Over the past 30 years the IMF has adapted to global shocks and evolving member needs

The IMF has always adapted to the evolving needs of its member countries, responding to challenges like volatile commodity prices in the 1960s, oil price shocks in the 1970s, the debt crisis of the 1980s, and the transition from centrally planned to market economies in the 1990s.

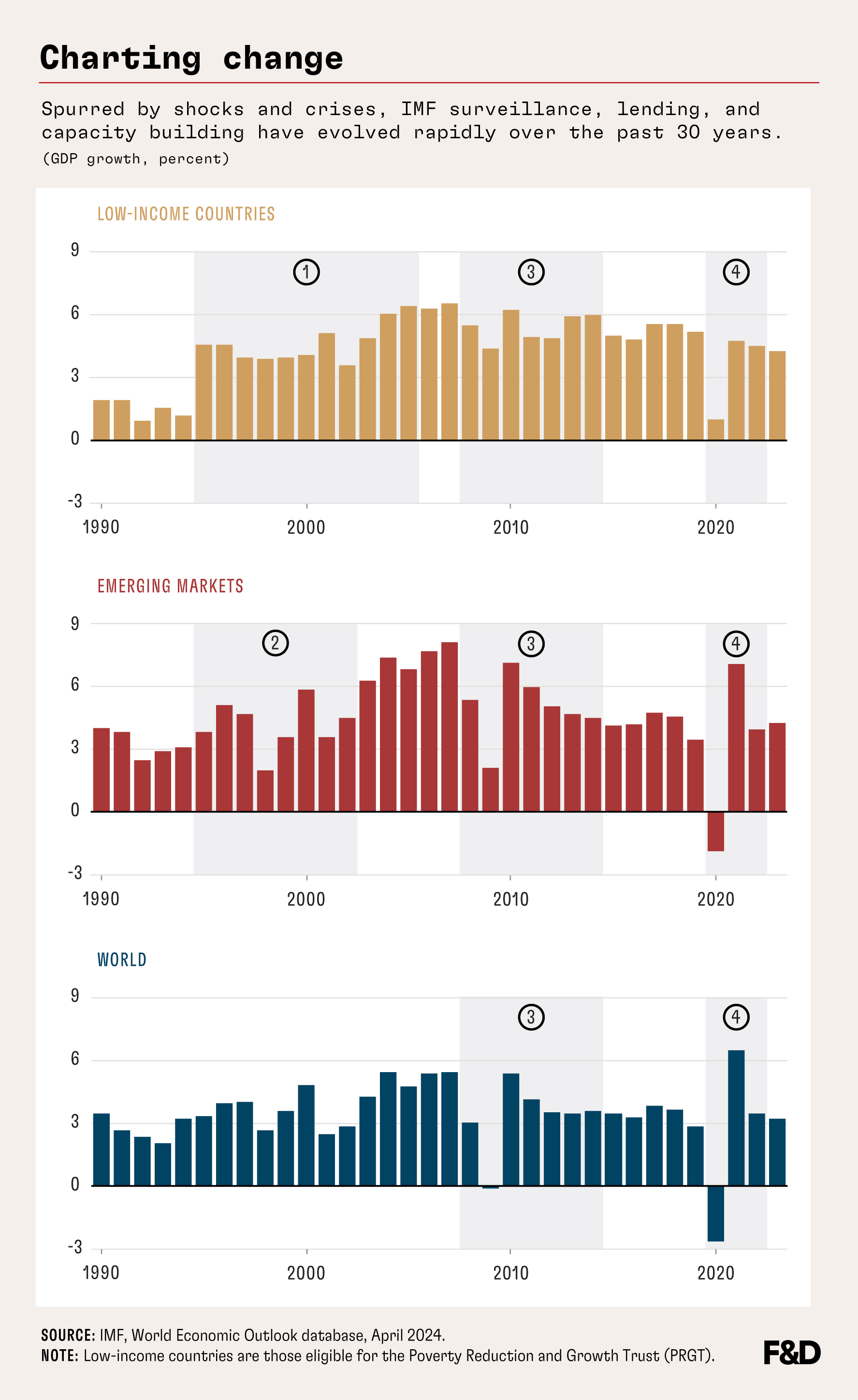

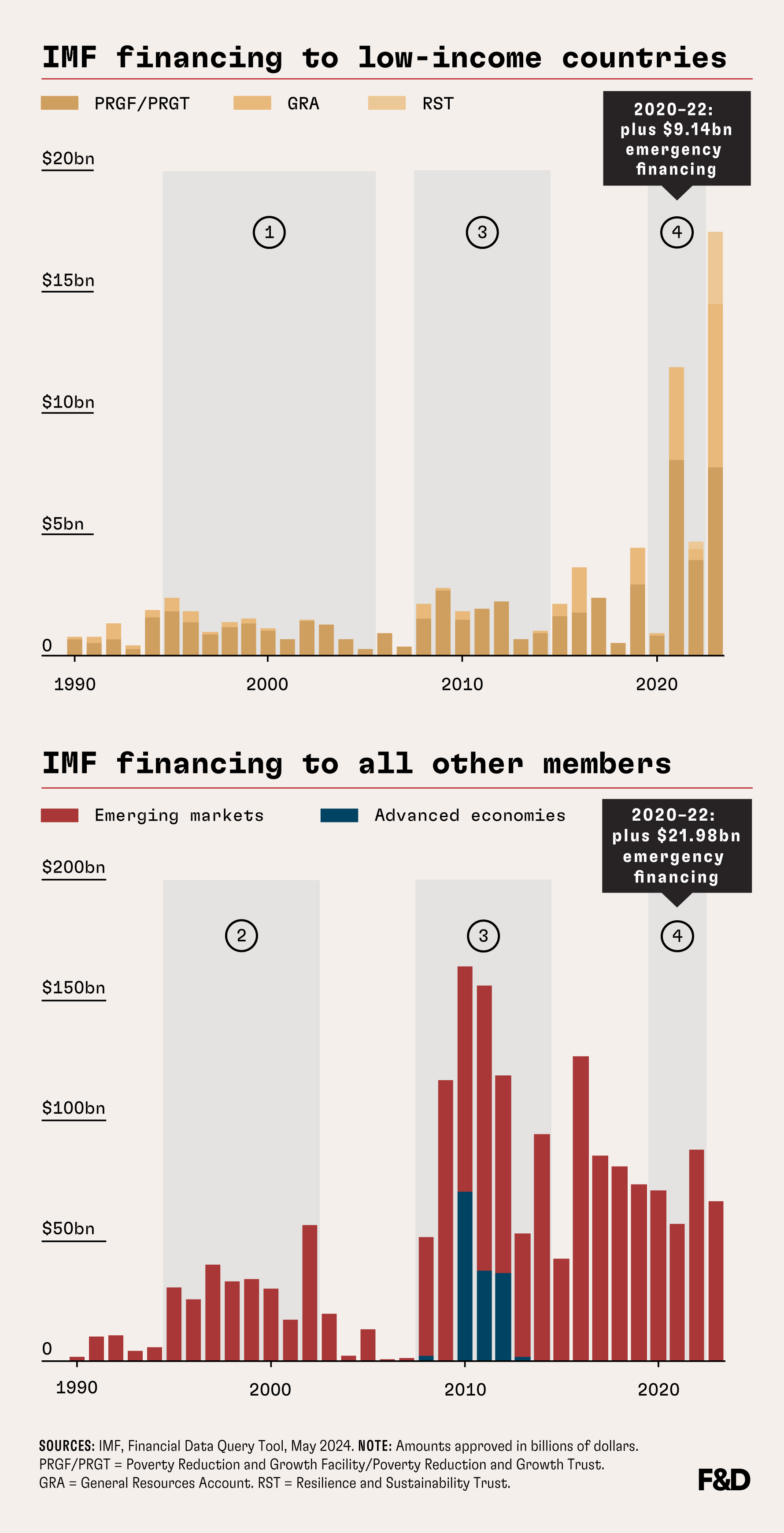

In the past 30 years, however, the pace of change has accelerated. In response to financial crises, the IMF not only stepped up lending (see charts below) but also enhanced its crisis prevention and resolution tool kits. Shifts in global economic conditions and new ways of thinking have also driven numerous reforms. For example, after a decade of sluggish growth in low-income countries in the mid-1990s, the IMF refocused its approach to prioritize growth and poverty reduction. Global imbalances emerged in the mid-2000s, and the IMF revised its surveillance framework and developed new tools to better assess exchange rates and reserve adequacy.

More recently, the IMF has helped its members address governance, gender equity, digitalization, and climate change adaptation and mitigation where these issues are macro-critical, alongside providing advice on macroeconomic, financial, and exchange rate policies. As the global landscape continues to evolve, the Fund remains committed to its mission, constantly innovating within its mandate to promote both domestic and external economic and financial stability. With this commitment, the IMF is well prepared to meet the complex challenges of today and the unforeseen events of tomorrow.

1. 1995-2005: Low-Income-Country Lending Reforms

In response to poor macroeconomic performance and declining per capita incomes during the debt crisis, the IMF reformed its lending tool kit in the mid-1990s to focus on growth and poverty reduction for low-income countries. It also extended full debt relief on outstanding obligations.

2. 1995-2002: Emerging Market Financial Crises

The emerging market financial crises prompted the IMF to enhance its exchange rate and financial sector surveillance, develop early-warning models, focus on debt sustainability and sectoral balance sheet analysis, and improve data provision and dissemination. The IMF streamlined its conditionality and created contingent financing instruments for countries with strong policies but suffering contagion from crises in neighboring countries or global shocks.

3. 2008-2014: Global Financial Crisis

During the Global Financial Crisis, the IMF increased its lending, streamlined conditionality, enhanced its tool kit, and issued $284 billion worth of special drawing rights (SDRs). It improved its crisis prevention tools and surveillance framework to better capture cross-border spillovers and help countries manage volatile capital flows.

4. 2020-2022: COVID-19 Pandemic

During the pandemic, the IMF swiftly provided unprecedented emergency financing and suspended debt-service payments for its poorest members. It also issued $650 billion worth of SDRs, with the RST allowing wealthier members to channel SDRs to countries in greater need.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.