Growth in Sub-Saharan Africa is Diverging

November 14, 2024

Stagnating incomes in sub-Saharan Africa’s resource-intensive economies necessitate more effective fiscal management and broad-based structural reforms

Sub-Saharan Africa is home to nine of the world’s top twenty fastest-growing economies this year. Such startling statistics, however, rarely feature in discussions of the region’s outlook. Instead, headline figures typically emphasize the relatively modest average economic performance. This disconnect reflects a two-track growth pattern, where a significant part of the region underperforms. Our analytical note for the latest Regional Economic Outlook for sub-Saharan Africa takes a closer look at this issue.

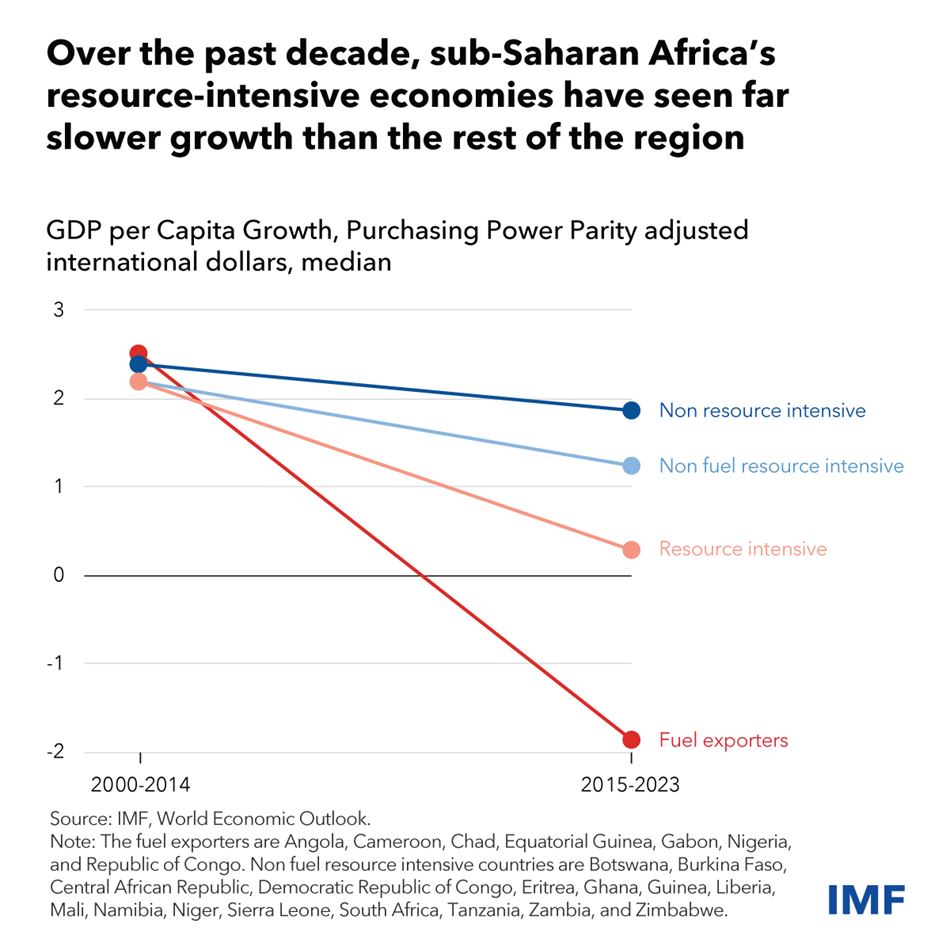

Over the past ten years, growth in sub-Saharan Africa’s resource-intensive countries (RICs)—and especially in fuel exporting economies such as Angola, Chad, and Nigeria—has slowed down sharply, falling far below growth in non-RICs (such as Ethiopia, Rwanda, and Senegal). Indeed, incomes in RICs have essentially stagnated. This marks a sharp contrast with the decade leading up to 2014, when RICs experienced rapid growth, in line with the region’s strong overall performance.

The post–2014 divergence between RICs and non-RICs has been driven largely by the combination of two factors.

First, RICs and especially fuel exporters experienced a dramatic decline in their commodity export prices around 2014–15, as the commodity “super-cycle”—a period of sharply rising commodity prices—came to an end. Since then, the terms-of-trade decline has only been partially reversed.

Second, and critically, the impact of the terms-of-trade shock on RICs was exacerbated by pre-existing structural vulnerabilities, including a poor business environment, limited human capital, weak governance, and poor management of resource revenues.

Structural Weaknesses

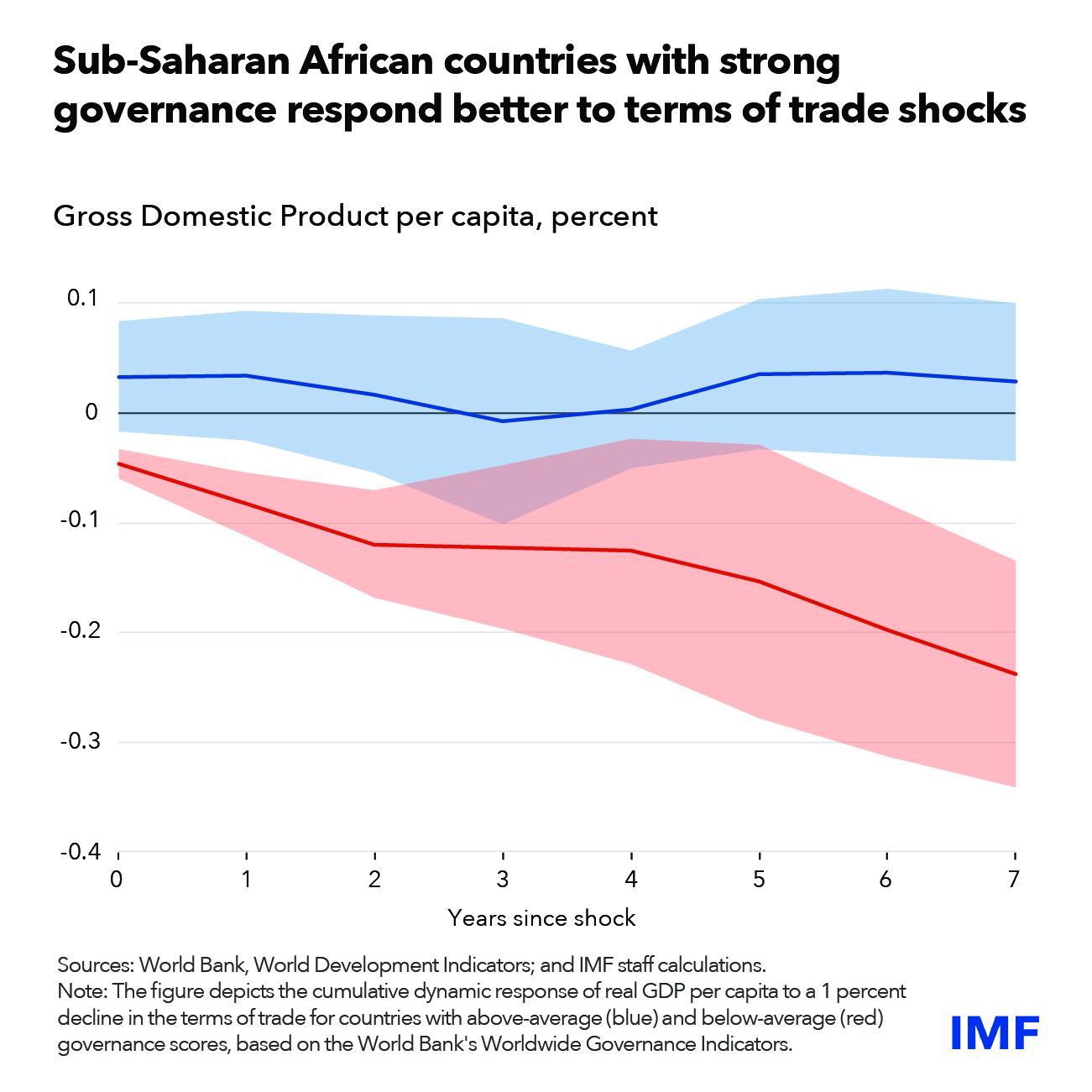

Weak governance, systemic corruption, and an unfavorable business climate take a toll on productivity and output—and the effects are most striking when commodity prices fall. Such weaknesses affect both the resource sector itself and prospects for the economy diversifying into other sectors. For instance, the potential for theft of oil production undermines productive efficiency and diverts precious resources from more productive uses. Or weak governance can be a central impediment for private sector investment more broadly. Fuel exporters outside the region, with generally stronger governance, have weathered the commodity price slump far better.

IMF staff analysis confirms that terms-of-trade shocks have a stronger and longer-lasting impact on growth in countries with weak governance. We estimate that for every one-percent worsening in a country’s terms of trade, medium-term growth is around ¼ percentage point higher in countries with smaller governance challenges.

In addition, poor resource management reinforced the original shock through a pro-cyclical fiscal bias. Fiscal policy in RICs, including in sub-Saharan Africa, is generally far more correlated with economic shocks, intensifying their effects, compared to other countries. For instance, when commodity prices are high, many RICs, particularly fuel exporters, have embarked on costly capital projects that are often poorly planned and implemented, with corresponding sharp reductions in capital spending when commodity prices fall. In addition, many fuel exporters also provide sizable fuel subsidies, the cost of which increases as oil prices rise, limiting their ability to save during booms, while crowding out growth-friendly development spending. The average oil-exporting country in sub-Saharan Africa has since 2011 consistently spent all its oil revenues in the year when they accrued.

The Way Forward

Reversing this growth divergence is a regional priority, as RICs make up about two-thirds of sub-Saharan Africa’s GDP and population. It is also a humanitarian priority. Poor growth performance has translated into poor development outcomes—progress in tackling poverty in RICs effectively halted in 2014. Compared to children in other parts of the region, a child born in a RIC today is expected to live 4 years less on average, and is 25 percent more likely to live in poverty.

Reigniting durable growth will require a stable macroeconomic environment. More prudent and consistently implemented fiscal frameworks can help address poor resource management challenges—and also help ensure growth is more resilient going forward. Further, broad-based reforms to address structural weaknesses—strengthening governance, enhancing the business environment, accumulating human capital, and addressing infrastructure bottlenecks—can help countries diversify and grow. And for fuel exporters, facing the global green-energy transition, the need to diversify is ever more urgent.

****

Saad Quayyum and Nikola Spatafora are senior economists, Sanghamitra Mukherjee is an economist, and Hamza Mighri is a research analyst, all in the IMF’s African Department.