IMF SPRING Meetings Update | April 18, 2022

In our daily recap for Monday, April 18, we spotlight a high-level panel discussion on digital money featuring central bankers from Brazil and Singapore and India's finance minister, a conversation on girls' education between Malala Yousafzai and IMF head Kristalina Georgieva, how record private debt will slow the global economic recovery, the risks facing emerging-market banks from their holdings of government debt, and much more.

Money at the Crossroads

Roberto Campos Neto, President of the Central Bank of Brazil, Ravi Menon, Managing Director of the Monetary Authority of Singapore, and India’s Minister of Finance Nirmala Sitharaman joined Kristalina Georgieva for a discussion of digital money moderated by Gillian Tett of the Financial Times. Georgieva said the IMF is expanding its work on digital money in several areas, including striking the right balance in international regulation and the risks to the monetary sovereignty of smaller nations. "Disruptive is good but destructive is bad," she said.

GEORGIEVA AND YOUSAFZAI ON GIRLS' EDUCATION

Malala Yousafzai on Monday called on world leaders to increase financing for global education, especially girls’ education. The Nobel Peace Prize Laureate said donor countries should give at least 0.7% of their gross domestic product in foreign aid, including for education for marginalized groups, and that debt relief could help developing countries to fund learning. “We know that developing countries have huge debts that they have to pay back and most of them then have to sacrifice things like education and health,” Yousafzai said in a conversation with IMF Managing Director Kristalina Georgieva.

Emerging-Market Banks’ Government Debt Poses Risks

Governments succeeded in lessening the economic pain of the pandemic by providing plenty of liquidity to stricken consumers and businesses through credit guarantees, concessional lending and moratoriums on interest payments. But although these policies proved effective in supporting balance sheets, they led to a spike in private debt. Recent levels of leverage could slow economic recovery by 0.9% of GDP in advanced economies and 1.3% in emerging markets over the next three years, the IMF’s Silvia Albrizio, Sonali Das, Christoffer Koch, Jean-Marc Natal, and Philippe Wingender write in a blog based on the World Economic Outlook's Chapter Two.

SPIKE IN PRIVATE DEBT TO WEIGH ON GLOBAL RECOVERY

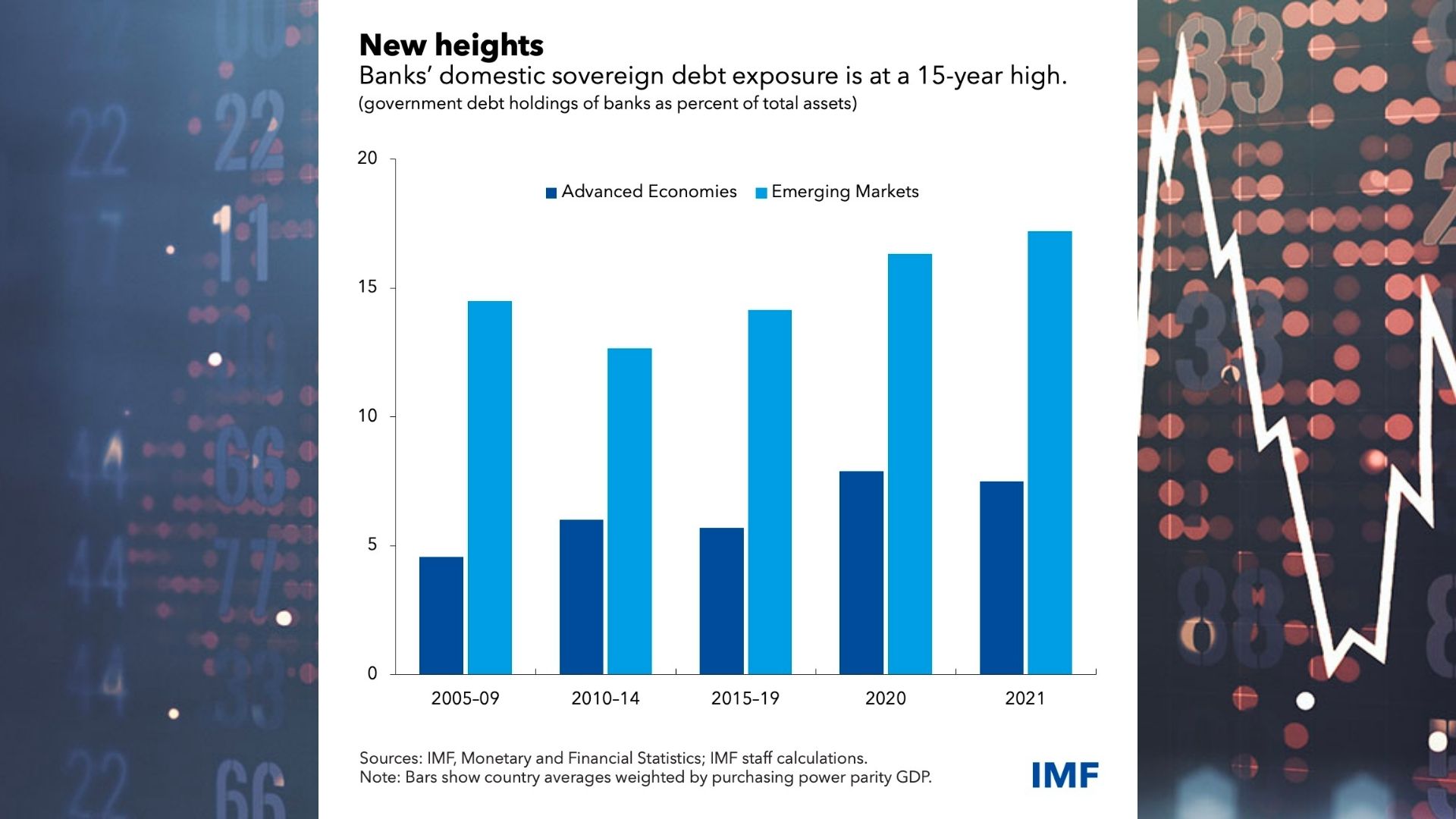

The pandemic has left emerging-market banks holding record levels of government debt, increasing the odds that pressures on public-sector finances could threaten financial stability. Economists call this interdependence between banks and governments the “sovereign-bank nexus,” because government debt is also known as sovereign debt—a vestige of the Middle Ages, when kings and queens did the borrowing. In a new blog based on Chapter Two of the April 2022 Global Financial Stability Report, the IMF’s Andrea Deghi, Fabio Natalucci, and Mahvash S. Qureshi say authorities should act quickly to minimize the risks.

Quote of the Day

If you educate all girls and give them access to quality education, you add up to $30 trillion dollars to the world economy.

MALALA YOUSAFZAI, CO-FOUNDER AND BOARD CHAIR, MALALA FUND

Photos

Behind the scenes at the IMF Spring Meetings 2022.

Malala's books were on display at the set of the IMF Inspired: Breaking Barriers event.

A GLIMPSE INSIDE THE IMF multimedia studio at the 2022 Spring Meetings.

Number of the Day

>100countries

Over 100 countries in the IMF's membership are at some point of exploring a Central Bank Digital Currency. At the head of the pack is the Bahamas, the first country to introduce the Bahamas Sand Dollar.

Learn more

SIGN UP FOR OUR DAILY NEWSLETTER

Sign up to our special daily briefing to help guide you through our April 2022 Spring Meetings—pointing to all of the key publications, live events and more.

Sign UP

Upcoming Events

Press Briefing: World Economic Outlook

IMF Chief Economist Pierre-Olivier Gourinchas, Petya Koeva Brooks, and Malhar Nabar present the latest forecast for the global economy.

Event Details

Press Briefing: Global Financial Stability Report

Press briefing and launch of April 2022’s issue of the Global Financial Stability Report.

IMF Seminar: New Forms of Digital Money

Kristalina Georgieva (IMF) and Agustín Carstens (BIS) discuss the issues policymakers will need to confront in the coming years on new forms of digital money.

Event Details