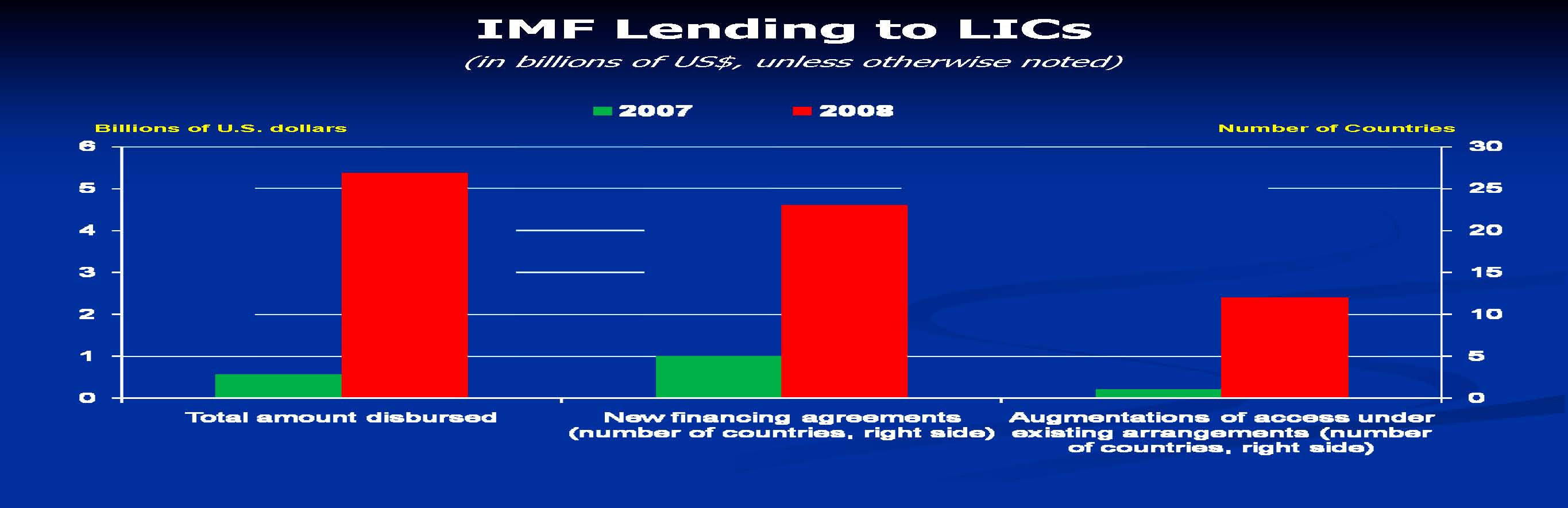

Chart 2: IMF lending to low-income countries

Last year, we significantly stepped up our financial assistance to developing countries hit by the food and fuel price shocks. Through 23 new financing arrangements and increased financing for 12 existing arrangements, our concessional lending to low-income countries doubled.

We are now moving swiftly to step up our help to countries affected by the global crisis. I expect a number of new or scaled-up loan agreements for our low-income country members in place very soon.

Looking ahead, my goal is to double our concessional lending capacity, which would make available $11 billion for low-income countries in concessional support over the next five years. I also want our lending to low-income countries to be more flexible, tailored to the needs of these countries. I am working towards concrete progress on this front by April, when the Spring Meetings take place in Washington.

We are redoubling our efforts to support these countries through non-financing channels. We are working closely with them on crafting the appropriate policy response to the crisis, drawing on the experience of working with other countries. We are stepping up our technical assistance, including by opening four new regional technical assistance centers. We also aim to bolster the role of developing countries in the ongoing policy debate, including by speeding up reform of IMF quotas.

To discuss the challenges faced by Africa, President Kikwete of Tanzania and I are convening a major international conference in Dar es Salaam next week. We expect the conference to bring together 300 participants—policymakers from Africa and beyond, and representatives of the private sector, civil society, and foundations.

I expect this conference to be an important opportunity to exchange ideas on how best to confront this crisis. African countries will have the opportunity to learn from each other's successes and about how best to deal with the current challenges. Very importantly, I hope to learn how we at the IMF can do even more to better support African nations (as well as other low-income countries) as they meet these challenges. I want the IMF to get feedback from Africa, and frankly and candidly discuss the work that the IMF is doing in the region.

Let me conclude by reiterating my simple message today.

The world is facing an unprecedented crisis. It demands bold and concerted action. Naturally, attention has been focused on advanced economies—after all, the longer it takes for them to recover, the longer the rest of the world will suffer too. Attention has also turned, rightly so, to the impact of the crisis on emerging economies.

But now, as a third wave of the crisis is hitting the low-income countries, we cannot act as if this is a crisis of advanced economies with some impact on emerging markets-it is now a global crisis. It is our duty to ensure that the most vulnerable countries, and the most vulnerable people in these countries, are not forgotten. Now is the time for the world to come together. Now is the time to provide rapid and generous support to those countries that need it most.

Thank you.

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6220 | Phone: | 202-623-7100 | |