IMF Executive Board Completes the Second Review under the Extended Credit Facility Arrangement for Burkina Faso

December 19, 2024

- The IMF Executive Board today completed the second review under Burkina Faso’s Extended Credit Facility arrangement, thereby enabling an immediate disbursement of about US$31.4 million.

- Burkina Faso’s performance under the program has been satisfactory. The authorities met all quantitative performance criteria, all indicative targets but one, and most structural benchmarks. The remaining structural benchmarks were implemented with delay. The authorities are progressing in their structural reform agenda, including on fiscal governance, while increasing social and development spending in a difficult context.

- The volatile security situation continues to weigh on economic activity, especially gold mining, which remains a vital sector for the economy.

Washington, DC: The Executive Board of the International Monetary Fund (IMF) completed the Second Review under the 48-month Extended Credit Facility (ECF) arrangement that was approved on September 21, 2023. The completion of the second review enables the immediate disbursement of about US$31.4 million (SDR 24.08 million), bringing total IMF financial support under the arrangement to about US$ 94.3 million (SDR 72.24 million).

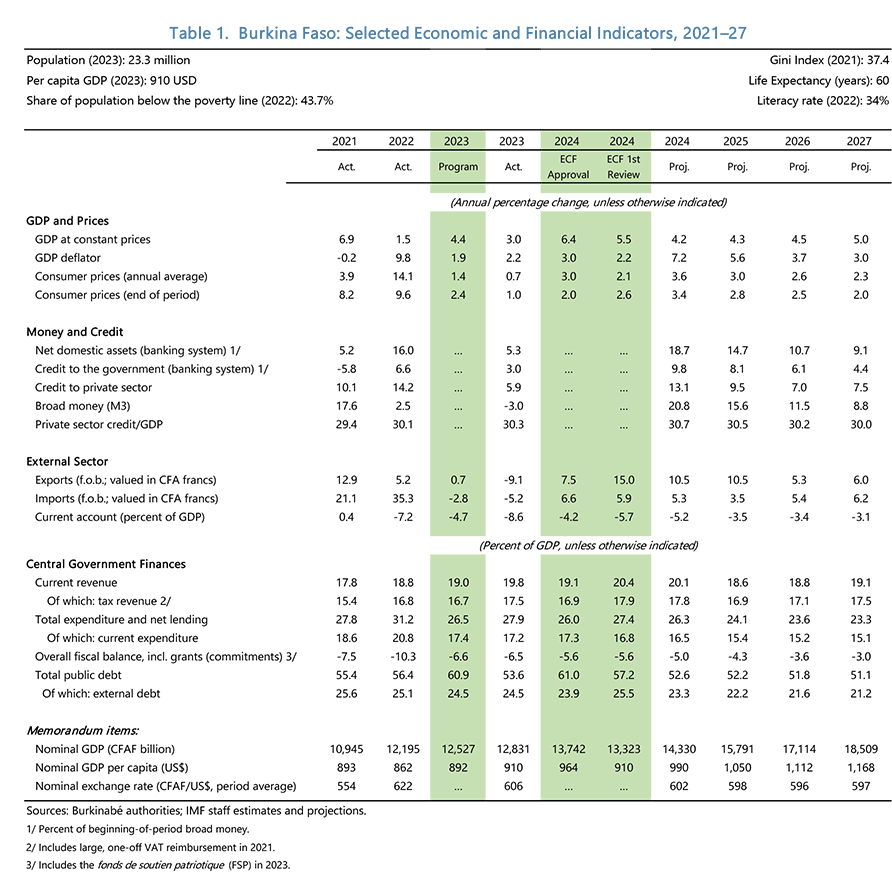

Conflict and adverse climate conditions continue to hamper economic growth and living conditions. With real GDP growth in 2023 revised down to 3.0 percent from 3.6 percent, it is projected to rise to a moderate 4.2 percent in 2024 and 4.3 percent in 2025. The volatile security situation has had a negative impact on key sectors, especially gold mining. Inflation has accelerated and is expected to rise to 3.6 percent on average in 2024 largely due to food price increases. The current account deficit is expected to improve from 8.6 percent of GDP in 2023 to 5.2 percent in 2024 supported by higher gold prices despite weaker gold production. Fiscal performance remains strong, supported by robust revenue collection. As a result, the overall fiscal deficit is projected to improve from 6.5 percent of GDP in 2023 to 5.0 percent in 2024. The financial sector weakened amid lower capital adequacy and higher non-performing loan ratios. Risks to the outlook are tilted to the downside due to continuous threats of terrorist attacks, which weigh on mining and agriculture, impact government revenues, and add to spending pressures.

Progress under the ECF arrangement has been satisfactory. The authorities have met all six quantitative performance criteria and indicative targets for end-June 2024, except for the indicative target on the non-accumulation of domestic arrears. They advanced their structural reform agenda, meeting five out of seven structural benchmarks for the second review. The structural benchmark for the audit of government arrears was not met but completed with delay. The tripartite performance contract with the state-owned energy companies was a prior action. The authorities have provided a closing report and an audit of measures under the IMF Food Shock Window. They focus on improving fiscal governance and transparency, adding four structural measures, including in the areas of procurement and treasury management, to their program at this review.

At the conclusion of the Executive Board’s discussion, Mr. Kenji Okamura, Deputy Managing Director, and Acting Chair, issued the following statement:

“Burkina Faso continues to face a fragile security situation on top of large development needs and recurring adverse climate events. A substantial and lasting economic recovery will require meaningful progress on security, as well as structural reforms on fiscal governance, economic diversification, and fostering resilience to climate change. These reforms will help create the foundation for stable and inclusive medium-term growth, which is necessary for lifting living standards.

“Despite the challenging context, program implementation has been broadly satisfactory. Given the still significant downside risks, a resolute commitment by the authorities to continued prudent fiscal policies and to their reform agenda is critical for maintaining debt sustainability, improving the macroeconomic outlook, catalyzing concessional financing, and boosting sustainable, resilient, and inclusive growth.

“The authorities have put renewed focus on fiscal governance and transparency, particularly to improve procurement and treasury deposit account management. These measures are partly informed by the preliminary findings of the IMF’s Governance Diagnostic Assessment conducted in September. The authorities have committed to publishing the final report and implementing key recommendations. Further strengthening fiscal governance and transparency is paramount to restore donors’ trust and catalyze concessional financing.

“The authorities remain committed to gradually reducing the overall fiscal deficit to three percent by the end of the ECF arrangement. Their fiscal consolidation path builds on further mobilizing domestic revenues, while controlling expenditures. This includes continued efforts to bring the public sector wage bill to a sustainable level and further advancing the energy sector reform. At the same time, safeguarding fiscal space for priority social spending is essential. These efforts should be accompanied by a strengthened debt management—including the clearance of government arrears—and by a prudent borrowing strategy.”

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Kwabena Akuamoah-Boateng

Phone: +1 202 623-7100Email: MEDIA@IMF.org