Tighter Fiscal Policy Can Help Mongolia Control Inflation

November 26, 2024

By working together but independently, the central banks and government can win the fight against inflation and foster economic stability and growth for years to come

Discussions at the Bank of Mongolia’s recent international conference marking its centennial highlighted an important policy issue: how to better align monetary and fiscal policies to tackle high inflation.

Ideally, monetary and fiscal policies should operate like a rider on a horse, working in concert but also within their mandates and objectives. In Mongolia, there is room to make the monetary-fiscal ride smoother to arrive at target inflation more quickly.

The Bank of Mongolia—one of Asia’s oldest central banks in a country that was an early initiator of coin and paper note circulation dating back eight centuries to the Mongol Empire—has played a major role in Mongolia’s transition from a centrally planned economy to a market economy. The Bank established a two-tier banking system in 1991 to separate the central bank from commercial lenders, scrapped the fixed exchange rate in 1993 to promote exports and improve the balance of payments, and phased out direct controls in favor of a market-oriented monetary policy framework.

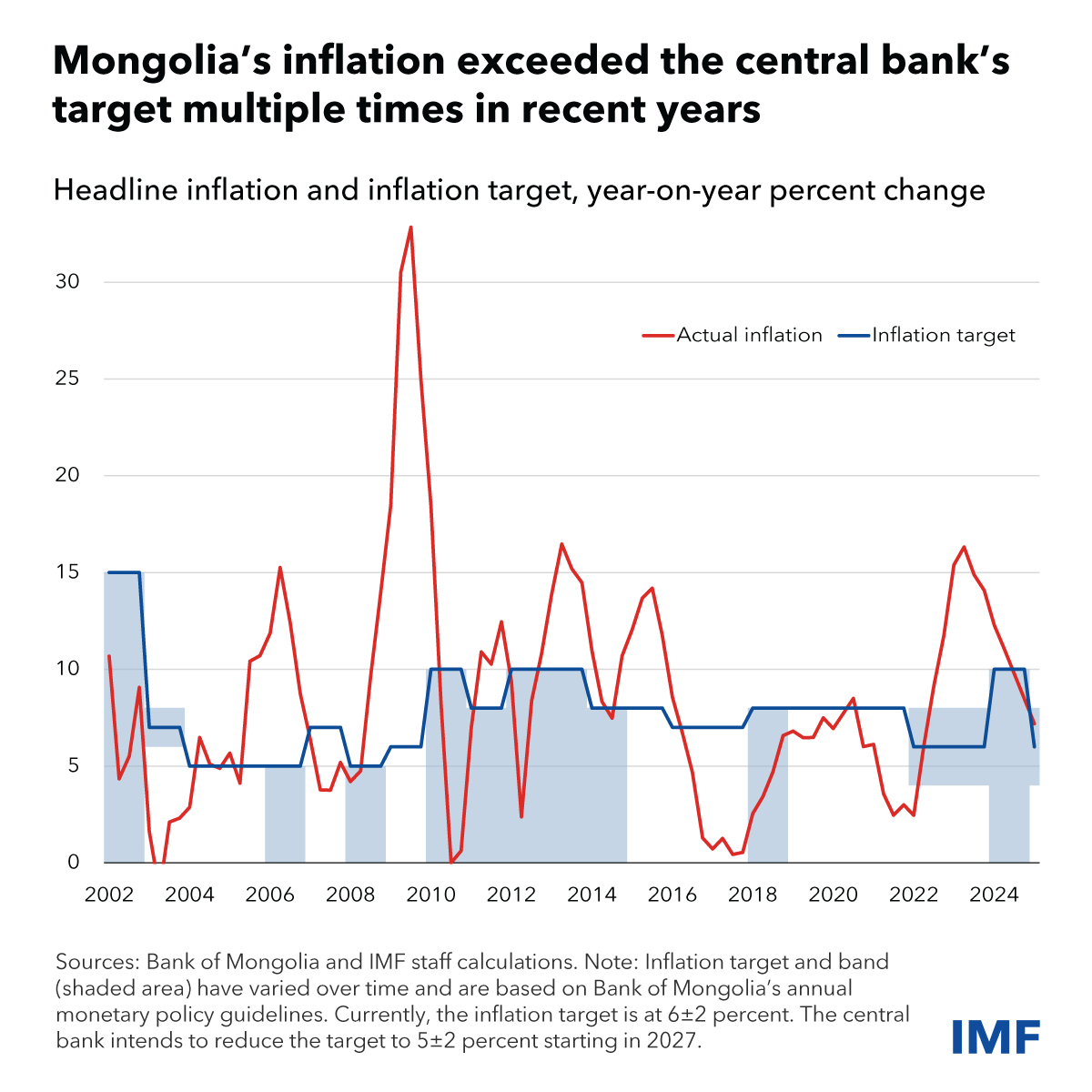

The Bank also introduced elements of an inflation targeting framework in 2013 but its journey toward full-fledged inflation targeting remains incomplete. While the central bank has a mandate to maintain stable prices, two obstacles impede the journey: a lack of operational independence and the significant impact of fiscal policies on monetary policy outcomes, given the large share of the government in the economy.

Improving government policies can therefore play an important role in keeping inflation in check.

One way to do this will be to grant Mongolia’s central bank greater independence from the government, including by eliminating requirements for the Bank to provide specific kinds of government-mandated lending to the private sector. The Bank does not enjoy the autonomy typical of advanced inflation targeting economies. Parliament has constitutional authority over monetary, financial, and credit policy. Lawmakers approve the central bank’s inflation target and other monetary policy guidelines annually.

On the fiscal side, budget spending often follows the business cycle in an economy that is deeply tied to global commodity markets. Mining exports make up about 90 percent of exports, and nearly a third of government revenue comes from the mining industry. Government spending that rises and falls in step with prices for commodities like coal or copper tends to be procyclical, fueling boom-and-bust economic cycles and surges in inflation.

The government can avoid procyclical fiscal policies by taking a prudent approach toward spending during good economic times by sticking to fiscal rules, as we noted after our October visit to Mongolia. Spending discipline during commodity booms helps prevent the economy from overheating and keeps inflation in check. It also helps with building fiscal buffers in good times that can provide support during economic downturns without imperiling debt sustainability.

In an economy that is heavily influenced by commodity market swings, the government therefore also shares responsibility in helping the central bank achieve its inflation objectives. This is important because monetary policy is most effective when fiscal and monetary policies are aligned, steering output and prices in the same direction together.

This implies that when inflation is high, fiscal policy should also be tighter to assist tighter monetary policy. Such synchronization can prevent the central bank from having to raise interest rates to very high levels. That in turn would help ensure that the fight against inflation does not disproportionately burden borrowers or fuel risks to financial stability.

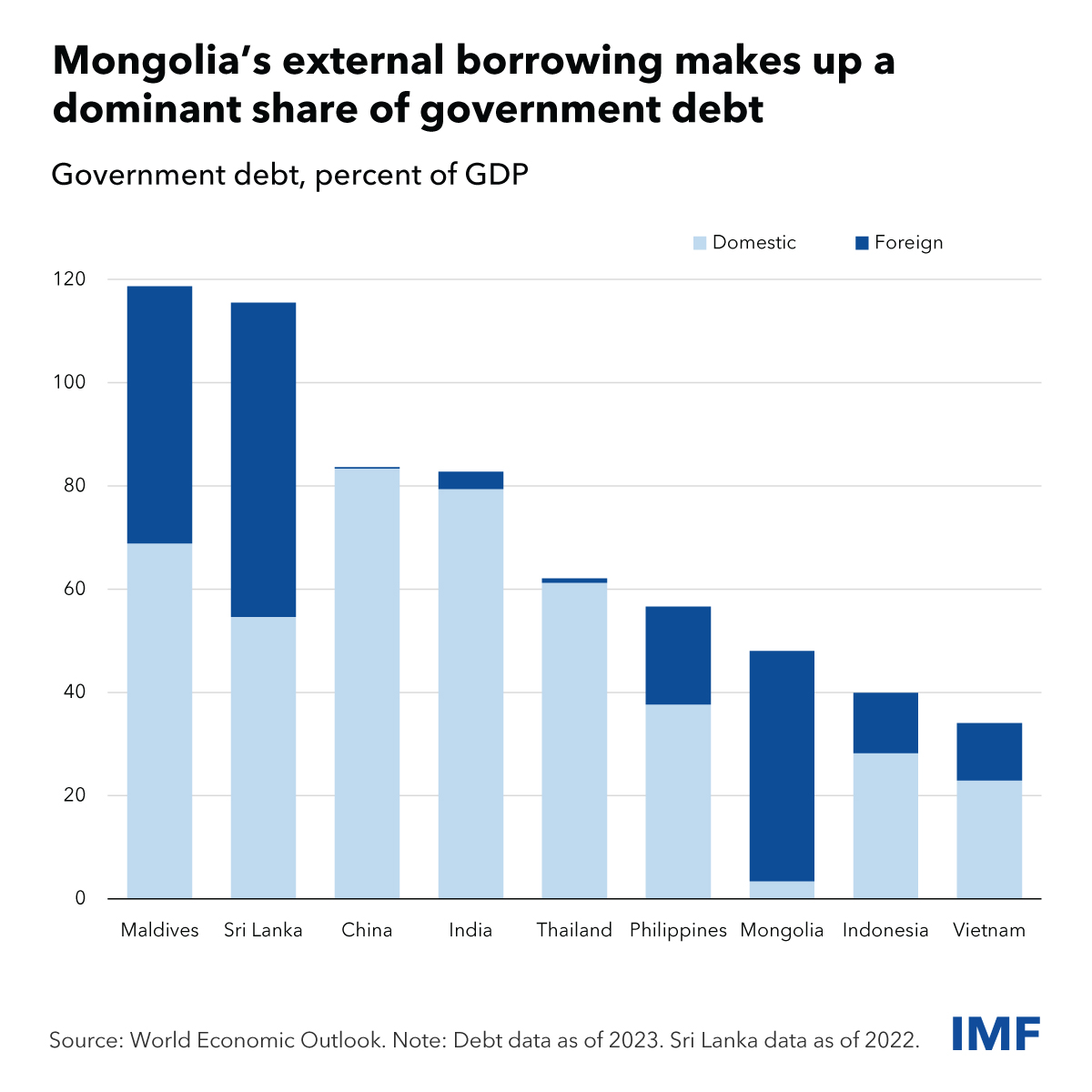

The government can also support monetary policy objectives by developing a well-functioning market for domestic securities. Until recently, the government has relied on external borrowing, to benefit from lower global financing costs.

Plans for new domestic securities issuances were deferred leading to a sharp decline in the pool of domestic debt securities available to the Bank for its monetary policy operations.

Unable to use government securities for monetary operations like most other central banks, the Bank has relied on issuing its own bills to absorb excess liquidity. The high interest costs of doing so are weakening its balance sheet and could hinder monetary policy operations down the road.

Restarting issuance, even amid fiscal strength, will help the central bank better manage liquidity and develop the domestic debt market. A robust domestic market will also improve monetary transmission by establishing benchmark bond yields.

When it comes to better alignment between monetary and fiscal measures, policymakers can take inspiration from the ancient tradition of Mongolian horse racing, a hallmark of the national festival of Naadam. A better monetary-fiscal coordination would not only smooth the ride; it would be a winning formula for the economy and the people of Mongolia.

****

Angana Banerji is a deputy division chief and Mongolia mission chief in the IMF’s Asia and Pacific Department. Thomas Helbling, a Deputy Director in the IMF’s Asia Pacific Department, oversees the IMF’s work on Mongolia.