IMF Spring Meetings Update | April 10, 2023

In our daily recap for Monday, April 10, we spotlight the dangerous divergence between the world’s developing and emerging economies, daunting digital investment needs, public debt, interest rates, the Financial Times’ Gillian Tett on anthropology and economics, and much more.

Holistic Perspectives in Economics

Anthropology offers important insights into public policy challenges, noted author and Financial Times journalist Gillian Tett in a discussion with the IMF’s Sabina Bhatia. Tett gave an anthropological perspective on today’s key economic issues, including the collapse of Silicon Valley Bank, pandemic-preparedness, and climate change. Every industry and profession has its own culture, but they have limitations and must avoid tunnel vision, she said. This necessitates looking at the world through other people’s eyes and absorbing other perspectives. For economists, this also means avoiding narrow economic models and being aware of other relevant elements, such as climate change and technological innovations.

Global Economy’s Slow Growth Poses Challenges for Poorer Nations

A robust recovery of the global economy remains elusive as a rapid transition to higher interest rates exposes financial vulnerabilities, the IMF’s Managing Director said on Monday. Speaking to World Bank President David Malpass, Kristalina Georgieva said that the global economy’s slow pace of projected growth over the next five years posed particular challenges for the world’s poorest countries. A ”dangerous divergence” has opened between the prospects of developing and emerging-market economies, with average incomes in low-income countries’ growing too slowly to converge with those of middle-income countries, she said.

Quote of the Day

Anthropology plus economics can be a powerful way to have checks and balances and to get more than one perspective

GILLIAN TETT, AUTHOR AND JOURNALIST AT THE FINANCIAL TIMES

How To Tackle Soaring Public Debt

Governments can reduce debt with well-timed and well-designed adjustments to fiscal policy, but countries in distress need a more comprehensive approach, IMF economists write in a blog. A sharp rise in interest rates and the strong US dollar are adding to the costs of servicing public debt, which soared to record highs during the pandemic, topping global gross domestic product. An analytical chapter of the World Economic Outlook explores what policies work best to durably reduce debt relative to GDP. The authors find that a fiscal contraction of about 0.4 percentage point of GDP—the average size in their sample—lowers the debt ratio by 0.7 percentage point in the first year and up to 2.1 percentage points after five years.”

Interest Rates Rises Likely to Be Temporary

As inflation is brought back under control, advanced economies’ central banks are likely to reverse recent rises in interest rates, but how far depends on the persistence of public debt and the extent of financial fragmentation, IMF economists write in a blog. Since the mid-1980s, real interest rates across advanced economies have been steadily declining, most likely reflecting a decline in the natural rate, or the real interest rate that would keep inflation at target and the economy operating at full employment—neither expansionary nor contractionary. An analytical chapter of the latest World Economic Outlook explores the forces that have driven the natural rate in the past and the most likely future path for real interest rates in advanced and emerging market economies.

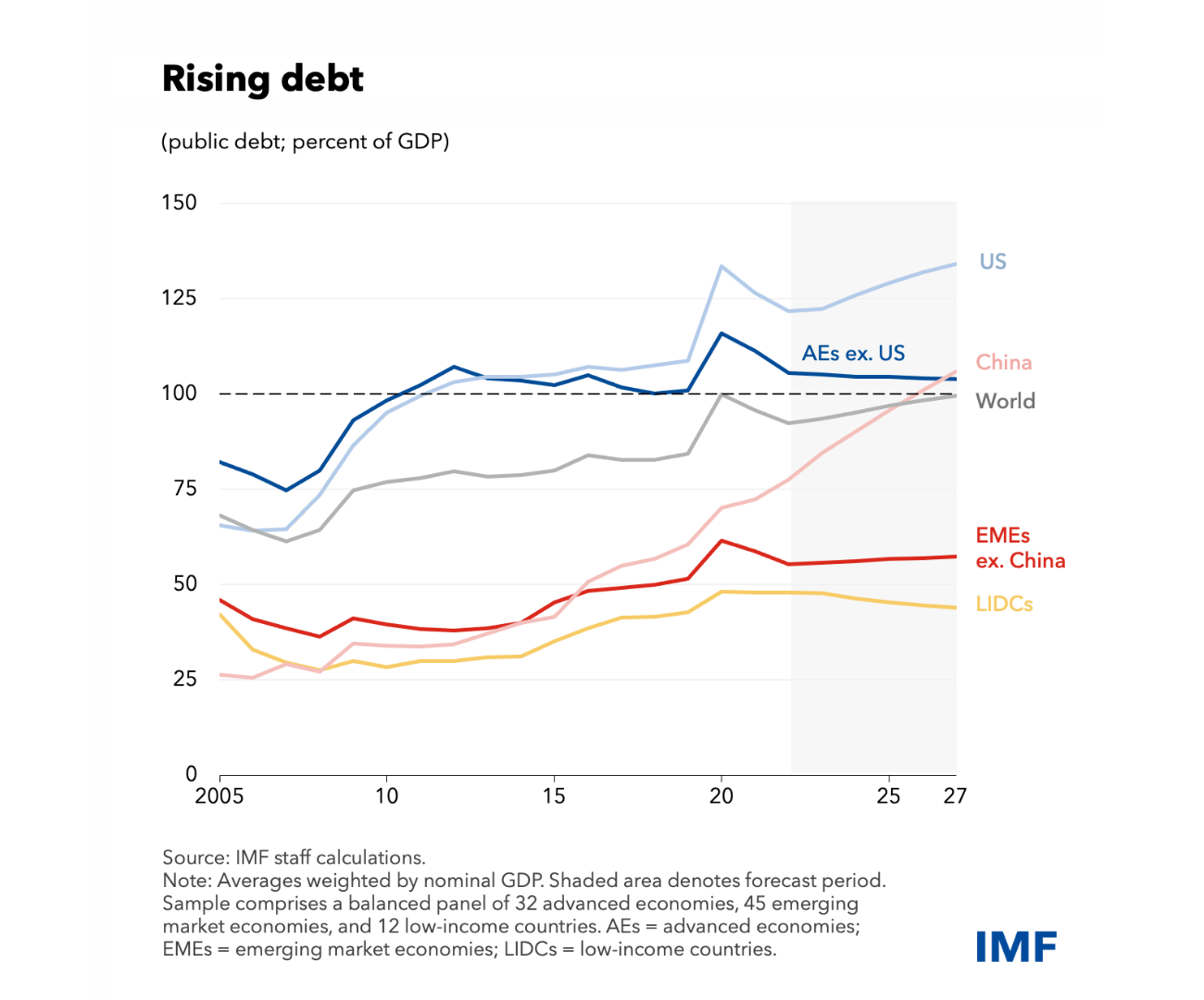

CHART of the Day

Public debt soared to a record during the pandemic, topping global gross domestic product. Now, with government debt still elevated, the rise in interest rates and the strong US dollar are adding to interest costs, in turn weighing on growth and fueling financial stability risks.

Our Chart of the Day shows that public debt hit a high in 2020 and is still rising in some countries.

Learn more

Public Debt Dynamics

As emerging markets and developing economies face higher risks of debt distress, the IMF’s Institute for Capacity Development has created a Public Debt Dynamics Tool to help governments project the debt to GDP ratio. IMF economists explained how to use this tool, and how it can be customized to look at various scenarios, such as the impact of natural disasters or commodity price shocks on public debt. The IMF offers training in the tool as part of its efforts to provide capacity development on public debt issues.

World's Daunting Digital Infrastructure Needs

An estimated $400 billion is needed for digital infrastructure globally, but the growth opportunities are enormous, said the IMF’s Mariano Moszoro during an Analytical Corner presentation. Moszoro estimated the annual gains from increased internet connectivity in low-income developing countries and emerging market economies could be as much as $2 trillion. Affordability is a major challenge, however. Mobile broadband prices have dropped by more than half since 2015. But relative to per capita income, the average mobile broadband price is still about nine times higher in developing economies than in advanced economies. Subsidies could help but our calculations show that subsidies would amount to 2% of GDP in low-income countries, said Moszoro.

Number of the Day

400BILLION

Around $400 billion is needed for digital infrastructure globally, but the growth opportunities are enormous, the IMF’s Mariano Moszoro said in an Analytical Corner presentation.

Learn more

Photos

IMF Managing Director Kristalina Georgieva attends the 2023 Global Parliamentary Forum with World Bank President David Malpass.

Participants wait in line to pick up their credentials for the 2023 Spring Meetings.

Spring Meetings signs are installed on the IMF building in Washington DC.

Upcoming Events

Press Briefing: World Economic Outlook

Watch Chief Economist Pierre-Olivier Gourinchas present our latest global growth projections and key policy recommendations.

Event Details

Press Briefing: Global Financial Stability Report

What challenges do higher inflation and interest rates pose for global financial stability? Tune in to the press briefing on April 11, 10:30 AM ET.

Event Details

IMF Seminar: Climate Finance and Energy Security

Our panel will discuss clean energy finance in the geopolitical context.

Event Details