IMF Spring Meetings Update | April 12, 2023

In our daily recap for Wednesday, April 12, we spotlight support for low-income countries, public debts and deficits, artificial intelligence, crypto’s pains and possibilities, Ukraine, public spending, and much more.

Kristalina Georgieva Calls For Support For Poor Nations

The IMF’s Managing Director called on the international community to support the world’s poorest countries by helping to close a funding gap facing the Poverty Reduction and Growth Trust, the Fund’s main instrument to support low-income countries. Speaking at the start of a session on concessional financing, Kristalina Georgieva said that low-income countries had been impacted severely by multiple economic shocks in recent years and their average per-capita income is expected to rise at the slowest pace since 1990, hindering their aspirations to catch up with richer economies. Since the start of the pandemic, the IMF has provided $24 billion in support through the PRGT, but higher international interest rates have raised the cost of borrowing and increased the funding gap.

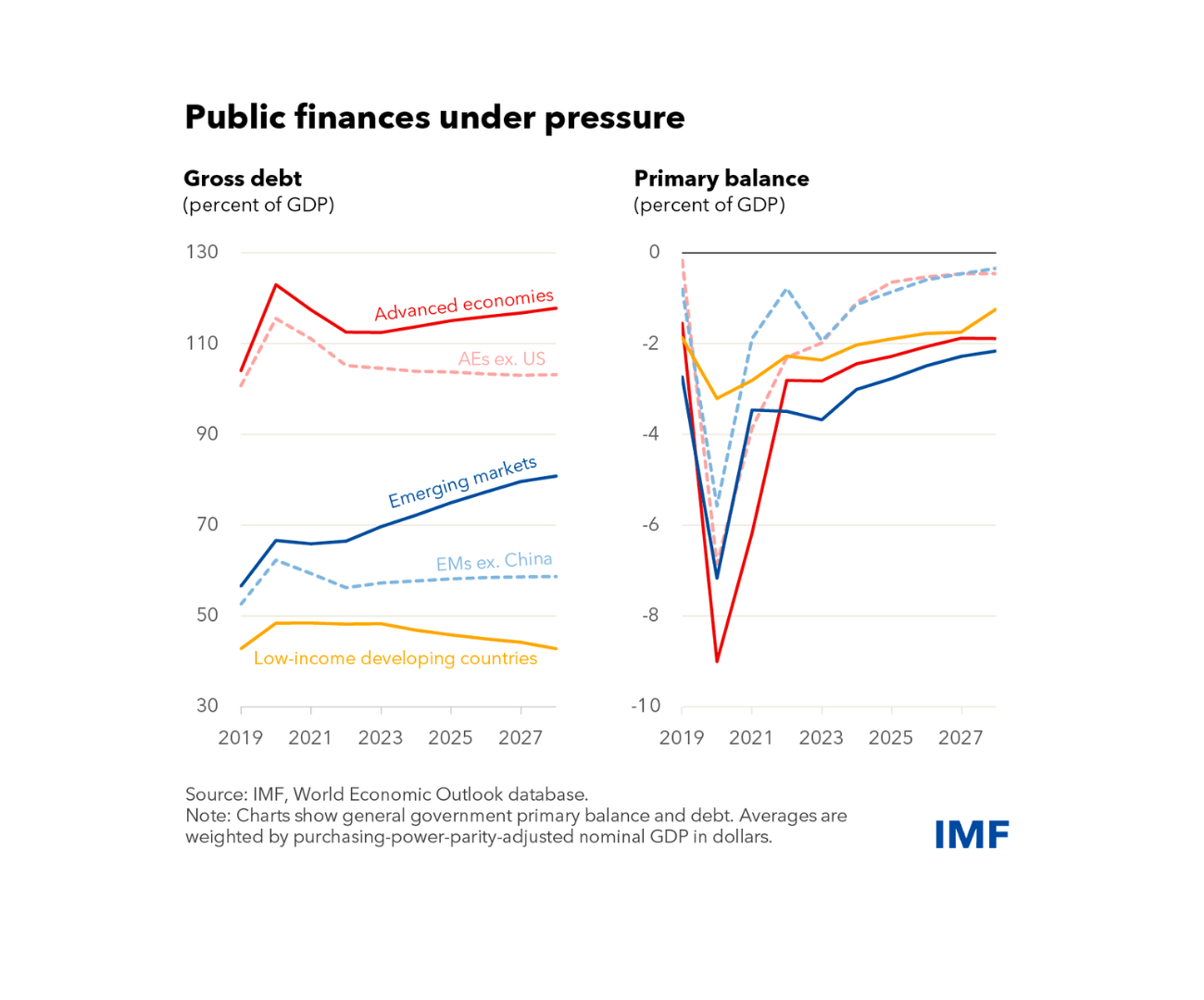

Fiscal Policy Can Promote Economic Stability and Address Risks to Public Finances

Fiscal policy has moved a long way toward normalization since the pandemic, said Vitor Gaspar, director of the IMF’s Fiscal Affairs Department, at a press briefing on the IMF’s latest Fiscal Monitor. Governments have withdrawn exceptional fiscal support, and public debt and deficits are falling from record levels. That’s happening amid high inflation, rising borrowing costs, a weaker growth outlook, and elevated financial risks. Debt sustainability is a cause for concern in many countries. Policymakers should prioritize keeping fiscal policy consistent with central bank policies to promote price and financial stability,” Gaspar said. “Tighter fiscal policies require better-targeted safety nets to protect the most vulnerable households, including addressing food insecurity, while containing overall spending growth, as governments are likely to confront social pressures to compensate for past increases in the cost of living."

Number of the Day

$1=$5

Every dollar committed in subsidies to the IMF’s Poverty Reduction and Growth Trust translates into $5 of interest-free lending to the world’s poorest countries.

Learn more

Ministerial Roundtable on Ukraine

President Volodymyr Zelensky described the terrible toll of Russia’s invasion and his country’s large reconstruction needs at a ministerial roundtable, co-chaired by the Ukraine government, World Bank and IMF. “The faster and more effective the solutions are the more reliable and long-lasting peace after this war will be,” he said. IMF Managing Director Kristalina Georgieva highlighted a recently approved program under the Extended Fund Facility worth a total of $15.6 billion in her remarks. “With its actions, Ukraine has earned strong international support and the IMF is proud to be part of it.”

Finance Ministries Face Mounting Spending Pressures

Multiple economic crises over the past few years have increased spending pressures on governments. At a panel discussion focused on the importance of spending well and spending with accountability, IMF Deputy Managing Director Antoinette Sayeh said that governments across the world spent $17 trillion to lift their economies after the pandemic. This has put pressure on policymakers, as they try to maintain fiscal responsibility while supporting the most vulnerable people. Albania’s Delina Ibrahimaj added that finance ministers around the world have had to be “superheroes” over the past few years, as they grapple with the challenge of building buffers, while dealing with immediate and future crises. Nancy Gathungu, Kenya’s auditor-general, emphasized the importance of communications and simplifying the language around spending and audits. She also stressed that governments should engage citizens and make them part of the audit process.

Banks Are Stronger Today Than in 2008

Despite recent stress in the financial sector, the global banking sector is not on the cusp of a major crisis, Bank of England governor Andrew Bailey said in a Governor Talk. Banks are in a much stronger position today than in 2007-08 and regulators have more weapons to fight off instability, Bailey told Alfred Kammer, director of the IMF’s European Department. “We’re in a very different place and I really don’t see this as the beginnings of a systemic financial crisis.” But Bailey said that authorities should learn from the speed at which depositors withdrew funds from Silicon Valley Bank, one of three US lenders to have collapsed since March, and stressed the importance of communication to reassure markets. Even as banks come under stress, authorities should not overlook risks coming from the non-bank sector, including crypto assets, money-market funds and open-ended funds, Bailey added.

Quote of the Day

There are three types of debt—good debt, bad debt, and ugly debt. There is a need to work on all three types to unlock productivity and growth.

CEYLA PAZARBASIOGLU, DIRECTOR OF THE STRATEGY, POLICY, AND REVIEW DEPARTMENT, IMF

Artificial Intelligence’s Winners and Losers

At a New Economy Forum discussion of artificial intelligence, attendees watched a thought-provoking video in which a ChatGPT-like AI generative tool described the progress it has made and the inevitable disruptions it will cause, resulting in both winners and losers. Anton Korinek of the Brookings Institution emphasized the exponential growth of generative AI and encouraged everyone to embrace these tools in their daily work. But he said policies should be put in place to address disruptions to labor markets and financial systems. Yale’s Hélène Landemore stressed the importance of investing in flawed democratic systems to make them more inclusive and better able to cope with the challenges that AI poses. Murielle Popa-Fabre of the Council of Europe agreed there would be winners and losers. People should prioritize cognitive training and refine their human qualities to remain unpredictable and distinct from AI robots, she said.

The Future of Crypto Assets

Crypto assets will boom again despite the sector’s near implosion last year when it lost around $2 trillion of value, panelists told a New Economy Forum. A new technology revolution is underway, powered by a growing class of young crypto natives who own these assets and believe that it is the future of finance, said Linda Jeng of the Crypto Council for Innovation. “We are heading into a world of programmable money.” Yet many of crypto’s issues are identical to those seen for decades. “We’re painfully relearning the same lessons we’ve learned in traditional finance—issues around old-fashioned types of risks,” such as inappropriate business models, liquidity and maturity mismatches, extensive leverage, and inadequate consumer and investor protection, said the Financial Stability Board’s Rupert Thorne.

CHART of the Day

Global debt posted the steepest decline in 70 years and stood at 92 percent of GDP at the end of last year, as nearly three-quarters of countries tightened both fiscal and monetary policies.

Our Chart of the Day shows that public debt and deficits are reverting to pre-pandemic levels, but in many countries, debt dynamics are projected to deteriorate over the medium term.

Learn more

Photos

Attendees enjoy a reception at the Morocco Pavilion.

US Secretary John Kerry Walks through the IMF building after a meeting during the 2023 Spring Meetings

IMF staff find their countries’ respective flags outside of the IMF building.

Upcoming Events

Press Conference: Economic Outlook for the Middle East & Central Asia

Tune in for this press conference with Jihad Azour, director of the Middle East and Central Asia Department.

Event Details

Press Conference: Asia and Pacific Department

Join us for the press briefing by Krishna Srinivasan, Director of the IMF’s Asia and Pacific Department.

Event Details

Young Entrepreneurs and Digital Transformation in the Middle East and North Africa

Our panel will discuss clean energy finance in the geopolitical context.

Event Details