Europe's Choice: Policies for Growth and Resilience

December 16, 2024

Ladies and gentlemen,

It is a privilege to address you today as we celebrate two remarkable milestones. First, congratulations to Lithuania on 10 successful years in the euro area. This is a testament to your commitment to European integration and stability. Second, let us celebrate 25 years of the Euro itself, a currency that has become a global symbol of unity and resilience.

And speaking of success, European policymakers deserve recognition for their extraordinary responses to the recent crises. Their swift and coordinated actions during the pandemic and the Russian gas shut-off have laid the foundation for the recovery that is getting traction.

Yet, while inflation is nearing target levels across most countries, we must acknowledge the enduring scars of the cost-of-living crisis—the pain that it is still causing—and, of course, we must confront the challenges that lie ahead. Europe’s external environment is becoming increasingly complex. More fundamentally, Europe must address two critical imperatives, durably raising growth and building a resilient shock-proof economy.

Europe’s Productivity Problem

Let’s start with a look at productivity, the engine of growth and the basis for shared prosperity.

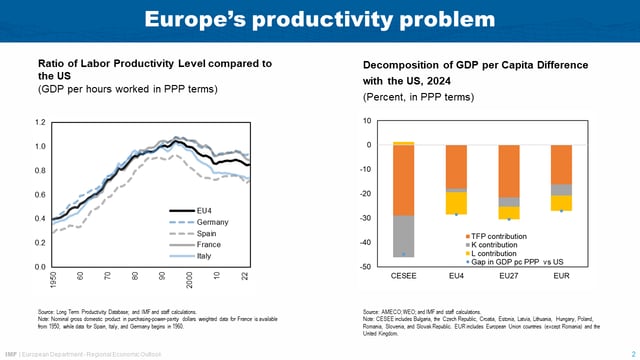

Europe’s productivity story is both inspiring and sobering. In the decades following World War II, Europe significantly narrowed the productivity gap with the United States—the global frontier. By the 1990s, advanced European economies were as productive as the US.

However, starting in the 2000s, Europe began falling behind. Structural deficiencies prevented the continent from fully benefitting from the ICT revolution. As a result, Europe’s advanced economies now lag the US by 15 percent in terms of labor productivity. This gap is the main reason that per capita income in the European Union today is about 30 percent below that of the United States.

This is not just a statistic. It represents untapped potential—potential that Europe cannot afford to leave on the table if it wants to maintain and expand shared prosperity.

Mounting challenges

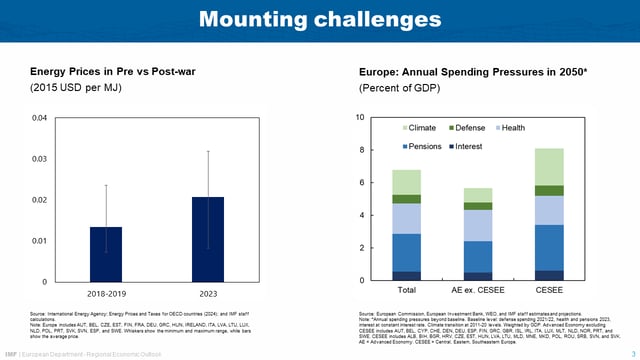

Our projections suggest that without significant policy action, Europe’s income gap with the United States will remain virtually unchanged through 2030. This stagnation reflects a series of mounting headwinds:

- Uncertain external and domestic environments. Russia’s war in Ukraine has reshaped trade patterns, increased energy costs, and heightened geopolitical uncertainty.

- Demographic decline. Europe’s shrinking labor force poses long-term challenges to innovation and growth.

- Fiscal pressures. High public debt levels may rise further as countries face growing demands for defense, climate action, and aging populations. In many cases, fiscal consolidation will be unavoidable.

Together, these challenges represent formidable obstacles to growth. They demand bold, coordinated action.

Policies for Revitalizing Dynamism

Despite these headwinds, Europe has the tools to chart a different course. Projections are not destiny. The key is to start revitalizing economic dynamism which is essential to boosting productivity.

To achieve this, policymakers must focus on three priorities.

- Deepening the single market.

- If pursued, industrial policy needs to be smarter and coordinated. And

- Implementing domestic structural reforms.

These priorities are interconnected and, importantly, they are within Europe’s control. The choice is yours to make.

Realizing a True Single Market

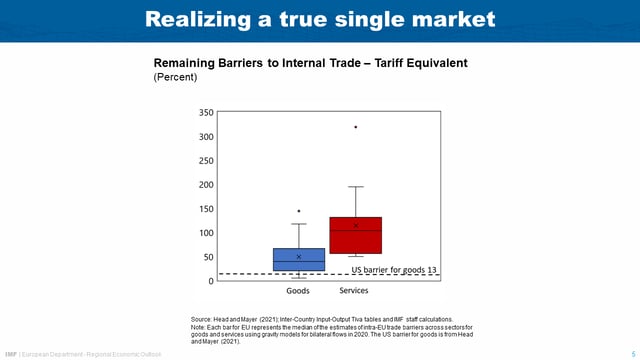

The single market is one of Europe’s greatest, and most unappreciated achievement, but its potential remains underutilized. The hard truth is that the EU is still far from operating as a true single market.

Intra-EU trade barriers remain significant. Our estimates suggest that these barriers might be as high as a tariff equivalent of about 44 percent on average for goods trade—three times higher than trade barriers between US states. For services, these estimates barriers are even steeper, equivalent to a 110 percent tariff. Just to give a sense of the magnitude of these remaining non-tariff barriers, the EU’s effective external tariff rate is of around 3 percent. This shows how much more needs to be done on the internal front, where the largest share of EU countries’ trade takes place.

Indeed, reducing these barriers would deliver significant benefits. Our analysis suggests that by just lowering these intra-EU trade barriers to US levels, the direct impact could raise productivity by nearly 7 percentage points in the long term. This would halve the current productivity gap between advanced EU economies and the US.

Reducing barrier to trade requires:

- Investing in cross-border infrastructure.

- Liberalizing protected sectors.

- Pursuing meaningful intra-EU trade liberalization.

- Harmonizing regulations across member states.

Enhancing Factor Mobility

Lower barriers to trade will allow large firms to reach scale, and thereby also be able to afford larger innovation efforts.

But innovations that push the productivity frontier come not just from large and established firms. They also come from disruptive new entrants that challenge incumbents and may themselves become the future leading firms. These young promising firms in particular need talent agglomeration, and they need risk capital.

In short, the single market is not just about trade: It is also about the movement of people and capital. Yet, barriers to factor mobility remain also stubbornly high.

For example, labor movement costs between EU countries are estimated to be eight times higher than between US states. These barriers prevent talent from flowing to where it is most needed, stifling innovation.

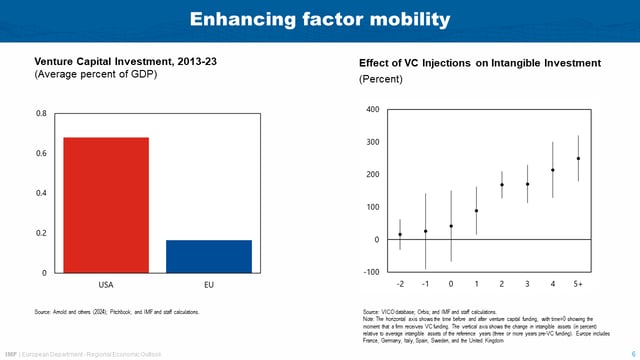

Similarly, Europe’s venture capital ecosystem is underdeveloped with investments at just one-quarter the level seen in the US. A vibrant venture capital market is critical for supporting startups and fostering disruptive innovation. Our research shows that venture capital injections lead recipient firms to double their intangible investments within a year.

Lowering barriers to both trade and factor mobility would amplify gains, creating a virtuous cycle of innovation and growth.

The Single Market and Productivity as Pillars of Economic Resilience

Raising productivity through a deeper single market would not only drive growth, but also strengthen economic resilience.

In a fully integrated single market:

- Banks would operate seamlessly across borders.

- Households would hold equity issued by firms in other member states. And,

- Centrally provided public goods would also play a larger role.

These dynamics would smooth out national shocks and increase the resilience of the EU as a whole.

Contrast this with the current state of risk sharing in the Euro area. According to recent ECB research, around 70 percent of an income shock hitting an individual Euro area economy must be borne domestically, compared to just 25 percent in the US.

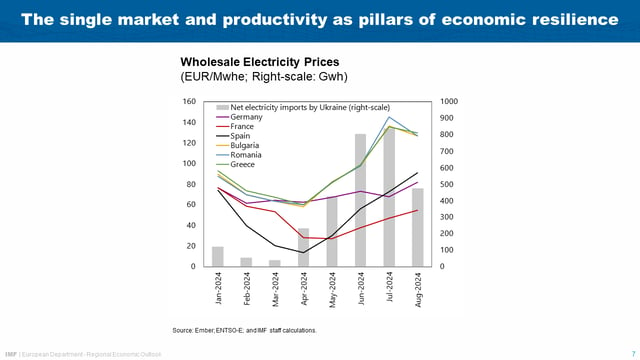

This limited risk-sharing has real world consequences. We observed recently a divergence in electricity prices between Southeastern and Western Europe when Ukraine increased its electricity imports following Russia’s attacks on its electricity generation capacity.

An EU-wide Energy Union, supported by an EU Climate and Energy Security Facility that we are advocating, would help lower energy costs and deliver Europe’s climate and energy security goals more cost effectively.

More generally, shocks will only become more frequent in the future. And the proposition of self-insuring against risks will become increasingly costlier.

Smarter Industrial Policy

To fully exploit the business-dynamism benefits of the single market, policymakers also need to be smart about industrial policy.

Industrial policy is back in vogue. State aid in EU countries now accounts for approximately 1.5 percent of EU GDP, up one percentage point from a decade ago.

Let me first state the obvious: Using industrial policy to protect mature industries is a losing proposition. Europe should think ahead, not backwards.

Industrial policy must be coordinated and:

- Laser-focused on addressing market failures.

- Time bound to contain fiscal costs. And

- Accompanied by a strong governance framework to avoid institutional capture.

Coordination at the EU level is essential. Without it, national-level policies risk creating negative spillovers to other member countries, distort trade, undermine comparative advantage and disrupt production patterns in the single market.

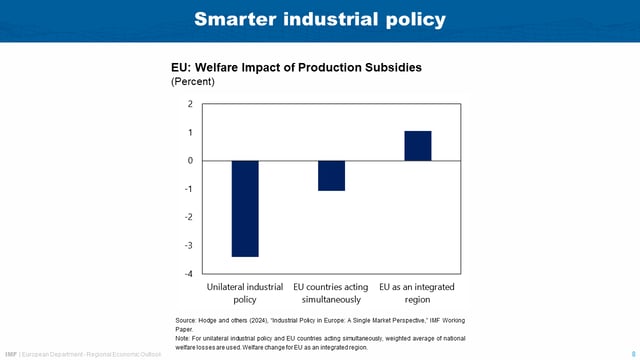

In research published today, we show that unilateral industrial policies can be harmful even if they target externalities at the national level (first bar).

Acting simultaneously in a coordinated way, the losses from unilateral industrial policy can be more than halved for the average European country (second bar). Moreover, coordination can help cushion any adverse impact on regions that might otherwise lose out, including through potential use of intra-EU fiscal transfers.

Should the EU significantly lower remaining internal barriers to labor and capital mobility, the losses can be turned into gains (third bar). In other words, a deeper single market can not only deliver higher productivity and resilience—it is also essential to boost the effectiveness of EU-level policies for all its members.

The start of the new European Commission earlier this month provides a good time to step up these coordination efforts.

Domestic Reforms to Complement EU Efforts

EU-level reforms must be complemented by domestic reforms to improve economic dynamism.

Key reforms include:

- Easing administrative barriers to entry for firms.

- Improving insolvency frameworks to facilitate the exit of unproductive firms.

- Enhancing labor market flexibility while protecting workers, as seen in Denmark’s flexicurity model. Such an approach would combine more flexible layoff procedures with adequate unemployment benefits and strong active labor market policies that support job search and employability.

The potential growth dividends of these domestic reforms are substantial.

For instance,

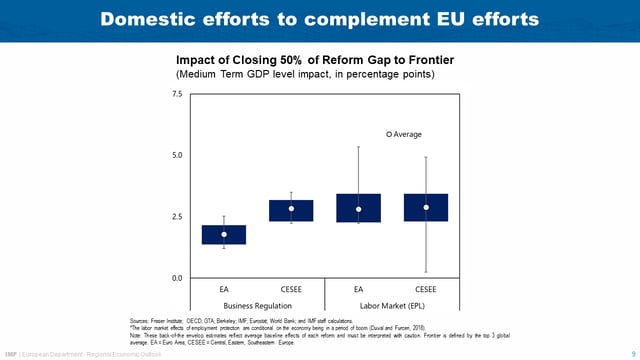

- EU countries lag global best practices in business regulation by 33 percent. Closing half of this gap to the global frontier could increase GDP by about 2 percent in the medium term for Euro area countries, and by 3 percent for countries in Central, Eastern and Southeastern Europe.

- And the gap in labor market regulation to global best practices is 31 percent. If anything, slightly larger gains can accrue from labor market reforms.

Rising to the Challenge

The challenges facing Europe are significant but they are not insurmountable.

History has shown that Europe rises to the occasion when confronted with crises. This was true during the pandemic and it was true during the energy crisis. With the right policies, it can be true now.

The path forward requires a more integrated single market, smarter industrial policy, and bold domestic reforms. These are the policies for growth and economic resilience.

The choice is Europe’s to make. Let us seize this moment to build a stronger, more dynamic, and more resilient Europe.

Thank you.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org