In 2010, the IMF Executive Board of the International Monetary Fund (IMF) made financial stability assessment under the Financial Sector Assessment Program (FSAP) a mandatory part of surveillance under Article IV for 25 jurisdictions with Systemically Important Financial Sector (SIFS). The decision to make financial stability assessments under the FSAP mandatory resulted in a more risk-based approach to financial sector surveillance and better integration of FSAPs into Article IV consultations in these jurisdictions.

The Review conducted in December 2013 used a new methodology for determining jurisdictions with SIFS. The new methodology places greater emphasis on interconnectedness—especially the structure of interlinkages that channel cross-border spillover effects. The change responds to the updated legal framework governing mandatory financial stability assessments to reflect the Integrated Surveillance Decision adopted in July 2012, highlighting the importance of spillovers in bilateral Article IV surveillance. The new methodology also expands the range of covered exposures; and considers the potential for price contagion across financial sectors while adhering to the principles of relevance, transparency, and even-handedness established by the 2010 Executive Board decision. Based on the new methodology, the list of jurisdictions with SIFS was expanded to 29 (so-called S29).

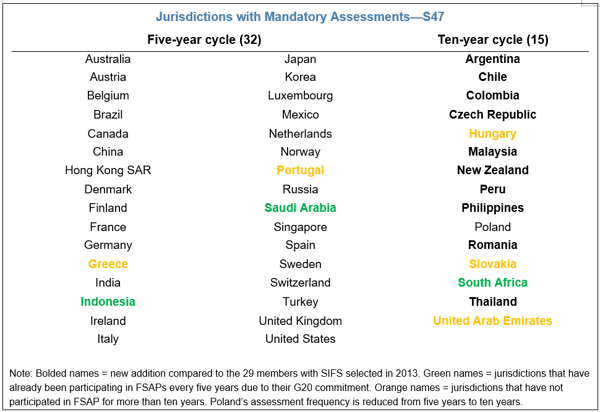

On May 12, 2021, the Executive Board concluded the quintennial Review of the FSAP and reexamined the methodology to identify SIFS and the list of members with SIFS. The Board endorsed the 2013 methodology remained adequate with a couple of minor adjustments. The Review aimed to make mandatory financial stability assessments even more risk-based, following the directions to make Fund surveillance more risk-based set in the concurrent Comprehensive Surveillance Review. The list of jurisdictions with SIFS was expanded to 47. Thirty-three jurisdictions with relatively more systemically important financial sectors would participate in FSAP every once in five years, while the other 15—many of them are emerging market economies—would participate every once in ten years. The mandatory frequencies are minimums, and assessments could be undertaken earlier if warranted. For instance, G20 members who have committed to participate in FSAP upon experiencing the Global Financial Crisis but were not part of the S29 (such as Indonesia, Saudi Arabia, and South Africa) have already participated in FSAP voluntarily regularly.