Short-term Policy Responses to Geoeconomic Shocks in CESEE Countries

February 26, 2025

It is a great pleasure to open this session.

Let me begin by setting the stage for what I hope will be an insightful discussion on short-term policy responses to geoeconomic shocks. I will focus on the Central, Eastern, and South Eastern European (CESEE) countries.

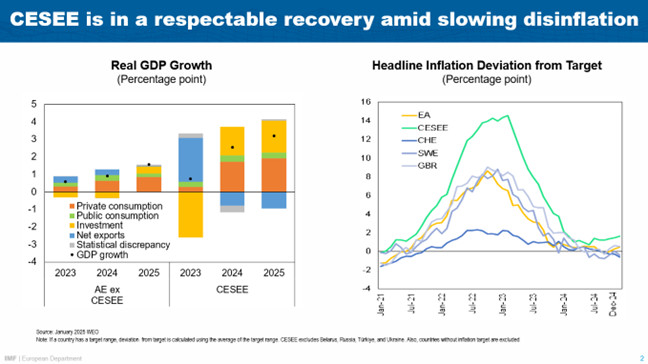

The CESEE region experienced a respectable recovery last year with growth accelerating from 0.8 percent in 2023 to 2.5 percent in 2024.

As expected, the composition of growth changed. Domestic demand (consumption and investment) rebounded, while net exports—which had been a key driver in 2023—turned into a drag.

Supportive fiscal policies at both the national and EU level played a role alongside a strong labor market and disinflation aided by tight monetary policy.

However, the growth momentum is weakening.

Geoeconomic fragmentation, linked to both Russia’s war in Ukraine and trade policy uncertainty, is weighing on demand.

In my remarks today, I will address three key questions:

- How much can the CESEE region rely on domestic and external demand for a continuation of the cyclical recovery into 2025?

- How well-prepared is the region to handle external demand challenges arising from geoeconomic fragmentation? And,

- What can policymakers do in the short term?

Let me start with the first question.

How much can the CESEE region rely on domestic and external demand to support growth in 2025?

Our baseline forecast assumes moderate growth in 2025 at around 3 percent, supported by some remaining pent-up demand.

However, the cyclical recovery has largely run its course for three reasons.

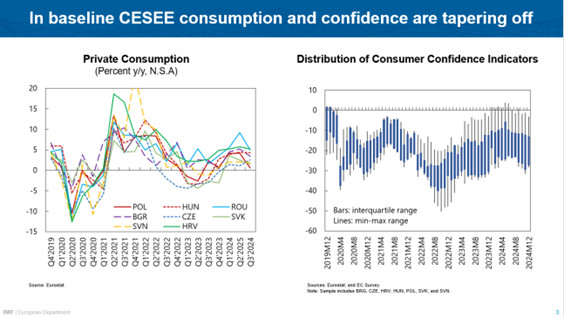

- First, the recovery in household spending is nearly complete. While strong wage and income growth initially supported consumption, momentum is fading as wage growth slows alongside inflation. Additionally, upward shift in uncertainty has also raised precautionary savings, dampening spending. This is unlikely to change anytime soon.

- Second, business investment is not expected to accelerate further. Despite improved financing conditions from less restrictive monetary policy, firms remain cautious due to diminished growth expectations and uncertainty about trade policies and EU reforms.

- Third, external demand remains weak, limiting the region’s ability to rely on exports for additional growth.

Let me add two more observations:

Not all CESEE countries face the same challenges.

Albania, Croatia, Montenegro, Bosnia and Herzegovina, will continue to benefit from remittances, EU support, and tourism revenues, offering them some insulation from external risks.

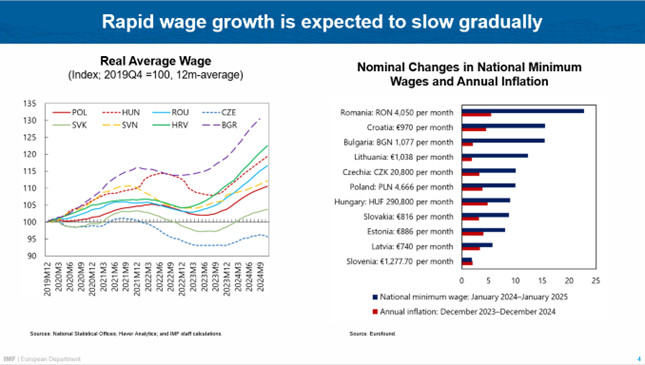

However, others will be impacted by the effects of the strong nominal wage growth over the last few years.

- Poland, Romania, Bulgaria, and Hungary saw wages grow by more than 10 percent last year, partly due to the ripple effects of large public sector and minimum wage increases (RHS).

But we do not expect the earning gains to translate into faster consumption growth.

- For one, minimum wage increases are unlikely to be repeated. More broadly, household incomes will grow much more slowly in 2025 as wage negotiations follow inflation, which is slowing down.

- In addition, like elsewhere, households have changed their savings behavior and are spending less out of their earned income, likely due to the lingering memory of recent income shocks and uncertainty about external developments.

Taken together this means that with a few exceptions the region’s recovery momentum is weakening.

Let me now turn to the second question.

How well-prepared is the region to handle external demand challenges arising from geoeconomic fragmentation?

The region faces three key vulnerabilities in the face of geoeconomic fragmentation:

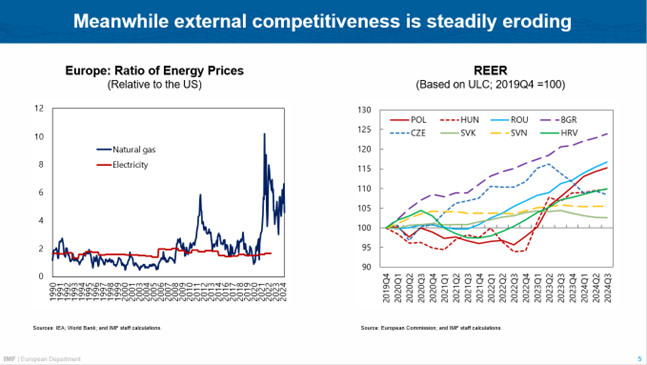

One, rising labor and high energy costs are eroding competitiveness.

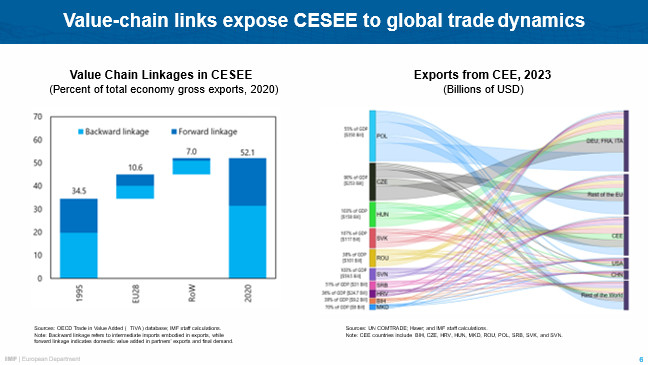

Two, high trade openness and deep integration into global value chains—once advantages during globalization—now heighten exposure to external demand shocks in times of de-globalization, and

Three, there is limited room from returning to accommodative macroeconomic policies.

Let me start with a word on cost competitiveness.

Export growth has stalled across the region with net exports subtracting about ½ percentage point from GDP growth last year.

Several adverse cost developments weigh now on CESEE’s competitiveness:

- Energy costs in Europe remain significantly higher than in the US—nearly five times more for natural gas and more than double for electricity (CHART).

- The level of labor costs is becoming a headwind. The real effective exchange rate (REER) relative to unit labor costs (CHART) has deteriorated for the region.

- Additional wage increases and persistently higher energy prices could translate into higher production costs and, eventually, higher final prices—just as external demand conditions are weakening.

These cost pressures have significant economic implications. If the REER continues to appreciate by 2 percentage points per year, as observed over the past five years, export growth could be dampened by approximately 0.6-0.8 percentage points per year.

Beyond costs, the CESEE region’s integration into global value-chains and trade linkages create exposure to shifting trade dynamics.

A recent IMF study shows that Chinese EV imports could have very large GDP effects on CESEE countries through the supply chain.

For example, the estimated negative impact on Hungary and the Czech Republic from a shift to EVs is about 10 times larger than in advanced European economies, reducing GDP by 1.5 to 2.0 percent (cumulatively) over 5 years. For these countries and sectors to adjust, retaining cost competitiveness plays an important factor.

Now to the third question:

What can policymakers do in the short term?

After waves of external shocks, reducing uncertainty through clear communication is crucial. Governments should focus on reinforcing fundamentals, pursuing credible and sustainable macroeconomic policies, and building resilience.

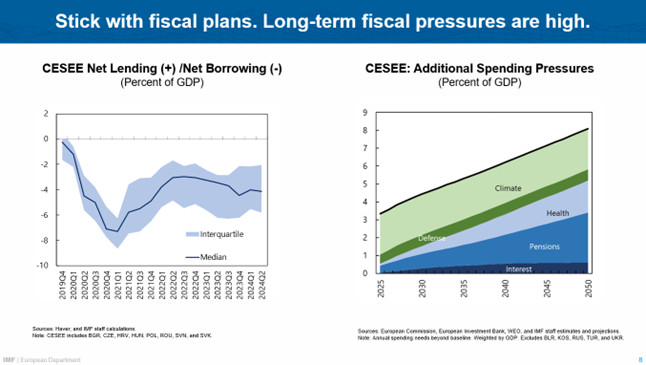

Fiscal consolidation is necessary, but it is not sufficient.

Despite the recovery, fiscal balances have not improved (LHS) and long-term fiscal spending needs remain high [RHS]. They are mostly aging-related (health and pensions), security related (defense) and climate-related.

An important discussion to be had is on the next EU budget, including on expenditures on European public goods, such as defense and the environment.

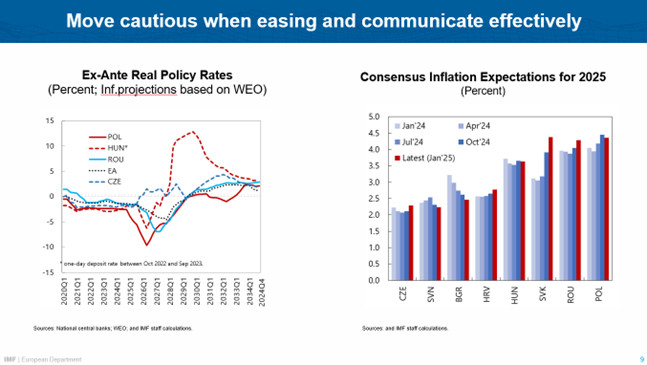

Monetary policy needs to move cautiously in removing its restrictive stance.

While weakening of external demand is likely to be disinflationary (barring sharp currency depreciations), inflation persistence remains a concern. This is especially the case in countries where inflation expectations remain above inflation targets (RHS) and where sustained wage growth is not supported by productivity gains.

Growth-oriented reforms and moderation in public sector wage raises—serving as signals to the private sector—are key.

Two observations on the role of central banks:

- Effective communication is crucial. Given the uncertainty, central banks must clearly communicate policy intentions to steer expectations. To clarify policy responses sensitivity analyses or scenarios are useful.

- Maintaining central bank independence is essential. Pressures on institutional independence have risen in several countries. Research shows that lower trust in central banks increases the costs of achieving price stability, a risk that the region cannot afford.

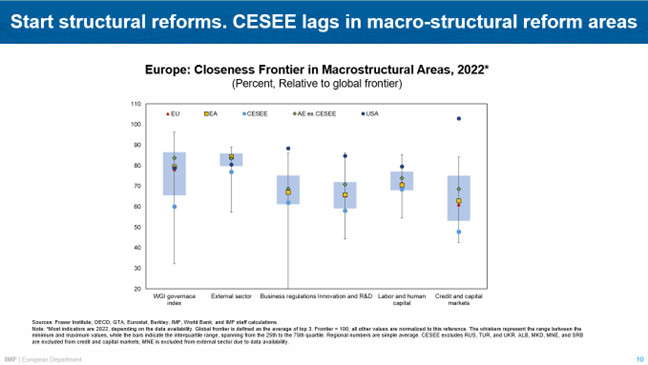

And last but not least in terms of policy priorities, countries need to accelerate structural reforms, to raise their growth potential and strengthen economic resilience.

We are currently undertaking new work on assessing national structural reform priorities across Europe. (This complements work on what can be done at the EU level).

This work finds that the CESEE region lags behind its European and global peers in almost all areas (see chart).

Governance and trade-related barriers are two areas where gaps are large. Similarly, credit and capital markets remain underdeveloped notwithstanding healthy banking sectors.

These gaps limit growth potential but can be addressed with limited fiscal costs. Targeted reforms could unlock investment and long-term competitiveness gains.

Thank you.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org