Opening Remarks by IMF Asia and Pacific Department Director Krishna Srinivasan at the Regional Economic Outlook Press Conference

October 13, 2023

(As prepared for delivery)

Good morning to everyone here in Marrakech and good afternoon to everyone in Asia. Thank you very much for joining our Press Briefing for Asia and Pacific. Please allow me to make a few opening remarks.

Global growth is forecast to slow from 3.5 percent in 2022 to 3 percent in 2023 and 2.9 percent in 2024. The global outlook is supported by continued consumption dynamism in the US, but faces pressures from China’s worsening property crisis, tight policy stances around the world, the consequences of Russia’s war in Ukraine, and growing geoeconomic fragmentation.

Despite a challenging global environment, the Asia-Pacific region remains a relatively bright spot. It is expected to grow by 4.6 percent in 2023 and by 4.2 percent in 2024, which puts it on track to contribute about two-thirds of global growth.

Now let me go into specific forecasts for a few major economies in the region.

The reopening of China’s economy has given the service sector and retail sales a boost, as experienced by other economies. However, the benefit to the manufacturing sector is proving short lived. The real estate sector in China is grappling with further pressures on debt repayments, home sales, and investment. Based on these weaknesses, we have revised down China’s growth forecast to 5 percent for 2023 and 4.2 percent for 2024.

In Japan, the economy is projected to grow by 2 percent in 2023. That is 0.7 percentage points higher than in our April forecast and reflects strong domestic demand as well as accommodative monetary and fiscal policies.

India’s economic growth remains robust, driven by a large public capital expenditure push and resilient domestic demand. The economy is expected to grow by 6.3 percent in both 2023 and 2024.

Although the downturn in the technology exports is projected to dampen the near-term growth momentum in Korea, the economy is expected to rebound next year, as the technology cycle turns the corner.

In Australia, large public investment and robust external demand should provide a lift to growth, but domestic demand is weakening, given rising mortgage payments and lower real disposable incomes.

The economies in ASEAN are expected to see growth of 4.2 percent in 2023 and 4.6 percent in 2024, a downward revision of 0.4 percentage points in 2023 and 0.3 percentage points in 2024 relative to the April World Economic Outlook. The downgrade reflects not only weaker growth outturns and external demand, but also more lackluster domestic demand because of waning revenge consumption and monetary policy tightening.

GDP in Pacific Island Countries with high dependence on tourism is still more than 10 percent below pre-pandemic levels, with challenges from higher fiscal deficits, elevated debt, and shrinking fiscal space.

Let me elaborate a bit more on Asia’s recent developments based on high-frequency indicators. Even as pressure in China’s property sector remains unabated, I would like to highlight that China’s manufacturing PMI showed an expansion of activity in September. The year-on-year growth of retail sales has also improved. But monthly data are volatile, and caution is warranted in the interpretation of short-term fluctuations.

Going beyond China, what we see is continued resilience and strength in activity in the services sector in Asia, as evident from the PMIs.

However, manufacturing activities exhibit weakness across Asia. The persistent downturn of the technology cycle continues to weigh on manufacturing activity in the region’s advanced economies. In September, manufacturing activity in Asia’s emerging markets (excluding China) also moved into negative territory, reflecting broader weakness in global demand.

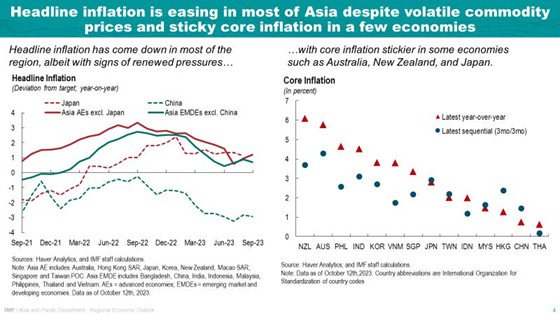

Headline inflation has declined from post-pandemic peaks as global commodity prices have receded and monetary policy bites, albeit with signs of renewed prices pressures emerging more recently.

Moreover, in a few advanced economies in Asia, core inflation remains sticky due to tight labor market and positive output gaps. Except for Japan, inflation is expected to return to within target ranges by the end of 2024. This puts Asia ahead of the rest of the world, although the risk of more persistent inflation could materialize, given recent commodity price spikes, exchange rate changes yet to fully pass through, and tighter labor markets.

Central banks should stay the course with policies to ensure that inflation is durably at appropriate targets and expectations are anchored. With accommodative financial conditions in Asia’s emerging markets, there is no urgent need to ease monetary policy.

Now moving to financial markets. Financial conditions in Advanced Asia have tightened as higher rates took hold, but Emerging Asia has seen accommodative financial conditions. However, the recent rise in US long-term yields following the September US FED meeting has exerted pressures.

In the past few weeks, we have seen financial tightening across Asian markets. Long-term local currency sovereign yields, notably in some economies in the Asia and Pacific, have increased substantially since the FOMC meeting in September. At the same time, Asian currencies have depreciated across the board, although to a limited extent compared to previous US dollar-strengthening episodes.

Financial supervisors in Asia should remain vigilant on systemic risks and calibrate macro-prudential measures given the higher leverage and rates. If financial sector stress were to emerge, deploying liquidity and other support measures promptly while modernizing resolution frameworks would be important.

Finally, to summarize: In the Asia and Pacific Regional Economic Outlook that we will publish in Singapore next week, we emphasize that the region is facing challenges from persistent medium-term output losses and China’s structural slowdown, geoeconomic fragmentation, and inflation.

Our policy messages for the Asia-Pacific region are:

Monetary policy must maintain a sufficiently restrictive stance until inflation is firmly back on target.

Fiscal consolidation should continue, in order to address rising debt servicing costs, through credible medium-term fiscal frameworks. Faster and more efficient coordination on debt resolution is needed to ease funding stresses faced by some emerging market and developing economies.

Macroprudential policies should be used to tackle vulnerabilities in the financial sector driven by the higher-for-longer interest rate environment.

Lastly, structural policies to boost productivity and strengthen multilateral cooperation are urgently needed to mitigate medium term output losses and risks posed by global de-risking. Meanwhile, addressing rising inequality and facilitating the green transition are essential for inclusive and sustainable growth.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org